Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out North Carolina Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Finding validated templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents for both personal and professional purposes as well as various real-world situations.

All the files are appropriately organized by function and jurisdictional areas, making the search for the Cary North Carolina Financial Statements related to Prenuptial Premarital Agreement as simple as pie.

Maintaining organized paperwork that adheres to legal standards is of utmost importance. Take advantage of the US Legal Forms library to have essential document templates readily available for any requirements!

- Review the Preview mode and form description.

- Verify you’ve selected the right document that fulfills your needs and is fully compliant with your local jurisdiction regulations.

- Look for another template if necessary.

- If any discrepancies arise, utilize the Search tab above to locate the accurate document.

- Proceed to purchase the document.

Form popularity

FAQ

A prenup, or prenuptial agreement, primarily serves to define how assets and debts will be treated in the event of a divorce. It protects individual financial interests and clarifies responsibilities regarding property ownership. This arrangement ensures that Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement are properly taken into account, thereby minimizing potential disputes. Overall, a prenup promotes financial transparency and stability, allowing both parties to enter the marriage with clarity about their financial futures.

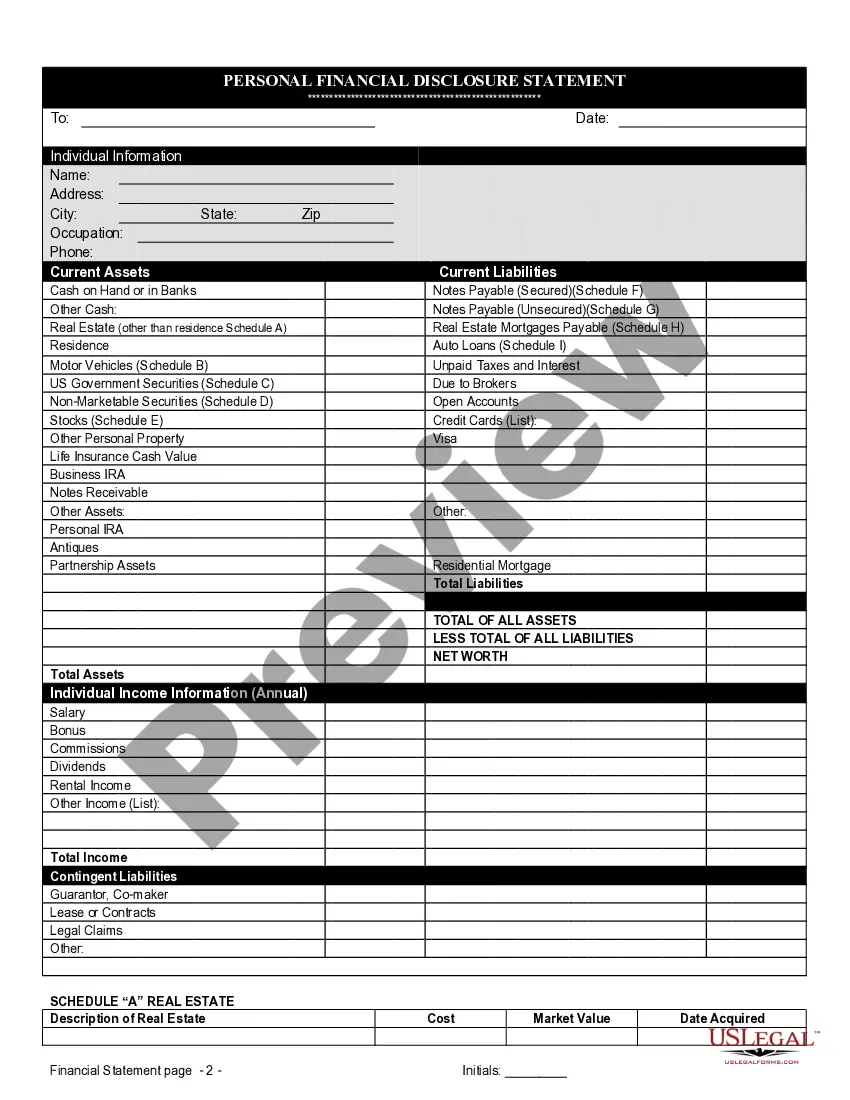

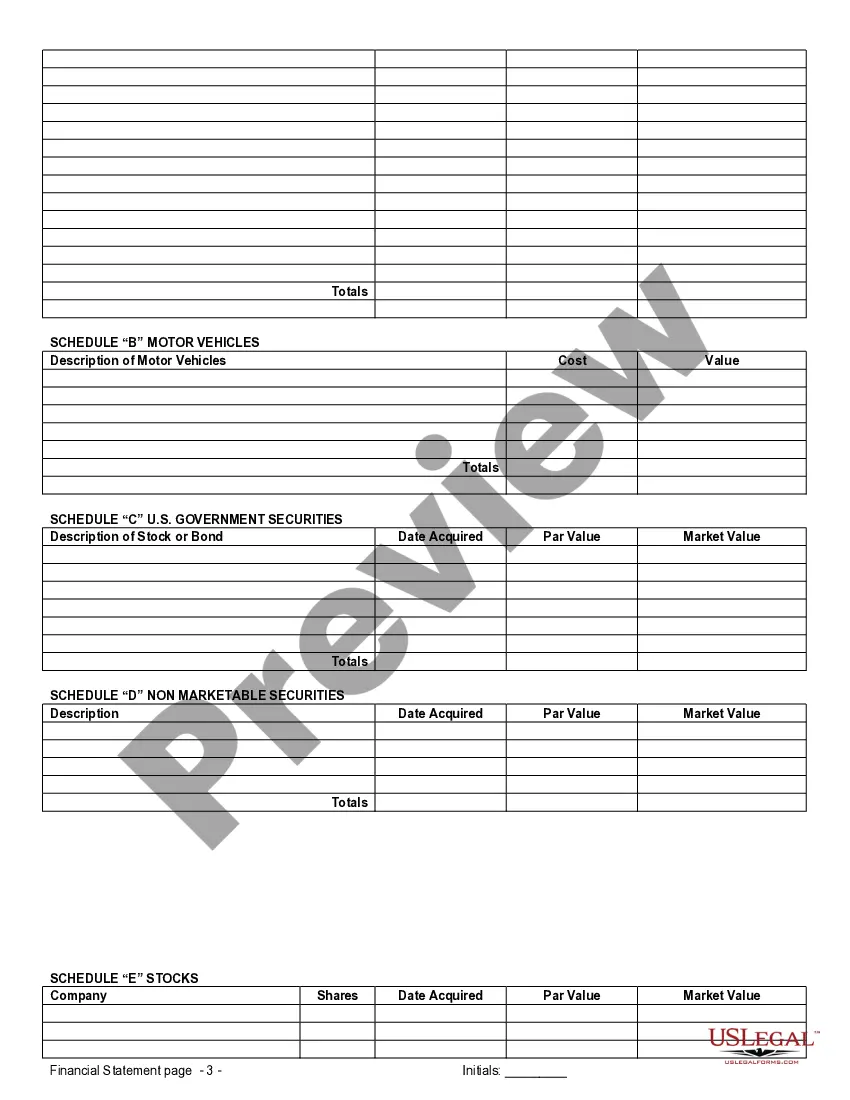

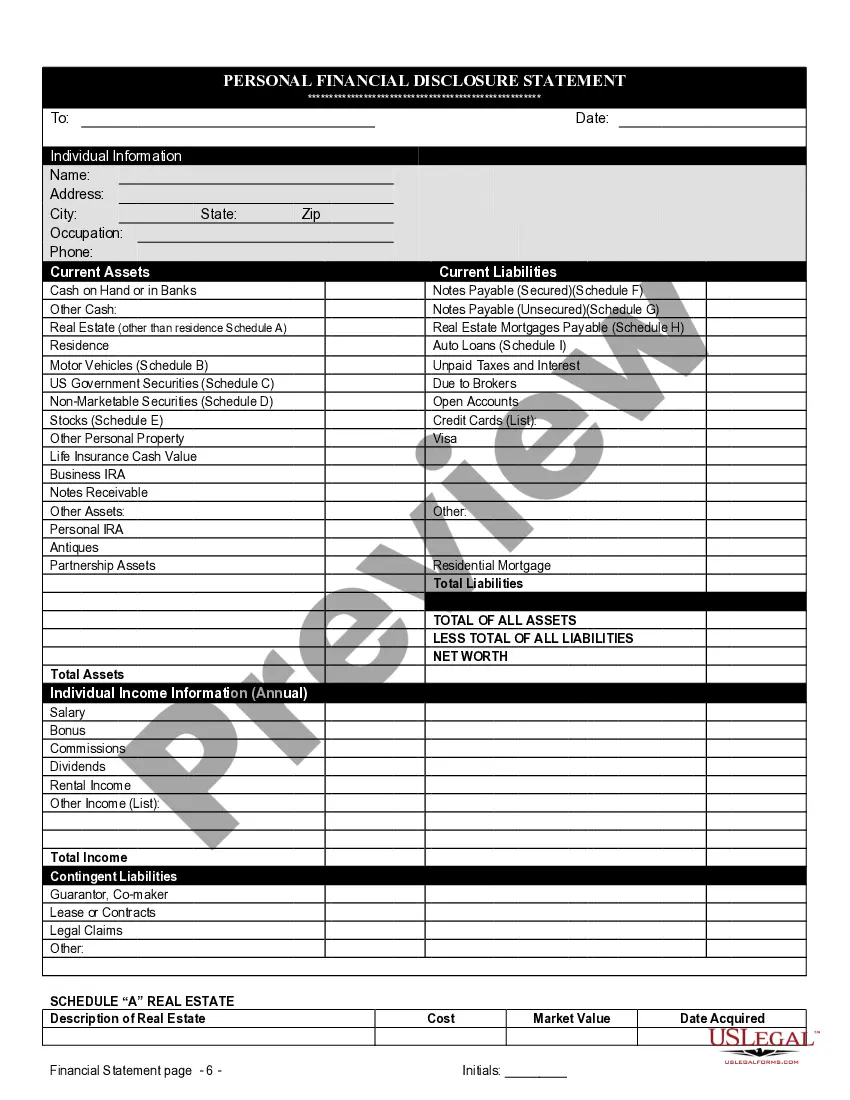

