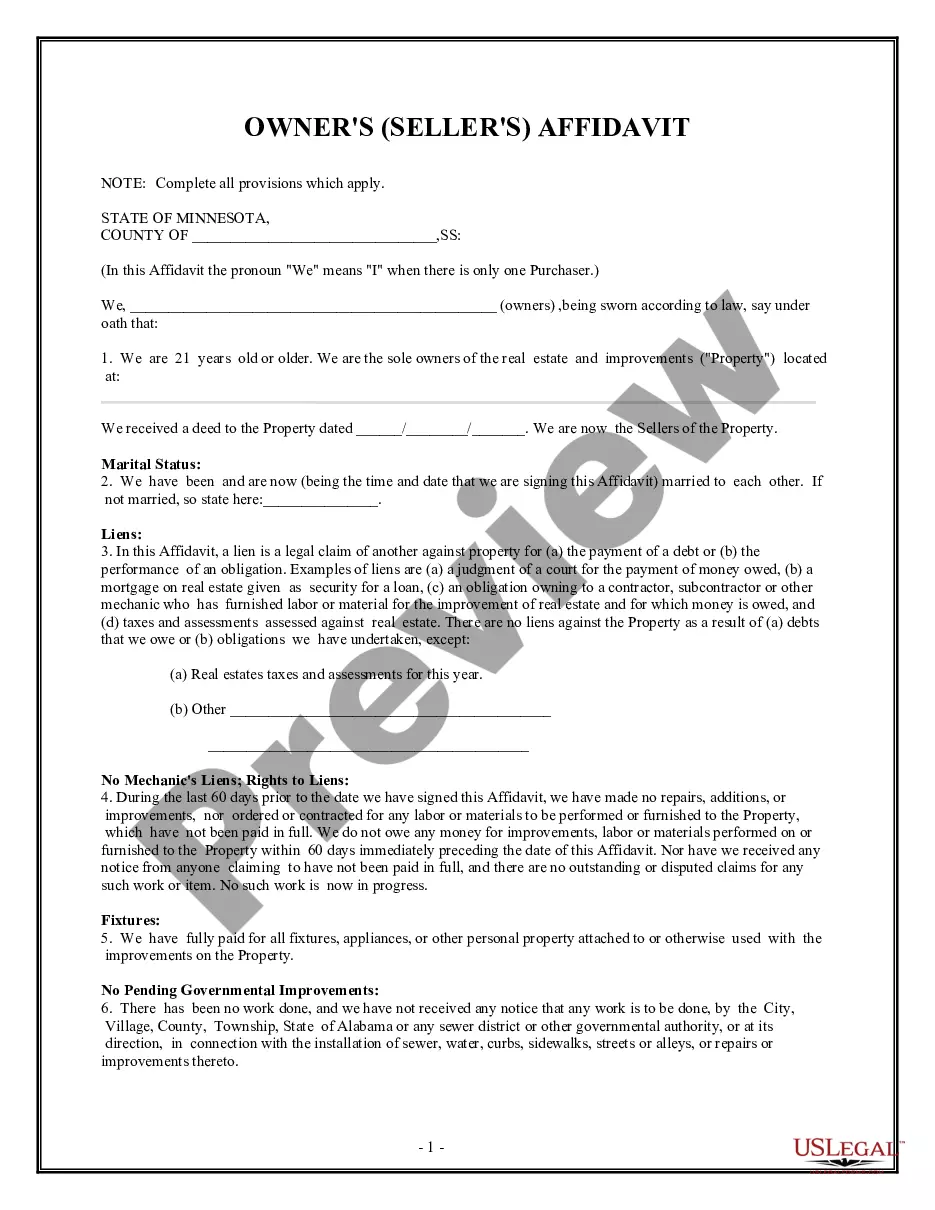

Minneapolis Minnesota Owner's or Seller's Affidavit of No Liens

Description

How to fill out Minnesota Owner's Or Seller's Affidavit Of No Liens?

