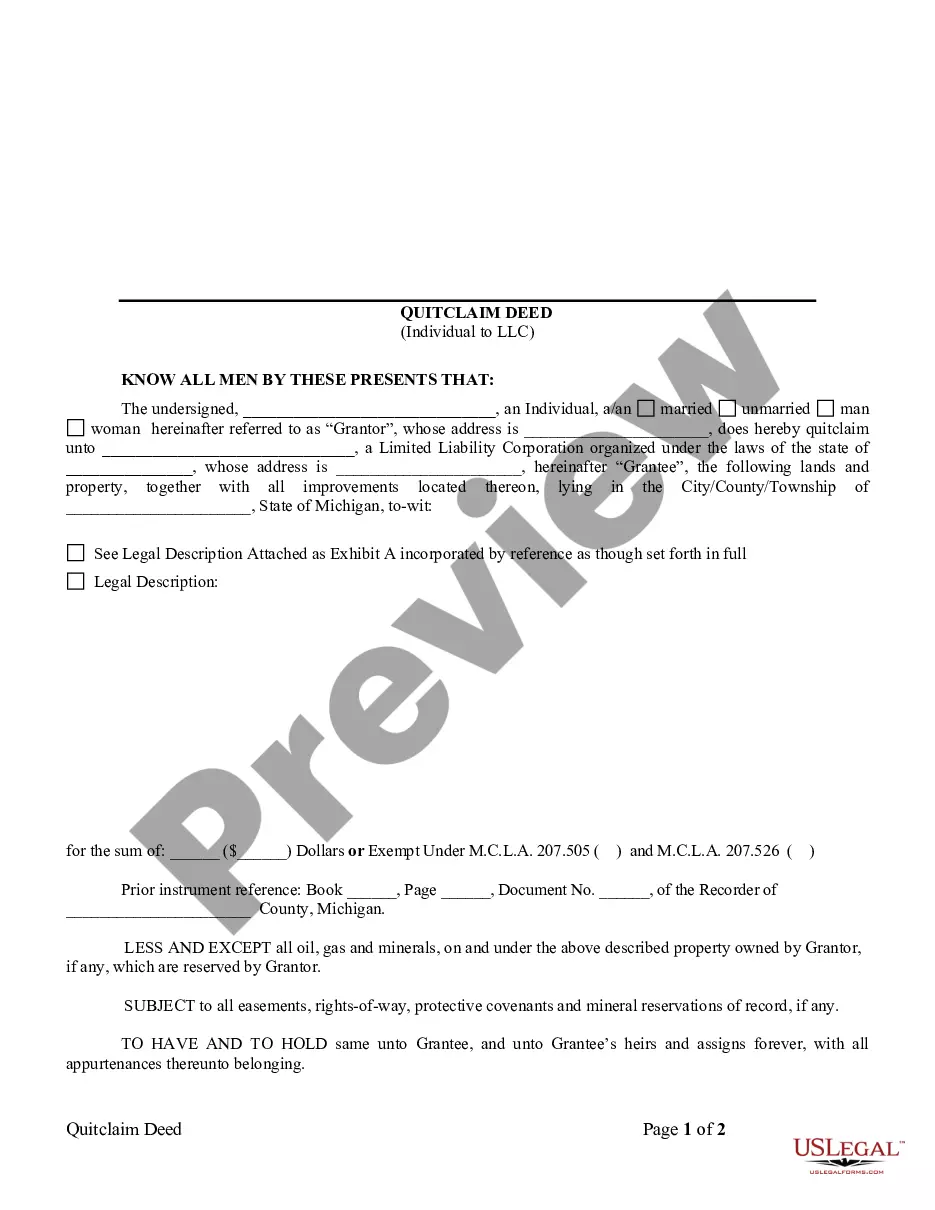

Detroit Michigan Quitclaim Deed from Individual to LLC

Description

How to fill out Michigan Quitclaim Deed From Individual To LLC?

We consistently endeavor to reduce or avert legal complications when handling intricate law-related or monetary matters.

To achieve this, we enroll in attorney services that are generally quite expensive.

Nevertheless, not all legal matters are similarly complicated.

Most of them can be managed independently.

Benefit from US Legal Forms whenever you're in need of easily and securely finding and downloading the Detroit Michigan Quitclaim Deed from Individual to LLC or any other document. Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always download it again in the My documents tab.

- US Legal Forms is an online repository of current DIY legal paperwork covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection empowers you to take control of your affairs without the necessity of a lawyer's services.

- We offer access to legal document templates that are not always readily accessible to the public.

