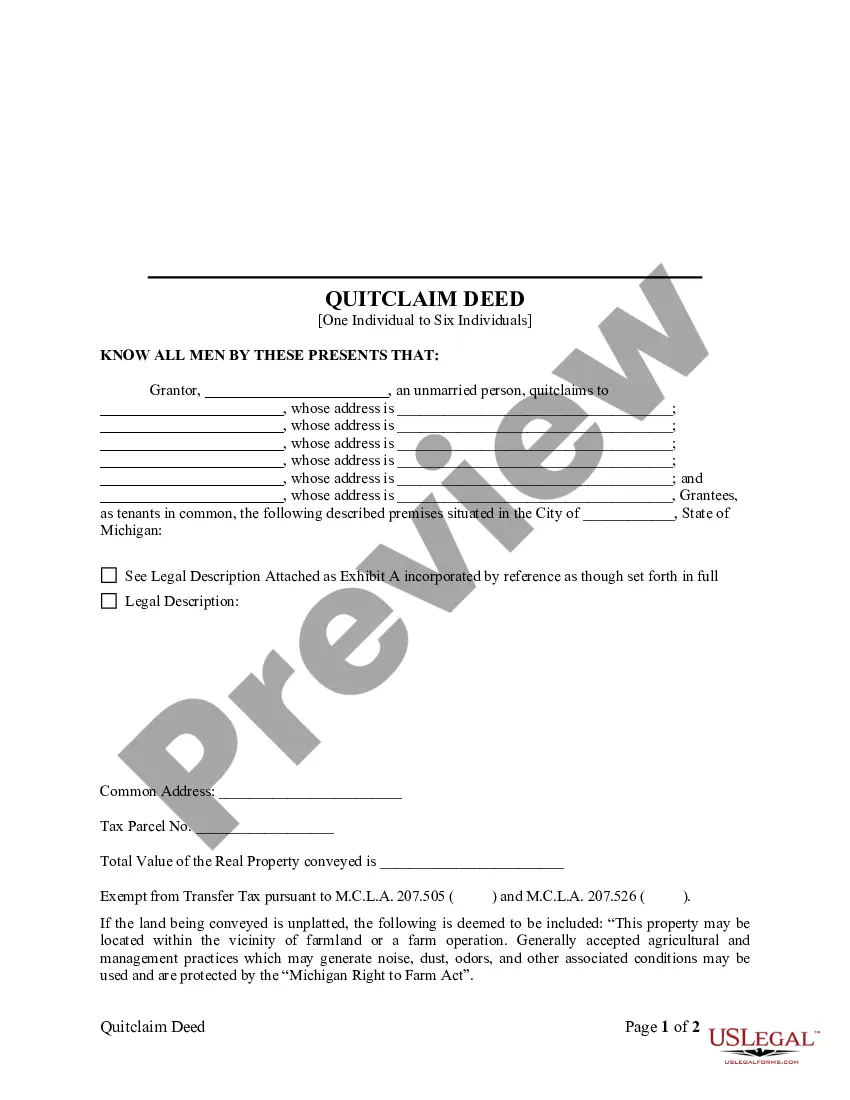

This form is a Quitclaim Deed where the grantor is an individual and the grantees are six individuals. The grantees take the property as tenants in common or as joint tenants with the right of survivorship. Grantor conveys and quitclaims the described property to grantees. This deed complies with all state laws.

Detroit Michigan Quitclaim Deed - One Individual to Six Individuals

Description

How to fill out Michigan Quitclaim Deed - One Individual To Six Individuals?

Finding confirmed templates relevant to your regional laws can be difficult unless you utilize the US Legal Forms database.

It’s a web-based repository of over 85,000 legal forms for both personal and professional purposes and any real-world scenarios.

All the documents are correctly categorized by field of use and jurisdictional areas, making it swift and straightforward to locate the Detroit Michigan Quitclaim Deed - One Individual to Six Individuals.

Maintaining documentation orderly and conforming to legal standards is highly significant. Take advantage of the US Legal Forms library to always have vital document templates for any requirements readily available!

- Verify the Preview mode and form description.

- Ensure you've selected the appropriate one that fulfills your needs and fully aligns with your local jurisdiction requirements.

- Search for another template if necessary.

- Should you encounter any discrepancy, use the Search tab above to find the correct one.

- If it fits your needs, move to the next step.

Form popularity

FAQ

As a homeowner, you have the ability to execute a quitclaim deed to change ownership, and you don't need to refinance the mortgage loan to file a quitclaim deed. Filing a quitclaim deed will change only the property's ownership and title, not anything regarding the loan.

