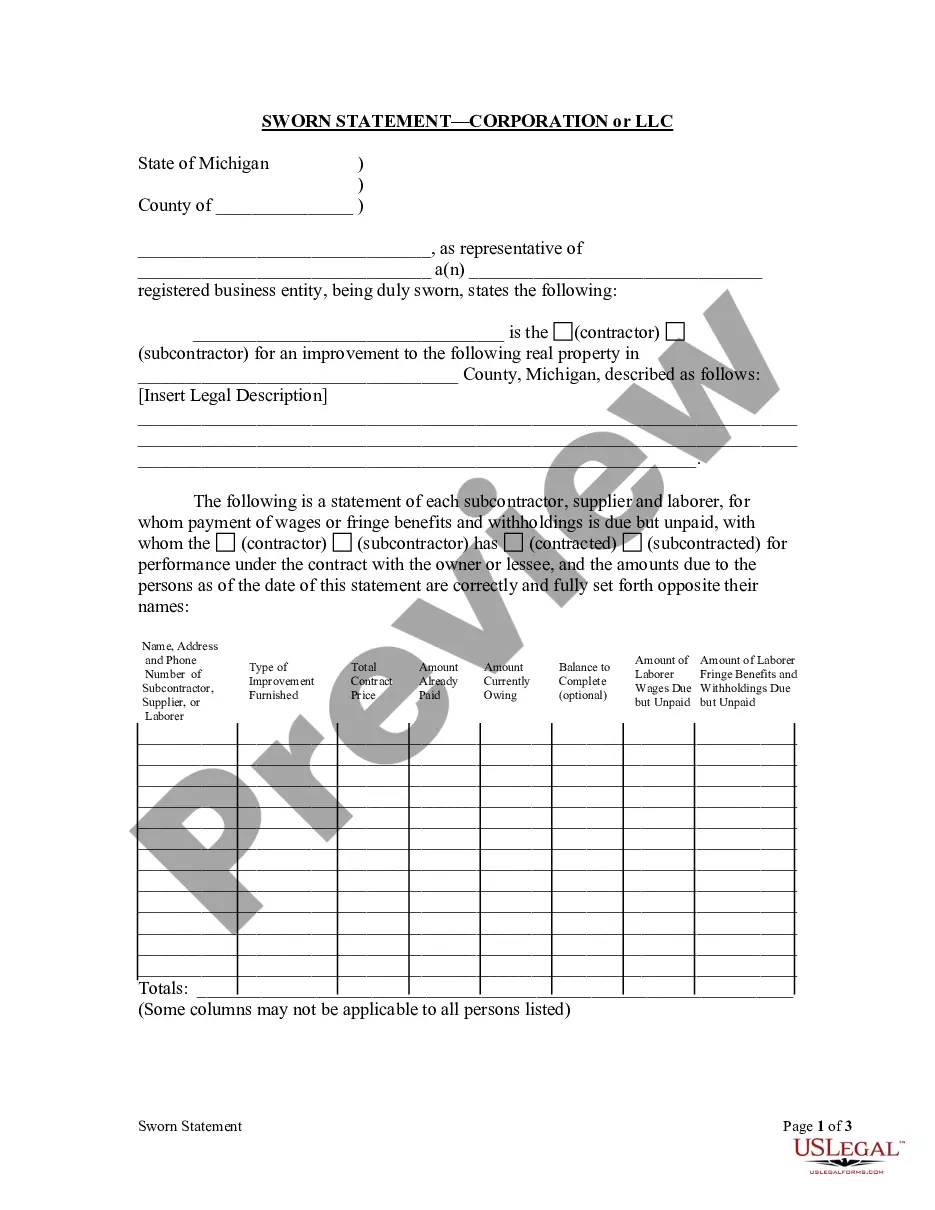

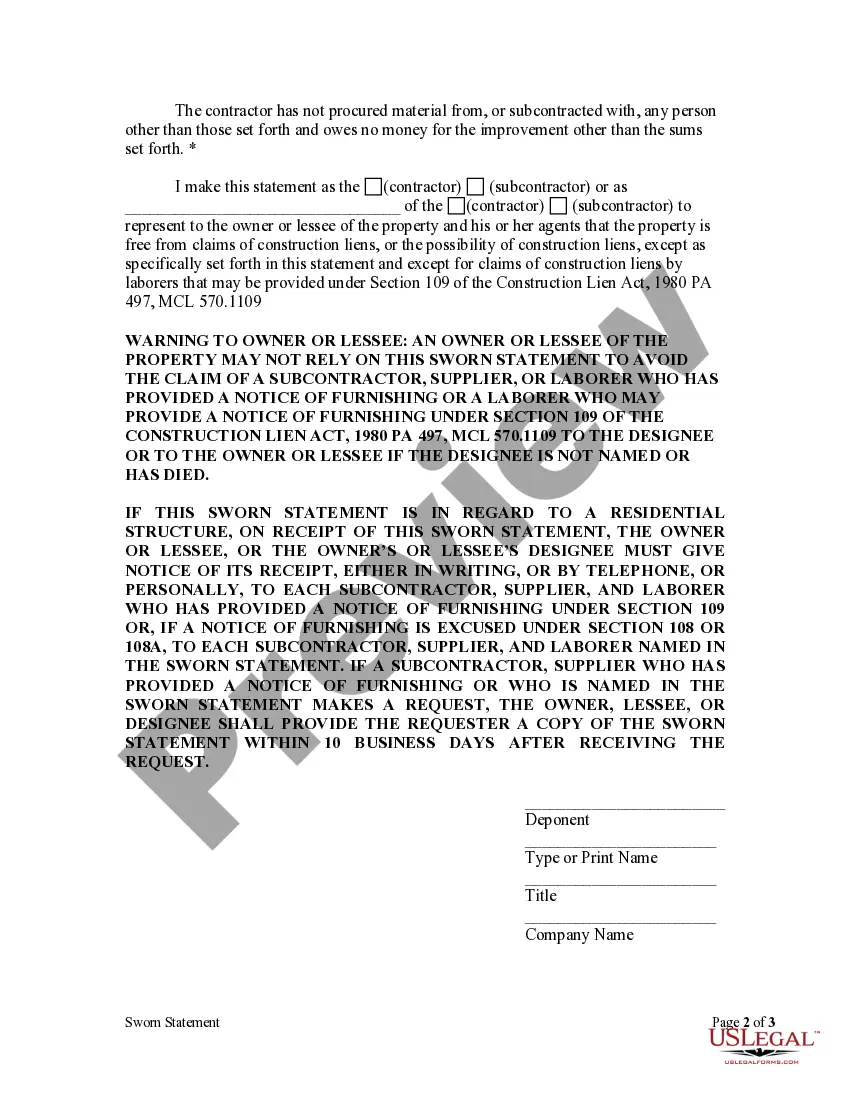

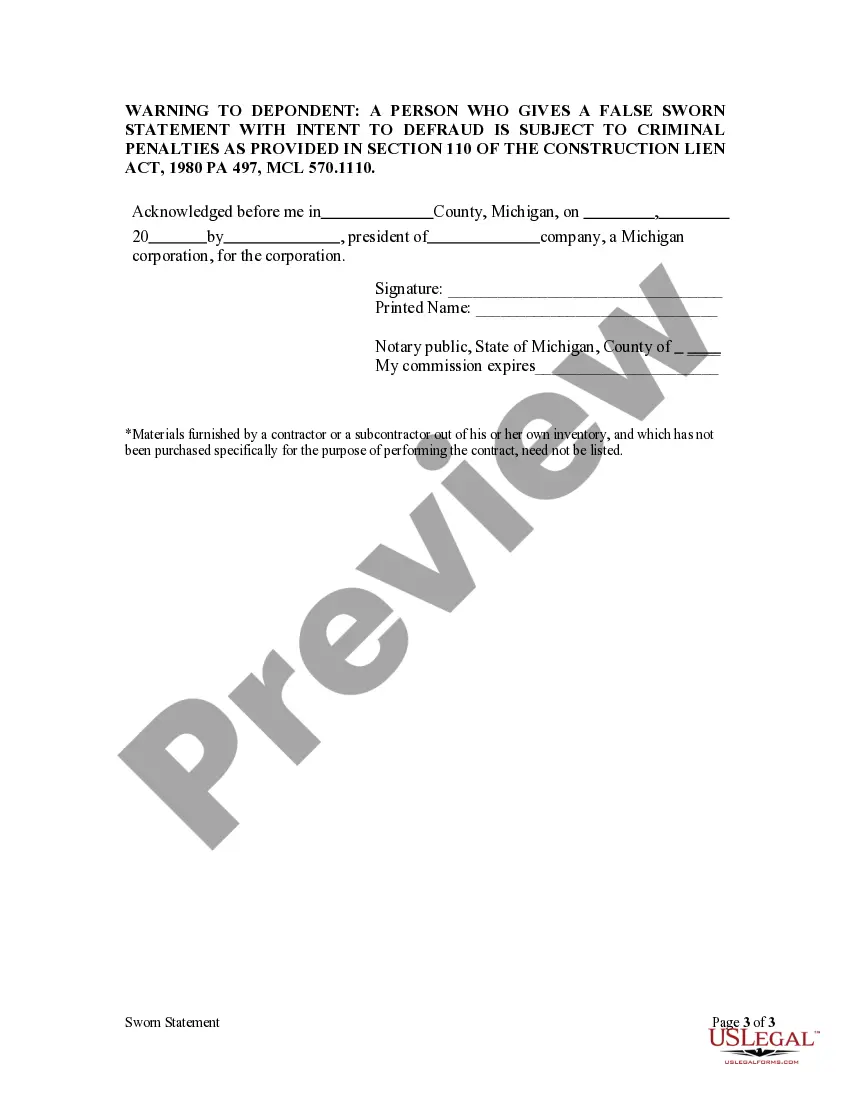

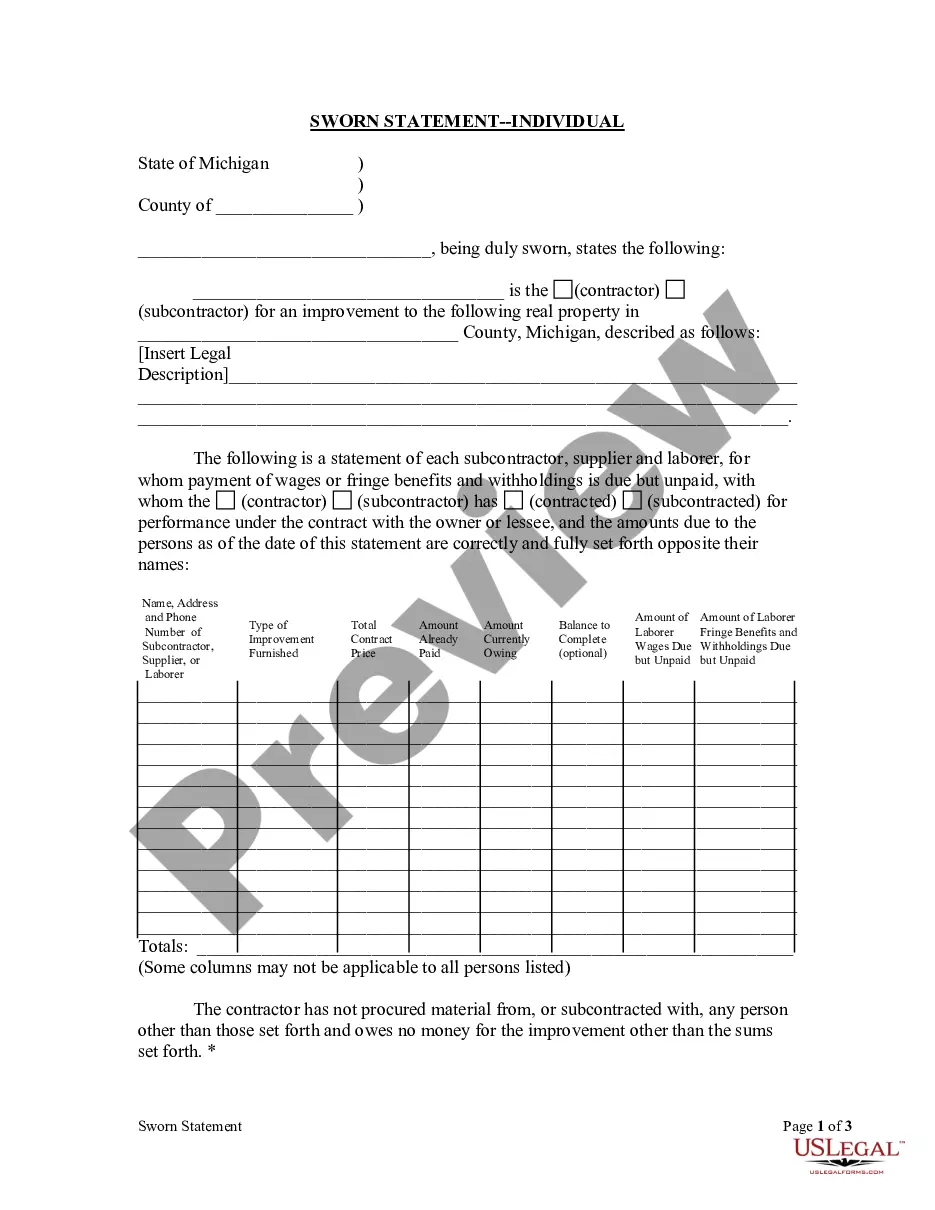

A corporate or LLC contractor is required by Michigan statutes to provide a Sworn Statement to the owner or lessee when payment is due to the contractor from the owner or lessee or when the contractor requests payment from the owner or lessee or when a demand for the Sworn Statement has been made by or on behalf of the owner or lessee. The statement lists each subcontractor and supplier who has provided labor or materials to improvements to the property in question and how much those parties are owed.

Detroit Michigan Sworn Statement - Corporation or LLC

Description

How to fill out Michigan Sworn Statement - Corporation Or LLC?

Regardless of social or professional ranking, finalizing legal paperwork is an unfortunate requisite in the contemporary professional landscape.

Often, it’s nearly unfeasible for someone without a legal background to generate this type of documentation from scratch, primarily due to the complicated terminology and legal intricacies involved.

This is where US Legal Forms proves to be beneficial.

