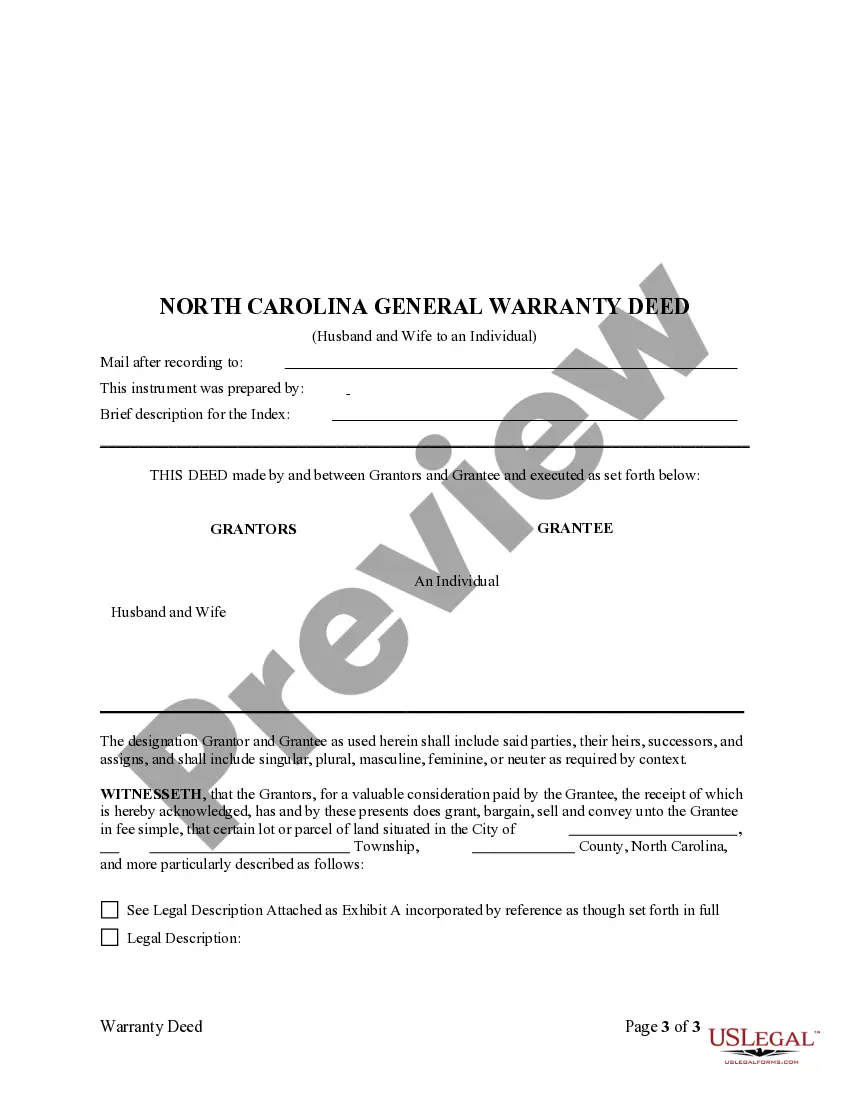

High Point North Carolina General Warranty Deed from Husband and Wife to an Individual

Description

How to fill out North Carolina General Warranty Deed From Husband And Wife To An Individual?

If you have previously used our service, sign in to your account and download the High Point North Carolina General Warranty Deed from Husband and Wife to an Individual onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your initial use of our service, follow these easy steps to acquire your document.

You have ongoing access to all documents you have purchased: you can find them in your profile under the My documents section whenever you need to retrieve them again. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Ensure you have found the right document. Review the description and utilize the Preview option, if available, to verify that it fulfills your needs. If it doesn't fit, use the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Access your High Point North Carolina General Warranty Deed from Husband and Wife to an Individual. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

