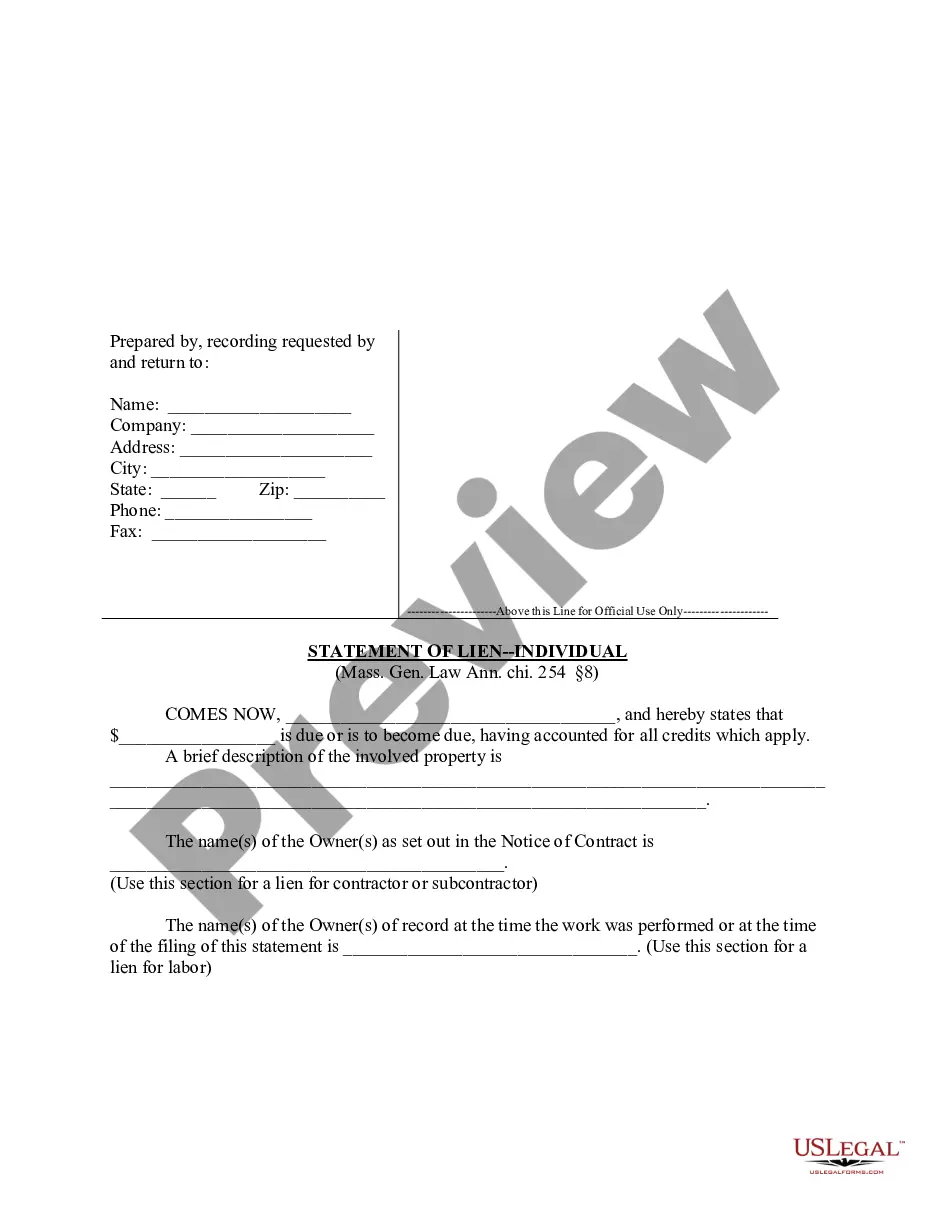

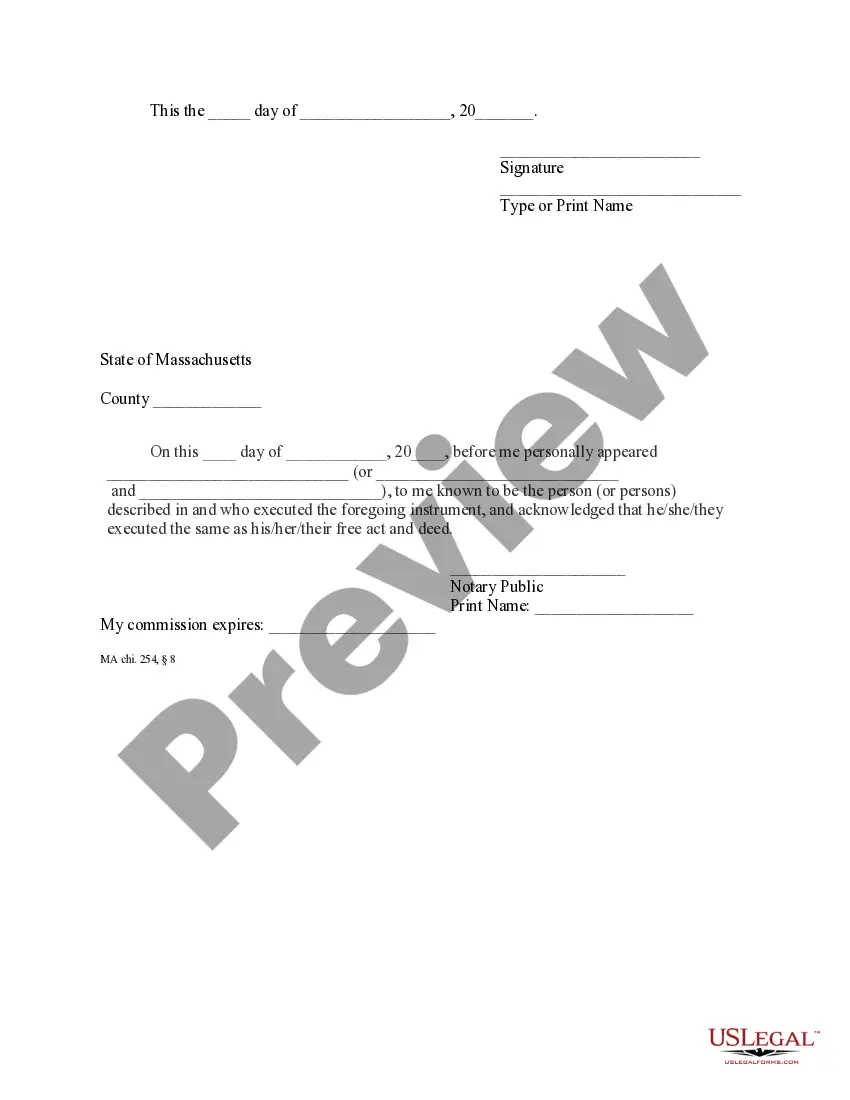

"Liens... shall be dissolved unless the contractor, subcontractor, or some person claiming by, through or under them, shall, not later than the earliest of: (i) ninety days after the filing or recording of the notice of substantial completion under section two A; (ii) one hundred and twenty days after the filing or recording of the notice of termination under section two B; or (iii) one hundred and twenty days after the last day a person, entitled to enforce a lien under section two or anyone claiming by, through or under him, performed or furnished labor or material or both labor and materials or furnished rental equipment, appliances or tools, file or record in the registry of deeds in the county or district where the land lies a statement, giving a just and true account of the amount due or to become due him, with all just credits..." Mass. Gen. Laws Ann. ch. 254 §8.

Boston Massachusetts Statement of Lien by Individual

Description

How to fill out Massachusetts Statement Of Lien By Individual?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms archive.

It’s a digital repository of over 85,000 legal documents catering to both personal and professional requirements and various real-life situations.

All the files are systematically arranged by application area and jurisdictional domains, making the search for the Boston Massachusetts Statement of Lien by Individual as straightforward as one, two, three.

Maintaining documents organized and in accordance with legal standards is crucial. Take advantage of the US Legal Forms library to consistently have essential document templates readily available for any requirements!

- Verify the Preview mode and form details.

- Ensure you’ve selected the correct one that aligns with your needs and fully complies with your regional jurisdiction criteria.

- Seek another template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