Make sure the template you’ve selected is appropriate for your area since the laws of one jurisdiction do not apply to another.

Examine the document and review a brief summary (if available) of situations for which the document can be utilized.

- Our platform boasts an extensive repository with over 85,000 ready-to-utilize state-specific documents applicable to nearly any legal scenario.

- US Legal Forms also acts as a valuable resource for associates or legal advisors looking to optimize their time by using our DIY forms.

- Whether you’re in need of the Detroit Michigan Sworn Statement - Corporation or LLC or any other document that is valid in your jurisdiction or locality, with US Legal Forms, everything is readily available.

- Here’s how you can swiftly obtain the Detroit Michigan Sworn Statement - Corporation or LLC using our reliable service.

- If you are already a registered customer, you may continue and Log In to your account to acquire the required form.

- However, if you are new to our site, please ensure you complete these steps before downloading the Detroit Michigan Sworn Statement - Corporation or LLC.

Form popularity

FAQ

How to Form a Corporation in 11 Steps Choose a Business Name. An important first step when starting a corporation is selecting a business name.Register a DBA.Appoint Directors.File Your Articles of Incorporation.Write Your Corporate Bylaws.Draft a Shareholder Agreement.Hold Initial Board of Directors Meeting.Issue Stock.

LLC's and corporations both have owners, but the form of ownership is different. LLC members have an equity (ownership) interest in the assets of the business because they have made an investment to join the business. Corporate owners are shareholders or stockholders who have shares of stock in the business.

Michigan Annual Reports must be submitted using the LARA Corporations Online Filing System OR by mailing the pre-filled form the state will send your resident agent 90 days prior to your filing due date. To File Online: Go to the LARA Corporations Online Filing System. Enter your customer ID number and PIN.

How to Form a Corporation in Michigan Choose a Corporate Name.File Articles of Incorporation.Appoint a Registered Agent.Prepare Corporate Bylaws.Appoint Directors and Hold First Board Meeting.File Annual Report.Obtain an EIN.

The Michigan Articles of Organization is the LLC form you fill out and file with the state to form an LLC....You will need to know the following information to complete each Article: Entity Name. Business Purpose. Duration of LLC. Registered Agent Name and Registered Office Address. Governing Authority.

A Michigan limited liability company (LLC) is a relatively new type of corporate entity. It is authorized by the Michigan Limited Liability Company Act (Michigan Compiled Laws Section 450.4101) and combines the limited liability advantages of a Michigan corporation with the tax advantages of a general partnership.

7 Steps to Forming a Corporation Choose a business name. A new corporation cannot legally have the same name as any other corporation.File articles of incorporation.Write up corporate bylaws.Appoint a board of directors.Issue stock if you wish.Prepare for taxation and regulation.Do business.

A limited liability company (LLC) is neither a corporation nor is it a sole proprietorship. Instead, an LLC is a hybrid business structure that combines the limited liability of a corporation with the simplicity of a partnership or sole proprietorship.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

For federal income tax purposes, there is no such thing as being taxed as an LLC. Instead, an LLC can be taxed like a sole proprietorship, a partnership, a C corporation or?if it qualifies?an S corporation.