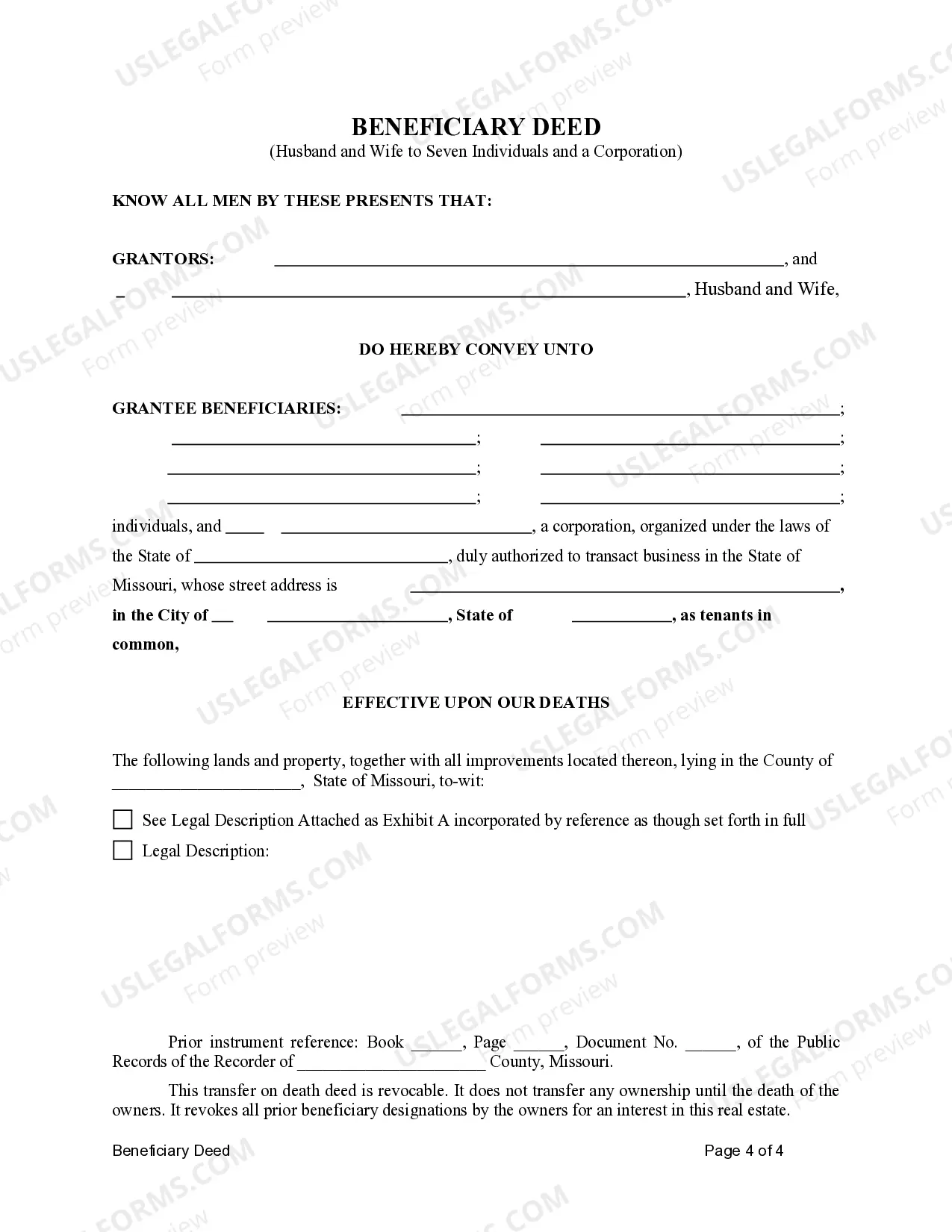

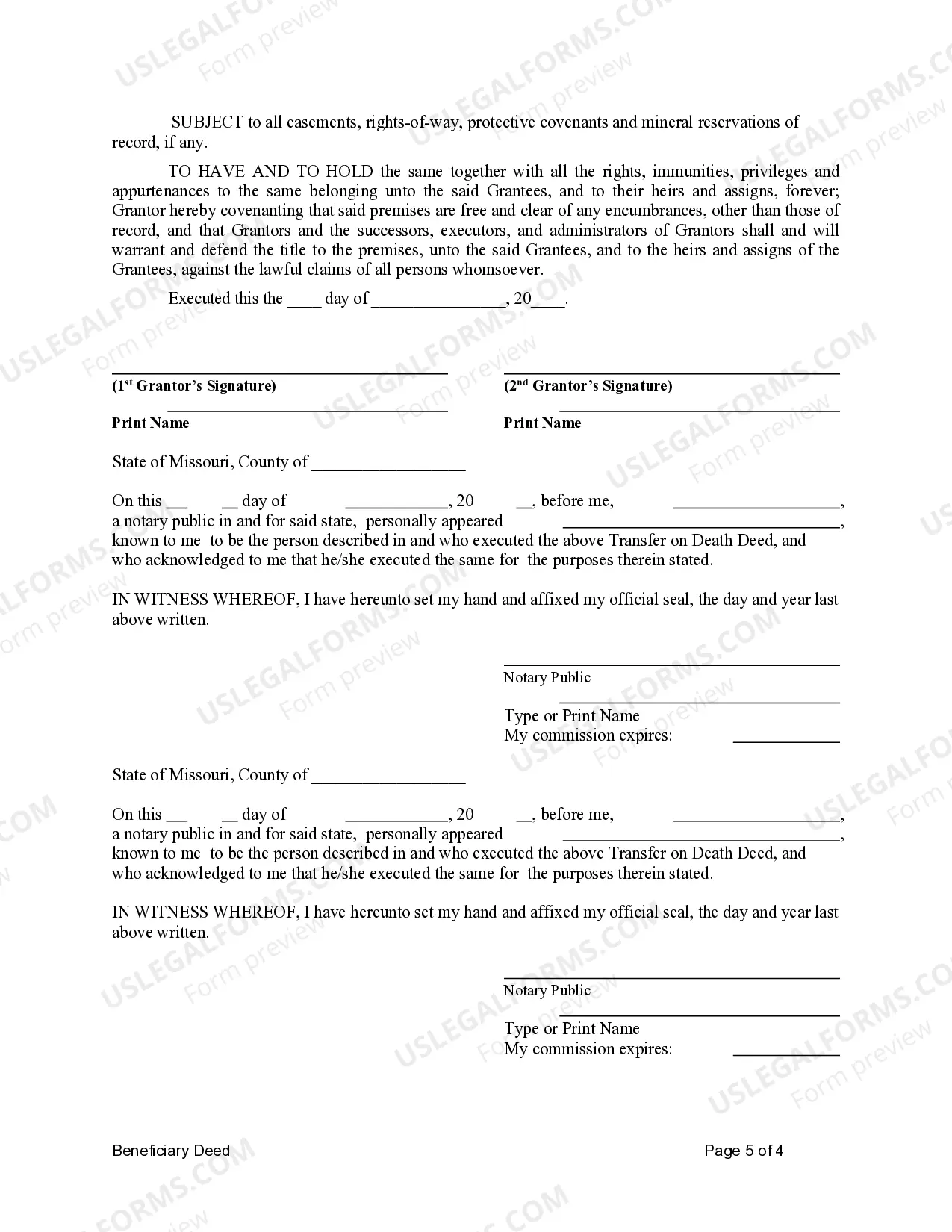

This form is a Transfer on Death Deed where the Grantors are husband and wife and the Grantees are seven individuals and one corporate beneficiary. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. The Grantees take the property as tenants in common. This deed complies with all state statutory laws.