Real property in Massachusetts, including time-shares, is subject to a lien for estate taxes upon the death of anyone who has a legal interest in the property. The lien applies even if the property was owned under a joint tenancy or as husband and wife.

NOTES: The Balance, an online magazine for investors, said if you do it right, Florida is a great state for tax lien investing. ?For example, Florida's maximum interest rate is set at 18% while Arizona's maximum rate tops out at 16%.

You can sell your property with a lien attached as long as the buyer is willing to pay off the lien at closing or the proceeds of the sale satisfy the lien before you receive your portion. Many buyers don't like the thought of buying a property with a lien attached, but you can find cash buyers who won't hesitate.

A judgment lien in Massachusetts will remain attached to the debtor's property (even if the property changes hands) for 20 years (for liens on real estate) or 30 days (for liens on personal property).

In intermediary states, the borrower keeps the title with the expressed agreement that the lender may take back the title if the borrower defaults on the loan. The intermediary states are: Alabama, Hawaii, Maryland, Massachusetts, Michigan, Minnesota, Montana, New Hampshire, Oklahoma, Rhode Island, and Vermont.

A state tax lien is the government's legal claim against your property when you don't pay your tax debt in full. Your property includes real estate, personal property and other financial assets.

County Clerk's Office: Your local county clerk, recorder or assessor has access to the public records as well. One of these offices is typically where liens are filed. You can speak with a clerk and more often than not they will assist you and let you know if there are any liens attached to your property.

Within the Commonwealth of Massachusetts, a lien is recorded in the local Registry of Deeds office or Secretary of State's office.