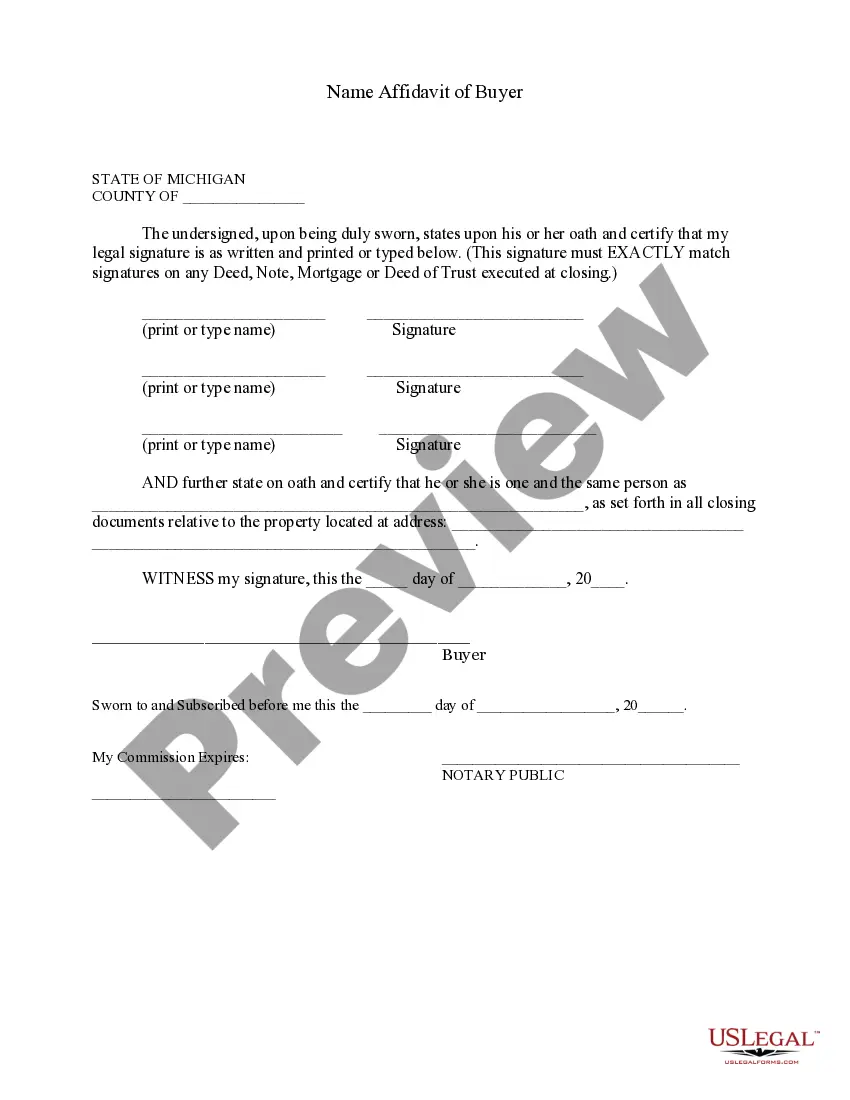

Detroit Michigan Name Affidavit of Buyer

Description

How to fill out Michigan Name Affidavit Of Buyer?

If you are looking for a legitimate form template, it’s difficult to find a more user-friendly platform than the US Legal Forms site – likely one of the largest collections on the web.

Here you can obtain numerous document samples for business and personal uses categorized by type and state, or by keywords. With the enhanced search option, locating the latest Detroit Michigan Name Affidavit of Buyer is as simple as 1-2-3.

Furthermore, the validity of each document is guaranteed by a team of expert attorneys who regularly review the templates on our site and refresh them according to the latest state and county regulations.