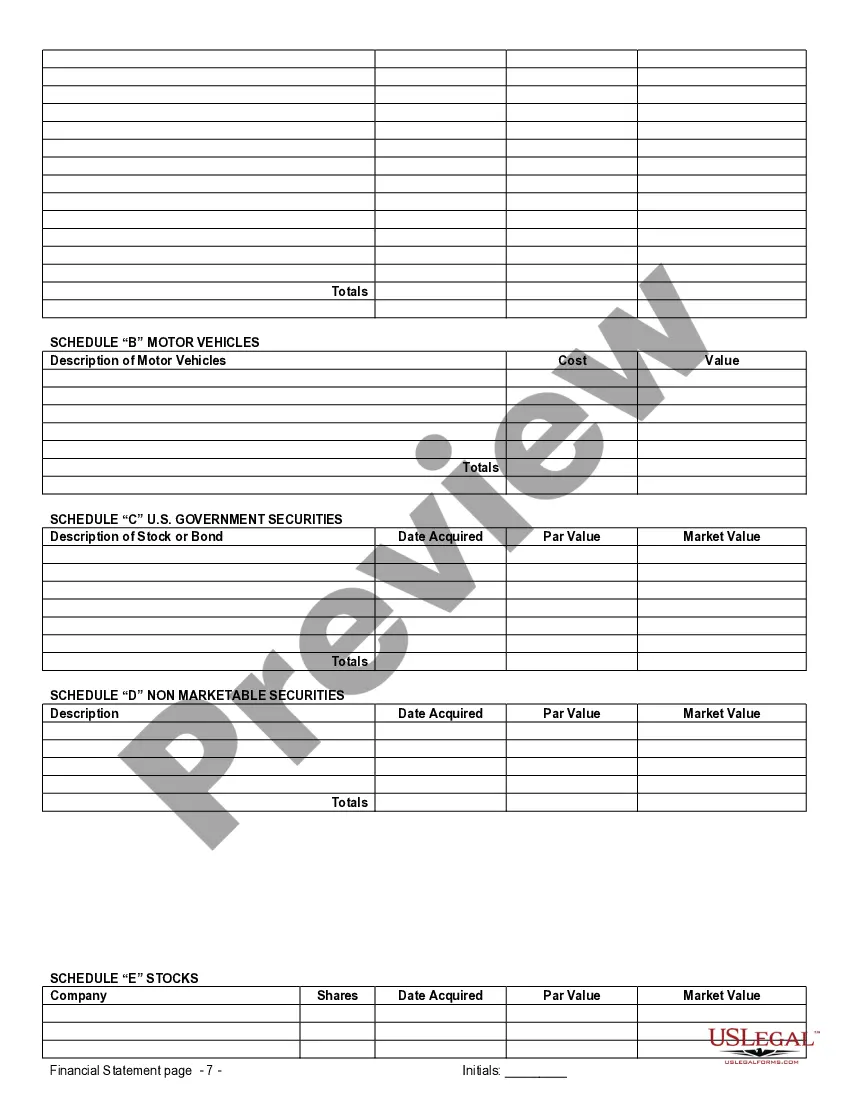

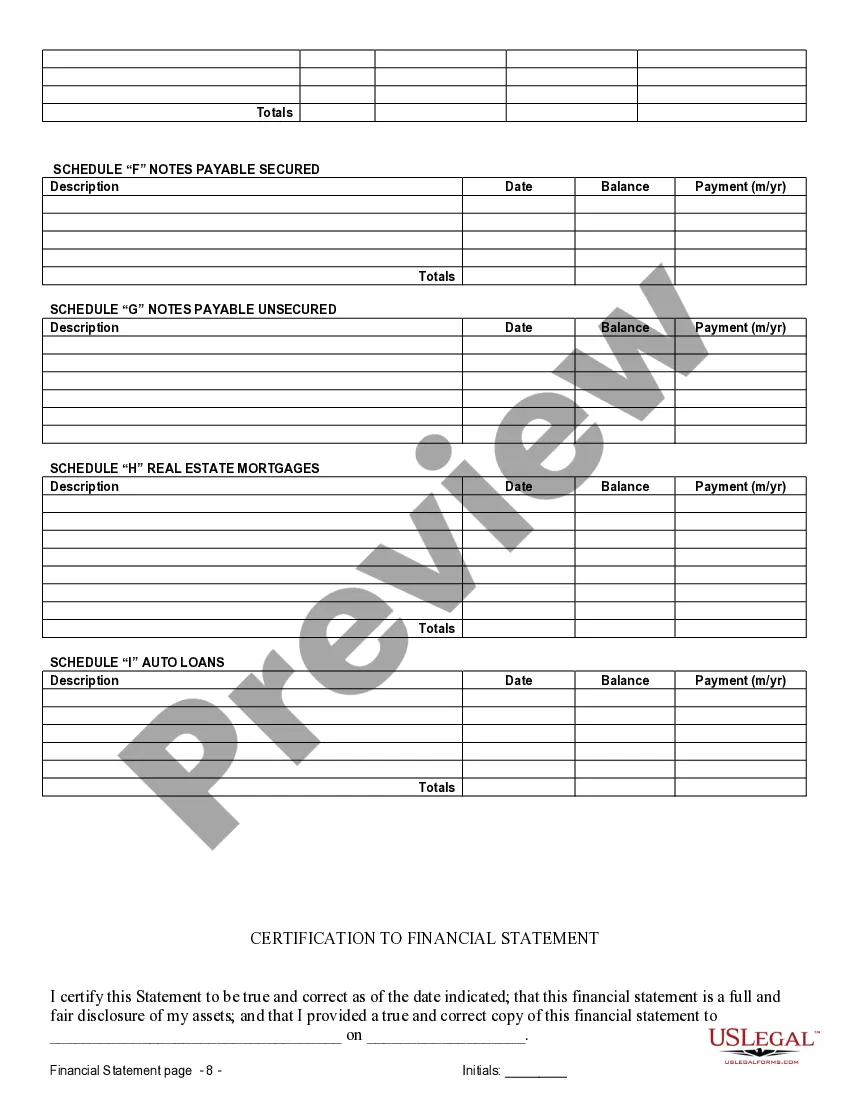

Listing assets for a prenup involves compiling a comprehensive inventory of your property, including real estate, bank accounts, vehicles, and personal belongings. It is crucial to ensure that each item is valued appropriately and documented accurately. In Cary, North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement can guide you in presenting your assets clearly. Utilizing platforms like USLegalForms can provide insightful templates that simplify this process.

