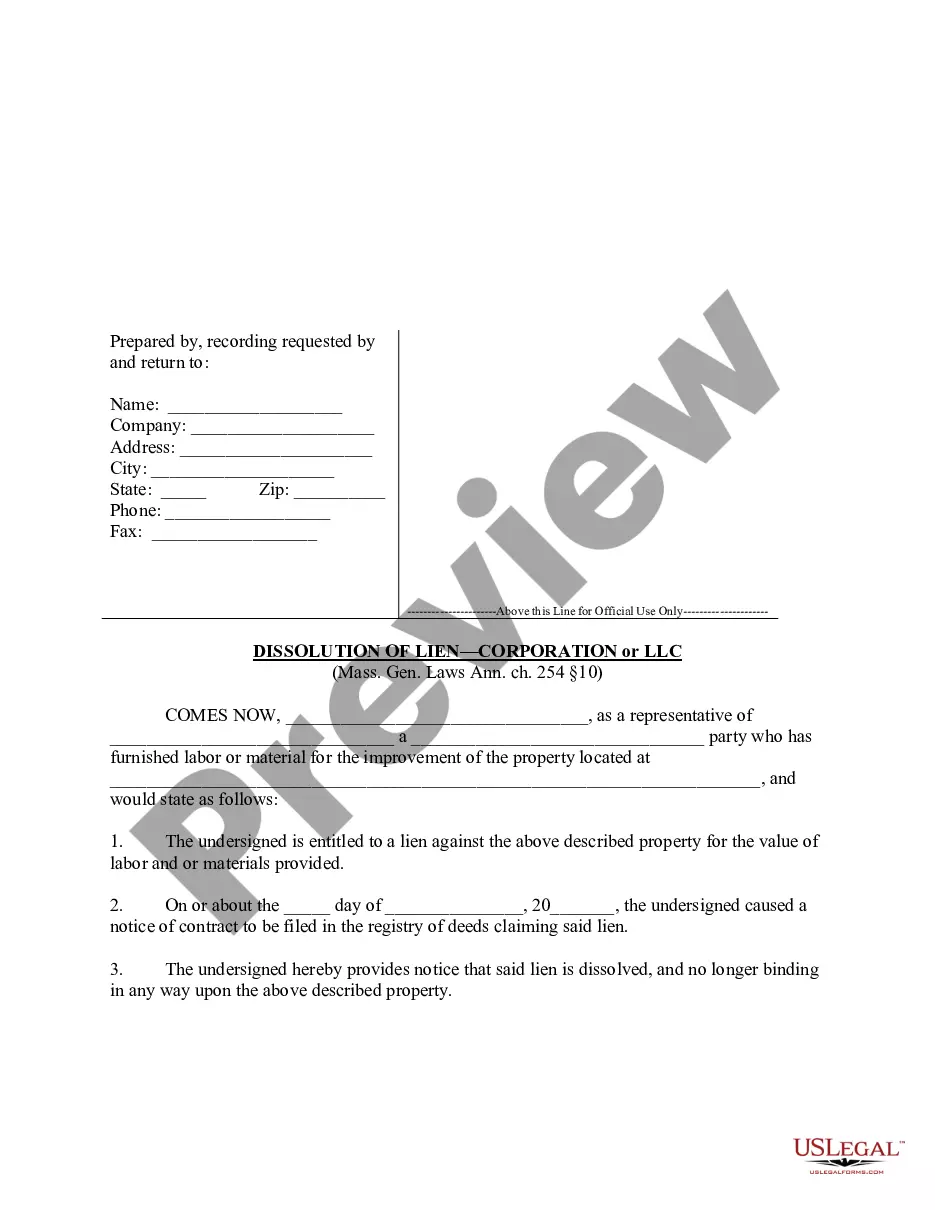

"The lien of any person may, so far as his interest is concerned, be dissolved by a notice signed by him, stating that his lien is dissolved, filed in the registry of deeds where the notice of the contract is filed under which contract the lien is claimed." Mass. Gen. Laws Ann. ch. 254 ?§10.

