Sterling Heights Michigan Summary Administration Package for Small Estates

Description

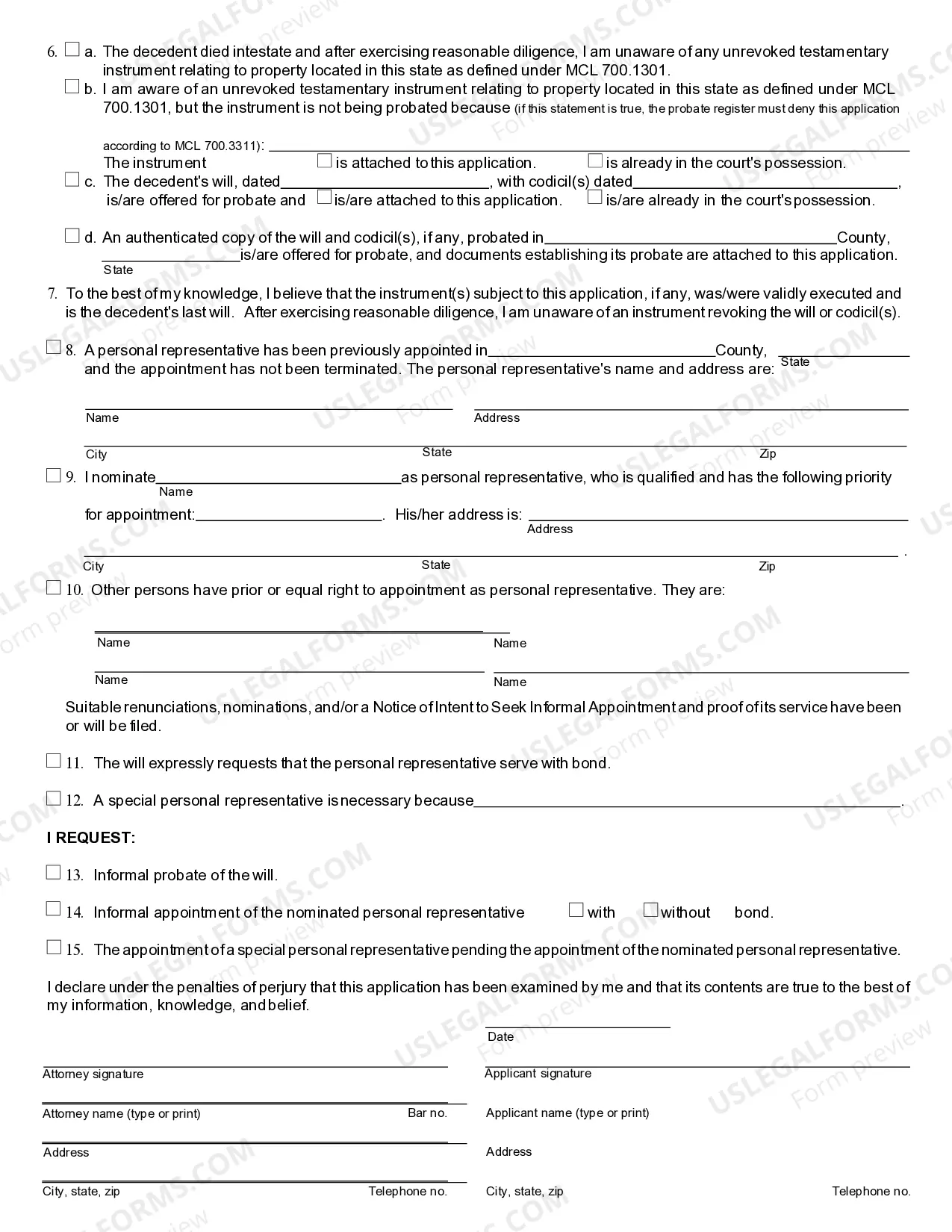

How to fill out Michigan Summary Administration Package For Small Estates?

Irrespective of societal or occupational standing, filling out legal documents is an unfortunate requirement in today’s workplace.

Frequently, it’s nearly impossible for someone without any legal education to create such paperwork independently, primarily because of the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can come to the rescue.

Check that the form you found is suitable for your jurisdiction since the laws of one state or county do not apply to another.

Examine the form and read a brief summary (if available) of scenarios for which the document can be utilized.

- Our service provides an extensive repository of over 85,000 ready-to-use, state-specific forms that cater to nearly every legal situation.

- US Legal Forms is also a valuable resource for associates or legal advisors looking to save time with our DIY documents.

- Whether you need the Sterling Heights Michigan Summary Administration Package for Small Estates or any other document valid in your locale, US Legal Forms has everything readily available.

- Here’s how to quickly obtain the Sterling Heights Michigan Summary Administration Package for Small Estates using our dependable service.

- If you're already a customer, simply Log In to your account to download the relevant form.

- If you are unfamiliar with our library, make sure to follow these steps before downloading the Sterling Heights Michigan Summary Administration Package for Small Estates.