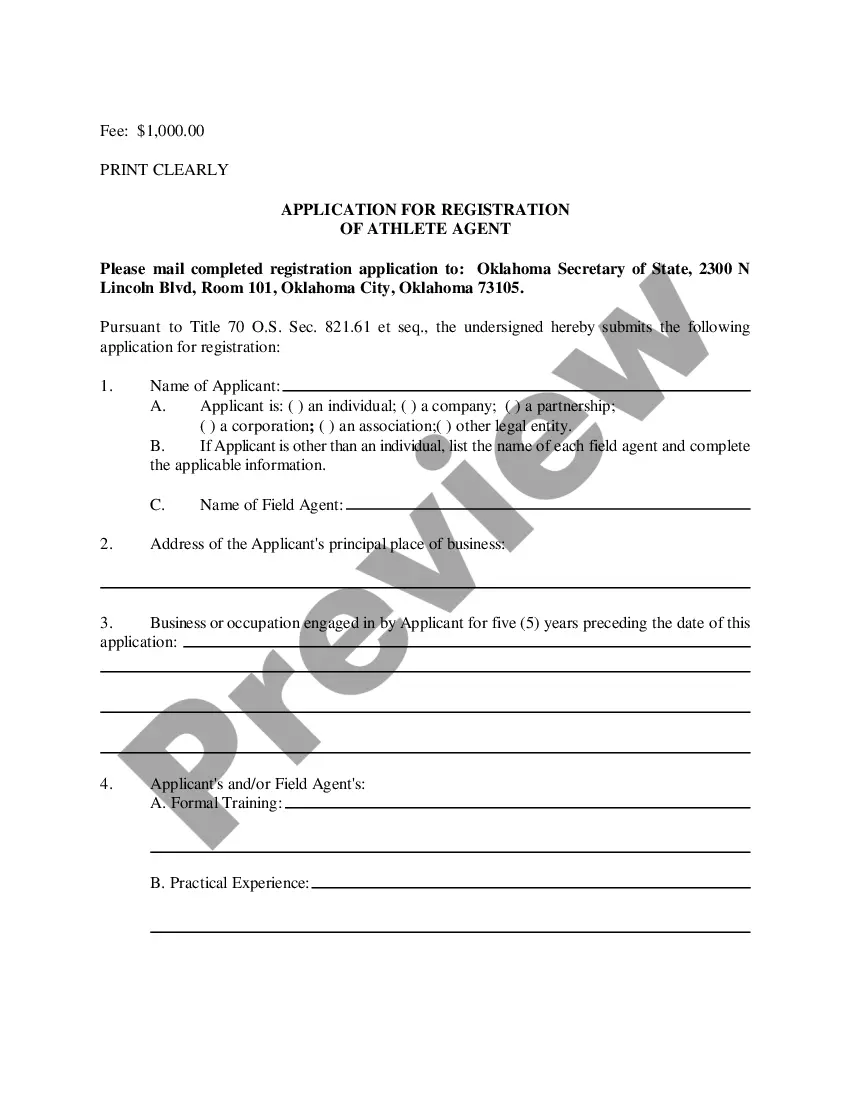

Finding authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s a digital repository of over 85,000 lawful documents for personal and business requirements and various real-world scenarios.

All the files are correctly categorized by field of application and jurisdiction, making the search for the Minneapolis Minnesota Owner's or Seller's Affidavit of No Liens as straightforward and simple as one, two, three.

Maintaining paperwork organized and compliant with legal stipulations is of utmost importance. Take advantage of the US Legal Forms library to always have essential document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve selected the correct option that fulfills your needs and fully aligns with your local jurisdiction standards.

- Seek another template, if required.

- If you encounter any discrepancies, use the Search tab above to locate the appropriate one. If it fits your needs, proceed to the next stage.

- Complete the purchase.

Form popularity

FAQ

Is a Bill of Sale required for selling a car in Minnesota? No. Alternatively, buyers and sellers can complete and sign an Application to Title and Register a Motor Vehicle (PS2000) form in place of a Bill of Sale.

There is a $50.00 fee for filing the WDC with the county recorder. A WDC is not required if the property has no wells or if a disclosure was previously recorded for the property and the number and status of wells has not changed.

The seller may assign ownership on the back of the Minnesota registration card, on an application for Minnesota registration (PS2000) or on a bill of sale that identifies the vehicle being sold and includes the date of sale and the name of the buyer.

Minnesota Firearm Bill of Sale For the buyer, the bill of sale provides proof of ownership and establishes the condition represented by the seller. Be sure to include: Buyer and seller's name, address, date of birth, and driver's license number. Date of the transaction.