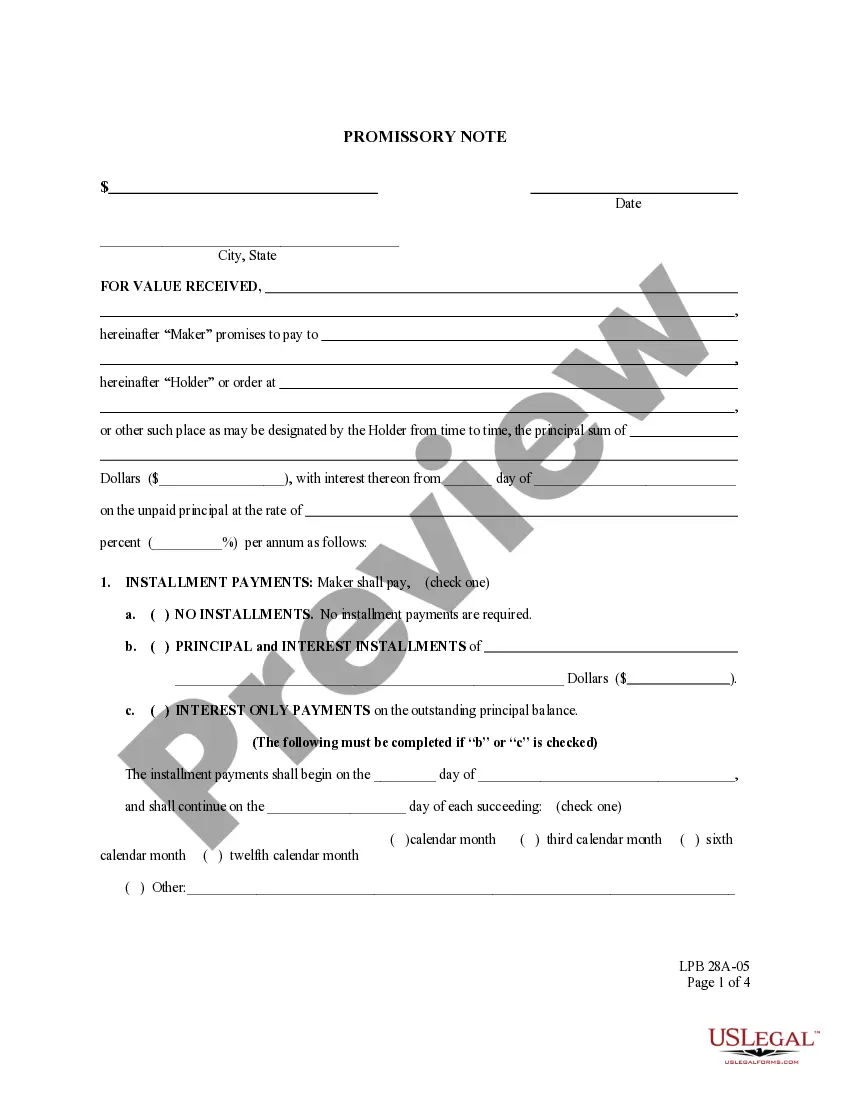

Obtain the template. Select the format and save it to your device.

Edit the document. Complete, adjust, print, and sign the downloaded Detroit Michigan Name Affidavit of Buyer.

- If you are already familiar with our platform and possess an account, all you need to obtain the Detroit Michigan Name Affidavit of Buyer is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure that you have located the form you need. Read its description and use the Preview feature to examine its content. If it does not meet your requirements, use the Search bar at the top of the page to find the correct document.

- Verify your selection. Click on the Buy now button. Then, choose your desired subscription plan and fill in the details to create an account.

- Complete the payment process. Use your credit card or PayPal account to finish the account registration.