Form popularity

FAQ

In Michigan, a small estate affidavit allows individuals to claim assets without formal probate. To obtain this affidavit, you must fill out the necessary forms and provide information about the deceased and the estate's assets. Utilizing the Sterling Heights Michigan Summary Administration Package for Small Estates from USLegalForms can provide step-by-step guidance and ensure you complete this process efficiently.

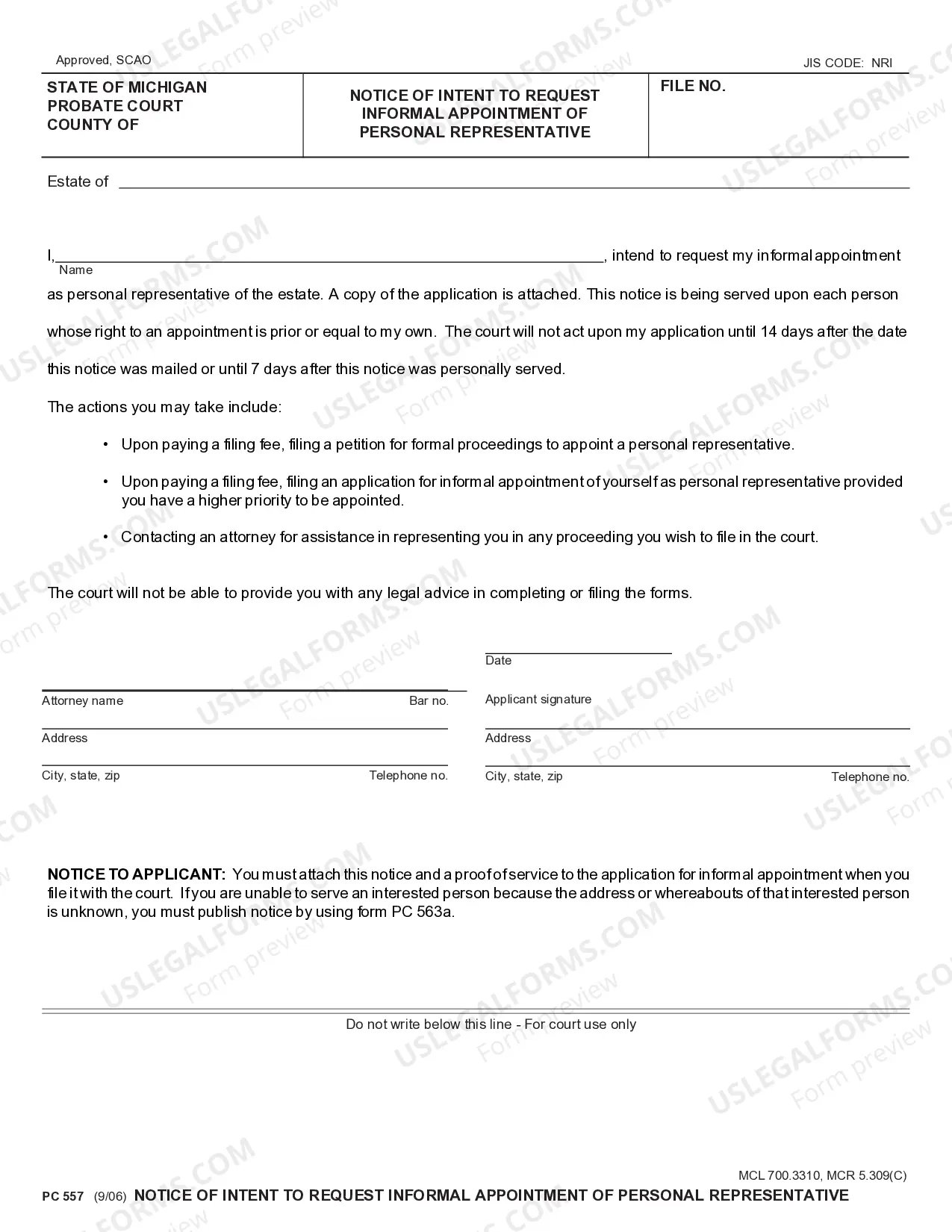

To obtain a letter of administration, you typically need to file a petition with the probate court in your local jurisdiction. The court will review your application and may require documents like death certificates and asset inventories. For those seeking a practical solution, consider using the Sterling Heights Michigan Summary Administration Package for Small Estates available through USLegalForms, which simplifies this process.

An executor is a person designated by a will to manage the estate of the deceased, while a letter of administration is granted by the court when there is no will. In the context of the Sterling Heights Michigan Summary Administration Package for Small Estates, understanding this distinction is essential for determining who will oversee the estate's administration process and how that authority is established.

A letter of administration is often referred to as a certificate of appointment. It serves as official documentation that grants an individual the authority to manage and distribute the assets of a deceased person's estate. When considering the Sterling Heights Michigan Summary Administration Package for Small Estates, this document becomes vital in ensuring proper estate management.

