Minneapolis Minnesota Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Minnesota Last Will And Testament With All Property To Trust Called A Pour Over Will?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms database.

It’s an online repository of over 85,000 legal documents for both individual and professional requirements and various real-life scenarios.

All the files are appropriately categorized by usage area and jurisdiction, making it as quick and simple as pie to search for the Minneapolis Minnesota Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will.

Ensure your documentation is tidy and meets legal standards. Leverage the US Legal Forms library to have essential document templates for any needs right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve chosen the right one that meets your needs and fully aligns with your local jurisdiction requirements.

- Search for another template if necessary.

- If you discover any discrepancies, utilize the Search tab above to find the correct one. If it works for you, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

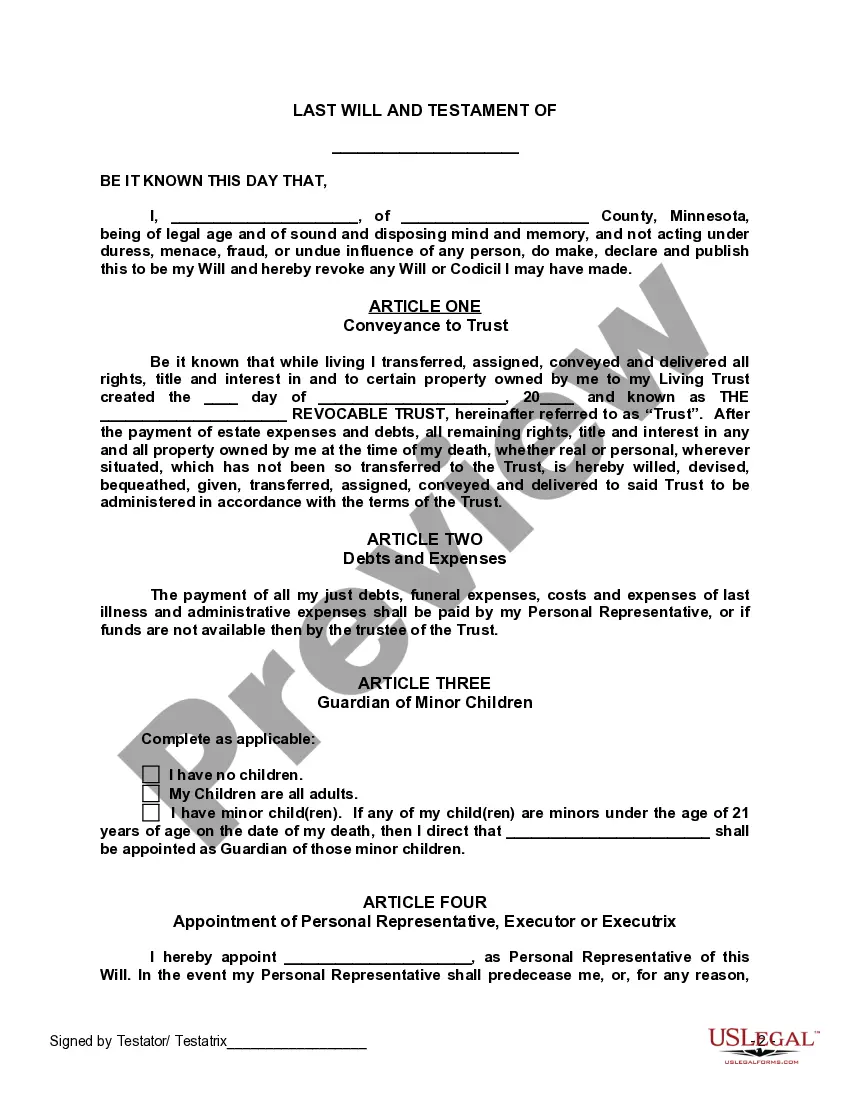

over will is a will used alongside a living trust. You can use it to transfer assets not already held in your trust before you die into your trust after your death.

