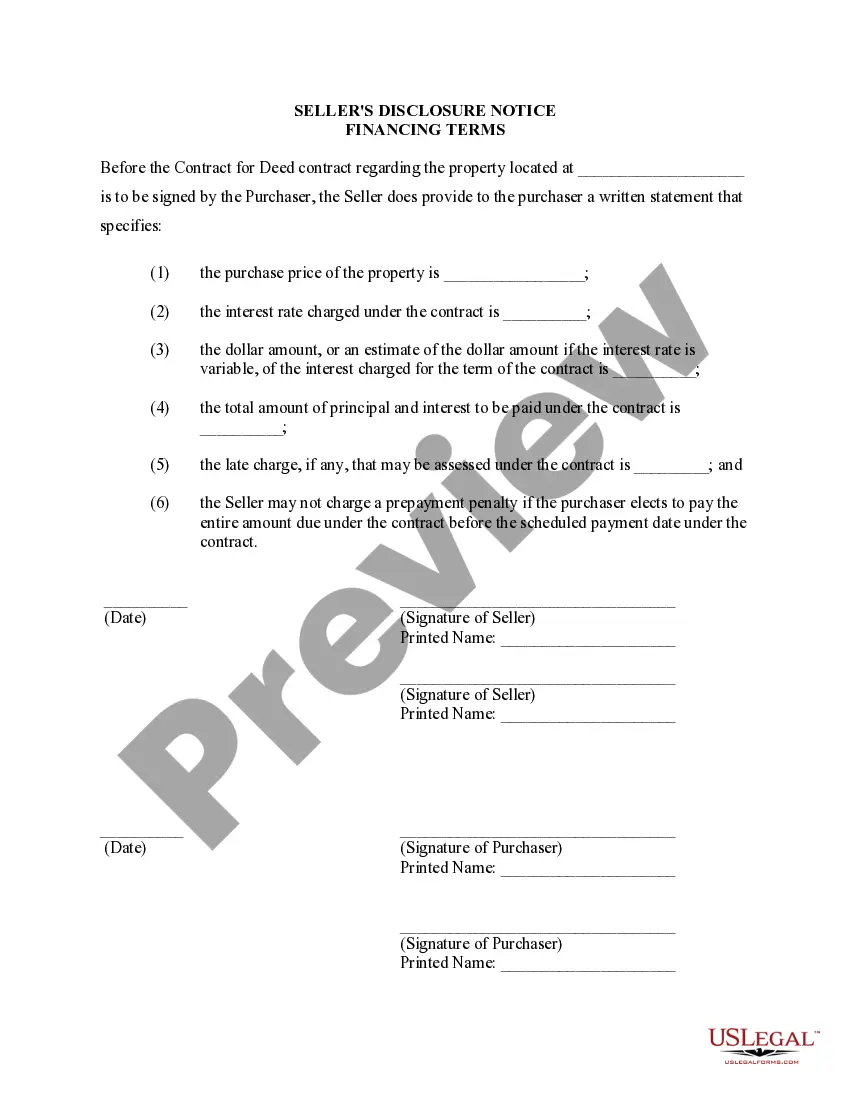

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Detroit Michigan Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