Lowell Massachusetts Dissolution of Lien by Corporation or LLC

Description

How to fill out Massachusetts Dissolution Of Lien By Corporation Or LLC?

Are you in search of a reliable and budget-friendly legal document provider for the Lowell Massachusetts Dissolution of Lien by Corporation or LLC.

US Legal Forms is your ideal choice.

Whether you require a straightforward agreement to establish rules for living with your partner or a collection of documents to facilitate your divorce through the legal system, we have you covered.

Our platform offers over 85,000 current legal document templates for personal and business needs. All templates we provide access to are not generic and are tailored in accordance with the regulations of distinct states and counties.

Review the form’s description (if available) to determine who and what the document is intended for.

Restart your search if the template does not suit your legal circumstances. You can now create your account. Then select the subscription plan and proceed to payment. After the transaction is completed, download the Lowell Massachusetts Dissolution of Lien by Corporation or LLC in any available format. You can revisit the website anytime and redownload the document at no additional cost. Obtaining up-to-date legal forms has never been simpler. Try US Legal Forms today, and put an end to spending hours learning about legal documents online.

- To obtain the document, you must Log In to your account, locate the necessary template, and click the Download button next to it.

- Please note that you can access your previously acquired document templates at any time from the My documents section.

- Are you unfamiliar with our website? No problem.

- You can set up an account in just a few minutes, but first, ensure to check the following.

- Verify that the Lowell Massachusetts Dissolution of Lien by Corporation or LLC complies with the laws of your state and locality.

Form popularity

FAQ

To dissolve a corporation in Massachusetts, you first need to ensure that all debts and obligations are settled. Next, you should file a Certificate of Dissolution with the Secretary of the Commonwealth. This process may require you to inform all stakeholders and distribute any remaining assets. Using US Legal Forms can simplify the Lowell Massachusetts Dissolution of Lien by Corporation or LLC by providing the necessary documents and guidance tailored to your needs.

The Massachusetts corporate dissolution form is a document required to officially dissolve a corporation within the state. This form must be filed with the Secretary of the Commonwealth and it signifies that the corporation will cease operations. Proper completion of this form is essential for ensuring a smooth Lowell Massachusetts Dissolution of Lien by Corporation or LLC. You can find the necessary resources and forms through USLegalForms to assist you in this process.

To dissolve a Massachusetts LLC, you must first ensure that all financial obligations are met. Next, file a Certificate of Dissolution with the Massachusetts Secretary of the Commonwealth. This process is crucial in managing the Lowell Massachusetts Dissolution of Lien by Corporation or LLC effectively. Utilizing platforms like USLegalForms can simplify this process, providing necessary forms and guidance.

Dissolution of the Lien A mechanic's lien may be dissolved by a simple written statement of the contractor or subcontractor recorded at the registry of deeds. Payment on a contract is often contingent on or partly in consideration for dissolving a mechanic's lien.

How long does a judgment lien last in Virginia? A judgment lien in Virginia will remain attached to the debtor's property (even if the property changes hands) for ten years.

If you are seeking to remove a lien from a vehicle, the lender will typically send the release of lien once the loan is paid in full. It can take up to thirty days to receive the title and the lien release after the final payment.

County Clerk's Office: Your local county clerk, recorder or assessor has access to the public records as well. One of these offices is typically where liens are filed. You can speak with a clerk and more often than not they will assist you and let you know if there are any liens attached to your property.

How long does a judgment lien last in New Jersey? A judgment lien in New Jersey will remain attached to the debtor's property (even if the property changes hands) for 20 years.

A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

According to the Daily Herald, the only people who can place a lien on your home are those who have done work or otherwise contributed to the value of your home. For example, contractors and suppliers could place a lien if you do not pay them. Other creditors, though, usually cannot put a lien on your property.