Kansas City Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary

Description

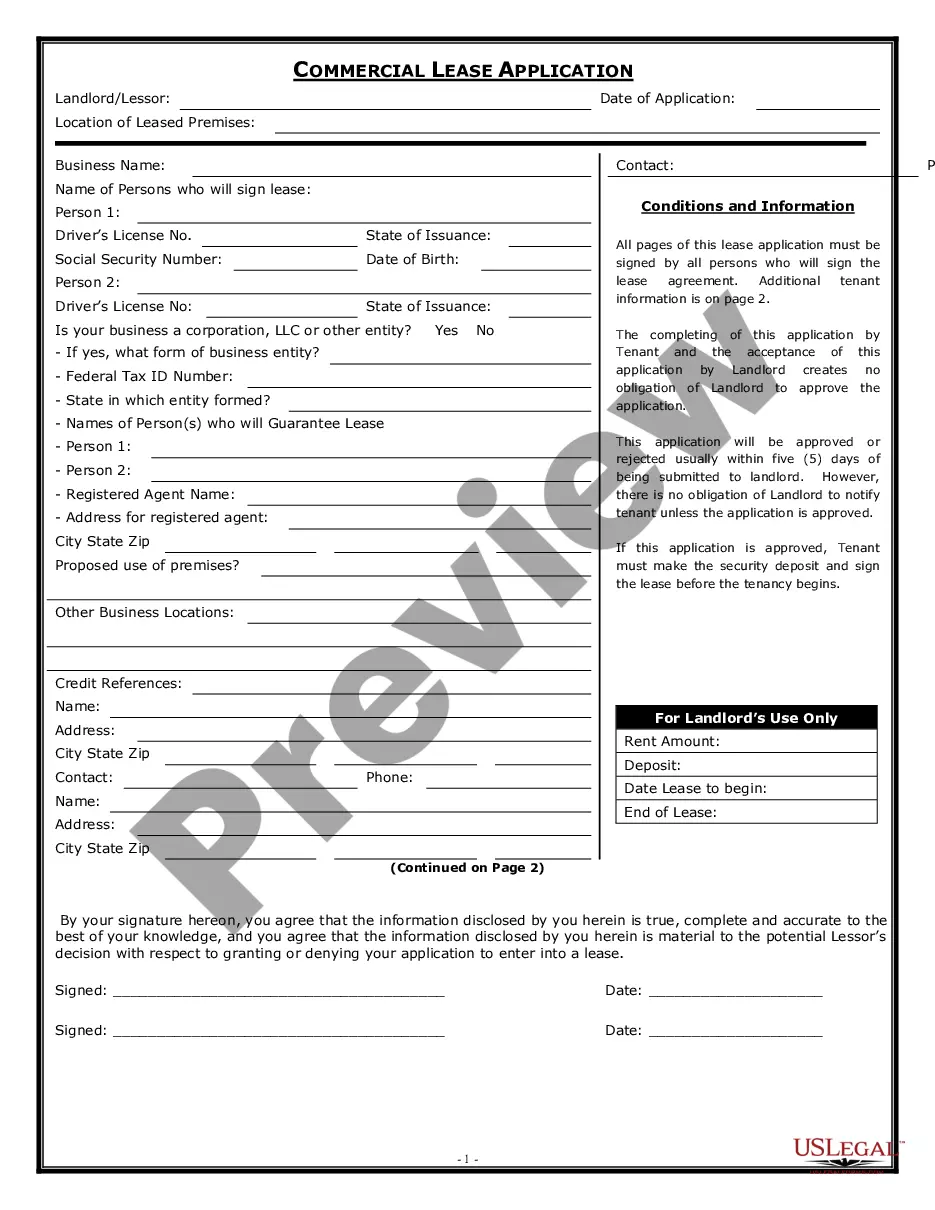

How to fill out Missouri Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Seven Individual Beneficiaries And A Corporate Beneficiary?

If you are searching for a pertinent form template, there’s no better place to discover it than the US Legal Forms website – one of the largest online collections.

With this library, you can obtain a vast number of form examples for both organizational and personal needs categorized by type and location, or keywords.

Thanks to our proficient search tool, finding the most recent Kansas City Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary is as simple as 1-2-3.

Complete the financial transaction. Use your credit card or PayPal account to conclude the registration process.

Access the template. Specify the file format and save it to your device. Make modifications. Complete, alter, print, and sign the obtained Kansas City Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary.

- Moreover, the relevance of each document is guaranteed by a team of experienced attorneys who consistently evaluate the templates on our site and update them per the latest state and county regulations.

- If you are familiar with our system and possess a registered account, all you need to do to obtain the Kansas City Missouri Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Seven Individual Beneficiaries and a Corporate Beneficiary is to Log In to your user profile and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions below.

- Ensure you have accessed the sample you need. Review its details and use the Preview feature to examine its contents. If it doesn’t fulfill your needs, use the Search function at the top to find the required file.

- Verify your choice. Click the Buy now button. Then, choose your desired subscription plan and provide information to register for an account.

Form popularity

FAQ

There are various components to titling; one is using a transfer on death (TOD), generally used for investment accounts, or payable on death (POD) designation, used for bank accounts, which acts as a beneficiary designation to whom the account assets are to pass when the owner dies.

A Missouri beneficiary deed form?also known as a Missouri transfer-on-death deed form or simply Missouri TOD deed form?is a written document that transfers real estate at an owner's death. It works in much the same way as a POD or TOD designation on a bank account.

