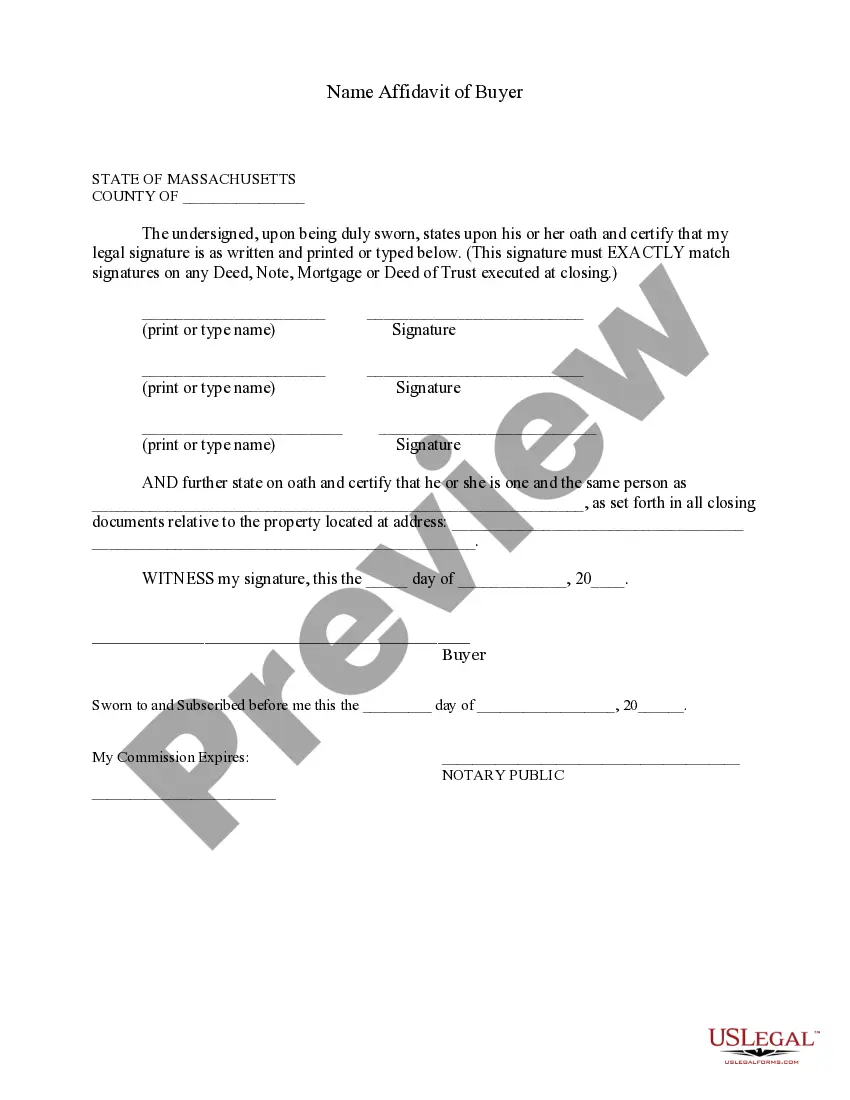

Cambridge Massachusetts Name Affidavit of Buyer

Description

How to fill out Massachusetts Name Affidavit Of Buyer?

If you have previously employed our service, sign in to your account and retrieve the Cambridge Massachusetts Name Affidavit of Buyer on your device by selecting the Download button. Ensure your subscription is current. If it is not, renew it according to your payment plan.

If this is your initial time using our service, follow these straightforward steps to acquire your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to retrieve it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