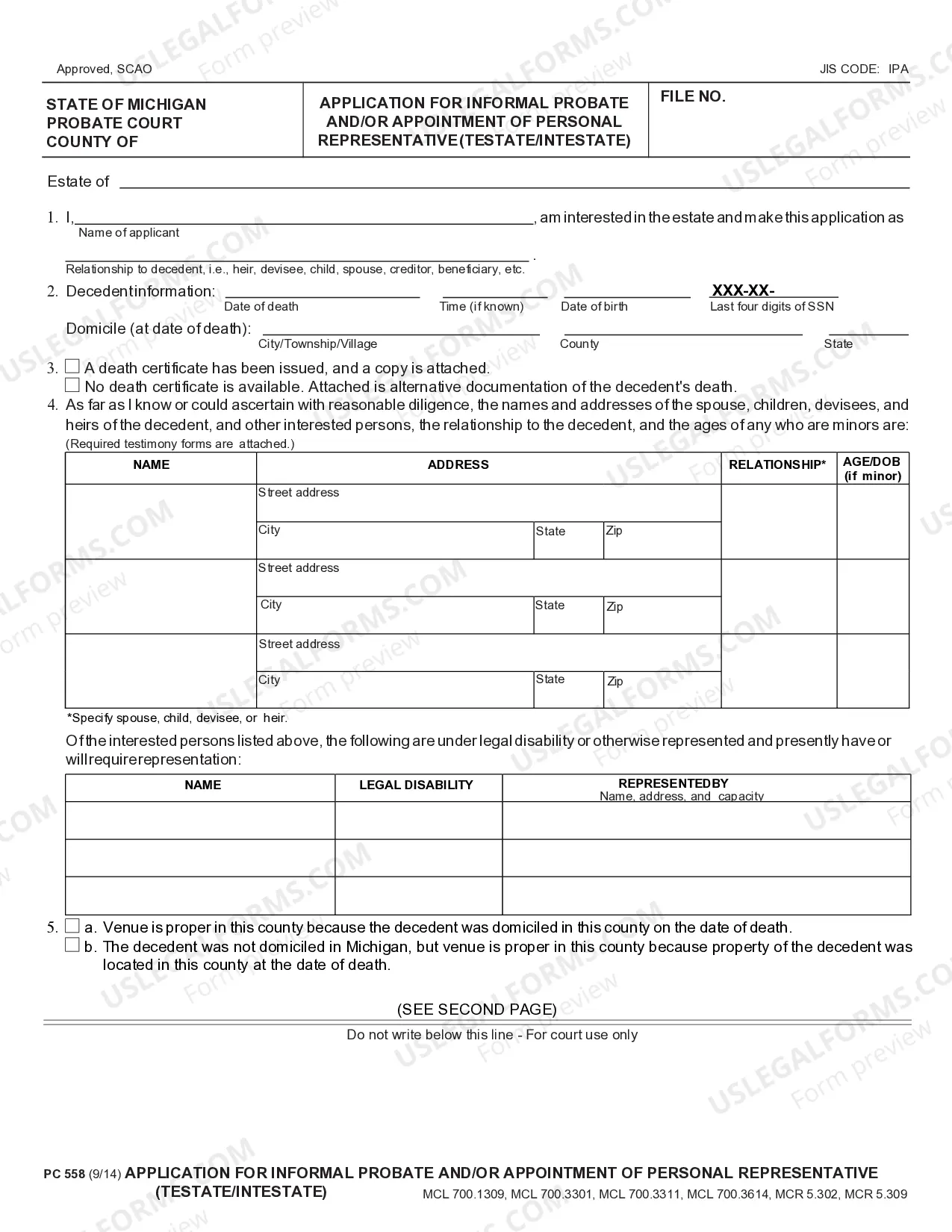

To calculate the value of an estate, you'll want to assess all assets, including real estate, bank accounts, and personal property. Utilize the Sterling Heights Michigan Summary Administration Package for Small Estates to create an organized approach for estimating value. This will involve compiling recent appraisals and current market values to determine the total worth accurately.

Certain assets do not form part of an estate, such as life insurance policies with designated beneficiaries, retirement accounts, and jointly owned property. Understanding these exclusions is crucial when using the Sterling Heights Michigan Summary Administration Package for Small Estates, as it can impact the value and distribution of the estate. Always confirm with legal advice to ensure accuracy.

In Michigan, a small estate affidavit allows for the transfer of assets without probate if the total value does not exceed a certain threshold. The Sterling Heights Michigan Summary Administration Package for Small Estates guides you through the requirements, which typically include the value of the estate, a list of assets, and signatures of interested parties. Ensure you comply with these requirements to smooth the process.

To fill out an inventory form, start by collecting all relevant financial documents and titles of assets. With the Sterling Heights Michigan Summary Administration Package for Small Estates, you can follow a structured format to input information clearly. Make sure to check for accuracy and update the inventory as needed during the estate settlement process.

Filling out an estate inventory involves listing all assets and liabilities of the estate. You will want to categorize items properly using the Sterling Heights Michigan Summary Administration Package for Small Estates to simplify this process. Ensure you include descriptions, estimated values, and details about each asset, as this information will be essential for estate administration.

Yes, clothing is typically considered an asset in an estate. In the context of the Sterling Heights Michigan Summary Administration Package for Small Estates, it's important to include all personal property, including clothing, when evaluating the overall value of the estate. However, keep in mind that the value assigned to clothing may not be significant compared to other assets.