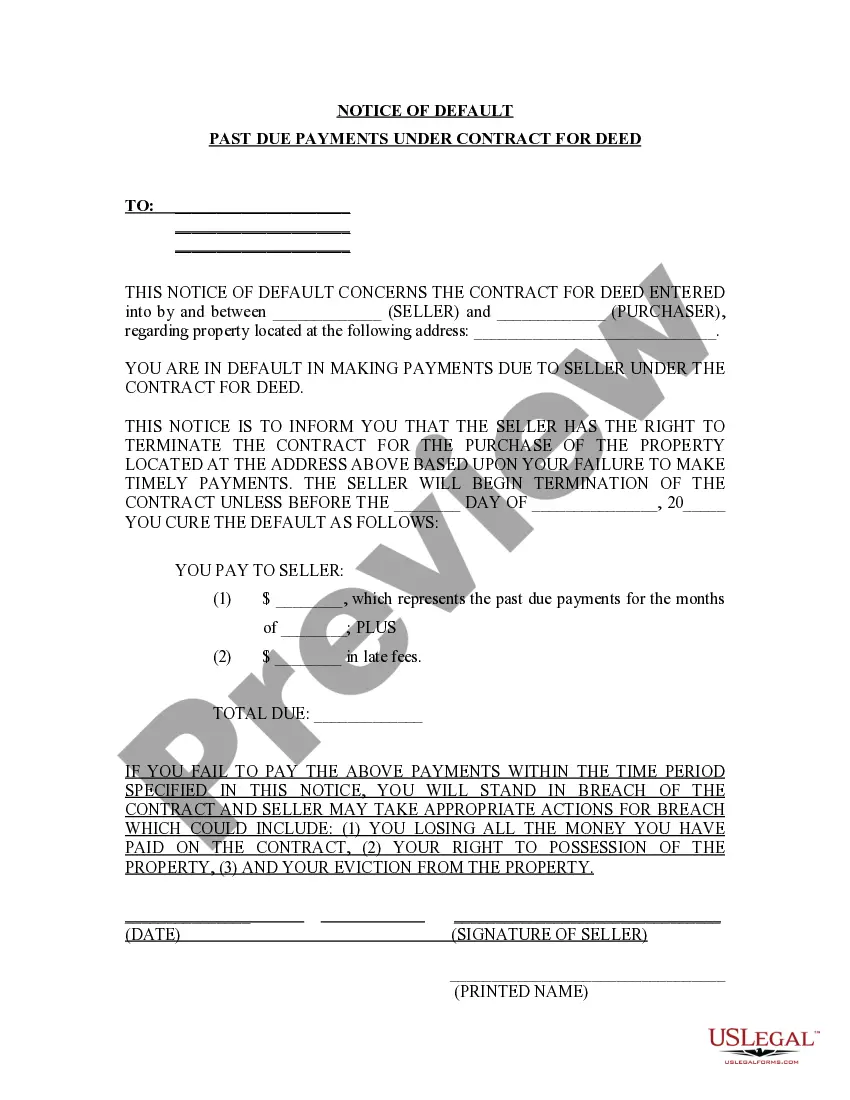

High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out North Carolina Notice Of Default For Past Due Payments In Connection With Contract For Deed?

If you’ve previously taken advantage of our service, Log In to your account and retrieve the High Point North Carolina Notice of Default for Past Due Payments related to Contract for Deed on your device by clicking the Download button. Ensure your subscription is active. If not, renew it according to your payment plan.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to conveniently locate and save any template for your personal or professional requirements!

- Ensure you’ve found the correct document. Review the description and utilize the Preview option, if accessible, to verify if it suits your requirements. If it does not align with your needs, employ the Search tab above to identify the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and finalize a payment. Enter your credit card information or use the PayPal option to complete the transaction.

- Retrieve your High Point North Carolina Notice of Default for Past Due Payments related to Contract for Deed. Choose the file format for your document and store it on your device.

- Complete your sample. Print it out or utilize professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

If someone defaults on a land contract, the seller has the right to terminate the contract and reclaim the property. This situation often leads to complicated legal proceedings, making it crucial to seek assistance. If you are dealing with a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, consider visiting USLegalForms, as they offer resources that can help you navigate this challenging situation.

The 120-day rule for foreclosure indicates that lenders must notify borrowers of their default and allow 120 days to cure the default before proceeding with foreclosure. This is an essential period where you can work out your payments, especially if you are facing a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed. Taking appropriate action during this time can be critical to avoid losing your property.

The timeline for foreclosure in North Carolina can vary but generally ranges from a few months to a year. After a borrower defaults, the lender must provide a notice of default, then wait at least 20 days before proceeding with a foreclosure sale. If you receive a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, being aware of this timeline can help you plan your next steps effectively.

One disadvantage of a contract for deed is that the buyer does not receive full legal title until all payments are completed, putting them at risk if they default. Another issue is the potential for higher costs over time due to interest and fees. If you find yourself facing a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, it becomes even more important to consider these factors.

Article 2A in Chapter 45 of the NC General Statutes specifically addresses contract for deed arrangements. It outlines the rights and responsibilities of buyers and sellers in these transactions. If you are dealing with issues related to a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, understanding this legal framework can be beneficial.

Foreclosure law in North Carolina follows a non-judicial process, meaning that lenders can proceed without going through court. This process requires lenders to notify borrowers of default, allowing a limited time to resolve the issue. If you receive a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, it is important to act quickly to explore all available options.

The redemption period for foreclosure in North Carolina generally does not exist after a property is sold at a foreclosure auction. However, during the pre-foreclosure period, borrowers can still address their debts, such as a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, to potentially avoid foreclosure altogether.

In North Carolina, the statute of limitations on foreclosure is typically 10 years. This means that a lender has 10 years from the date of default to initiate foreclosure proceedings. Understanding this timeframe is crucial, especially when dealing with a High Point North Carolina Notice of Default for Past Due Payments in connection with Contract for Deed, as it impacts your options moving forward.

Yes, a contract for deed is often referred to as a land contract, and they typically function identically. Both involve a buyer making payments over time for a property while gaining equitable interest. However, clarity on these terms is crucial when addressing challenges like a High Point North Carolina Notice of Default for Past Due Payments.

A land contract is also known as a 'contract for deed' or an 'installment sale agreement.' This arrangement allows buyers to make payments over time while living on the property. When considering a High Point North Carolina Notice of Default for Past Due Payments, it is essential to understand the implications of such agreements fully.