An AB trust is a trust created by a married couple to avoid probate and minimize federal estate tax. An AB trust is created by each spouse placing property into a trust and naming someone other than his or her spouse as the final beneficiary of that trust. Upon the death of the first spouse, the surviving spouse does not own the assets in that spouse's trust outright, but has a limited power over the assets in accordance with the terms of the trust. Such powers may include the right to receive interest or income earned by the trust, to use the trust property during his or her lifetime, e.g. to live in a house, and/or to use the trust principal for his or her health, education, or support. Upon the death of the second spouse, the trust passes to the final beneficiary of the trust. For estate tax purposes, the trust is included in the first, but not the second, spouse's estate and therefore, avoids double taxation.

Charlotte North Carolina Marital Deduction Trust - Trust A and Bypass Trust B

Description

How to fill out North Carolina Marital Deduction Trust - Trust A And Bypass Trust B?

Are you looking for a reliable and affordable provider of legal documents to obtain the Charlotte North Carolina Marital Deduction Trust Trust A and Bypass Trust B? US Legal Forms is your ideal choice.

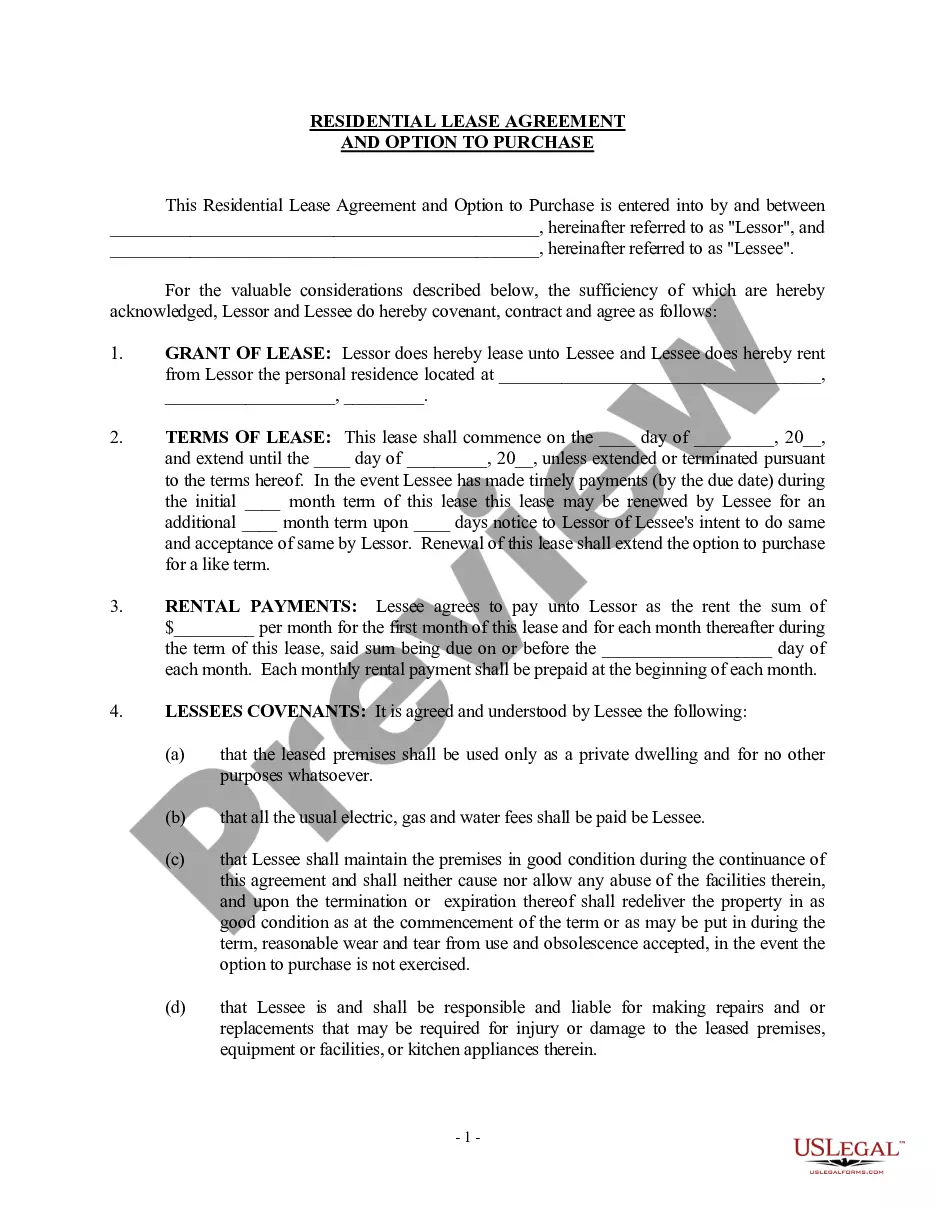

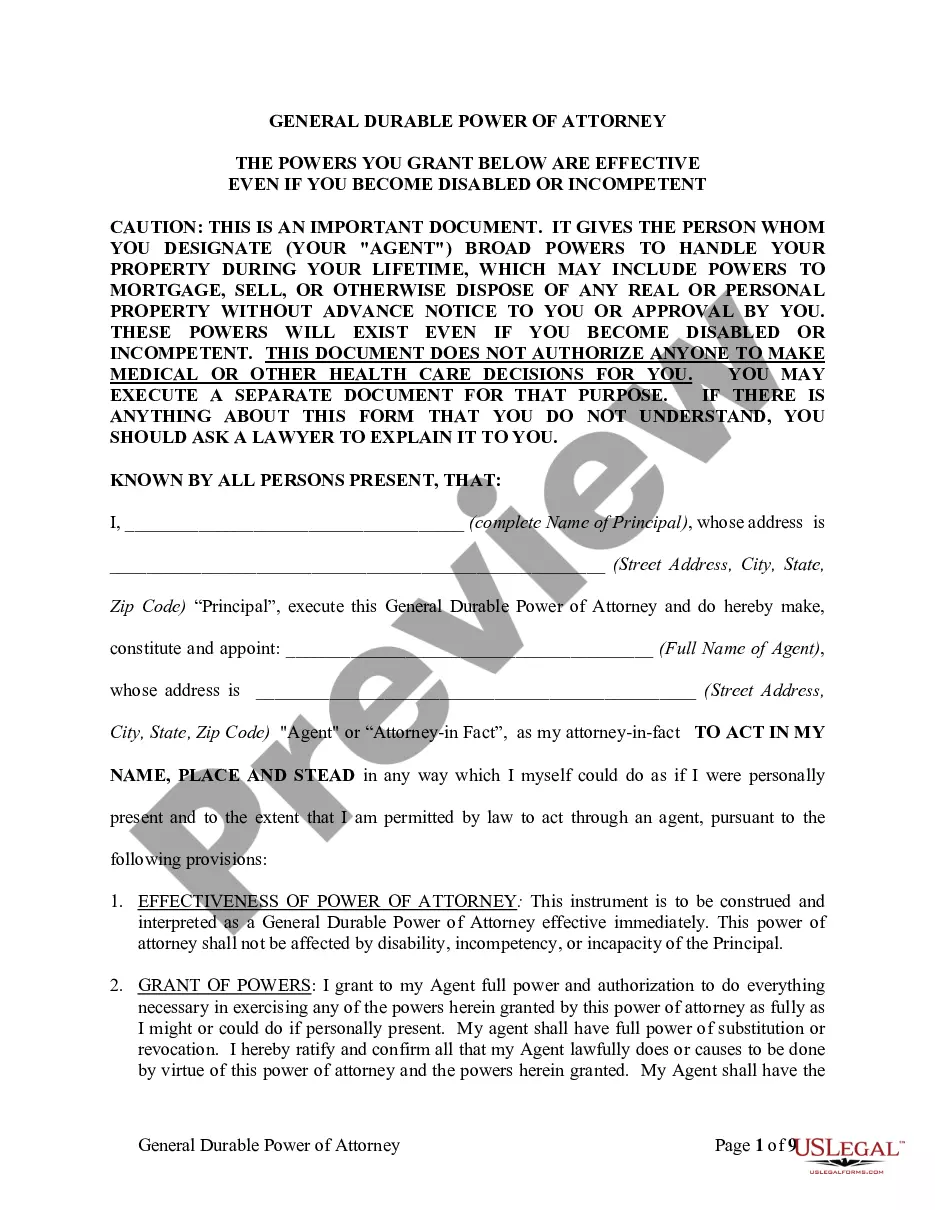

Whether you require a straightforward agreement to establish guidelines for living with your partner or a complete set of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business use. All templates we provide access to are not generic and are tailored to comply with the specifications of individual states and counties.

To obtain the document, you need to Log In to your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time in the My documents section.

Is this your first visit to our site? Don't worry. You can set up an account within minutes, but before that, make sure to do the following.

Now you can create your account. Then select a subscription plan and proceed with the payment. Once the payment is completed, download the Charlotte North Carolina Marital Deduction Trust Trust A and Bypass Trust B in any of the available formats. You can return to the website at any moment and download the document again without any cost.

