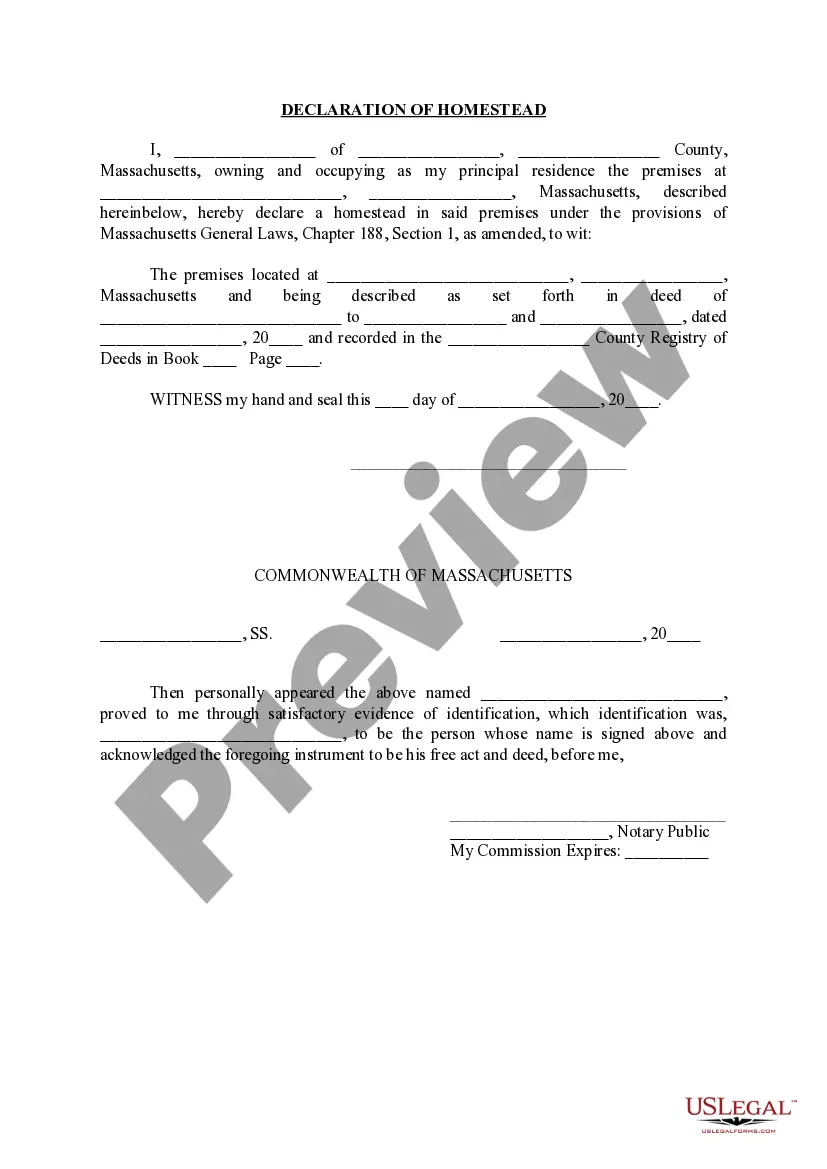

Boston Massachusetts Declaration of Homestead

Description

How to fill out Massachusetts Declaration Of Homestead?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our user-friendly website filled with a vast array of document templates eases the process of locating and obtaining almost any document sample you desire.

You can save, complete, and authenticate the Boston Massachusetts Declaration of Homestead in a matter of minutes instead of spending hours online searching for the appropriate template.

Utilizing our collection is an excellent method to enhance the security of your form submissions.

If you do not have an account yet, follow the instructions outlined below.

Locate the form you need. Confirm that it is the form you were looking for: check its title and description, and use the Preview feature if it is available. Otherwise, utilize the Search field to find the required one.

- Our knowledgeable legal experts routinely review all documents to guarantee that the templates are pertinent to specific regions and comply with new laws and regulations.

- How can you acquire the Boston Massachusetts Declaration of Homestead.

- If you have a subscription, simply Log In to your account.

- The Download button will be activated on all the templates you view.

- Additionally, you can find all the previously saved documents in the My documents section.

Form popularity

FAQ

Massachusetts laws Automatically protects up to $125,000 in home equity without filing. Protects up to $500,000 for those who file for homestead protection. Allows both spouses to file. Clarifies that there is no need to re-file after refinancing.

The Homestead Act, enacted during the Civil War in 1862, provided that any adult citizen, or intended citizen, who had never borne arms against the U.S. government could claim 160 acres of surveyed government land. Claimants were required to live on and ?improve? their plot by cultivating the land.

A Declaration of Homestead is a way to protect your home from unsecured creditors. The Declaration of Homestead protects the equity or cash value in your home. To find out the equity you have in your home, get the fair market value of your home.

$125,000 is protected automatically In Massachusetts a $125,000 homestead protection is automatically on your home. You do not have to file anything to get the $125,000 homestead protection. That means if you have $125,000 or less in equity no one can force the sale of your house.

If you own and live in your property as a primary residence, you may qualify for the residential exemption. The residential exemption reduces your tax bill by excluding a portion of your residential property's value from taxation.

The Commonwealth of Massachusetts provides homeowners with an estate of ?homestead,? also referred to as the homestead act or a homestead deed, to protect the possession and enjoyment of the owner and his/her/their family against the claims of certain creditors by preventing the property from execution and forced sale,

A homestead can be defined as the house and adjoining land where the owner primarily resides. Legally, what constitutes as a homestead varies state by state. Properties that qualify as homesteads may also benefit from homestead exemptions, which can offer homeowners certain financial and legal protections.

Chapter 395 of the Acts of 2010, an Act Relative to the Estate of Homestead, revises and replaces the provisions of the Massachusetts homestead protection law, General Laws Chapter 188.