Saint Paul Minnesota Registration of Foreign Corporation

Description

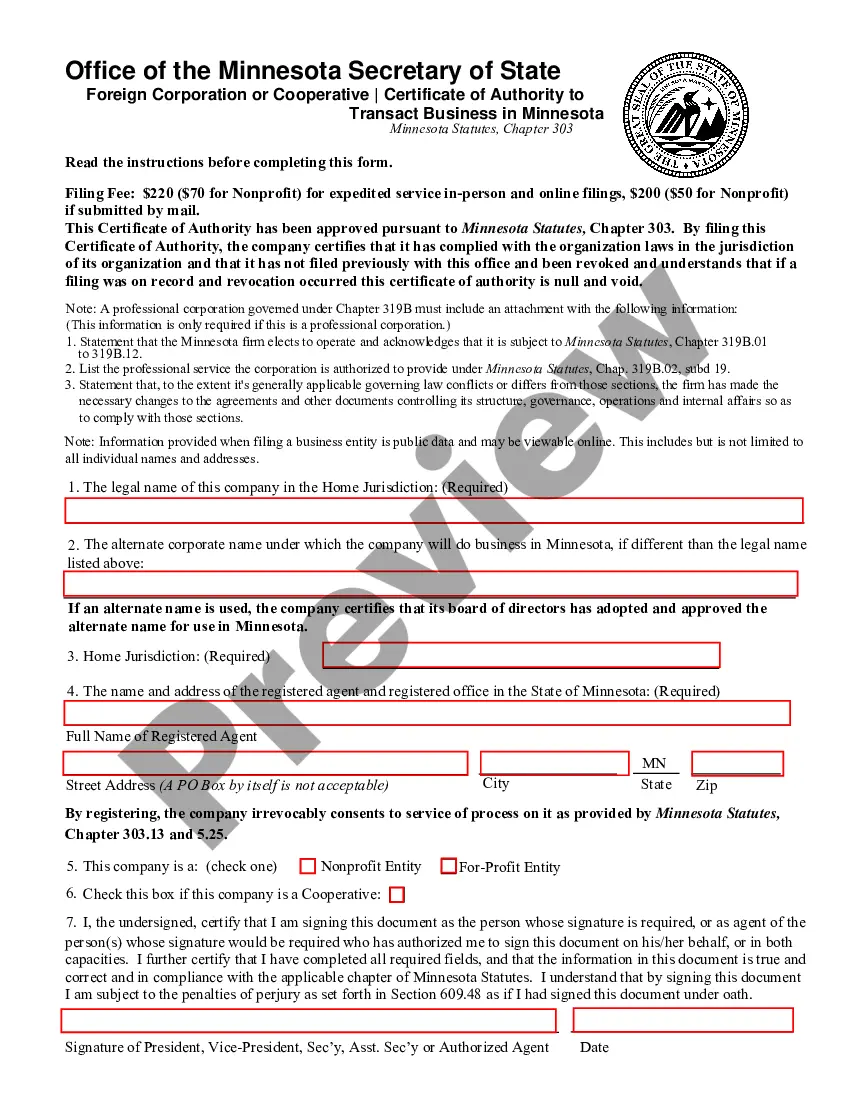

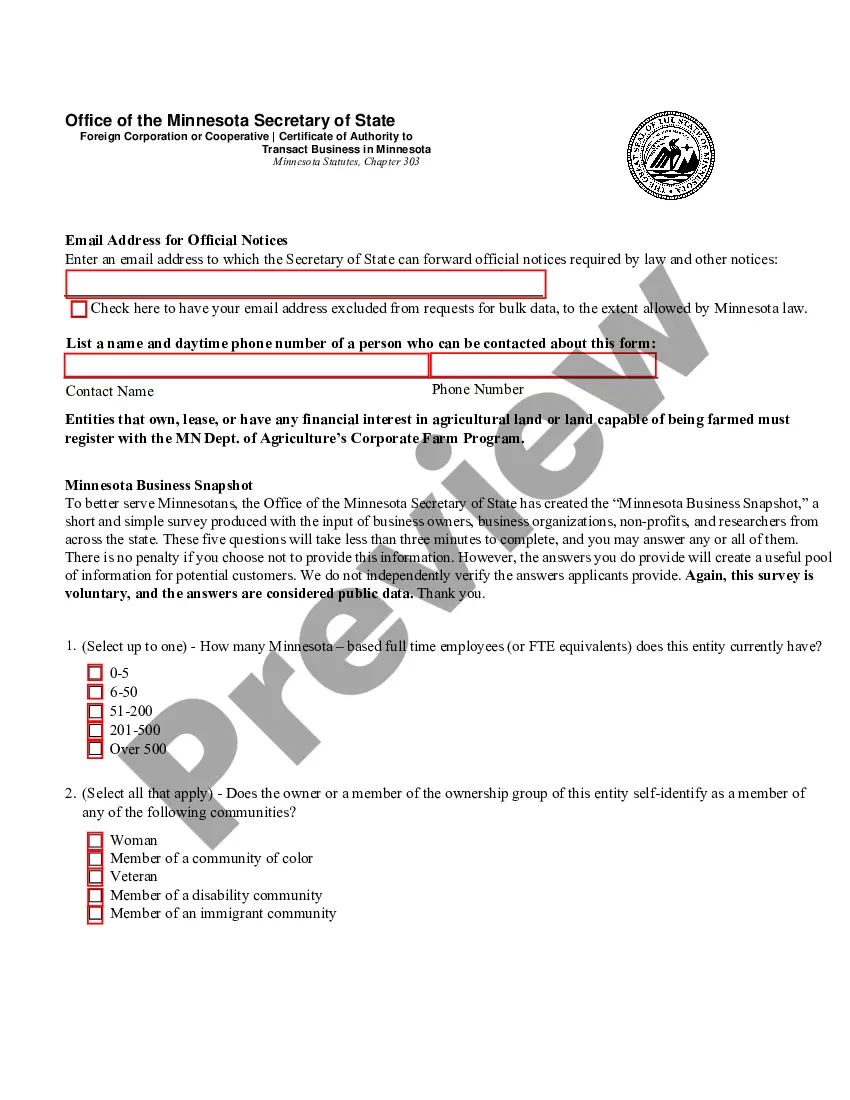