Quitclaim deeds transfer only the part of the property the grantor actually owns, so if the grantor owns one-fourth of the property, that's all he can transfer to the grantee. If you're the grantee, be mindful that quitclaim deeds can be risky if you don't know or trust the grantor or know the property's history.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Simply defined, a ladybird deed is a transfer of real prop- erty to a contingent grantee that reserves a life estate and the lifetime power to convey the property and unilaterally defeat the grantee's interest. Page 2. 31. June 2016 Michigan Bar Journal.

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).

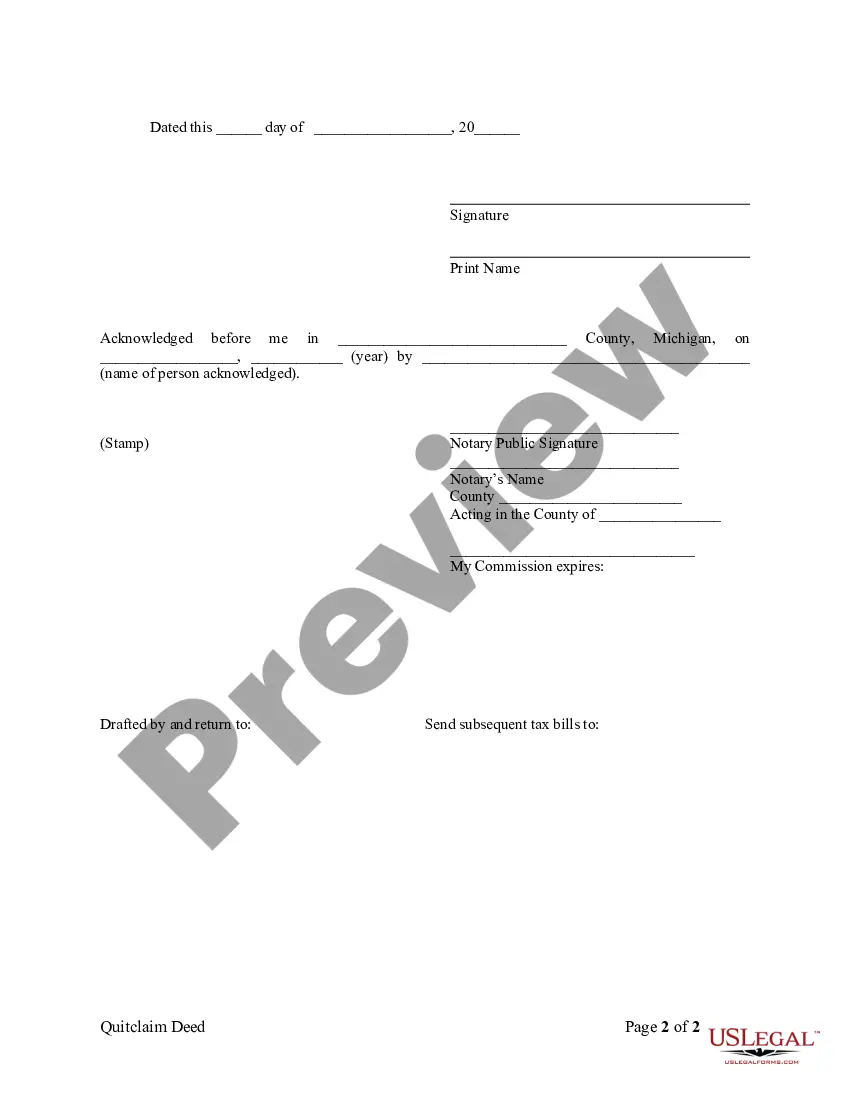

If you are the person transferring your property to your ex-spouse, you must sign the quitclaim deed in front of a notary. Then give the deed to your ex-spouse. Your ex-spouse will need to sign the deed and take it to be recorded at the Register of Deeds.

If you are the person keeping the property, take the deed to the Register of Deeds and record it after your ex-spouse has signed it and delivered it to you. There will be a $30 recording fee.

How to Transfer Michigan Real Estate Find the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

You cannot simply add someone to the deed in most cases, and it will require a change in the form of the deed on the property. You will have to file a quitclaim deed and then file a new deed with joint ownership.

Current Transfer Tax rate is $8.60 per $1,000, rounded up to the nearest $500. $7.50 is State Transfer Tax and $1.10 is County Transfer Tax. Transfer tax imposed by each act shall be collected unless said instrument of transfer is exempt from either or both acts and such exemptions are stated on the face of the deed.