A transfer on death direction may only be placed on an account record, security certificate or instrument evidencing ownership of property by the transferring entity or a person authorized by the transferring entity.

A TOD account allows the account holder to name a beneficiary on a non-retirement financial account to receive assets at the time of the account holder's death, thereby (generally ? i.e., when used correctly) avoiding probate.

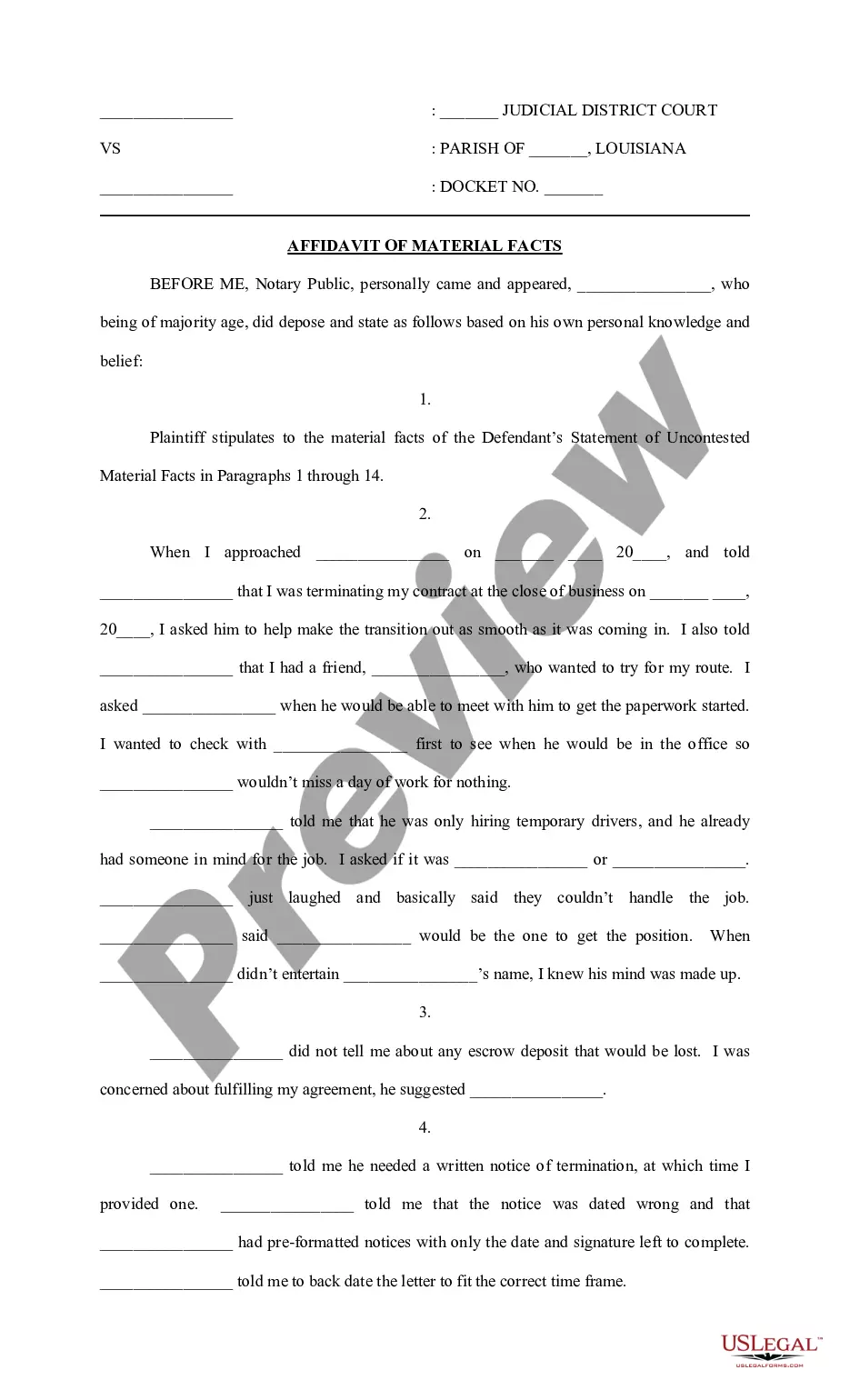

Wills, trusts, revocable trusts, beneficiary deeds, quit claim deeds, warranty deeds, options, life insurance beneficiary designations, retirement account beneficiary designations, bank account beneficiary designations, and other related matters may all be challenged for undue influence, incompetency, or fraud.

