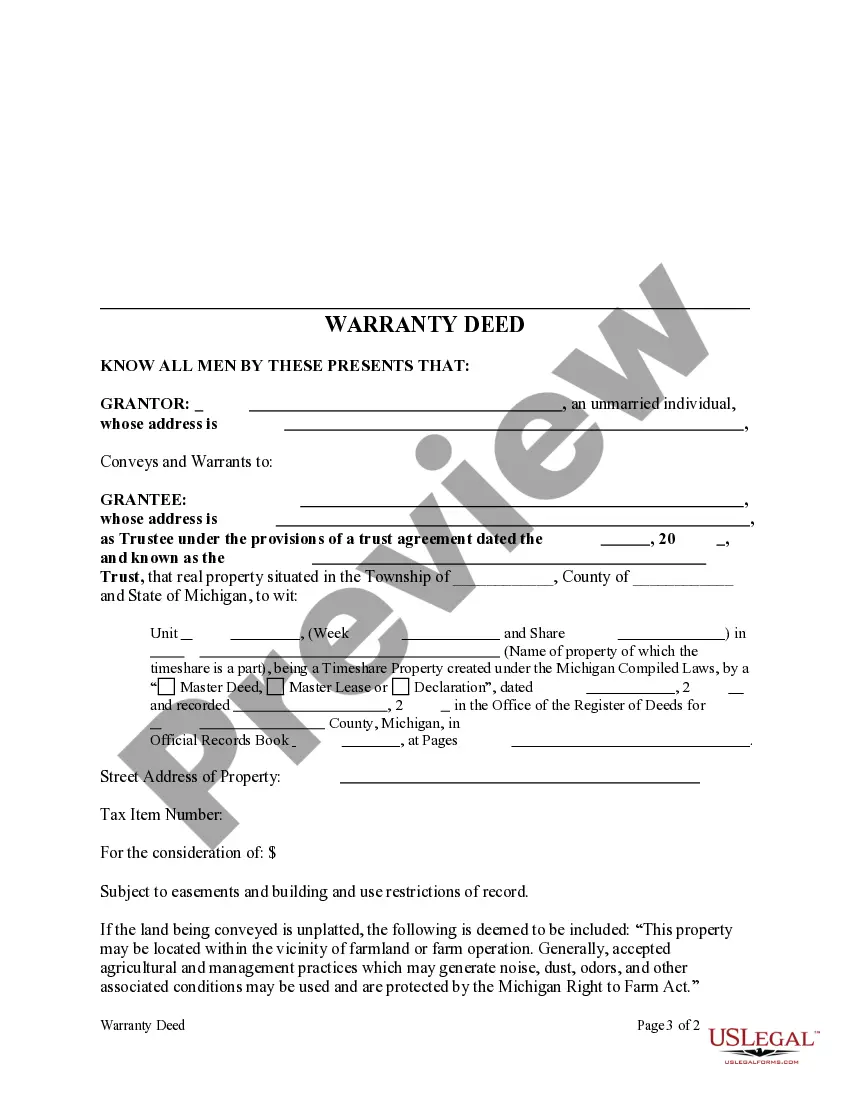

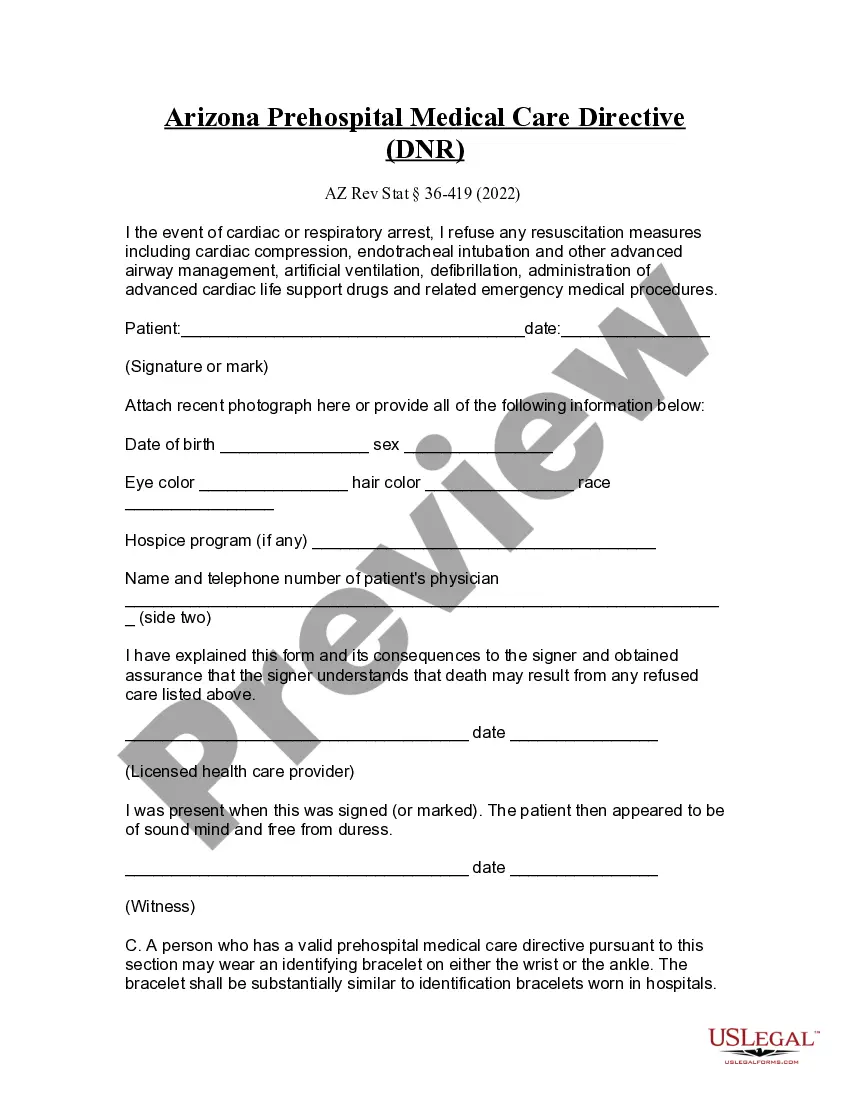

This form is a Warranty Deed for a Time Share where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Detroit Michigan Warranty Deed for a Time Share from an Individual to a Trust

Description

How to fill out Michigan Warranty Deed For A Time Share From An Individual To A Trust?

If you are seeking a pertinent form template, it’s challenging to select a more suitable service than the US Legal Forms site – one of the most extensive collections available online.

With this collection, you can locate numerous document examples for business and personal use by categories and areas, or keywords.

With our enhanced search feature, acquiring the latest Detroit Michigan Warranty Deed for a Time Share from an Individual to a Trust is as simple as 1-2-3.

