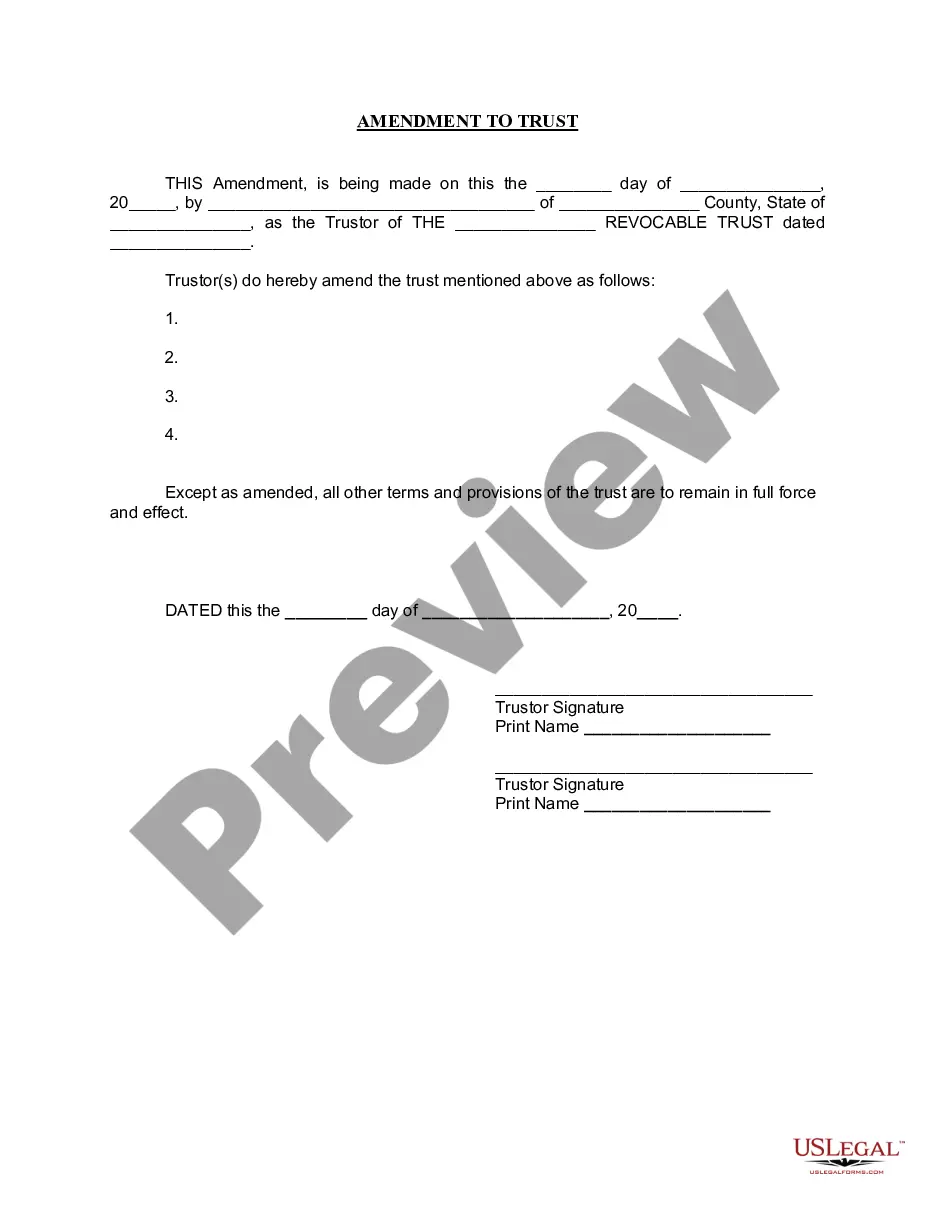

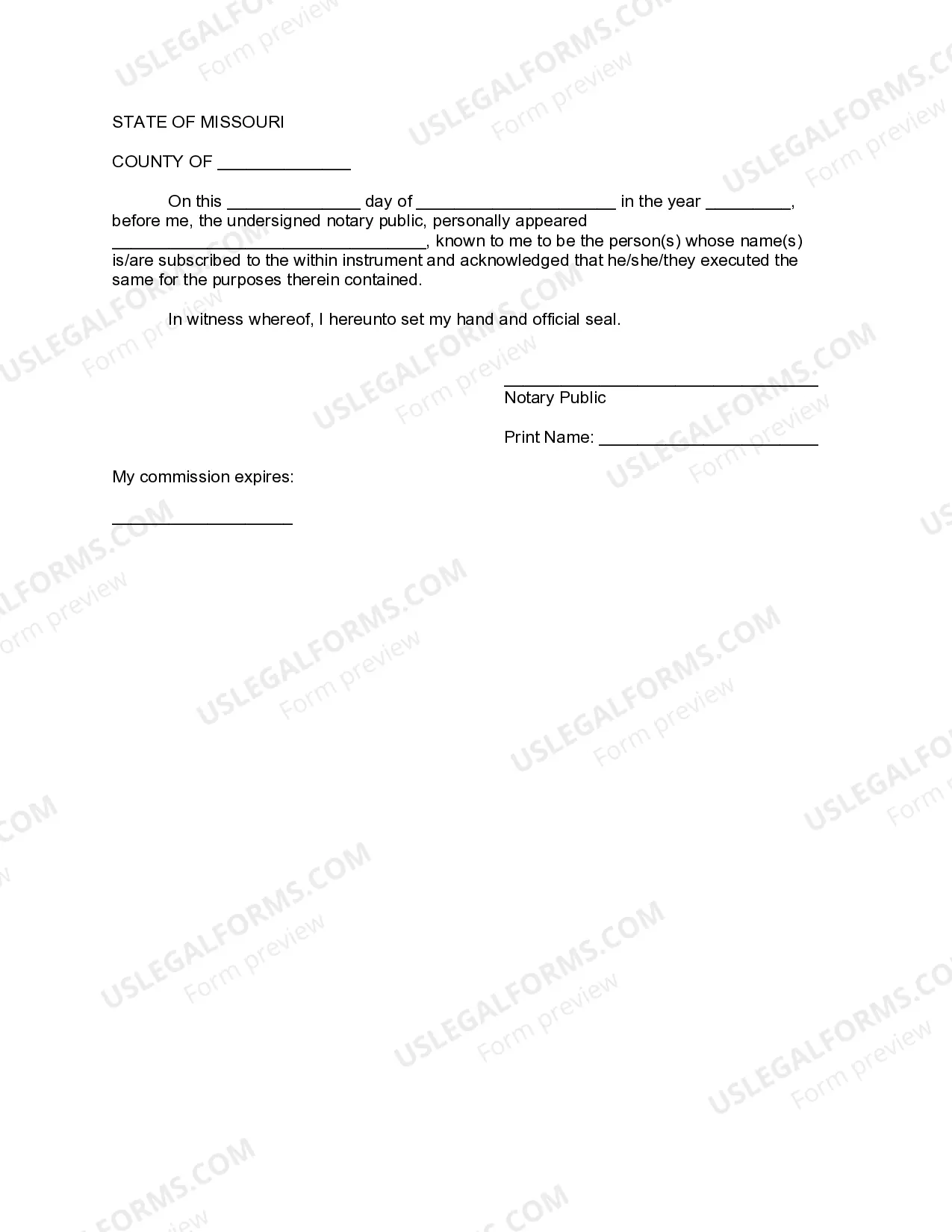

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Springfield Missouri Amendment to Living Trust

Description

How to fill out Missouri Amendment To Living Trust?

If you are looking for a suitable form, it’s challenging to discover a more accessible location than the US Legal Forms website – likely the most extensive libraries available online.

Here you can locate a vast number of form samples for business and personal uses categorized by types and states, or key phrases.

Utilizing our top-notch search feature, obtaining the most current Springfield Missouri Amendment to Living Trust is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal to finalize the registration process.

Obtain the form. Choose the format and download it to your device.

- Additionally, the relevance of each record is verified by a group of experienced attorneys who consistently assess the templates on our site and update them per the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Springfield Missouri Amendment to Living Trust is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, just adhere to the instructions outlined below.

- Ensure you have located the form you need. Review its description and utilize the Preview feature to examine its contents. If it doesn’t satisfy your needs, use the Search box at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. After that, select your preferred payment plan and provide credentials to create an account.

Form popularity

FAQ

The creation of a living trust requires that the creator drafts a trust document that provides information regarding who is the appointed Trustee, the assets that are to be included, and who the beneficiaries are. The trust comes into effect as soon as it is signed, preferably in the presence of a Notary Public.

The cost of creating a living trust in Missouri can vary widely, depending on several factors. Some people do it with a few hundred dollars using online programs. Others seek the assistance of a lawyer and easily drop more than $1,000.

