Hennepin Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees

Description

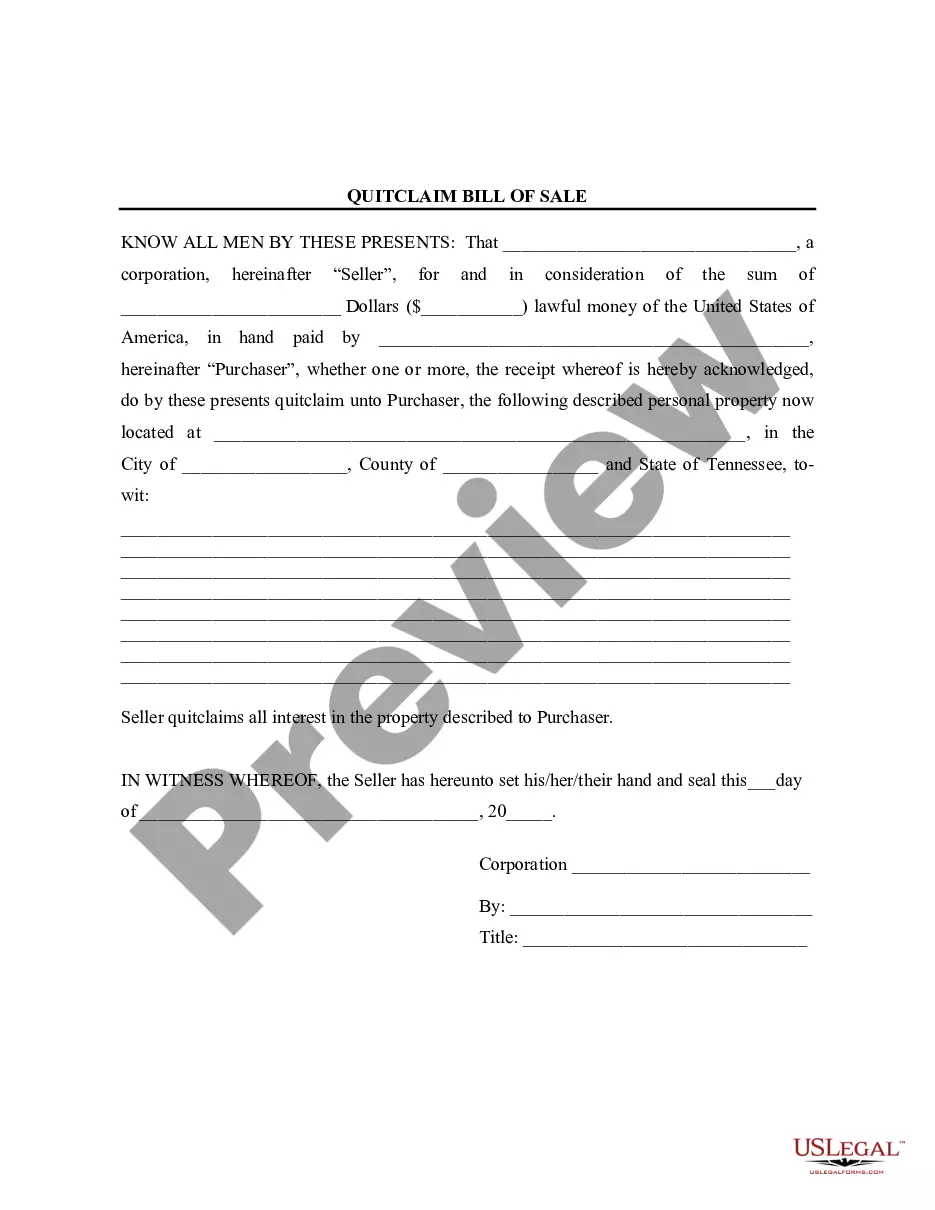

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Utilize the US Legal Forms and gain immediate access to any template you desire.

Our advantageous platform with a vast selection of templates makes it easy to locate and obtain nearly any document sample you require.

You can save, complete, and certify the Hennepin Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees in merely a few minutes instead of spending hours online searching for the appropriate template.

Employing our catalog is an excellent way to enhance the security of your form submissions. Our skilled attorneys frequently review all the documents to ensure that the templates are suitable for a specific state and compliant with new laws and regulations.

If you have not registered an account yet, follow the steps outlined below.

Open the page with the form you require. Ensure that it is the form you were looking for: review its title and description, and utilize the Preview feature when available. Otherwise, use the Search box to locate the desired one.

- How can you acquire the Hennepin Minnesota Waiver of Homestead Exemption by Client to secure Attorney's Fees.

- If you possess a profile, simply Log In to your account. The Download option will be accessible on all the samples you check.

- Furthermore, you can access all the previously saved files in the My documents menu.

Form popularity

FAQ

Remove your homestead status Notify the county assessor within 30 days if you sell, move, or for any reason no longer qualify for homestead. Complete the notice-of-move form (PDF). Email form to ao.programs@hennepin.us or mail to the address on the form.

To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident.

You'll remember from before that homesteads get a portion of their value excluded from property taxes altogether. They also get more favorable rates than non-homesteaded properties. The first $500,000 in taxable market value of a homesteaded property has a rate of 1.00% and the remainder has a rate of 1.25%.

Applying for homestead Applications can be completed online or by printing the paper application form. Completed paper applications must be submitted to the Assessor's office by mail, fax or in-person delivery to the Assessor's Office.

To qualify for a homestead, you must: Own a property. Occupy the property as your sole or primary residence. Be a Minnesota resident....Qualifying property includes all property used as a residence, including: Gardens. Garages. Outbuildings.

To qualify for homestead: You must own the property, or be a relative or in-law of the owner (son, daughter, parent, grandchild, grandparent, brother, sister, aunt, uncle, niece or nephew). You or your relative must occupy the property as the primary place of residence. You must be a Minnesota resident.

What are the Benefits of Homestead Classification? A homestead classification qualifies your property for a classification rate of 1.00% on up to $500,000 in taxable market value. Homesteads are also eligible for a market value exclusion, which may reduce the property's taxable market value.

A person requesting homestead exemption must make a written application, must be a natural person, the head of a family, have ownership and eligible property, occupy the dwelling as a home, and be a Mississippi resident.

To qualify for homestead: You must own the property, or be a relative or in-law of the owner (son, daughter, parent, grandchild, grandparent, brother, sister, aunt, uncle, niece or nephew). You or your relative must occupy the property as the primary place of residence. You must be a Minnesota resident.

Non-homestead real property is real property that does not meet the definition of a homestead The home which is owned by and is the usual residence of the client..