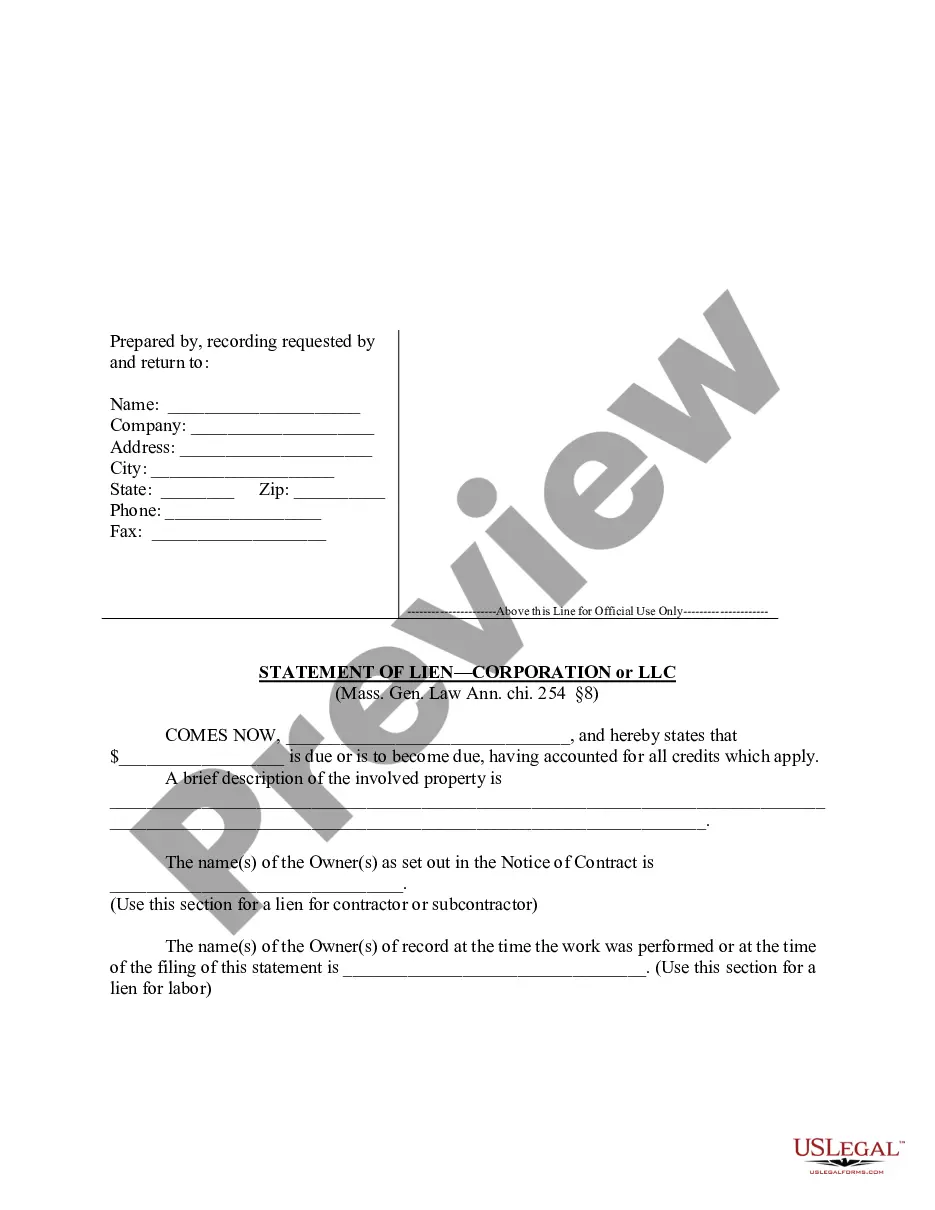

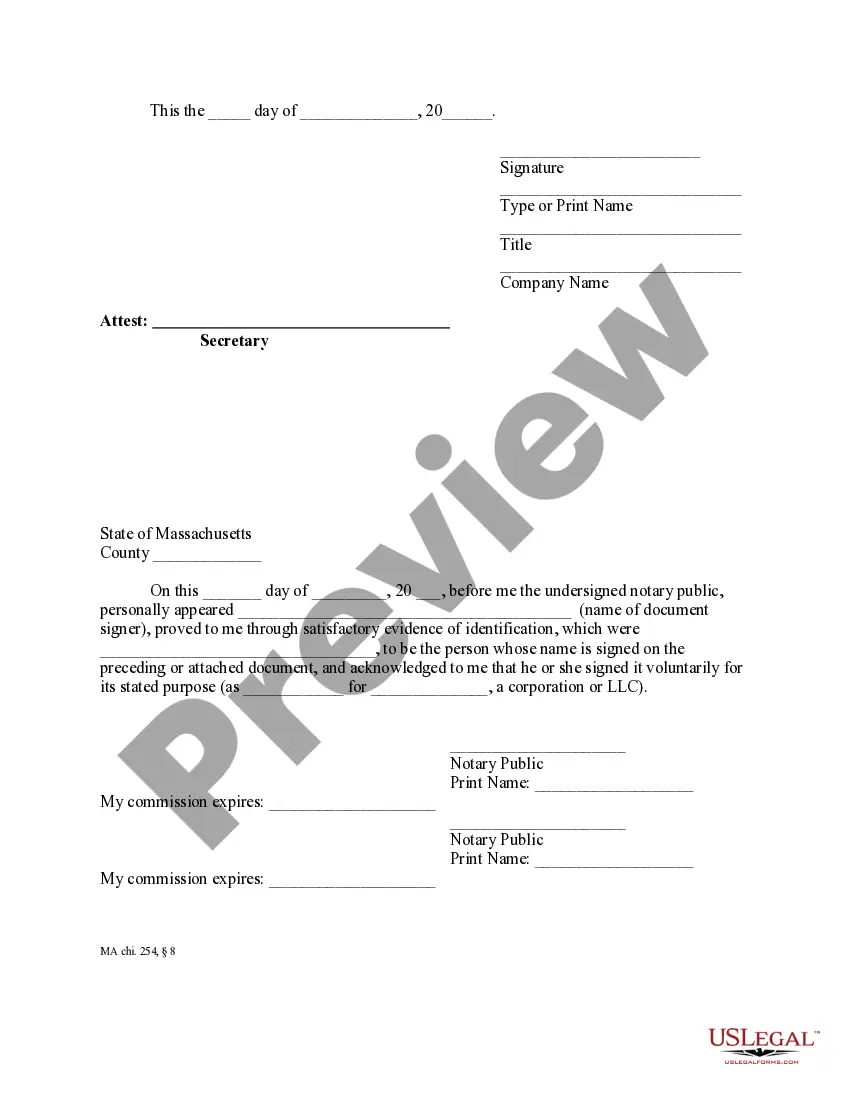

"Liens shall be dissolved unless the contractor, subcontractor, or some person claiming by, through or under them, shall, not later than the earliest of: (i) ninety days after the filing or recording of the notice of substantial completion under section two A; (ii) one hundred and twenty days after the filing or recording of the notice of termination under section two B; or (iii) one hundred and twenty days after the last day a person, entitled to enforce a lien under section two or anyone claiming by, through or under him, performed or furnished labor or material or both labor and materials or furnished rental equipment, appliances or tools, file or record in the registry of deeds in the county or district where the land lies a statement, giving a just and true account of the amount due or to become due him, with all just credits..." Mass. Gen. Laws Ann. ch. 254 §8.

Lowell Massachusetts Statement of Lien by Corporation or LLC

Description

How to fill out Massachusetts Statement Of Lien By Corporation Or LLC?

Take advantage of the US Legal Forms and gain instant access to any form sample you need.

Our helpful website, featuring numerous document templates, enables you to locate and acquire nearly any document sample you desire.

