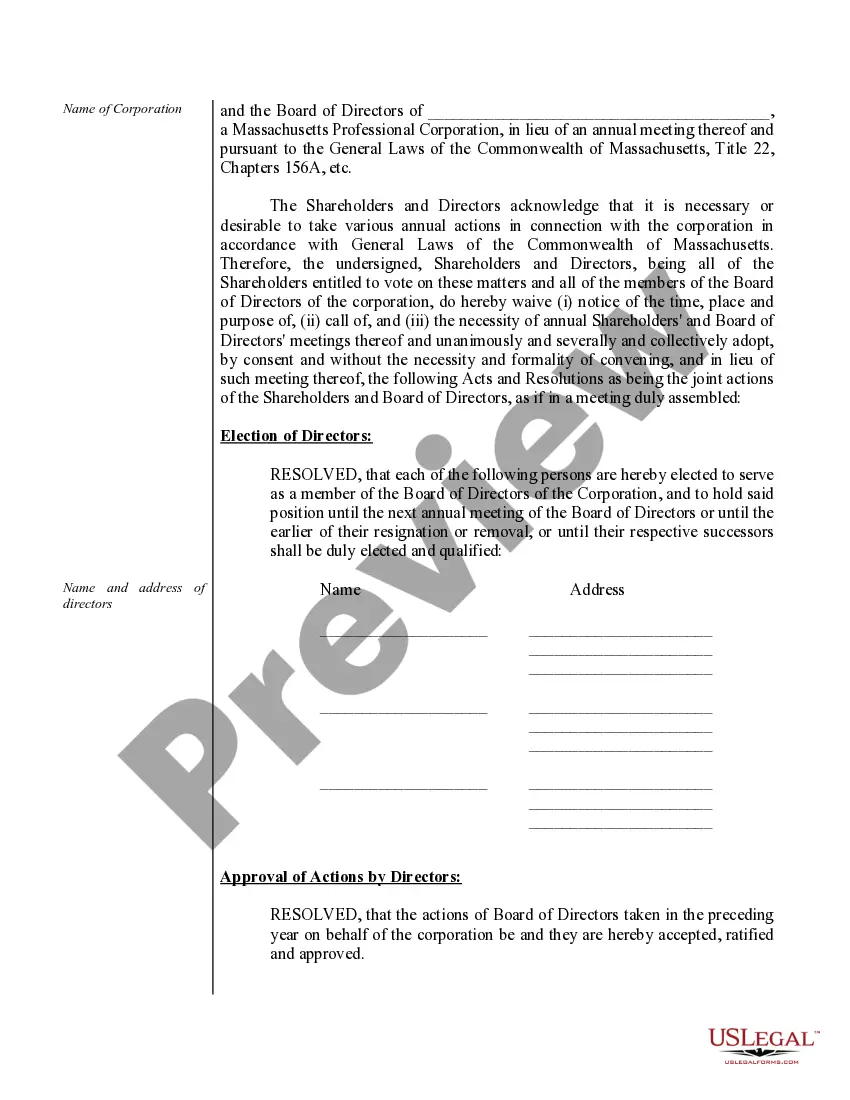

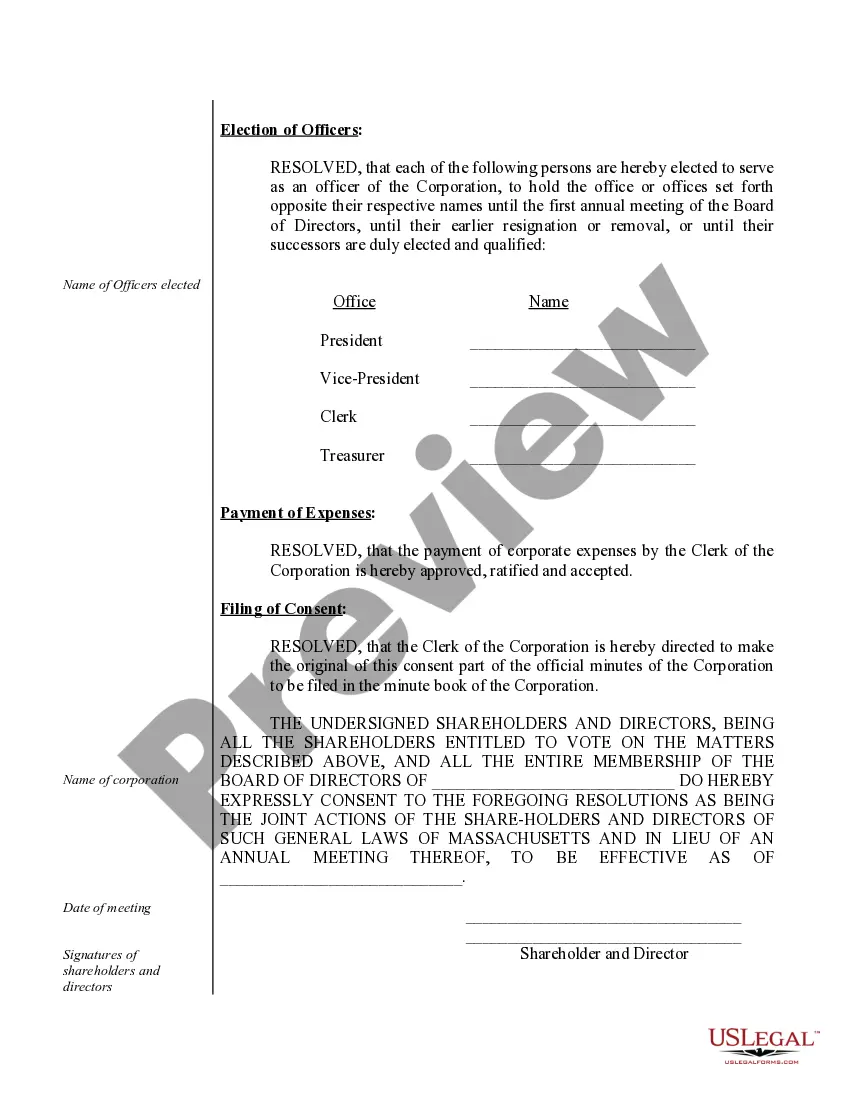

Boston Annual Minutes for a Massachusetts Professional Corporation

Description

How to fill out Annual Minutes For A Massachusetts Professional Corporation?

If you’ve previously made use of our service, Log In to your account and store the Boston Annual Minutes for a Massachusetts Professional Corporation on your device by selecting the Download button. Ensure your subscription is active. If it isn’t, renew it according to your payment scheme.

If this is your initial interaction with our service, follow these simple instructions to obtain your document.

You retain ongoing access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to reuse it. Take advantage of the US Legal Forms service to easily locate and preserve any template for your personal or professional requirements!

