High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out North Carolina Promissory Note In Connection With Sale Of Vehicle Or Automobile?

We consistently seek to reduce or evade legal repercussions when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically very costly.

However, not all legal concerns are as complicated.

Many of them can be handled independently.

Utilize US Legal Forms whenever you wish to obtain and download the High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile or any other document efficiently and securely.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our library enables you to manage your affairs without the need for a lawyer's services.

- We provide access to legal document templates that are not always publicly available.

- Our templates are tailored to specific states and regions, significantly easing the search process.

Form popularity

FAQ

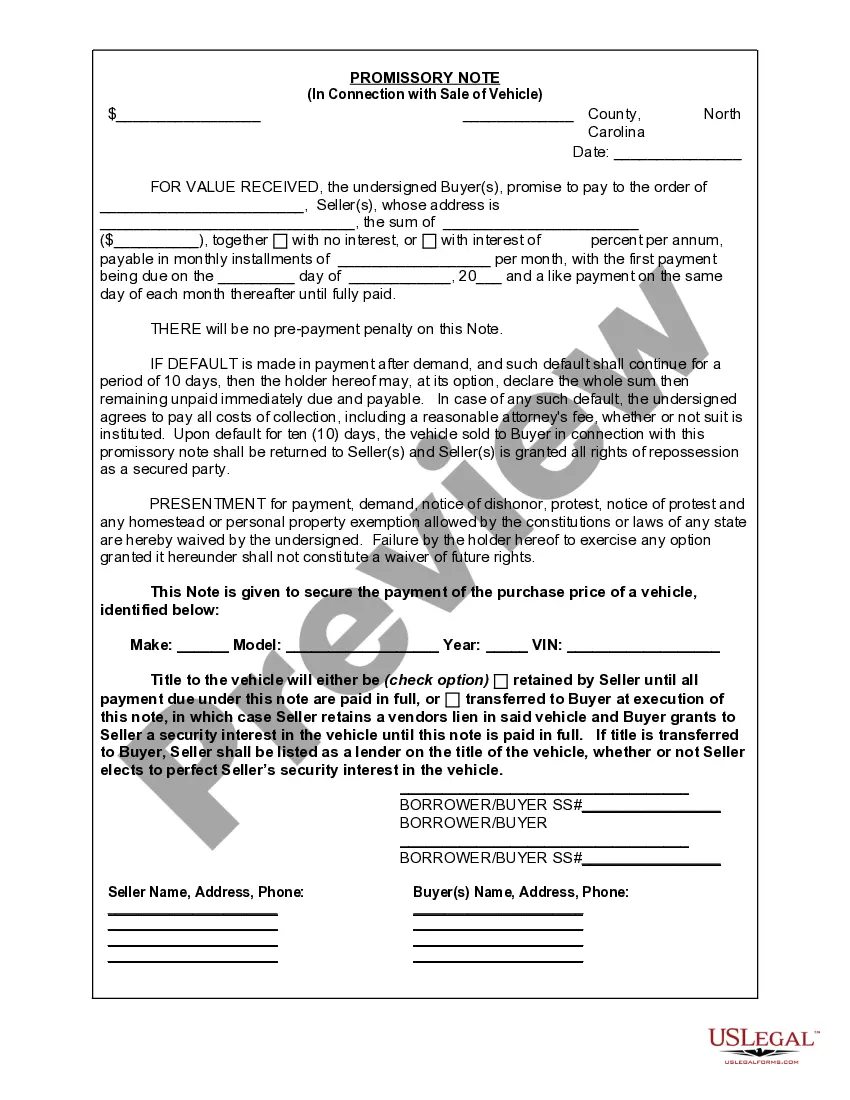

To fill out the promissory note, begin by entering the date and the names of the borrower and lender. Clearly state the total amount to be borrowed and the terms of repayment, including monthly installments. When preparing a High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, make sure to include details about the vehicle involved. Lastly, both parties need to sign to verify the agreement.

When filling out a promissory note sample, start by entering the names and addresses of both parties. Next, specify the principal amount, interest rate, and any applicable payment schedule. For a High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, outline how the note will be repaid upon sale. Make sure to review all sections for accuracy, then have both parties sign the document.

A promissory note in North Carolina remains valid until the debt is satisfied or becomes legally unenforceable due to the statute of limitations. Generally, the duration for enforcement is up to three years. If you are using a High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, maintaining records of payments and communications can help ensure its validity throughout this period.

A promissory note is generally enforceable as long as it meets certain legal requirements, such as being written and signed by the borrower. In North Carolina, courts typically uphold valid promissory notes when there is an agreed-upon repayment plan. However, it's important to ensure that your High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile is properly drafted to avoid any potential disputes. Always consider seeking legal guidance for comprehensive protection.

Yes, there is a time limit on a promissory note, commonly known as the statute of limitations. In North Carolina, the general limit for promissory notes is typically three years. This means that a creditor has up to three years to take legal action to collect on a High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile before the right to collect expires.

In North Carolina, debts may become uncollectible after three years from the date of the last payment or the last documented communication. This time frame can vary based on the nature of the debt. For a High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile, it's crucial to understand this limitation, as it can impact your rights and options if payment issues arise. You should consult with a legal professional for specific advice regarding your situation.

You do not necessarily need a lawyer to write a promissory note, as many templates are available online to help you draft one. However, consulting a lawyer can provide additional support and reassurance, particularly for complex transactions. Using a High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile template from USLegalForms can simplify the drafting process.

To obtain a promissory note, first decide whether you want to draft it yourself or use a legal template. You can find a reliable template for a High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile online. Many legal platforms, like USLegalForms, provide customizable options that are straightforward and user-friendly.

You can obtain a copy of your promissory note by contacting the seller and requesting a duplicate if they hold the original. If you used a legal service to draft the note, you may also access it through that service. Platforms like USLegalForms often allow you to retrieve copies of your High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile easily.

When writing a promissory note for a car, include the names of both the lender and borrower, details about the vehicle, payment terms, and the due date for payments. The High Point North Carolina Promissory Note in Connection with Sale of Vehicle or Automobile should also specify any taxes, fees, or interest involved. Utilizing a template from uslegalforms can provide you with a structured format, making the process easier and helping you cover all necessary details.