The Missouri beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Missouri allows transfer-on-death registration of vehicles. If you register your vehicle this way, the beneficiary you name will automatically inherit the vehicle after your death. No probate court proceeding will be necessary.

Missouri is one of a few states that allow residents to avoid probate with their home by recording what is called a beneficiary deed.

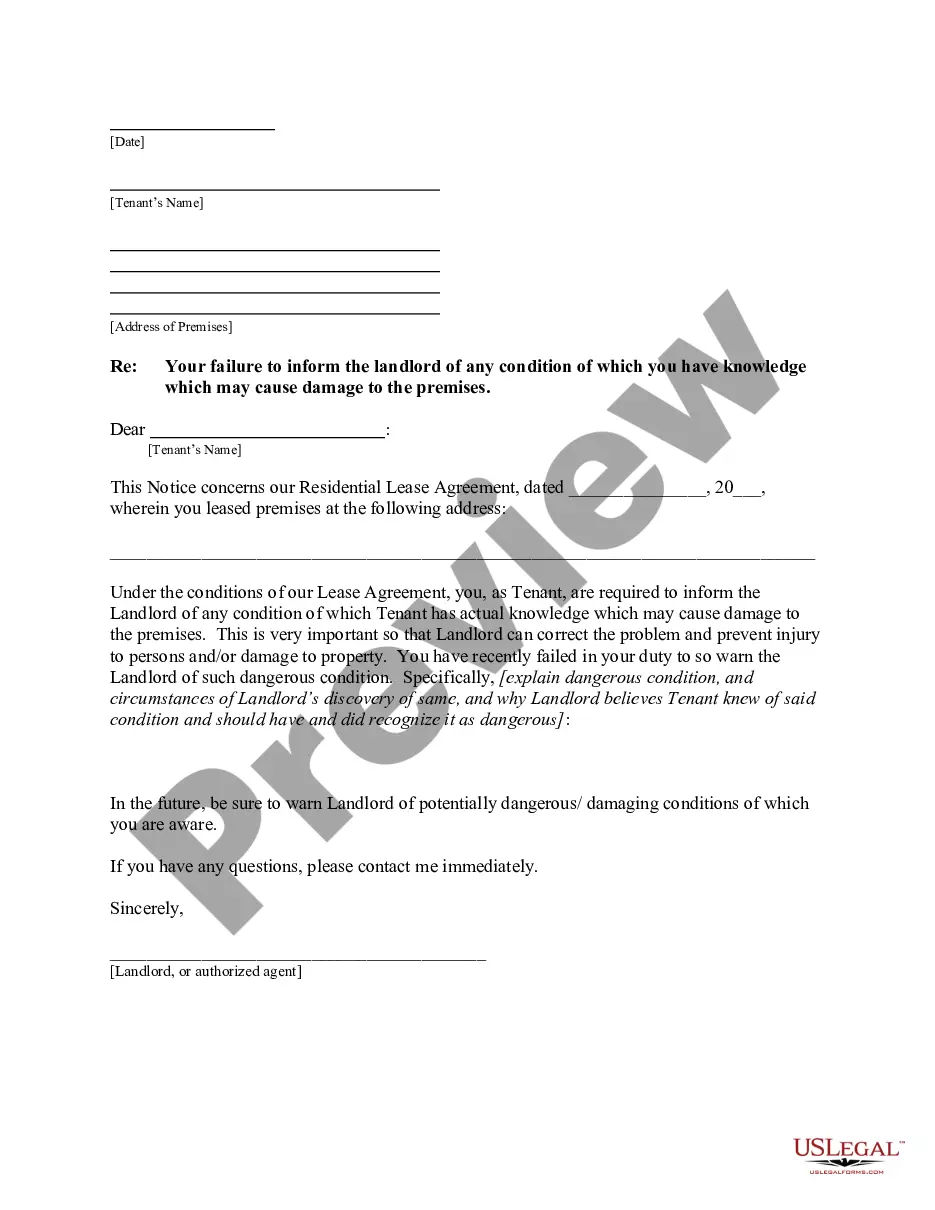

If you have made a will or previous beneficiary deed that leaves the property to someone, your new beneficiary deed will override it. Your rights. You keep complete ownership of, and control over, the real estate while you're alive.