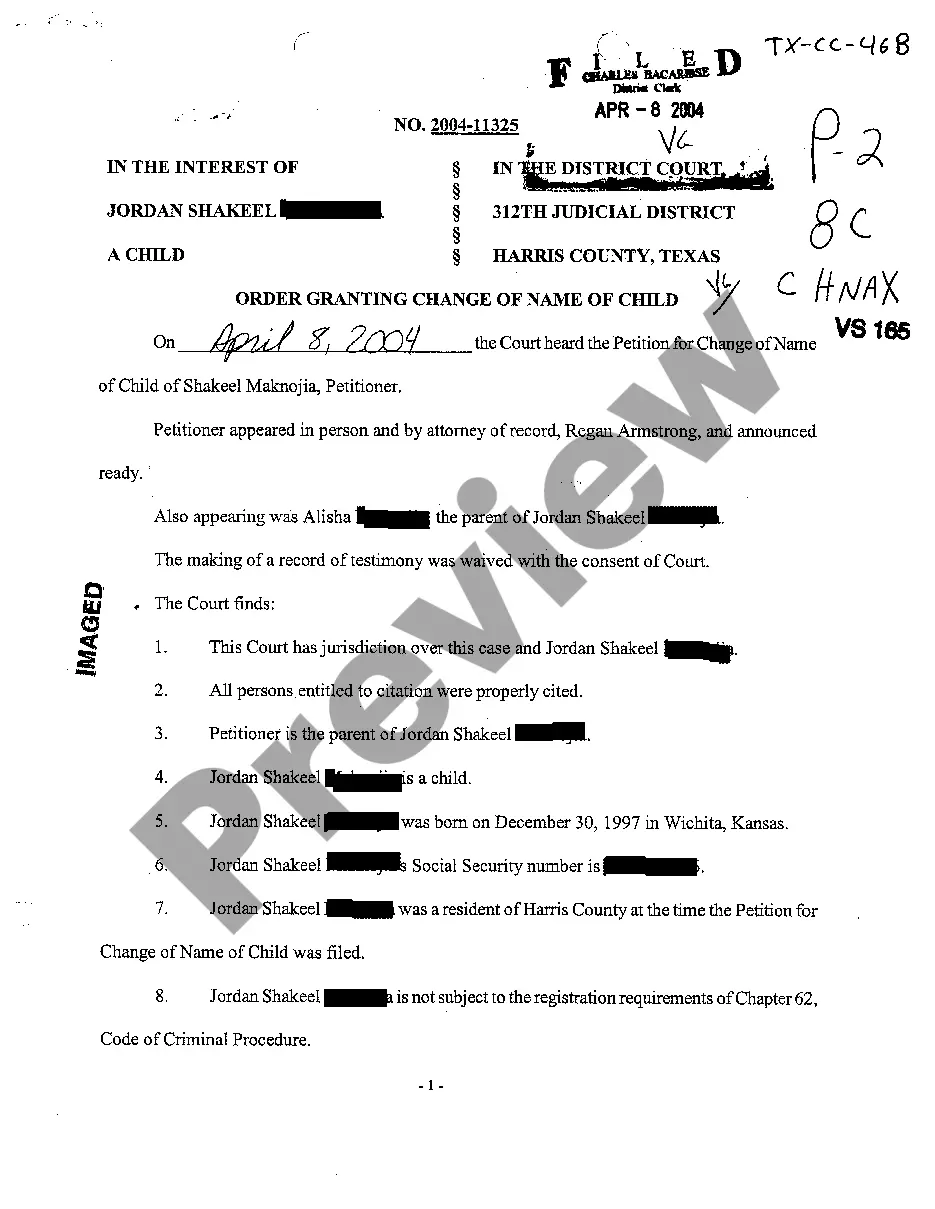

- Confirm you’ve found a suitable document. Browse the description and utilize the Preview option, if accessible, to verify if it satisfies your needs. If it does not meet your criteria, use the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Cambridge Massachusetts Name Affidavit of Buyer. Choose the file format for your document and store it on your device.

- Complete your sample. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

To add a name to your house deed in Massachusetts, you will need to draft a new deed that includes the current owner and the new co-owner. After preparing the deed, you must sign it in front of a notary and submit it to the local Registry of Deeds. This ensures that the addition is legally recognized. Services like US Legal Forms can assist you in this process, including providing the Cambridge Massachusetts Name Affidavit of Buyer to facilitate your needs.

The Torrens system in Massachusetts is a method of land registration that simplifies the process of property ownership. In this system, land titles are registered with the state, eliminating the need for lengthy title searches during property transactions. If you are dealing with properties in Cambridge, understanding the Torrens system can be beneficial. The Cambridge Massachusetts Name Affidavit of Buyer is also applicable within this context.

You are not legally required to hire a lawyer when adding someone to a deed in Massachusetts. However, consulting a legal professional can help ensure that all paperwork is correct and compliant with local laws. This can prevent potential issues down the road. If you'd like assistance, US Legal Forms offers resources that can guide you through the process, including the Cambridge Massachusetts Name Affidavit of Buyer.

To add someone to your house deed in Massachusetts, you will need to complete a new deed. This document must include the names of both parties and be signed in front of a notary. Following this, you should file the new deed with the local Registry of Deeds to make it official. Utilizing services like US Legal Forms can simplify this process by providing customized forms, including the Cambridge Massachusetts Name Affidavit of Buyer.

The public is able to access documents, such as deeds, birth and death certificates, military discharge records, and others through the register of deeds. There may be a fee to access or copy public records through the register of deeds.

Your final property tax amount is calculated by multiplying the Cambridge final property tax rate for the year by the MPAC property assessed value. You can calculate your property tax using either your home's MPAC assessed value or your home's most recent market price.

Residential exemption Background. If you own and live in your property as a primary residence, you may qualify for the residential exemption. The residential exemption reduces your tax bill by excluding a portion of your residential property's value from taxation.

All of the Massachusetts registries of deeds now offer free online document search capabilities. The main portal for most registries is operated by the Secretary of State's Office. Other registries have their own systems.

The residential tax exemption for Cambridge, MA The Cambridge residential tax exemption is 30% of the average assessed value of residential homes. In 2020 this meant a tax savings of $2,365.

How's it calculated? The residential exemption is the dollar value that is exempt from taxation. For example: if the residential exemption value were $100,000, a home with an assessed value of $300,000 would be taxed on just $200,000 of value.