The lender is responsible for releasing the vehicle lien by submitting the following documentation to the Minnesota DVS: The vehicle title. Lien Notification signed by the lender (this form must be notarized)

A Minnesota motor vehicle bill of sale is a legal document that serves as a recording that two (2) parties have executed the sale of a motor vehicle. The document also establishes a change of ownership and provides the required information for the vehicle's registration. This form requires notarization.

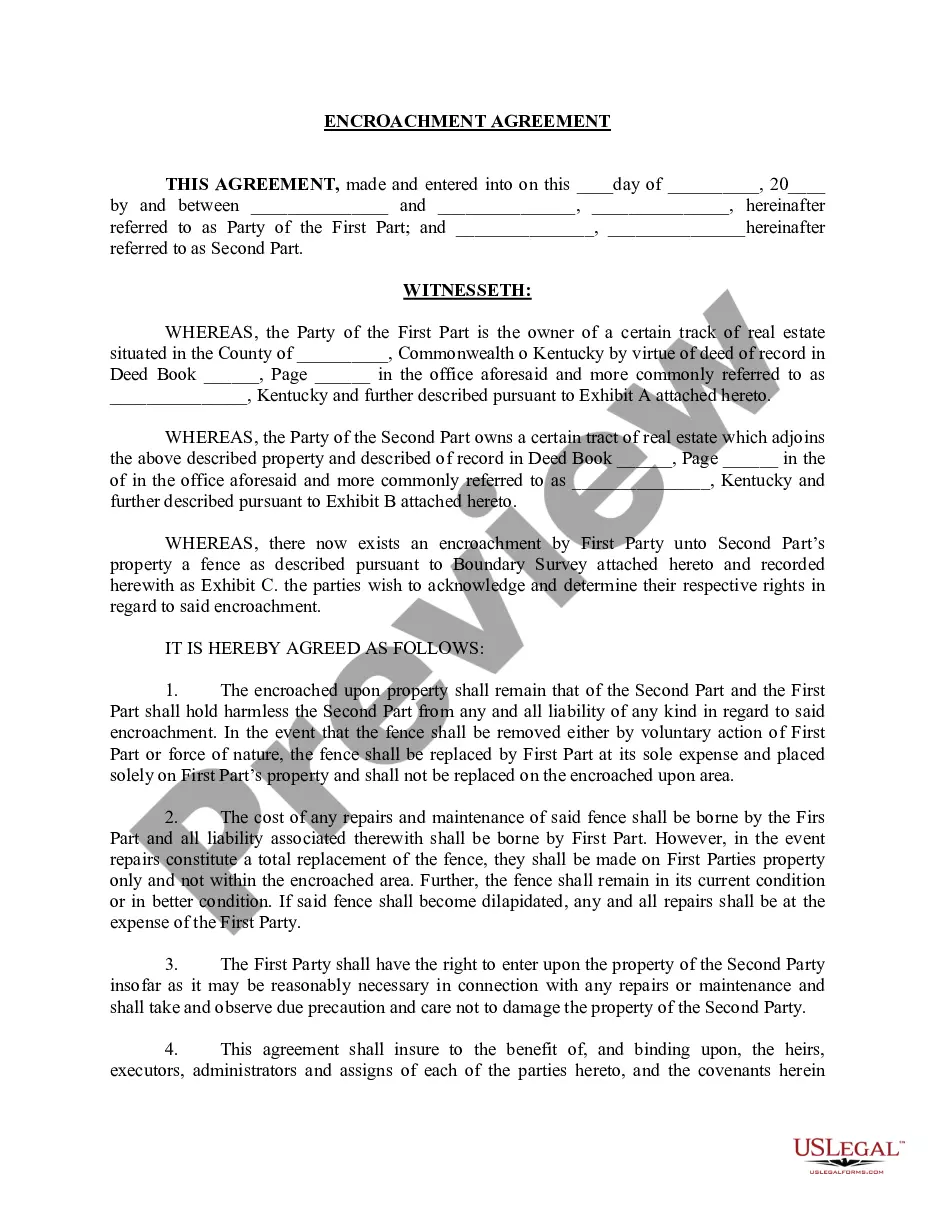

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

Property Transfer in Minnesota The grantor must sign the deed and have their signature notarized in order to accomplish a transfer of property. The Minnesota deed is then recorded in the county where the property is located.

All sellers must handprint their name and sign in the assignment area of the title. The seller must list the sales price of the vehicle in the sales tax declaration area on the back of the certificate of title. The seller must enter the date of sale and complete any disclosure statements that apply.