You can also amend a trust if you decide to add or remove property from the trust. Common situations that lead to a trust amendment are divorce or marriage, birth of a child or grandchild, a move to a state with different laws, a change in tax laws, a change in your financial situation, or the death of a beneficiary.

Trust restatement is the process of rewriting the structure of a Trust to make significant changes to its provisions. The process of restatement completely replaces the previous structure of the Trust, and must follow the same formalities of the original process.

To create a living trust in Missouri, you put the terms of the trust into a trust agreement which you then sign in front of a notary public. The final step is to fund the trust, transfer ownership of assets into the name of the trust. A revocable living trust can offer you flexibility, control, and privacy.

An amendment is a formal document making a change to one or multiple parts of a Revocable Living Trust. A codicil is a formal document making a change to one or multiple parts of a Last Will and Testament. If your Living Trust has been lost or destroyed, we can Restate your original Trust.

The income of an estate or trust is taxed to the fiduciary or beneficiary. The tax is paid by the fiduciary responsible for administering the estate or trust, except that beneficiaries pay the tax on distributions of estate or trust income received during the taxable year.

The assets contained in the trust go to your beneficiaries on your death, without having to go through probate. If you make the trust a revocable living trust, you're able to change its terms or even revoke at any time you want. Revoking a trust means ending or terminating it. Jointly owned property.

A family trust company does not engage in business with the general public or otherwise hold itself out as a trustee for hire. No family trust company shall conduct business in this state without paying a filing fee and registering with the Secretary of State.

A trust amendment is a legal document that changes specific provisions of a revocable living trust but leaves all of the other provisions unchanged, while a restatement of a trust?which is also known as a complete restatement or an amendment and complete restatement?completely replaces and supersedes all of the