This is an official form from the Massachusetts Court System, which complies with all applicable laws and statutes. USLF amends and updates these forms as is required by Massachusetts statutes and law.

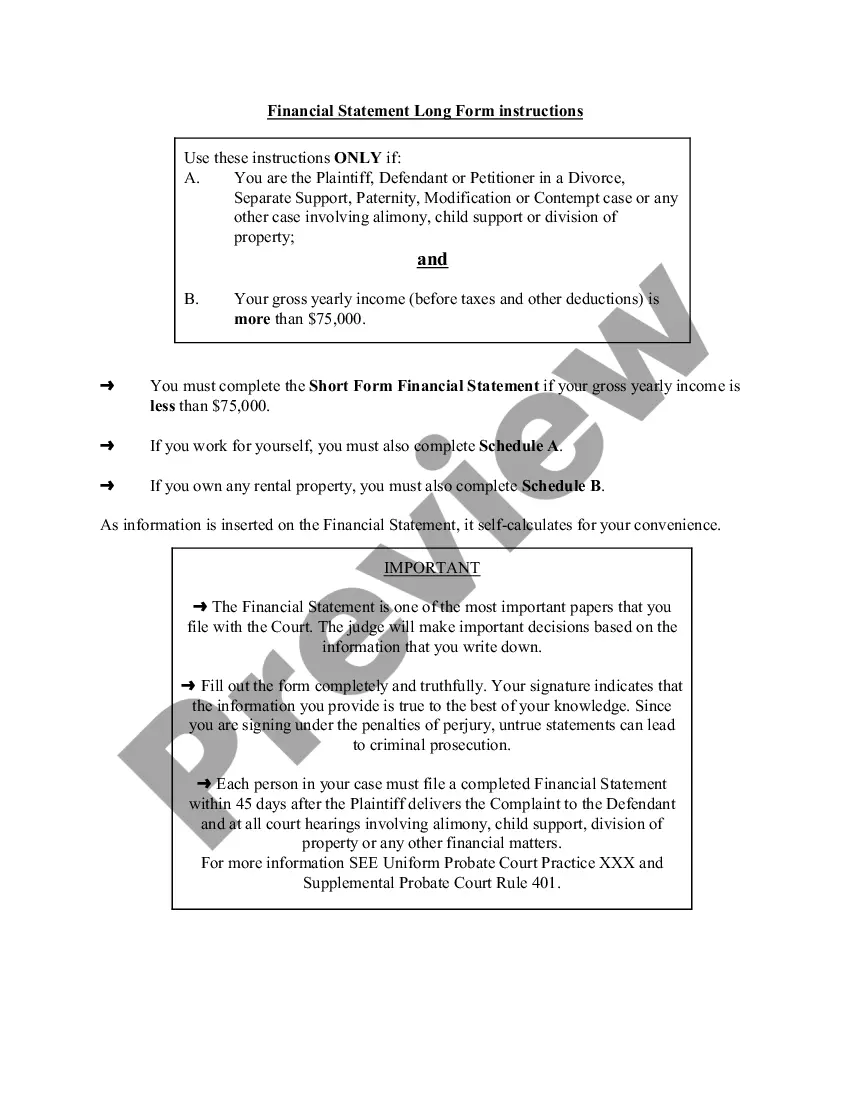

Boston Massachusetts Financial Statement Short Form Instructions

Description

How to fill out Massachusetts Financial Statement Short Form Instructions?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our practical website featuring a vast array of templates simplifies the process of locating and acquiring almost any document sample you might need.

You can download, fill out, and sign the Boston Massachusetts Financial Statement Short Form Instructions in just a few minutes instead of spending hours online trying to find a suitable template.

Utilizing our library is an excellent method to enhance the security of your document submissions.

US Legal Forms is among the largest and most trustworthy template libraries available online.

We are always prepared to assist you with virtually any legal matter, even if it is merely downloading the Boston Massachusetts Financial Statement Short Form Instructions.

- Our experienced attorneys regularly review all documents to ensure that the forms are accurate for a specific state and compliant with recent laws and regulations.

- How can you obtain the Boston Massachusetts Financial Statement Short Form Instructions? If you hold a subscription, simply Log In to your account. The Download option will be activated for all documents you view.

- Moreover, you can access all previously saved documents in the My documents section.

- If you don’t have an account yet, follow the instructions below.

- Locate the form you need. Confirm that it is the template you were looking for: verify its title and description, and utilize the Preview feature when available. Alternatively, use the Search field to find the required one.

- Initiate the downloading process. Click Buy Now and select the pricing plan that suits you best. Then, create an account and complete the transaction using a credit card or PayPal.

- Store the file. Select the format to obtain the Boston Massachusetts Financial Statement Short Form Instructions and modify and complete, or sign it as per your requirements.

Form popularity

FAQ

4 Types of Financial Statements That Every Business Needs Balance Sheet. Also known as a statement of financial position, or a statement of net worth, the balance sheet is one of the four important financial statements every business needs.Income Statement.Cash Flow Statement.Statement of Owner's Equity.

Financial statements are written records that convey the business activities and the financial performance of a company. Financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing, or investing purposes.

The main elements of financial statements are as follows: Assets. These are items of economic benefit that are expected to yield benefits in future periods.Liabilities. These are legally binding obligations payable to another entity or individual.Equity.Revenue.Expenses.

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program.Step 2: Fill In Your Personal Information.Step 3: Write Down Your Assets.Step 4: Write Down Your Liabilities.Step 5: Fill Out the Notes Payable to Banks and Others Section.Step 6: Fill Out the Stocks and Bonds Section.

According to the Corporate Finance Institute, the basic financial statement format for an income statement states revenues first, followed by expenses. The expenses are subtracted from the revenue to calculate the net income of the business.

A personal financial statement is a spreadsheet that details the assets and liabilities of an individual, couple, or business at a specific point in time. Typically, the spreadsheet consists of two columns, with assets listed on the left and liabilities on the right.

How To Fill Out the Personal Financial Statement Step 1: Choose The Appropriate Program.Step 2: Fill In Your Personal Information.Step 3: Write Down Your Assets.Step 4: Write Down Your Liabilities.Step 5: Fill Out the Notes Payable to Banks and Others Section.Step 6: Fill Out the Stocks and Bonds Section.

4 Types of Financial Statements That Every Business Needs Balance Sheet. Also known as a statement of financial position, or a statement of net worth, the balance sheet is one of the four important financial statements every business needs.Income Statement.Cash Flow Statement.Statement of Owner's Equity.

The balance sheet, the income statement, and the cash flow statement are the three most crucial financial statements. Together, these three statements display a company's assets, liabilities, revenues, expenses, and cash flows from financing, investing, and operating operations.

What is a Divorce Financial Statement? The divorce financial statement is a form that lists all assets and liabilities of each person involved in the divorce. Each person must fill one out their portion and submit it to the court in order to explain their financial situation to the court.