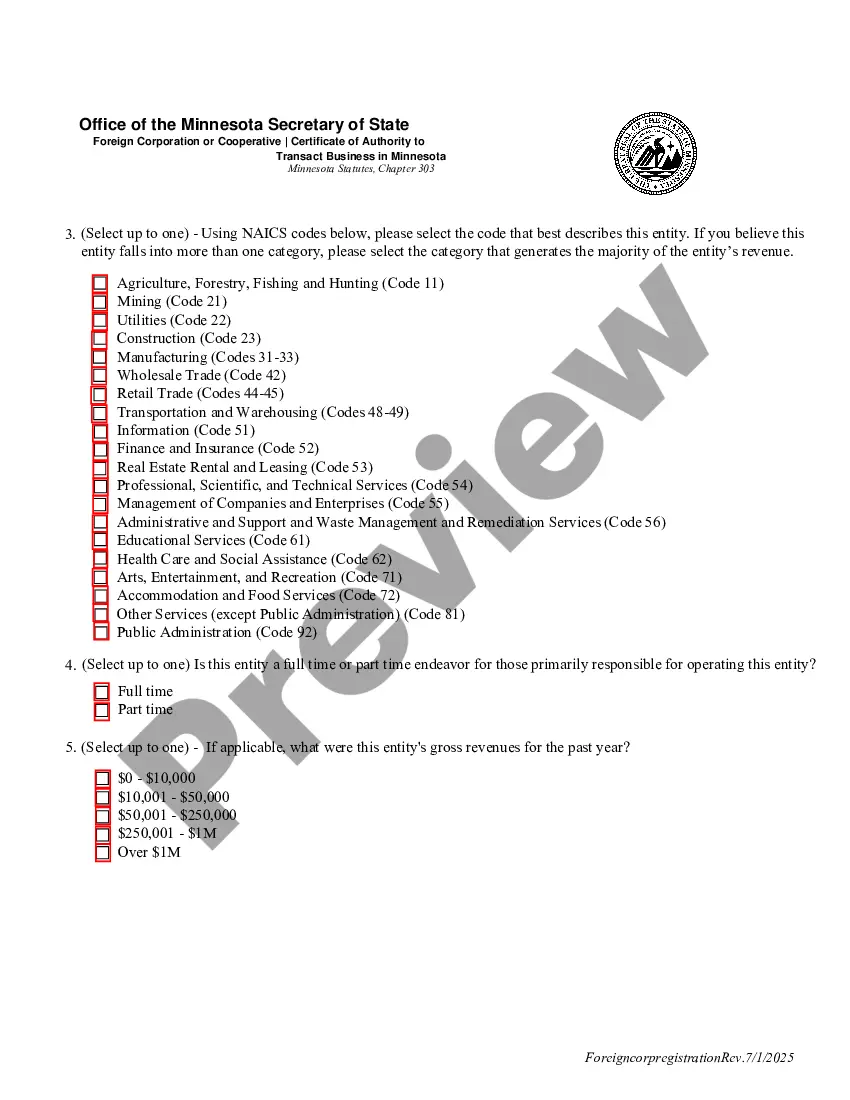

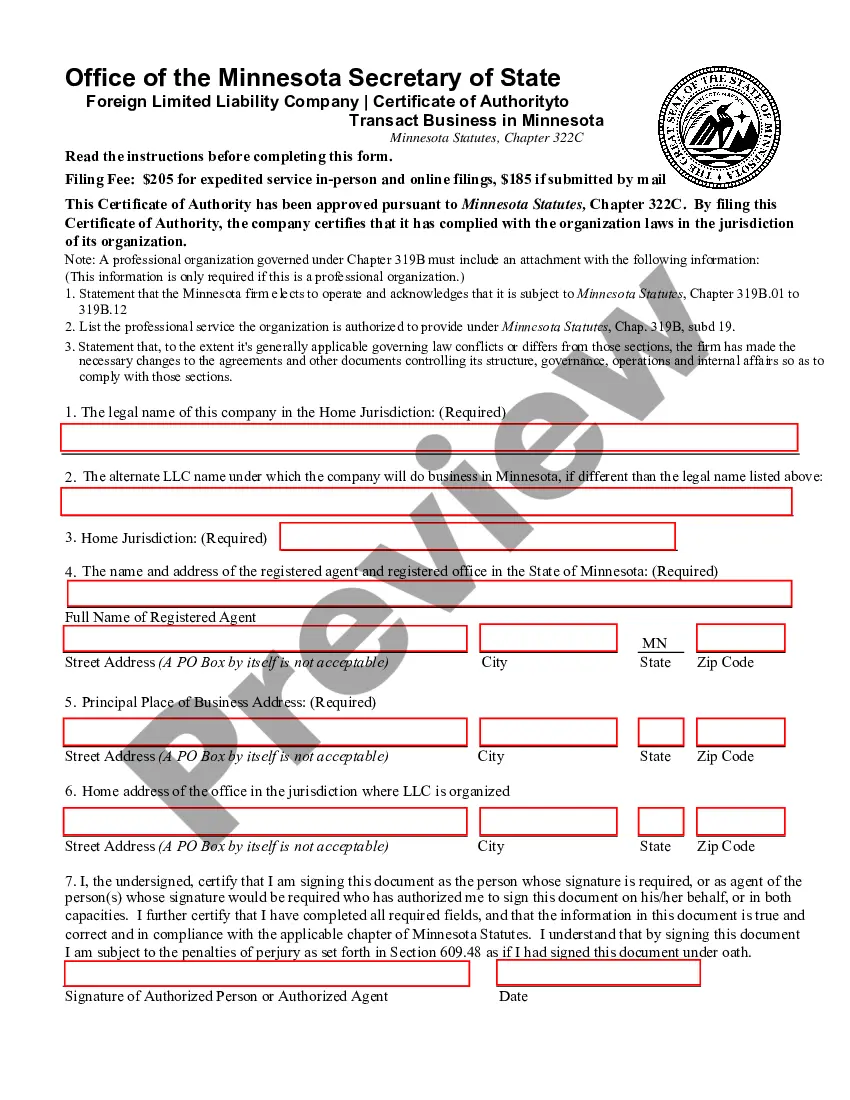

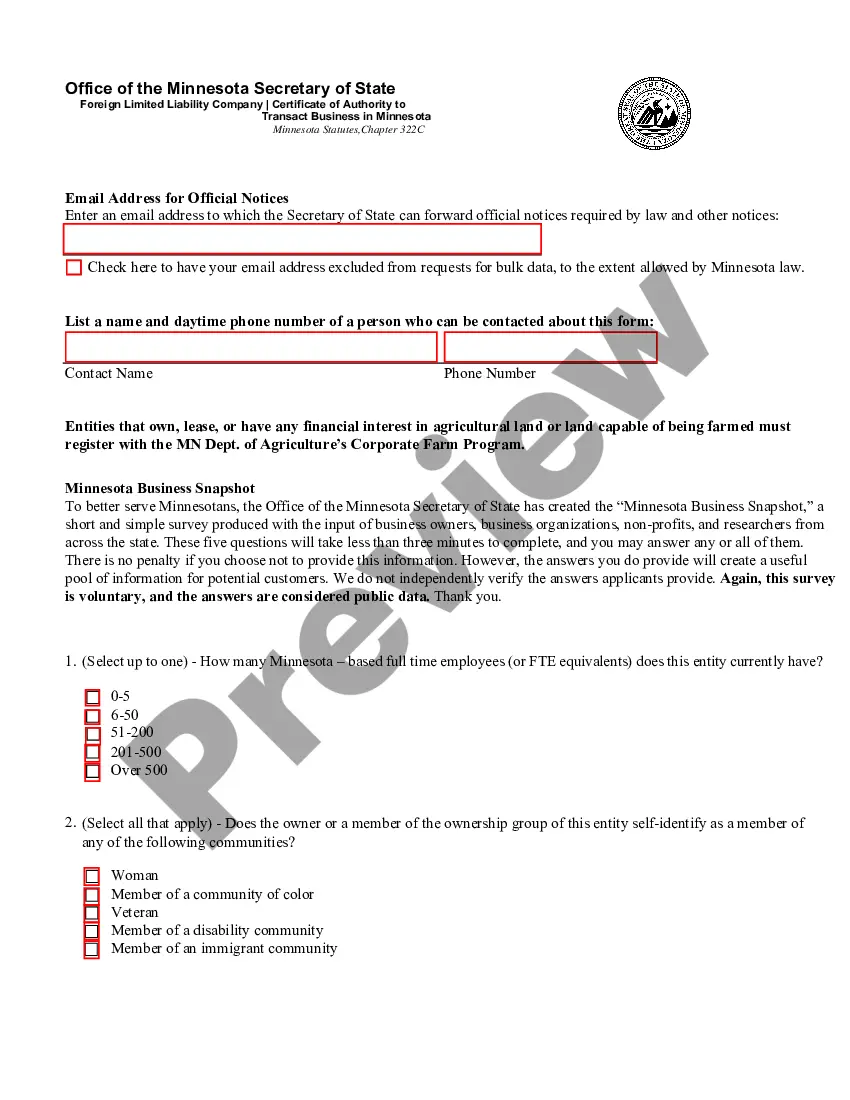

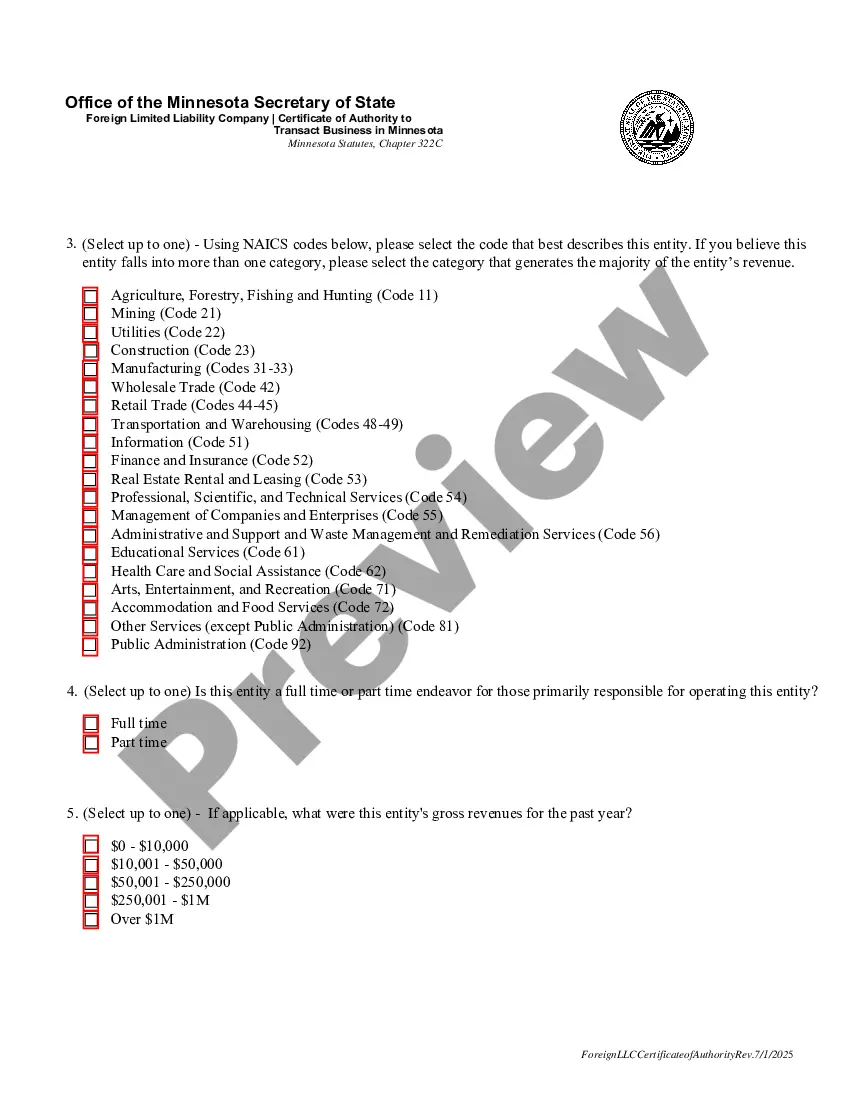