Locating current legal documents has never been more straightforward. Try US Legal Forms today, and stop wasting your precious time searching for legal paperwork online once and for all.

- Verify that the Charlotte North Carolina Marital Deduction Trust Trust A and Bypass Trust B complies with the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the document is meant for.

- Initiate the search again if the template is unsuitable for your legal needs.

Form popularity

FAQ

A major disadvantage of a bypass trust is the loss of the second income tax basis step up at the death of the surviving spouse for the assets in the bypass trust. When someone dies, the capital basis of the person's assets, with certain exceptions, is adjusted to the fair market value at the person's date of death.

With a marital trust, the surviving spouse generally is able to access the income, as well as the principal balance. However, the principal in a bypass trust can be used for expenses of the surviving spouse, such as health and support, but is not generally accessible to the surviving spouse.

A bypass trust receives assets as stipulated in the trust document. These may be half or all of the property belonging to the deceased spouse; it may also just receive sufficient property to the extent that the dead spouse's tax exclusion is fully utilized.

A Living Trust is a revocable trust created while a person is alive, whereas a Bypass Trust is typically an irrevocable trust created at death. A Bypass Trust can be created by a Living Trust or by a Will.

A Bypass Trust is a sub-Trust that becomes irrevocable after the first spouse dies. A Bypass Trust is sometimes called a Residual Trust, a Family Trust, or a Tax Avoidance Trust.

Bypass trust (also called an AB trust or a credit shelter trust) is a tool used by well-off married individuals to legally maximize their estate tax exemptions. The strategy involves creating two separate trusts after one spouse passes.

The assets in the Bypass Trust do not go to the children right away, but are held and used to support the surviving spouse. Once the surviving spouse dies, the assets in the Bypass Trust go to the ultimate beneficiaries (which are usually the children of the first spouse to die).