- Our templates are specific to states and regions, which greatly simplifies the search process.

Form popularity

FAQ

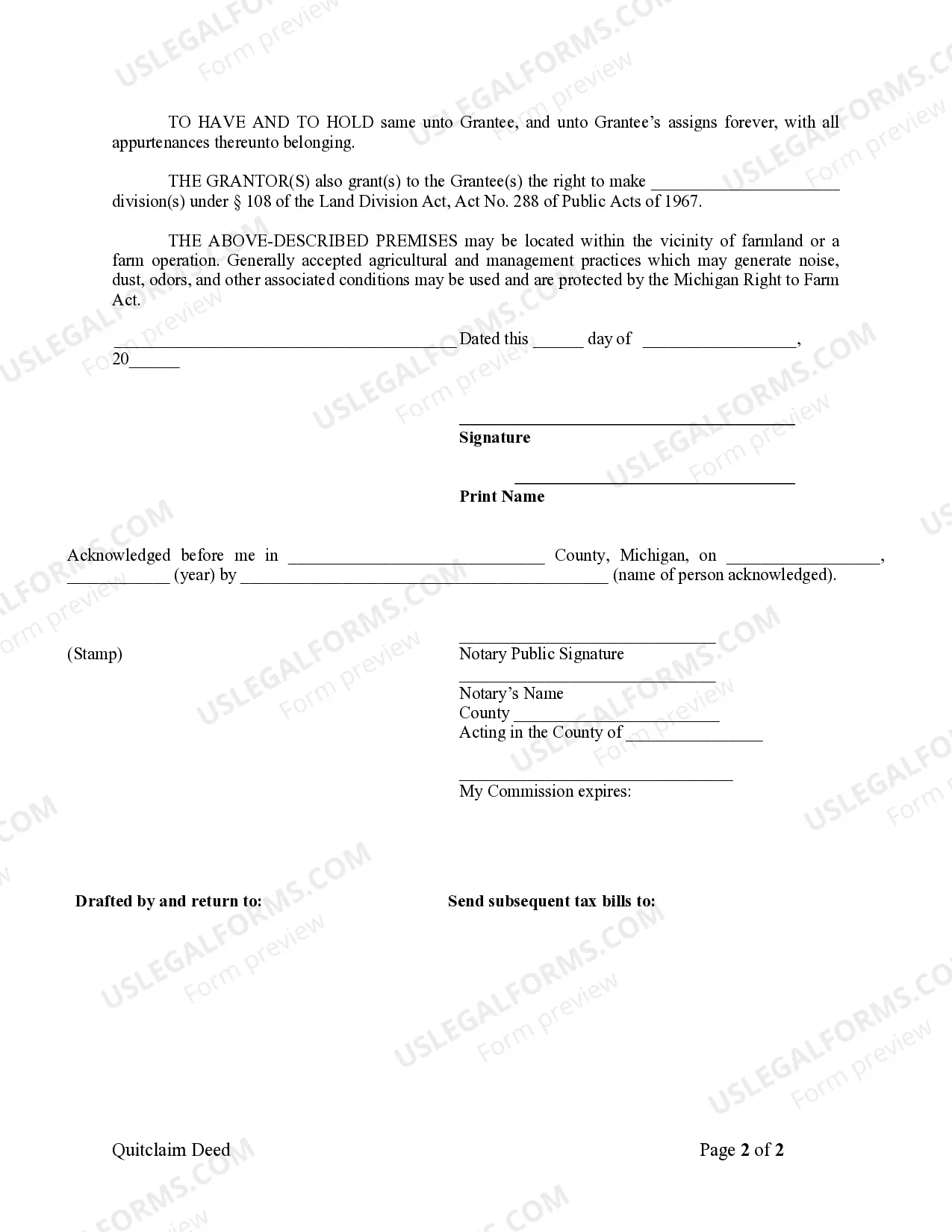

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

To successfully execute a quitclaim deed in Michigan, the property owner needs to complete a quitclaim deed form and sign it in front of a notary. Then they pay any transfer taxes due and record the deed in the land recorder's office in the county in which the property is located.

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

In most cases, the fees will amount to between £100 and £500 +VAT. Your conveyancer may or may not include cover for additional charges within their service.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.

You can prepare a quitclaim deed using the Do-It-Yourself Quitclaim Deed (after Divorce) tool. If you are the person giving your share of the property to your ex-spouse, sign the quitclaim deed in front of a notary. Then give the quitclaim deed to your ex-spouse or your ex-spouse's lawyer.