Detroit Michigan Quitclaim Deed from two Individuals to One Individual

Description

How to fill out Michigan Quitclaim Deed From Two Individuals To One Individual?

We consistently aim to lessen or avert legal harm when handling intricate legal or financial issues.

To achieve this, we enlist the help of legal professionals whose services are often quite expensive.

Nevertheless, not every legal matter is so complicated; most can be managed independently.

US Legal Forms is a web-based repository of current DIY legal templates covering everything from wills and powers of attorney to incorporation documents and dissolution petitions.

The process is equally straightforward for newcomers! You can establish your account in just a few minutes. Ensure the Detroit Michigan Quitclaim Deed complies with the regulations and laws of your state and region. Additionally, it's vital to review the form's description (if provided), and if you notice any inconsistencies with your initial needs, look for an alternative form. Once you've confirmed that the Detroit Michigan Quitclaim Deed is suitable for you, you can select a subscription option and proceed with payment. Afterward, you can download the document in any available format. For over 24 years, we have assisted millions by offering customizable and updated legal documents. Utilize US Legal Forms today to conserve time and resources!

- Our platform empowers you to handle your affairs without needing legal counsel.

- We offer access to legal document templates that may not be freely available to the public.

- Our templates are tailored to specific states and regions, which significantly streamlines the search process.

- Leverage US Legal Forms when you need to swiftly find and download the Detroit Michigan Quitclaim Deed from two Individuals to One Individual or any other document securely.

Form popularity

FAQ

To transfer a joint ownership property to sole ownership, it is essential for all parties to sign the transfer deed and register it with the Land Registry. People who are interested in becoming the sole owner of the property can buy out the share of their ex-spouse or siblings, or reach a different type of agreement.

If you need to remove a name from a title deed for a property with a mortgage on it, you will need written consent to do so from the lender. Generally, it is easier to obtain this if the person(s) left on the title deed is (are) sufficiently financially secure.

There are 5 steps to remove a name from the property deed: Discuss property ownership interests.Access a copy of your title deed.Complete, review and sign the quitclaim or warranty form.Submit the quitclaim or warranty form.Request a certified copy of your quitclaim or warranty deed.

Despite the amounts involved, it is possible to transfer ownership of your property without money changing hands. This process can either be called a deed of gift or transfer of gift, both definitions mean the same thing. Executing a deed of gift can be a complex undertaking, but it isn't impossible.

Statute of Limitations on a Quitclaim Deed in Michigan For example, challenging a quitclaim deed given by a close family member or a court-ordered sale has a five-year statute of limitations.

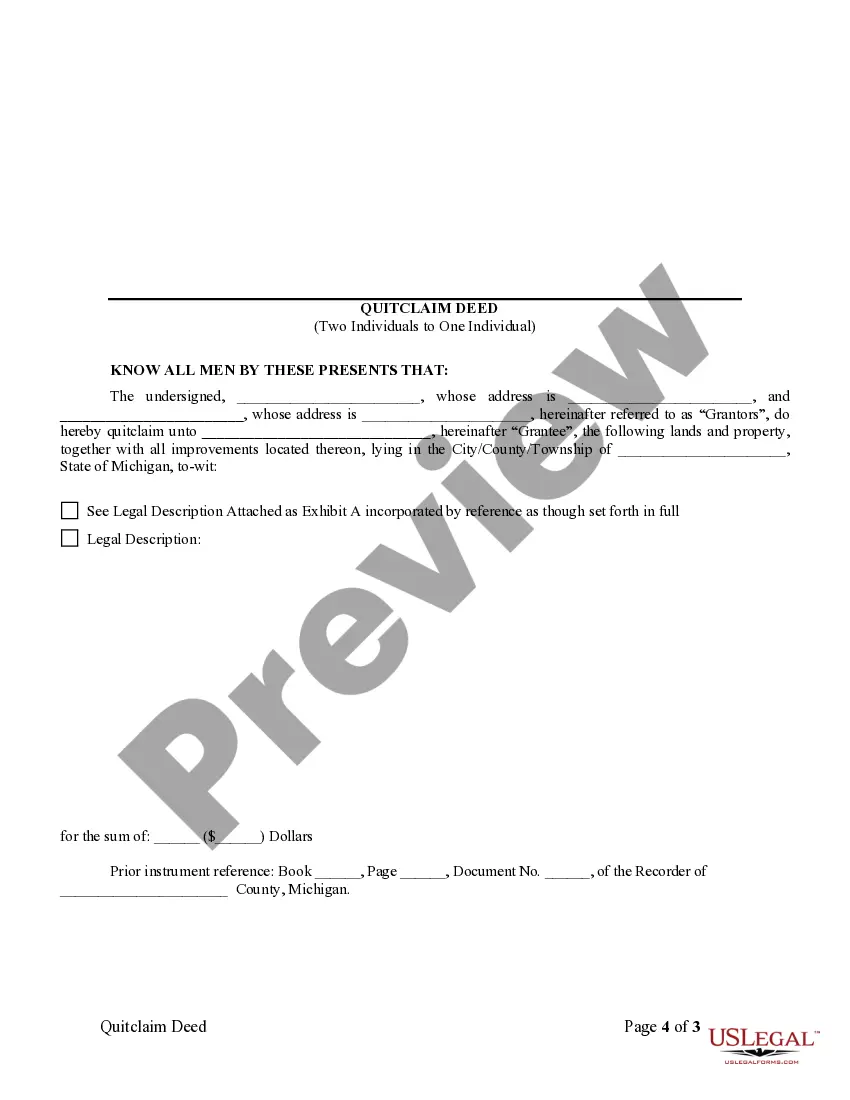

To successfully execute a quitclaim deed in Michigan, the property owner needs to complete a quitclaim deed form and sign it in front of a notary. Then they pay any transfer taxes due and record the deed in the land recorder's office in the county in which the property is located.

The lender will need to be satisfied that you will be able to afford the mortgage as the sole mortgagor. The mortgage lender will then need to give you written consent in order to remove the other party from the deeds to your house. The lender will require the change in ownership to be carried out by a solicitor.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

MCL 207.505/MCL 207.526 $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.