Form popularity

FAQ

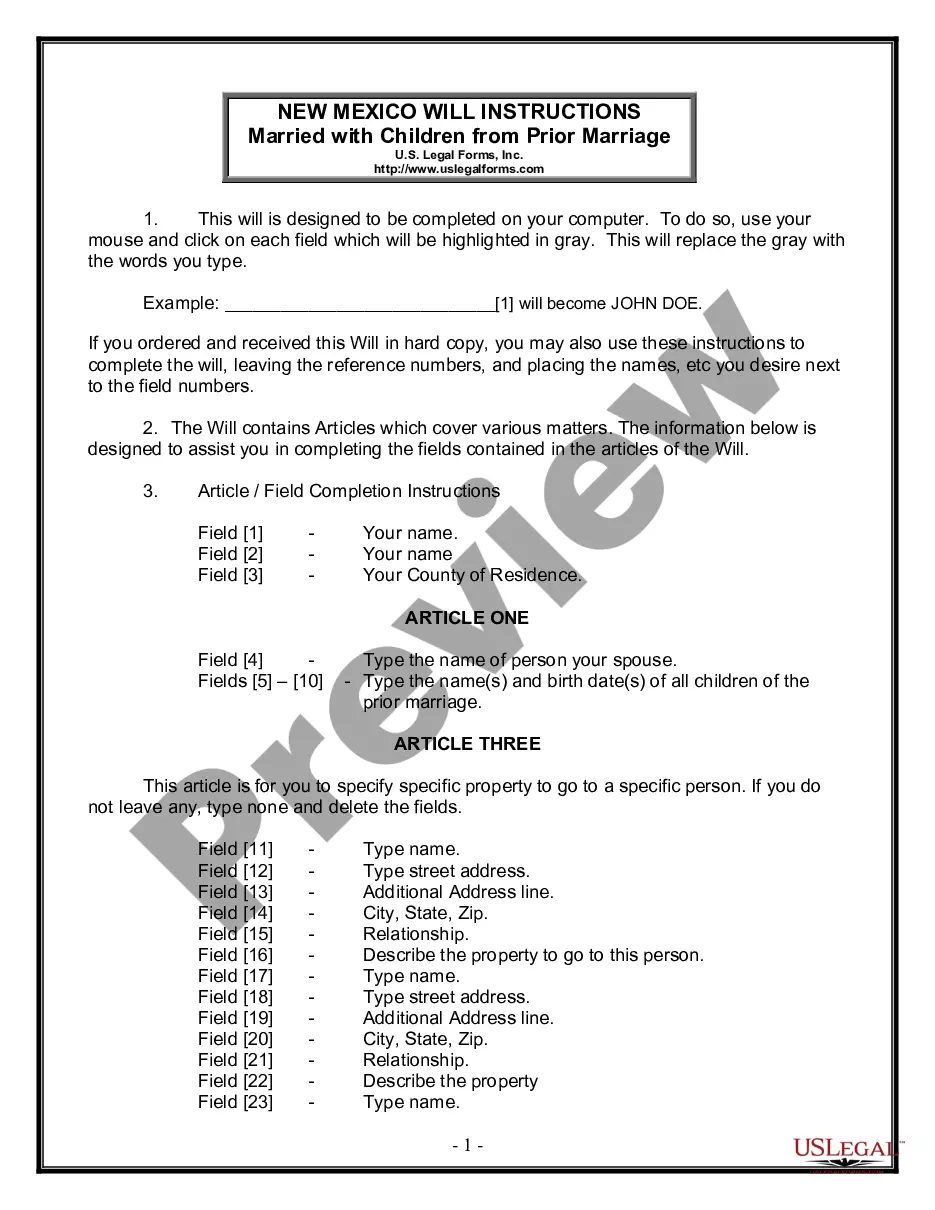

Property Transfer Information: A property transfer affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of transfer.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

A Property Transfer Affidavit is a form that notifies the local taxing authority of a transfer of ownership of real estate.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

Rights in property can be transferred only on execution and registration of a sale deed in favour of the buyer. A conveyance deed is executed to transfer title from one person to another. Generally, an owner can transfer his property unless there is a legal restriction barring such transfer.

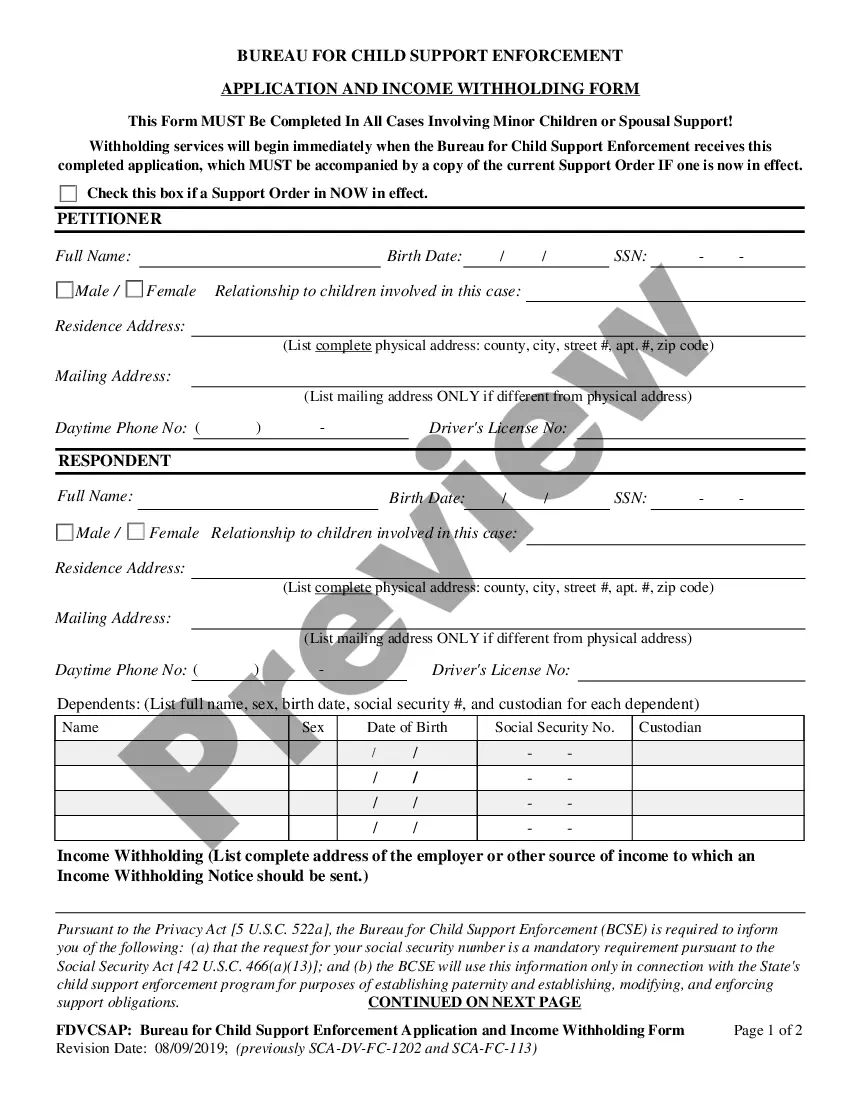

Go to the Assessor's office of the municipality or city where the property is based. 2). Request for TRANSFER OF OWNERSHIP OF TAX DECLARATION. -DEED OF ABSOLUTE SALE (DOAS) stamped as received by the BIR.

How do I know if property is publicly owned? Before applying to purchase a property, please research its ownership status. Information maintained at the Wayne County Treasurer's Office regarding ownership is available online: .

MCL 207.505/MCL 207.526 $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.