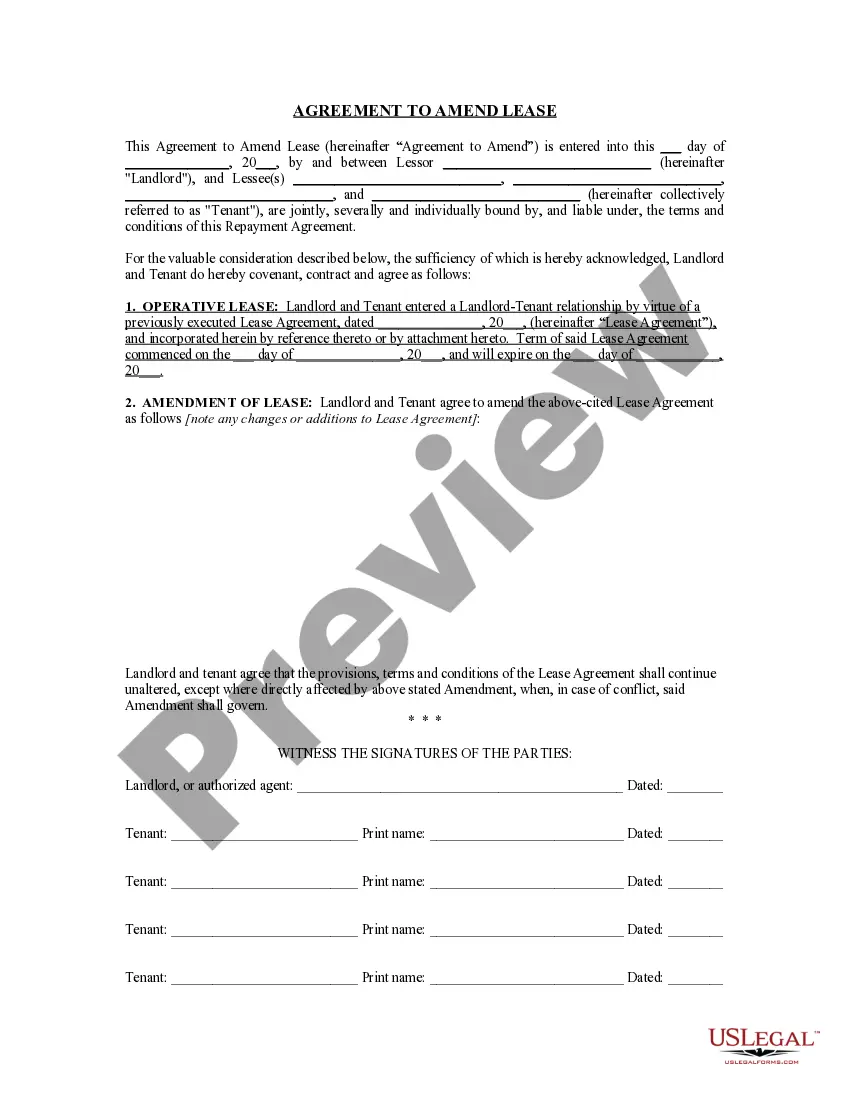

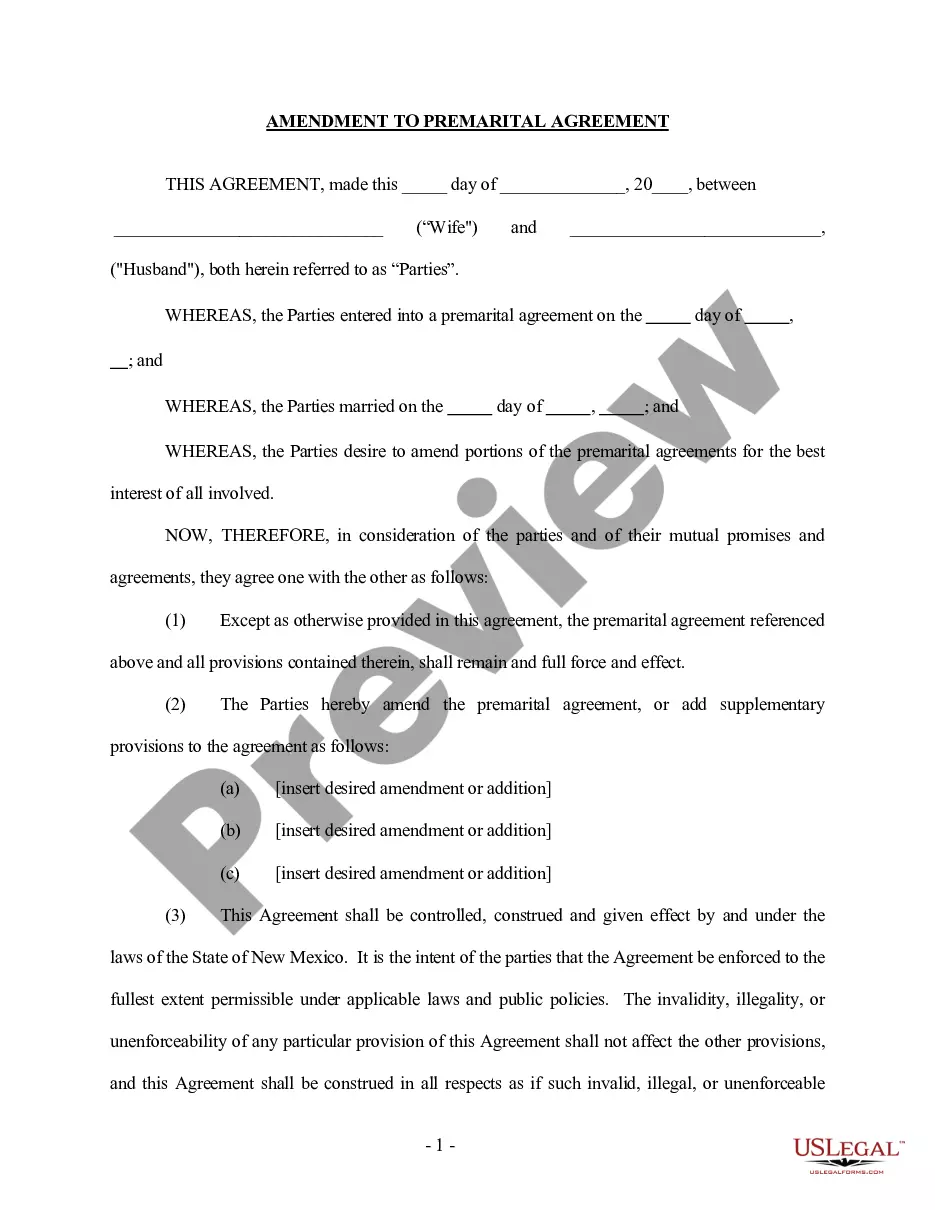

- Ensure you’ve located an appropriate document. Review the description and utilize the Preview feature, if available, to determine if it fulfills your requirements. If it doesn’t suit you, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Utilize your credit card information or the PayPal option to finalize the transaction.

- Obtain your Boston Annual Minutes for a Massachusetts Professional Corporation. Select the file format for your document and store it on your device.

- Complete your document. Print it or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

Professional corporations provide a limit on the owners' personal liability for business debts and claims. Incorporating can't protect a professional against liability for his or her negligence or malpractice, but it can protect against liability for the negligence or malpractice of an associate.

All foreign and domestic corporations registered in Massachusetts are required to file an annual report with the Secretary of the Commonwealth within two and one-half months after the close of their fiscal year.

How to File Your Massachusetts Annual Report Determine your business's due date and filing fees. Download a paper form OR complete the report online. LLPs ? foreign and domestic ? must create their own Massachusetts Annual Report. Submit your report and filing fee.

7 Steps to Start a Professional Corporation in Massachusetts Select Your Board of Directors.Designate a Registered Agent.Choose a Name for Your Corporation.File your Articles of Incorporation.Establish Your Corporate Record & Hold Your First Board Meeting.Obtain Business Licenses.Set up a Business Bank Account.

Corporations Division Filing Fees Domestic Profit and Professional CorporationsSpecial Certificates$25.00Limited Liability CompaniesCertificate of Registration$500.00Annual Report$500.00138 more rows

In Massachusetts, a corporation is only allowed to offer professional services (i.e., be a professional corporation) if every share of stock is owned by a person licensed for the profession.

Professional corporations may exist as part of a larger, more complicated, legal entity; for example, a law firm or medical practice might be organized as a partnership of several or many professional corporations.

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.

Massachusetts Annual Report Due Dates and Fees Late Fees: Massachusetts only assesses corporations ? foreign and domestic ? a late fee ($25) for failing to file an annual report. However, all business entities will be administratively dissolved if they are delinquent for more than 2 years.

Every corporation authorized to transact business in the commonwealth MUST file an annual report with the Corporations Division within two and one half (2½) months after the close of the corporation's fiscal year end.