Boston Massachusetts Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out Massachusetts Last Will And Testament With All Property To Trust Called A Pour Over Will?

Regardless of one’s social or occupational stature, filling out law-related documents is an unfortunate necessity in the current professional landscape.

Frequently, it’s nearly unfeasible for individuals lacking legal education to generate such paperwork independently, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms becomes invaluable.

Verify that the template you have located is tailored to your locality since the laws of one state or county are not applicable to another.

Examine the document and read a brief description (if available) of situations for which the paper can be utilized.

- Our service provides a vast library containing over 85,000 ready-to-use state-specific forms applicable to nearly any legal matter.

- US Legal Forms is also a superb resource for associates or legal advisors seeking to conserve time by using our DIY templates.

- Whether you need the Boston Massachusetts Legal Last Will and Testament Form with All Property to Trust, referred to as a Pour Over Will, or any other document suitable for your state or county, with US Legal Forms, everything is readily available.

- Here’s how to quickly obtain the Boston Massachusetts Legal Last Will and Testament Form with All Property to Trust known as a Pour Over Will using our reliable service.

- If you are already a subscriber, you can simply Log In to your account to access the correct form.

- However, if you are new to our library, make sure to follow these steps before acquiring the Boston Massachusetts Legal Last Will and Testament Form with All Property to Trust identified as a Pour Over Will.

Form popularity

FAQ

Disadvantages of Wills May be subject to probate and possible challenges regarding validity. Can be subject to federal estate tax and income taxes. Becomes public record which anyone can access.