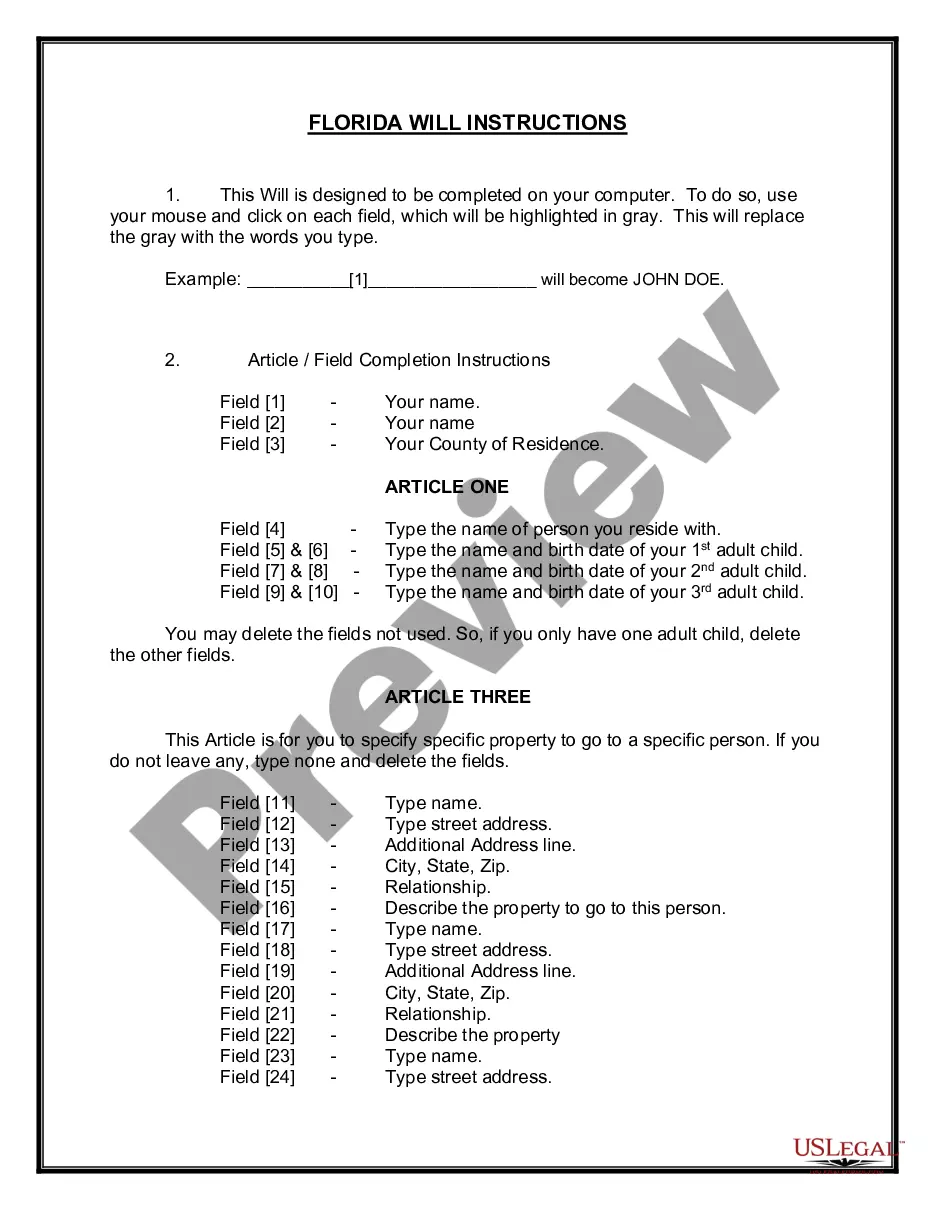

How to fill out Michigan Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Utilize the US Legal Forms and gain instant access to any sample form you need.

Our user-friendly platform with a vast array of document templates enables you to discover and acquire nearly any sample document you may require.

You can download, fill out, and sign the Detroit Michigan Seller's Disclosure of Financing Terms for Residential Property related to the Contract or Agreement for Deed also known as Land Contract in just a few minutes instead of spending hours online looking for a suitable template.

Utilizing our library is an excellent way to enhance the security of your form submissions.

- Our experienced attorneys frequently review all documents to ensure that the templates are suited for a specific state and adhere to current laws and regulations.

- How do you obtain the Detroit Michigan Seller's Disclosure of Financing Terms for Residential Property associated with Contract or Agreement for Deed also referred to as Land Contract.

- If you possess an account, simply Log In to your profile. The Download function will be activated for all documents you examine.

- Additionally, you can access all previously saved documents in the My documents section.

- If you do not yet have an account, follow the steps provided below.

Form popularity

FAQ

A land contract in Michigan grants buyers an equitable title to gain immediate control over the property. However, the legal title remains with the property owner until the fulfillment of the land contract. Furthermore, the interest rates on land contracts in Michigan cannot exceed 11%.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

The Michigan Seller Disclosure Act requires the seller (or the seller's agent) to provide a written Seller's Disclosure Statement (SDS) to the prospective buyer (or prospective buyer's agent) before execution of a binding purchase agreement for the property.

In Michigan, the seller of a residential property has an obligation to disclose certain information to the buyer of the property in what is commonly referred to as a ?Seller's Disclosure Statement.? The Seller Disclosure Act, MCL 565.951, et seq.

(b) The contract must be signed by both parties either as one document or as identical documents each signed by one party which are then exchanged. Letters offering to sell land and a confirmatory response will generally not be enough.

A Michigan property disclosure statement is a form through which sellers must report the condition of their residential real estate to potential buyers. The items specified may include pending legal cases, unpaid fees, property defects, or damage from flooding or fires.

In Michigan, a land contract is an option for potential property buyers, especially those unable to secure traditional bank financing. Some fundamental laws behind Michigan land contract terms distinguish it from land contracts in other states.

Michigan disclosure laws require a seller to disclose what is personally known about the home, including any imperfections. This could include things like lead-based paint, water damage, hazardous conditions, pest damage, past repairs, past insurance claims, etc.

Which of the following facts about a property in Michigan would a licensee need to disclose? The property is subject to an easement that could adversely and significantly affect an ordinary purchaser's use or enjoyment.