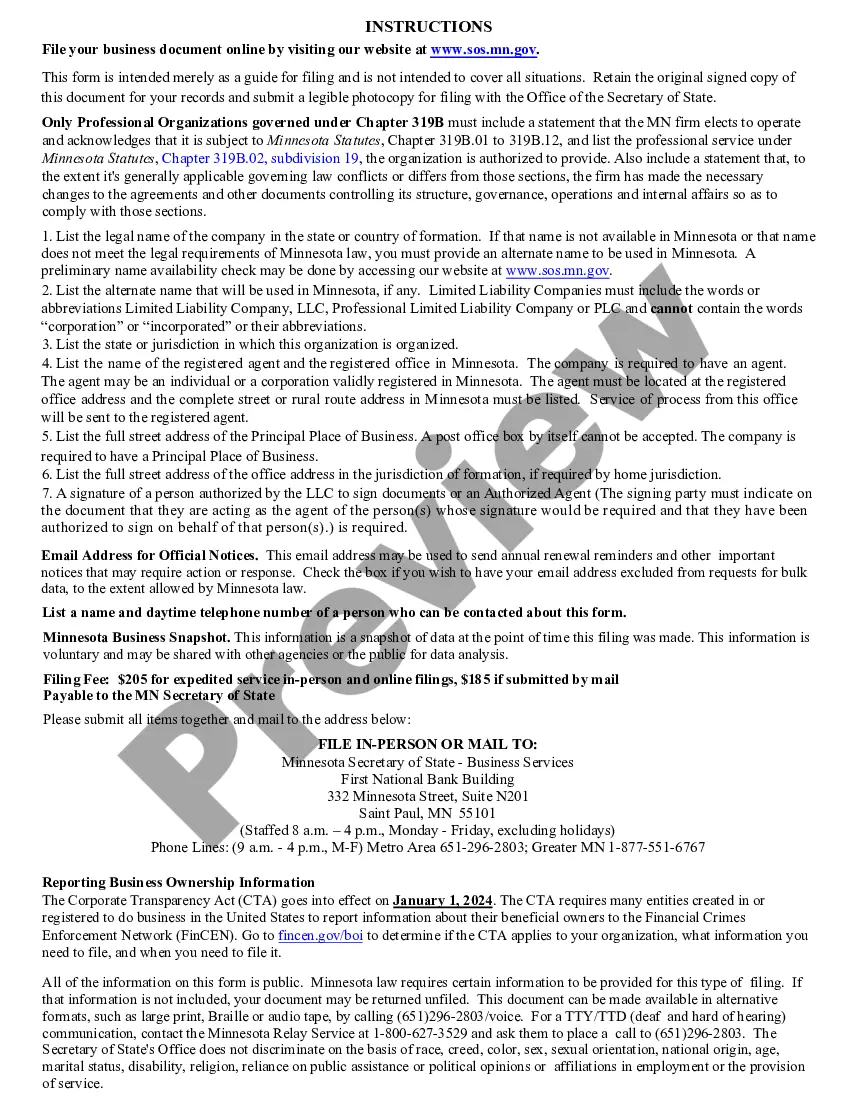

How to fill out Minnesota Registration Of Foreign Corporation?

If you are looking for a legitimate form template, it’s challenging to discover