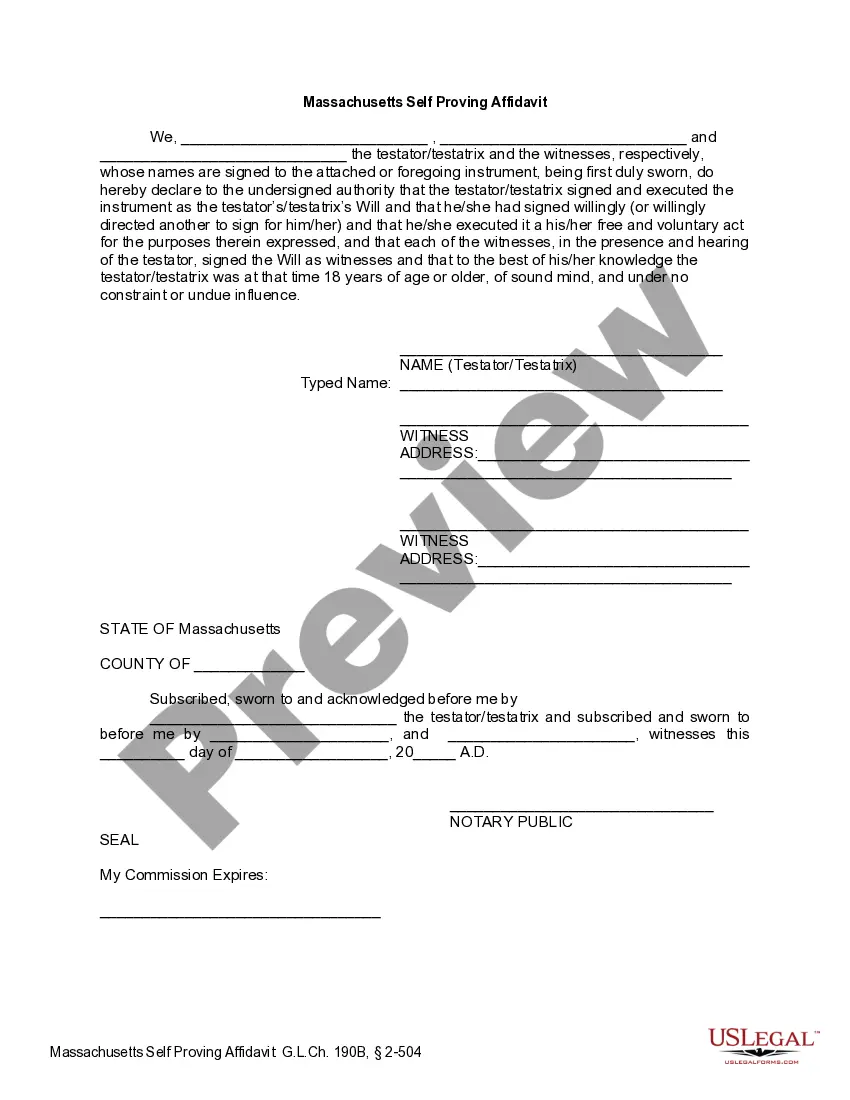

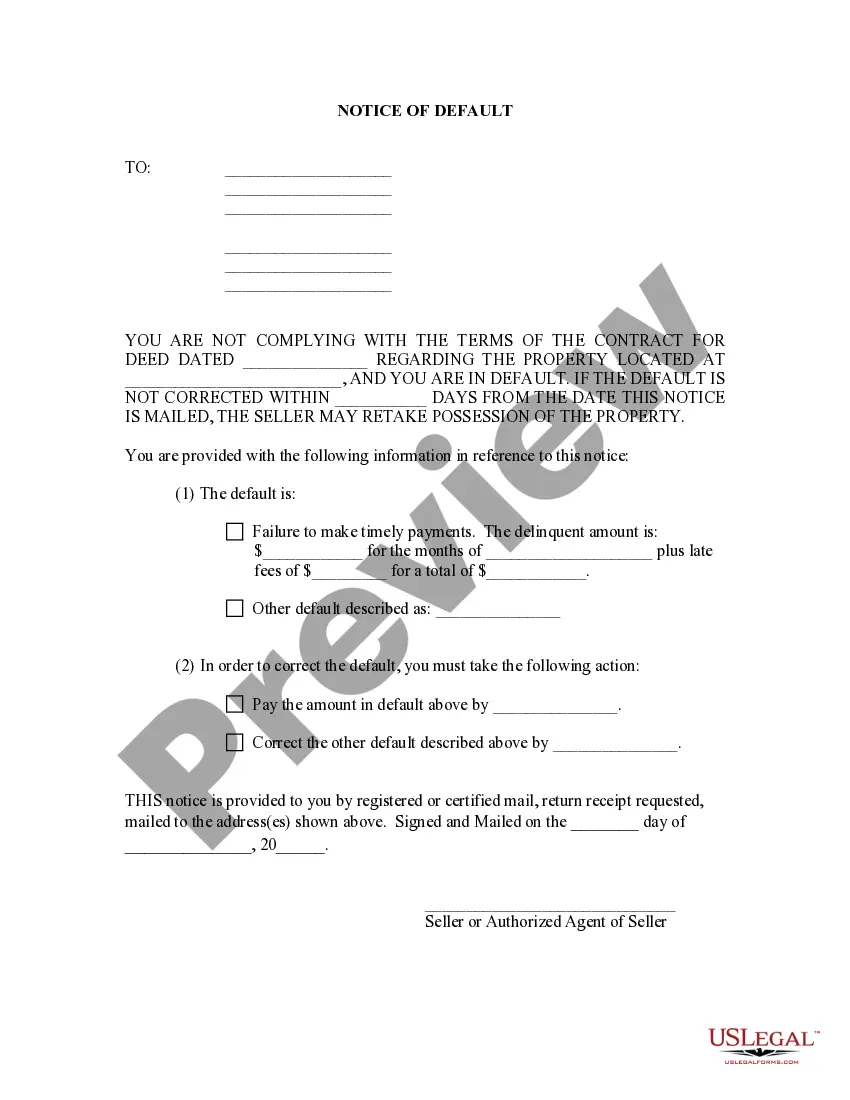

Pour-over wills act as a backstop against issues that could frustrate the smooth operation of a living trust. They ensure any assets a grantor neglects to add to a trust, whether by accident or on purpose, will end up in the trust after execution of the will.

over will is a last will and testament that serves as a safety device to capture any assets that are not transferred to or included in a living trust.

over will only goes through probate if you have failed to attach all your assets to your living trust. The probate process with a pourover will is much shorter than probate with a traditional will.

The main downside to pour-over wills is that (like all wills), the property that passes through them must go through probate. That means that any property headed toward a living trust may get hung up in probate before it can be distributed by the trust.

over will is a will used alongside a living trust. You can use it to transfer assets not already held in your trust before you die into your trust after your death.

The will directs the testator's estate to a revocable trust, which is used with a pour-over will to help the settlor avoid probate, maintain privacy, and ease the transition in asset management on the settlor's incapacity or death.

over will is a will used alongside a living trust. You can use it to transfer assets not already held in your trust before you die into your trust after your death.