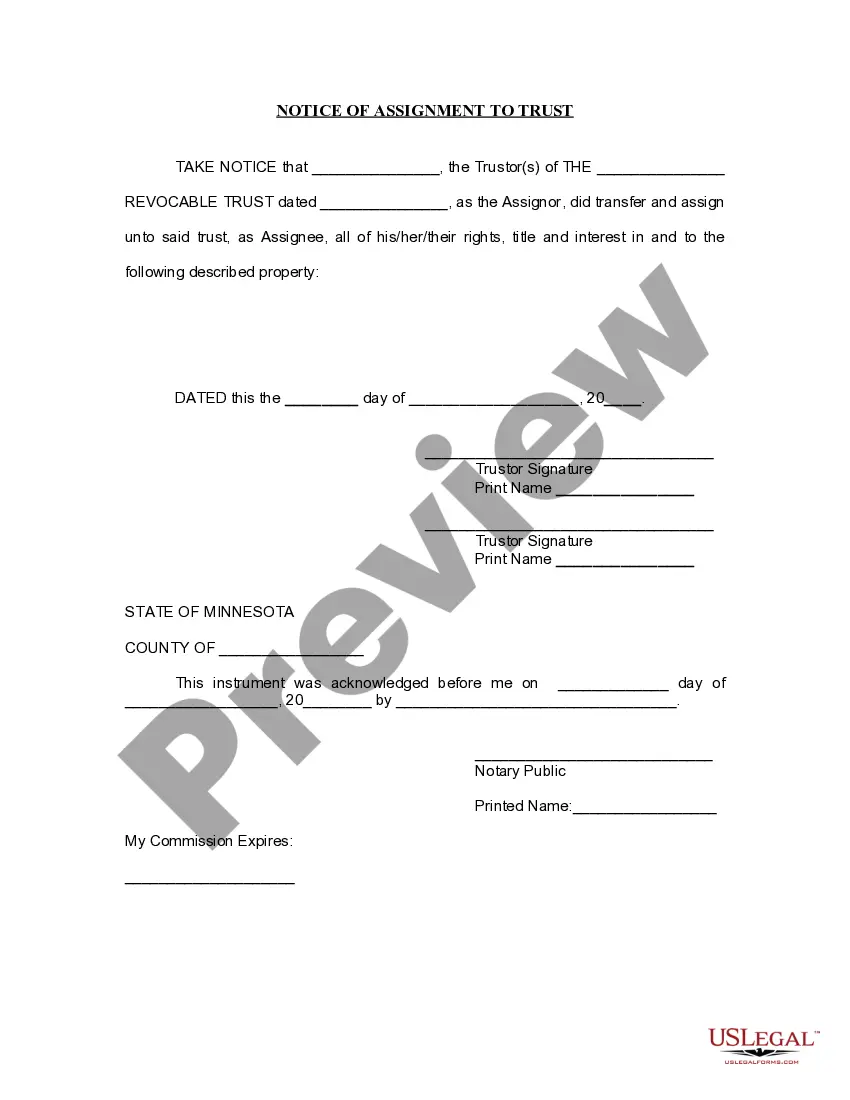

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

The Hennepin Minnesota Notice of Assignment to Living Trust is a legal document that conveys the transfer of assets or property to a living trust in Hennepin County, Minnesota. This assignment is a crucial step in estate planning, ensuring the smooth transition of assets to a trust while maintaining the granter's control and flexibility during their lifetime. When executing a Notice of Assignment to Living Trust in Hennepin County, Minnesota, it's essential to understand the various types available. These may include: 1. Revocable Living Trust Assignment: This type of assignment allows the granter to retain control over the assets transferred to the trust and modify or revoke it at any time. It offers flexibility and is favorable for those who anticipate changes in their estate plans over time. 2. Irrevocable Living Trust Assignment: Irrevocable living trusts, on the other hand, cannot normally be altered or revoked once established. Assigning assets to an irrevocable trust can have advantages like reducing estate taxes, protecting assets from creditors, or qualifying for certain government benefits. However, it typically requires careful consideration and professional advice due to the lack of flexibility. 3. Testamentary Living Trust Assignment: This type of assignment allows assets to be transferred to a living trust only after the granter's death. It is established within the granter's will, taking effect upon their passing. Testamentary trusts offer a streamlined transfer of assets while providing the opportunity for specific instructions and safeguards. The Hennepin Minnesota Notice of Assignment to Living Trust requires detailed information, including the granter's name, address, and contact information, as well as a clear identification of the assets being assigned. It is crucial to accurately identify the assets to ensure their proper transfer and avoid any ambiguity. Furthermore, the notice should clearly state the purpose of the assignment, which is to transfer the identified assets to the living trust, along with the trust's name and details. It is essential to specify whether the trust is revocable or irrevocable, and indicate any specific conditions or instructions related to the assignment. Consulting with an experienced attorney specializing in estate planning and trust administration is highly recommended when executing the Hennepin Minnesota Notice of Assignment to Living Trust. They can provide guidance based on the unique circumstances and goals of the granter, ensuring that the assignment is compliant with Minnesota state laws and tailored to their specific needs. In summary, the Hennepin Minnesota Notice of Assignment to Living Trust is a critical legal document used to transfer assets to a living trust in Hennepin County, Minnesota. Understanding the different types of living trust assignments, such as revocable, irrevocable, and testamentary, is essential for selecting the most suitable option. Seeking professional advice is highly advisable to ensure a smooth and accurate execution of the assignment while adhering to state laws and personal estate planning goals.