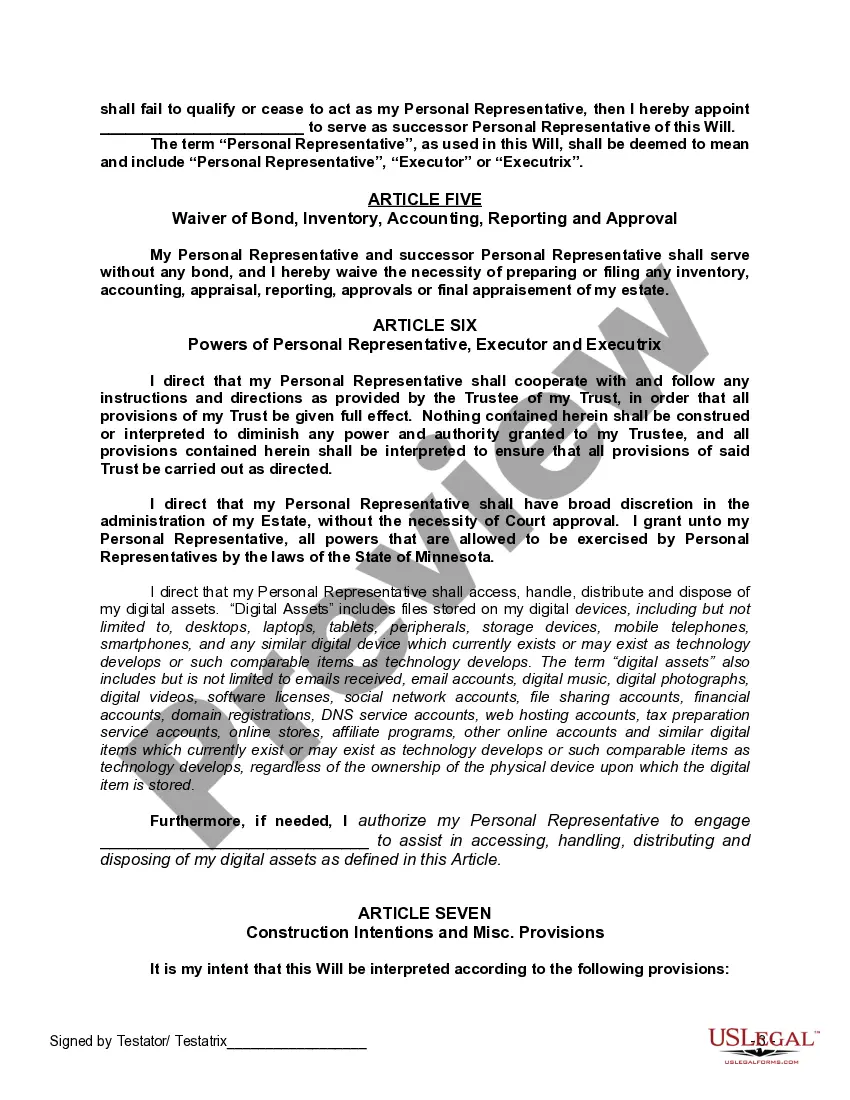

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

The main downside to pour-over wills is that (like all wills), the property that passes through them must go through probate. That means that any property headed toward a living trust may get hung up in probate before it can be distributed by the trust.

A will must be probated in court and made public record. Your trust does not need to approved by a court or become public record. The assets, beneficiaries and terms of the trust are not disclosed. A trust offers the added benefit of being more difficult to contest than a will, making your wishes secure.

A pour over will functions after an individual has already created a trust and funded the trust?meaning, they have placed certain assets in the trust to be given to beneficiaries after their death in order to avoid the probate court process.

over will is a will used alongside a living trust. You can use it to transfer assets not already held in your trust before you die into your trust after your death.

A living trust in Minnesota offers privacy whereas a will does not. A will must be probated in court and made public record. Your trust does not need to approved by a court or become public record. The assets, beneficiaries and terms of the trust are not disclosed.

Keep in mind that in the case of certain assets such as real estate, you may incur fees and transfer taxes. If the living trust contains all of your property, a will may be unnecessary and you can avoid probate. If the trust contains only part of your property, you need a will for the rest of it.

over will only goes through probate if you have failed to attach all your assets to your living trust. The probate process with a pourover will is much shorter than probate with a traditional will.

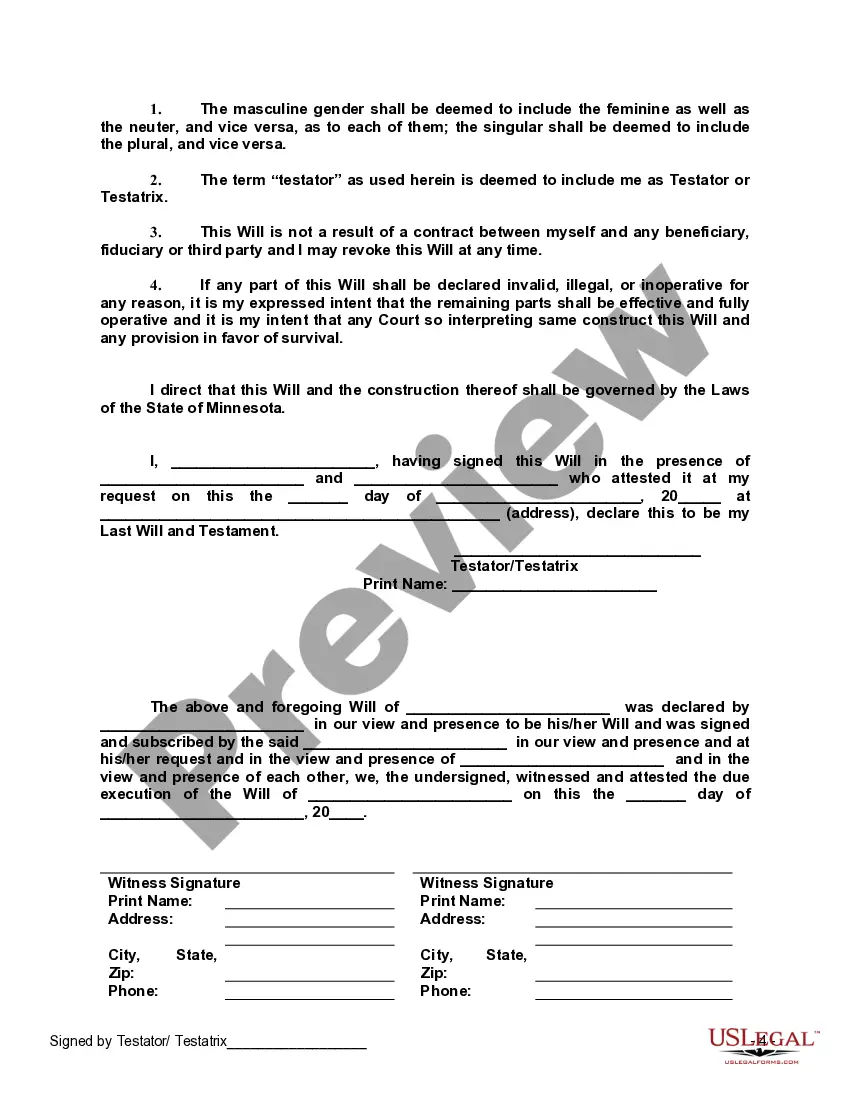

Disadvantages of Wills May be subject to probate and possible challenges regarding validity. Can be subject to federal estate tax and income taxes. Becomes public record which anyone can access.