You can save, fill out, and sign the Lowell Massachusetts Statement of Lien by Corporation or LLC in just a few moments instead of spending hours online trying to find an appropriate template.

Utilizing our collection is an excellent way to enhance the security of your record submission.

If you haven't yet created an account, follow the steps outlined below.

Feel free to take advantage of our form catalog and simplify your document experience!

- Our knowledgeable attorneys frequently evaluate all the documents to ensure that the templates are applicable for a specific area and in compliance with current laws and regulations.

- How can you access the Lowell Massachusetts Statement of Lien by Corporation or LLC.

- If you already possess a subscription, simply Log In to your account. The Download button will be activated for all the documents you view.

- Additionally, you can retrieve all the previously saved documents from the My documents section.

Form popularity

FAQ

In Delaware, it usually takes just a few hours to receive a certificate of good standing if requested online, while mail requests may take longer. This quick turnaround makes Delaware a favorable state for business registration. Ensure you have all necessary information ready to expedite the process. If your entity operates in Massachusetts, remember that you can easily utilize services like uslegalforms to obtain the necessary documents, including certificates of good standing.

In Massachusetts, obtaining a certificate of good standing typically takes about 5 to 7 business days, depending on the processing workload. For those who need faster access, there are expedited services available. This certificate is crucial for businesses looking to maintain compliance and credibility, especially when dealing with legal filings like a Lowell Massachusetts Statement of Lien by Corporation or LLC.

Typically, it takes about 5 to 7 business days to receive a certificate of good standing from the Commonwealth of Massachusetts. However, the processing time may vary based on the volume of requests. If you need this certificate urgently, consider using online services, as they may offer expedited options. This document is often necessary when filing legal documents, such as a Lowell Massachusetts Statement of Lien by Corporation or LLC.

In Massachusetts, a mechanics lien statement of account outlines the amounts owed for labor or materials provided for a construction project. This document is crucial for contractors and subcontractors to ensure they receive payment. It must detail the services rendered, the total amount due, and must be filed properly to secure a lien on the property. Understanding this process can aid you in effectively managing your financial interests.

A certificate of good standing in Massachusetts typically includes the company name, date of incorporation, and confirmation that the entity is in good standing with the state. This document may also state that the corporation or LLC is current with all tax obligations and has filed all necessary reports. Obtaining this certificate is essential for businesses seeking to establish credibility in dealings, especially when filing a Lowell Massachusetts Statement of Lien by Corporation or LLC.

To file a lien on a property in Massachusetts, you need to prepare a Lowell Massachusetts Statement of Lien by Corporation or LLC. Start by ensuring that you have all necessary information about the property and the debt. After preparing the document, you must file it in the appropriate registry of deeds for the property location. It is important to follow specific regulations to ensure the lien is valid.

Yes, it is possible for someone to place a lien on your house without your immediate knowledge. Unpaid debts or legal judgments can lead to a Lowell Massachusetts Statement of Lien by Corporation or LLC being filed against your property. Staying proactive by regularly checking your property records can help you identify any liens early. Seeking legal advice can guide you through the implications of this situation.

You can look up liens on a business by accessing your state's department of revenue or using online public record databases. For a Lowell Massachusetts Statement of Lien by Corporation or LLC, ensure you check county-specific records. Regularly monitoring lien activity can help protect your business and prevent unwelcome surprises. Platforms like US Legal Forms might offer additional tools for this process.

To remove a lien from a business, you first must settle the debt associated with the lien. After payment, the creditor should file a release of the Lowell Massachusetts Statement of Lien by Corporation or LLC with the relevant authorities. Documenting this process is vital for your records. Seeking assistance from legal professionals can simplify the removal process.

You can discover who placed a lien on your business by searching public records at your local county clerk or court office. Additionally, online databases may provide access to lien information for a Lowell Massachusetts Statement of Lien by Corporation or LLC. Maintaining awareness of your business’s financial obligations is crucial. Utilizing services like US Legal Forms can streamline this process.