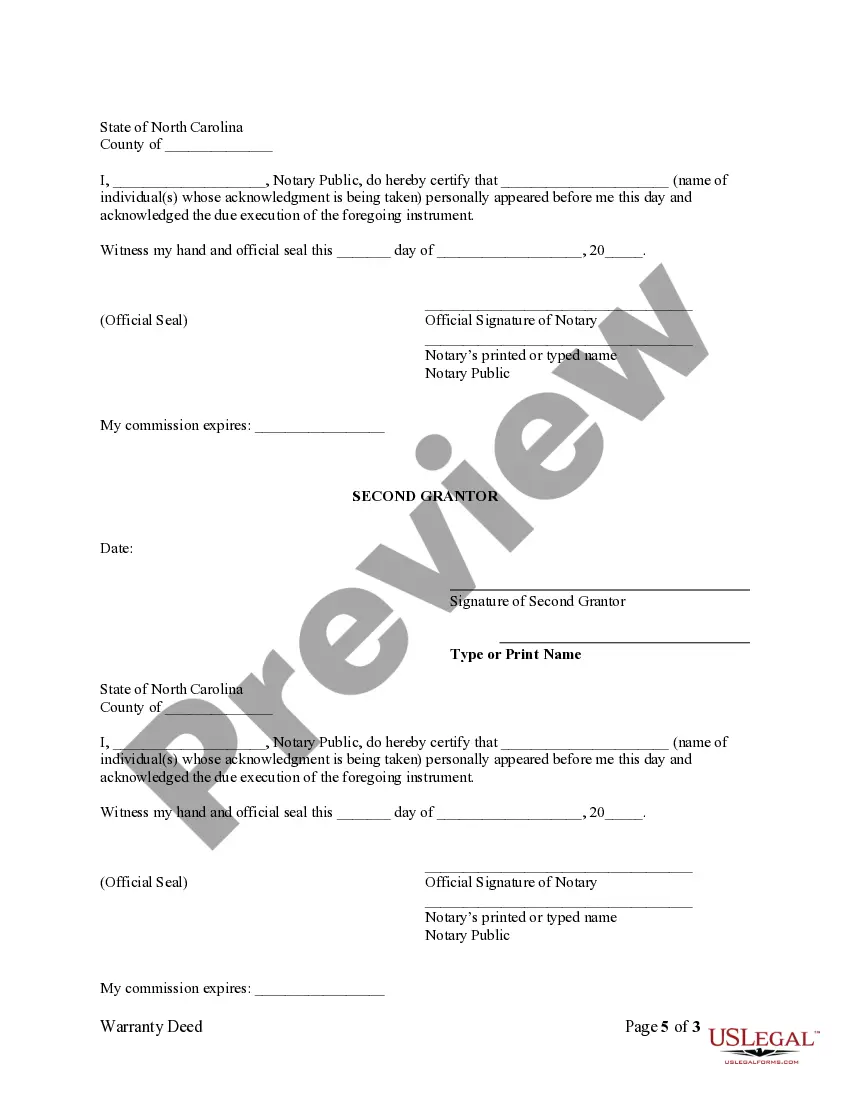

To transfer a property title to a family member in North Carolina, you typically need to execute a warranty deed. The process involves completing the High Point North Carolina General Warranty Deed from Husband and Wife to an Individual, signing it, and having it notarized. After that, file it with the county register of deeds to formalize the transfer and ensure everyone understands the new ownership.

In North Carolina, hiring a lawyer is not mandatory for transferring a deed. However, consulting a legal professional can ensure that your High Point North Carolina General Warranty Deed from Husband and Wife to an Individual is completed correctly and meets all legal requirements. A lawyer can also provide valuable legal advice tailored to your situation.