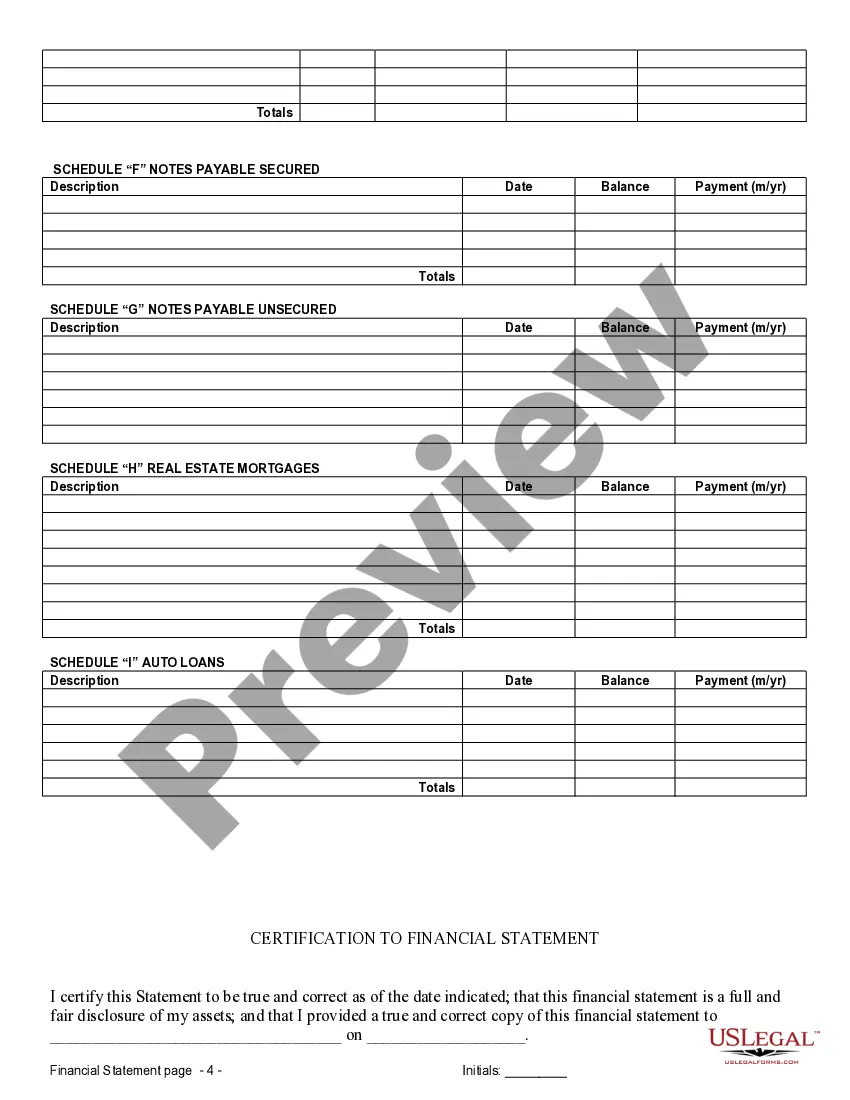

A financial statement for a prenuptial agreement outlines the assets, liabilities, and overall financial situation of each party entering the marriage. Essentially, it provides full transparency, often including income, real estate, investments, and debts. In Cary, financial statements only in connection with prenuptial premarital agreements play a critical role in safeguarding both parties’ finances. By accurately documenting this information, you ensure that both you and your partner have a clear understanding of each other’s financial landscape.

A loophole in a prenup often refers to any ambiguities or unclear terms that may arise during legal disputes. Without precise language, certain provisions within the agreement might be challenged in court. Understanding how Cary North Carolina Financial Statements only in Connection with Prenuptial Premarital Agreement affect your prenup can help clarify potential loopholes. It is essential to consult legal experts to ensure that every detail in your prenup is specific and enforceable.

A prenuptial agreement can specify how debts will be managed, which helps to keep them separated. By clearly outlining each partner's financial responsibilities, a prenup can prevent one spouse from being liable for the other's debts. This separation is essential for financial stability within the marriage. For assistance with Cary North Carolina financial statements only in connection with prenuptial premarital agreements, consider reaching out to legal experts.

Premarital assets are generally considered separate property, but without a prenup, proving this status can be challenging. In some cases, courts may regard any increase in value during the marriage as marital property. It’s advisable for individuals to protect their premarital assets with a well-drafted prenuptial agreement. Referencing Cary North Carolina financial statements only in connection with prenuptial premarital agreements can clarify these protections.

To legally keep finances separate in marriage, couples should create a prenuptial agreement that defines the ownership of assets and debts. Establishing separate bank accounts and keeping financial records distinct can also help maintain clarity. Regular communication regarding financial matters is crucial for avoiding misunderstandings. Seek guidance on Cary North Carolina financial statements only in connection with prenuptial premarital agreements for informed decision-making.

A prenuptial agreement can effectively keep assets separate if it is structured correctly. It allows each partner to declare their individual property and outline which assets will remain separate during the marriage. This separation can safeguard assets from being classified as marital property in the event of a divorce. For clarity, consulting Cary North Carolina financial statements only in connection with prenuptial premarital agreements is beneficial.

Yes, North Carolina recognizes prenuptial agreements as valid and enforceable when properly executed. Couples can agree on various financial aspects, including asset division and spousal support. It's advisable to follow specific legal requirements to ensure the agreement holds up in court. Utilizing Cary North Carolina financial statements only in connection with prenuptial premarital agreements covers these important regulations.

The financial statement of a prenuptial agreement details each spouse's assets, liabilities, and income before marriage. This document is essential for establishing transparency and fairness between partners. Properly drafting a financial statement can help enforce the terms of the prenup in case of disputes. Engaging with Cary North Carolina financial statements only in connection with prenuptial premarital agreements ensures accuracy in this critical aspect.