a more user-friendly platform than the US Legal Forms website – likely the largest online repositories.

Here you can find thousands of templates for business and personal use categorized by types and states, or keywords.

With the enhanced search feature, locating the latest Saint Paul Minnesota Registration of Foreign Corporation is as simple as 1-2-3.

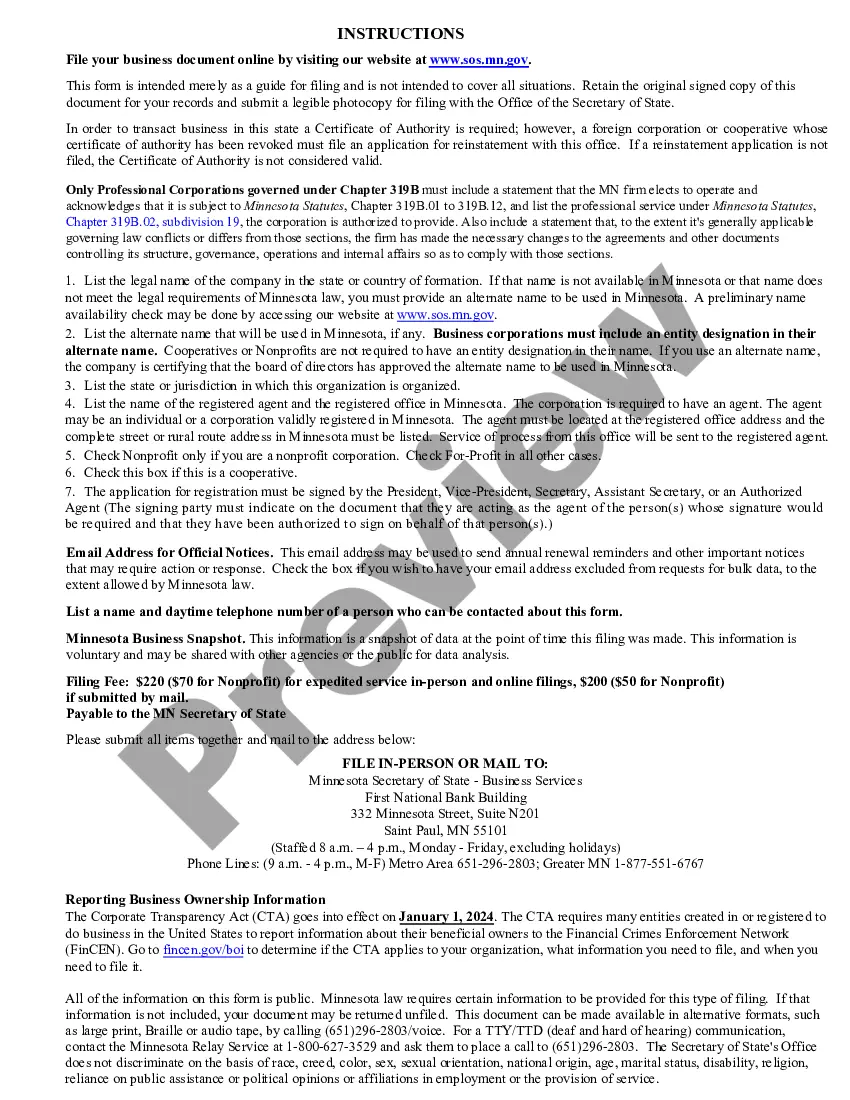

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Specify the format and download it onto your device.