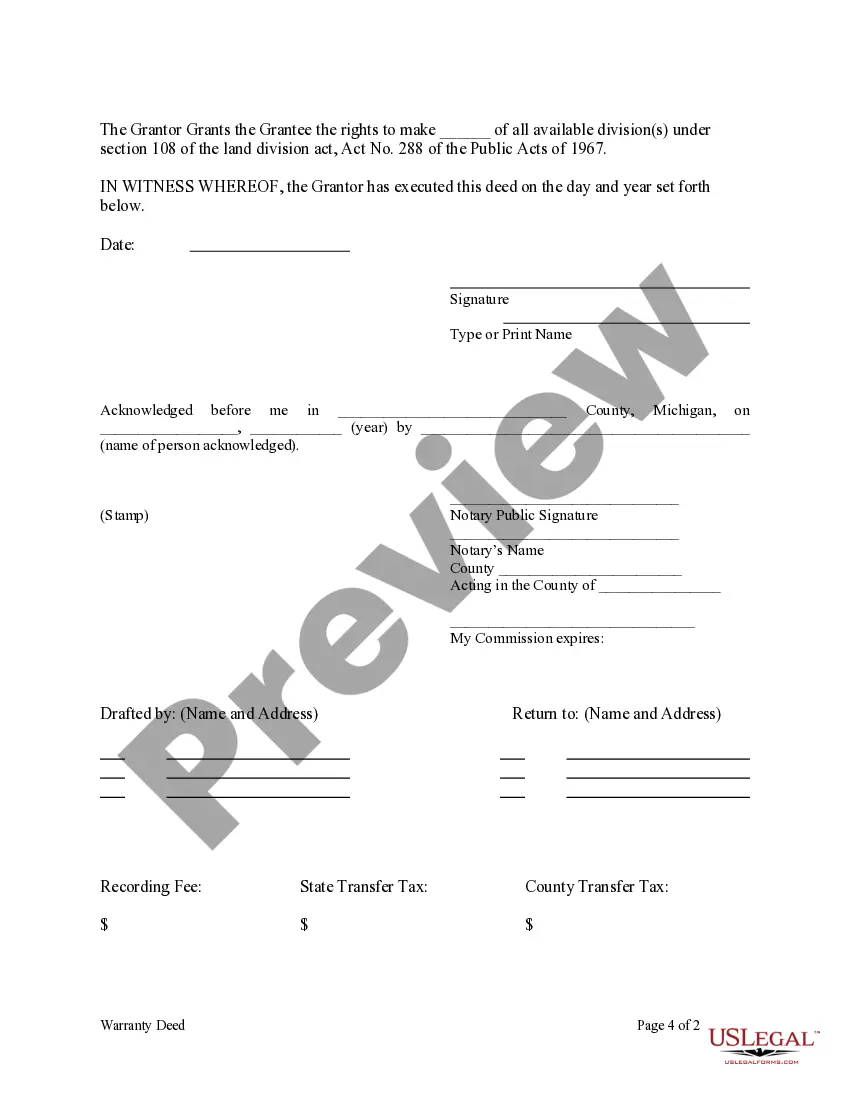

Complete the payment. Use your credit card or PayPal account to finish the registration process.

Retrieve the template. Select the file format and download it to your device. Modify. Fill in, alter, print, and sign the obtained Detroit Michigan Warranty Deed for a Time Share from an Individual to a Trust.

- Moreover, the significance of each document is confirmed by a team of skilled attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Detroit Michigan Warranty Deed for a Time Share from an Individual to a Trust is to Log In to your user account and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have found the template you need. Review its description and use the Preview feature to examine its content. If it does not meet your requirements, utilize the Search field at the top of the page to find the right document.

- Verify your choice. Select the Buy now option. After that, pick the desired pricing plan and provide information to create an account.

Form popularity

FAQ

There are three main types of deeds in Michigan: warranty deeds, quitclaim deeds, and covenant deeds.

12. Who benefits the most from recording a warranty deed? D. Explanation: The grantee is the one who has acquired an interest in the land, and she is the one who benefits the most from recording the deed to provide constructive (legal) notice of that interest.

Disadvantages of a Lady Bird Deed If you plan to apply for a mortgage on the property, some title insurance companies may be reluctant to provide title insurance on property subject to a Lady Bird deed. You want to leave the property to more than one grantee. There is a fairly large mortgage balance on the property.

B. The general warranty deed provides the buyer with the greatest protection. A bargain and sale deed carries no warranties against liens or other encumbrances, but assures that the grantor has the right to sell or convey the property.

Revocable trusts are similar to lady bird deeds in that they both offer significant amounts of control while the original owner is still alive. However, as third parties usually manage revocable trusts, owners tend to exert less direct control over the assets.

The Michigan warranty deed is a form of deed that provides an unlimited warranty of title. It makes an absolute guarantee that the current owner has good title to the property. The warranty is not limited to the time that the current owner owned the property.

A Lady Bird deed is a special kind of deed that is commonly recognized by Texas law. Also called an enhanced life estate deed, it can be used to transfer property to beneficiaries outside of probate. It gives the current owner continued control over the property until his or her death.

This fee is typically $27.70.

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

Disadvantages of a Lady Bird Deed If you plan to apply for a mortgage on the property, some title insurance companies may be reluctant to provide title insurance on property subject to a Lady Bird deed. You want to leave the property to more than one grantee. There is a fairly large mortgage balance on the property.