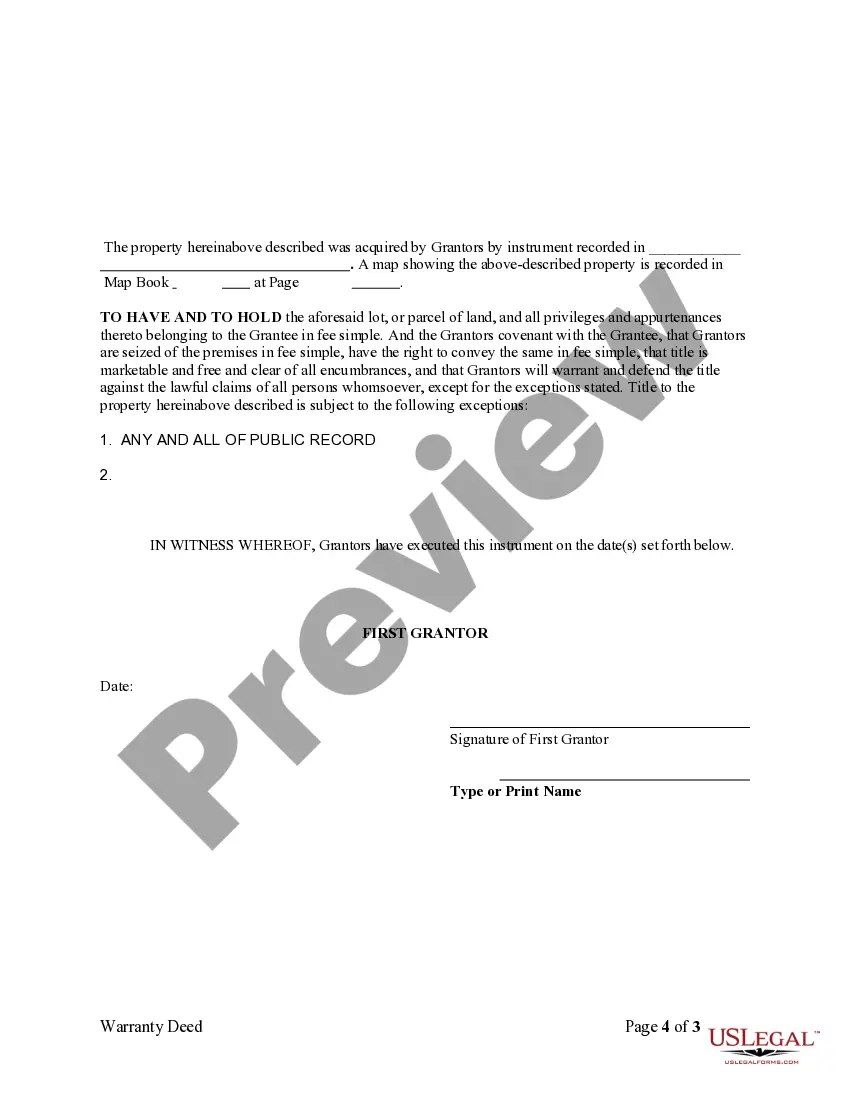

To transfer property using a warranty deed, you need to fill out the necessary forms, such as the High Point North Carolina General Warranty Deed from Husband and Wife to an Individual. Next, you sign the deed in front of a notary, and then file the deed with the county register of deeds. This ensures the transfer is legally recognized and provides a clear title to the new owner.

In North Carolina, it is not necessary for your wife to be on the deed when you transfer property. However, if the property is titled in both your names, her consent is essential for a High Point North Carolina General Warranty Deed from Husband and Wife to an Individual. Including her helps clarify ownership and can prevent future disputes.

To add your spouse to your warranty deed, you will need to draft a new deed that includes both names. It's recommended to utilize the High Point North Carolina General Warranty Deed from Husband and Wife to an Individual for this purpose. Ensure the new deed is properly notarized and recorded with the local clerk to protect ownership rights.

To transfer a house deed to a family member in North Carolina, you must create a new deed that outlines the transfer details. You'll need to include the recipient's name and complete the High Point North Carolina General Warranty Deed from Husband and Wife to an Individual. Once the deed is signed and notarized, file it with the local register of deeds to finalize the transfer.

When two people are on a deed, it is referred to as co-ownership. This means both individuals have legal rights to the property. In the context of the High Point North Carolina General Warranty Deed from Husband and Wife to an Individual, co-ownership can simplify property transfer and provide shared benefits for both parties.

You can file a warranty deed yourself, but it is crucial to follow the proper legal protocols to ensure acceptance. This includes preparing the deed accurately and paying any necessary filing fees. UsLegalForms can provide easy-to-use templates for a High Point North Carolina General Warranty Deed from Husband and Wife to an Individual to help you navigate the process.

Yes, it is possible to have two names on a deed. In fact, many properties are co-owned by spouses, family members, or business partners. For the High Point North Carolina General Warranty Deed from Husband and Wife to an Individual, simply ensure that both parties' names are clearly listed and that the deed is recorded according to state regulations.

Adding a name to a deed can lead to potential complications such as tax implications or the loss of control over the property. When you include another person, you share ownership, which means decisions about the property require mutual agreement. This situation may create conflict, especially if the new co-owner has different goals or expectations regarding the property.