- Furthermore, the accuracy of each document is verified by a group of professional attorneys who consistently evaluate the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to acquire the Saint Paul Minnesota Registration of Foreign Corporation is to Log In to your account and click on the Download option.

- If you are using US Legal Forms for the first time, just follow the instructions detailed below.

- Ensure you have located the form you need. Review its description and use the Preview option to examine its content. If it does not satisfy your needs, use the Search feature at the top of the page to find the required document.

- Verify your selection. Click the Buy now button. Then, choose your desired pricing plan and provide information to register for an account.

Form popularity

FAQ

Starting an S Corporation in Minnesota involves several key steps. First, you need to select a name and file the Articles of Incorporation with the state. Next, apply for an Employer Identification Number (EIN) from the IRS. Finally, if you will conduct business outside Minnesota, don’t forget to handle the Saint Paul Minnesota Registration of Foreign Corporation to ensure compliance across state lines.

Yes, you can set up an S Corporation yourself, but it requires careful attention to detail. You will need to gather necessary documents, file the Articles of Incorporation, and complete the IRS S-Corp election. While self-setup is possible, using resources like USLegalForms can simplify the process and ensure you meet all legal requirements, including the Saint Paul Minnesota Registration of Foreign Corporation.

To set up an S Corporation in Minnesota, first, you need to choose a unique business name that complies with state regulations. Next, you will file Articles of Incorporation with the Minnesota Secretary of State. Additionally, to elect S Corporation status, you must file Form 2553 with the IRS. After completion, consider the Saint Paul Minnesota Registration of Foreign Corporation if you plan to operate in multiple states.

Yes, a foreign corporation must register in Indiana if it plans to conduct business within the state. This registration is essential to comply with Indiana laws and to legally operate. It involves submitting an application and meeting specific state requirements. Using platforms like US Legal Forms can simplify this process, ensuring your Saint Paul Minnesota registration of foreign corporation is handled efficiently and accurately.

To register an out-of-state business in Indiana, you must first obtain a Certificate of Authority from the Indiana Secretary of State. You will need to provide documentation such as the legal name of your corporation, the state of formation, and the principal address. This process involves filling out an application, paying the applicable fees, and ensuring compliance with state regulations. For assistance, consider using US Legal Forms, which offers templates and guidance to streamline your Saint Paul Minnesota registration of foreign corporation.

Registering a foreign company in the USA involves filing for registration in each state where the company plans to operate. You need to provide details like the business's home state and your registered agent in that state. Using platforms like US Legal Forms can simplify the process for your Saint Paul Minnesota Registration of Foreign Corporation and help you with state-specific requirements.

To register a foreign corporation in Indiana, you must file the necessary paperwork with the Indiana Secretary of State. Ensure that you provide detailed information about your corporation's formation and operations. By completing this process, you establish your business legally, similar to how you would achieve your Saint Paul Minnesota Registration of Foreign Corporation.

Yes, a foreign corporation can conduct business in the US, but it typically must register in each state where it operates. This registration process varies by state, and you need to comply with local laws and requirements. For businesses interested in the Saint Paul Minnesota Registration of Foreign Corporation, it is crucial to understand these processes to avoid legal issues.

Doing business in Minnesota includes activities such as having a physical presence, conducting sales, or providing services in the state. If your corporation engages in these activities, it may need to register as a foreign corporation. This registration can help ensure compliance with state laws during your Saint Paul Minnesota Registration of Foreign Corporation.

Yes, a foreign corporation refers to a company that is incorporated in a different state but wishes to operate in Minnesota. In this context, 'foreign' designates that the corporation is from outside Minnesota. Understanding this distinction is crucial for navigating the Saint Paul Minnesota Registration of Foreign Corporation process.