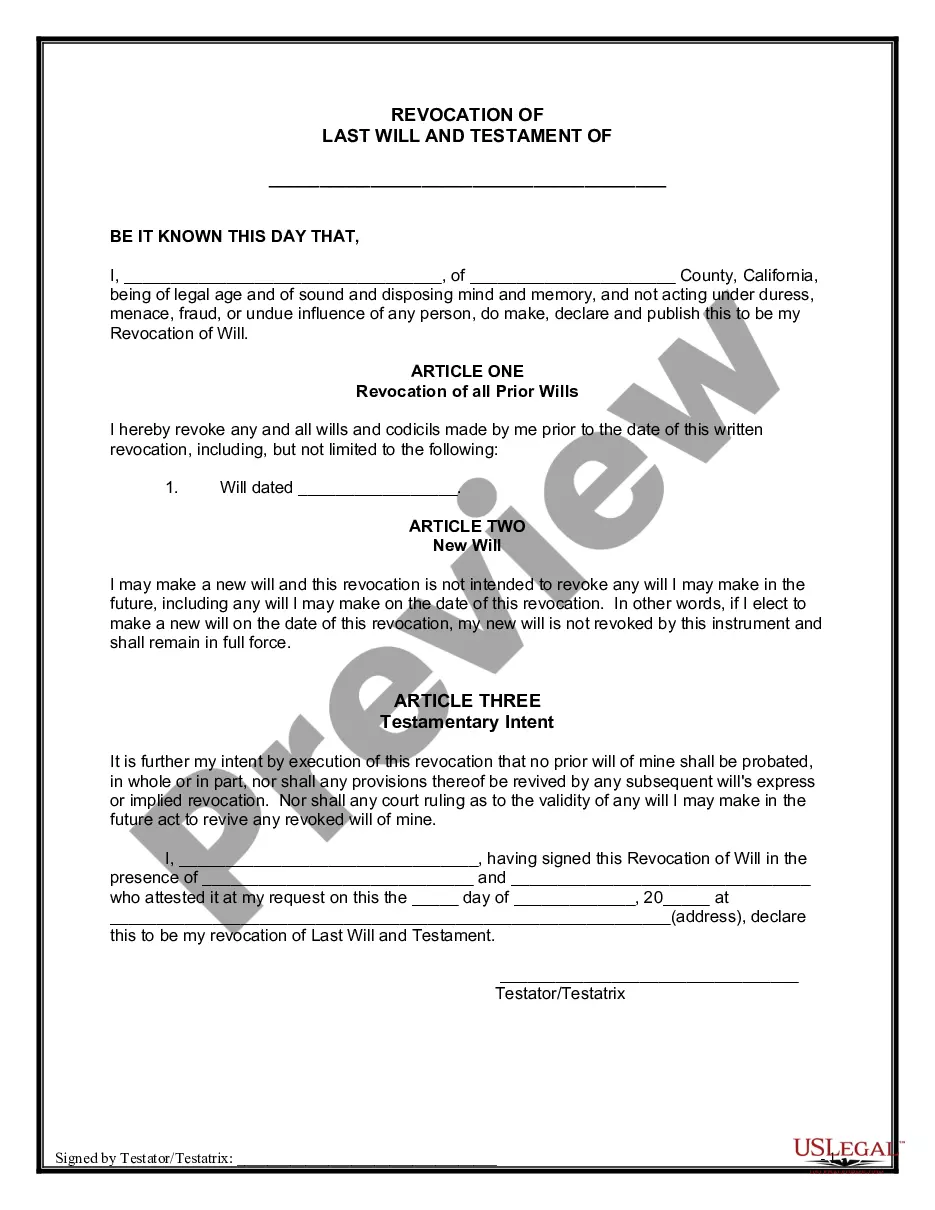

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Kansas City Missouri Warranty Deed from Husband and Wife to LLC

Description

How to fill out Missouri Warranty Deed From Husband And Wife To LLC?

Do you require a dependable and affordable legal documents provider to purchase the Kansas City Missouri Warranty Deed from Spouses to LLC? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a set of documents to facilitate your divorce through the court, we have you covered. Our site features over 85,000 current legal document templates for individual and business needs. All templates we offer are customized and tailored to comply with the regulations of distinct states and regions.

To download the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Please keep in mind that you can download your previously bought form templates anytime from the My documents tab.

Are you a newcomer to our platform? No problem. You can create an account in just a few minutes, but before that, ensure you do the following.

Now you can set up your account. Then select the subscription option and proceed to payment. Once the payment is complete, download the Kansas City Missouri Warranty Deed from Spouses to LLC in any available file format. You can return to the website anytime and redownload the document at no cost.

Finding current legal forms has never been simpler. Give US Legal Forms a try now, and stop wasting your precious time trying to learn about legal documents online.

- Check whether the Kansas City Missouri Warranty Deed from Spouses to LLC aligns with the regulations of your state and locality.

- Review the form’s description (if available) to determine who it benefits and what the document is intended for.

- Restart your search if the form does not fit your particular situation.

Form popularity

FAQ

A Missouri beneficiary deed form?also known as a Missouri transfer-on-death deed form or simply Missouri TOD deed form?is a written document that transfers real estate at an owner's death. It works in much the same way as a POD or TOD designation on a bank account.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

Missouri Quit Claim Deed Form ? Summary The Missouri quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Recording fees for quitclaim deeds vary among counties. In Clay County and Platte County, the fee is $24 for the first page and $3 for each additional page. Unlike the majority of other states, Missouri doesn't assess a real estate transfer tax on quitclaim deeds.

The fee charged by a local County Recorder of Deeds office to record a Beneficiary Deed averages between $24 and $30. The Grantor should contact the local County Recorder of Deeds office to inquire as to the current fee charged. Upon recording the deed the Recorder of Deeds office will mail the original to the Grantor.

Missouri does require that a non-owner spouse sign a deed selling, conveying, or otherwise encumbering a property by the owner spouse. This is a form of ownership specifically created for spouses.

Unlike many states, Missouri has no real estate transfer tax. The deed must only be accompanied by the recording fees. Recording fees are usually $20 to $25 for the first page and $3 for each additional page.

The Missouri warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

Transferring Missouri real estate is a four-step process: Locate the Prior Deed to the Property. The prior deed includes important information that is needed to prepare the new deed.Get a New Deed to the Property.Sign and Notarize the New Deed.Record the New Deed in the Land Records.