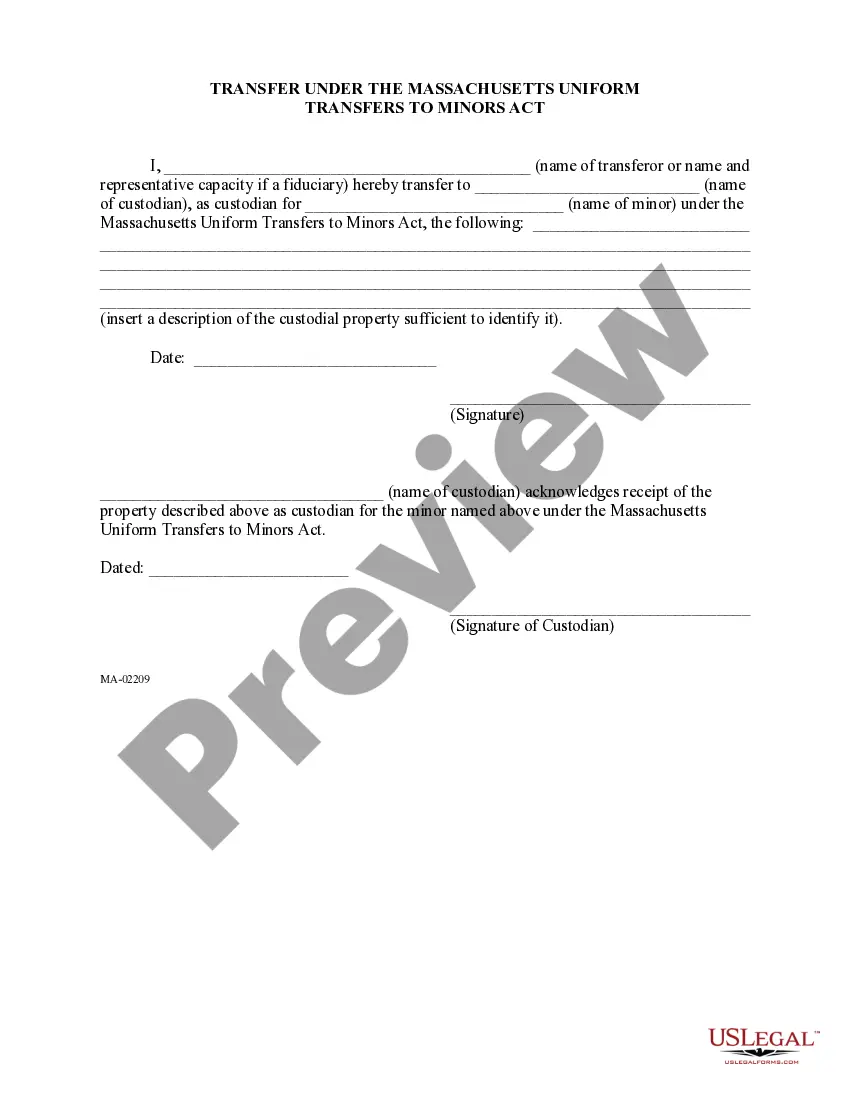

Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act

Description

How to fill out Transfer Under The Massachusetts Uniform Transfers To Minors Act?

If you have previously engaged our service, Log In to your account and retrieve the Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act on your device by selecting the Download button. Confirm that your subscription is active. If it is not, renew it based on your billing plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your file.

You have continuous access to all documents you've purchased: they can be found in your profile under the My documents section whenever you wish to reuse them. Utilize the US Legal Forms service to easily locate and save any template for your personal or business requirements!

- Ensure you've identified the correct document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your requirements. If it does not suit you, use the Search tab above to locate the suitable one.

- Purchase the template. Select the Buy Now button and choose either a monthly or annual subscription plan.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act. Choose the file format for your document and save it on your device.

- Finalize your sample. Print it or utilize professional online editors to complete and sign it digitally.

Form popularity

FAQ

The Uniform Transfers to Minors Act (UTMA) allows adults to transfer assets to minors while maintaining control until the minor reaches adulthood. Under the Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act, custodial accounts can hold various types of assets. This act serves as a legal framework to manage and protect these assets until the child becomes mature enough to handle them responsibly. Understanding UTMA can help families make informed financial decisions for their children.

While a UTMA account offers benefits, there are also disadvantages to consider. One major concern is that once the child reaches the appropriate age, they gain complete control of the funds and can use them as they see fit. Additionally, these accounts can affect the child’s financial aid eligibility for college. Therefore, it's essential to weigh these factors when planning a Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act.

When a child reaches the age of 21 under the Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act, they gain full control of the UTMA account. At this point, the funds are officially transferred to the child, allowing them to access the assets without any restrictions. For parents and guardians, it’s important to communicate the implications of this transition with the child. Preparing them can ensure they handle their new financial responsibilities wisely.

In Massachusetts, a Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act typically transfers to the minor when they reach the age of 18. However, custodians often manage the account until the child turns this age. This means that until the minor reaches 18, a responsible adult oversees the assets. It’s essential to plan accordingly, as this transition may impact how the funds are used.

The purpose of an UTMA is to provide a straightforward way for adults to transfer assets to minors, promoting financial education and responsibility. Additionally, it serves to protect assets until the minor is old enough to manage their finances effectively. Through a Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act, guardians can invest in a minor's future, whether for education or other financial needs. Ultimately, UTMA aims to empower minors while ensuring a secure pathway for asset management and access.

Once a minor reaches the age of 21, the funds within an UTMA account are transferred to the individual, providing them with complete access to their assets. This transition can be significant, as it often marks a point where the individual must now make responsible choices regarding their finances. The Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act facilitates this process, allowing for a smooth transition of assets. It is essential for guardians to consider how the minor will handle these resources once they become adults.

The Uniform Transfers to Minors Act, or UTMA, enables adults to transfer assets to minors without the need for a formal trust. The intention is to simplify the process of transferring wealth to children, making it easier for them to access these assets once they reach the age of majority. A Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act allows guardians to manage financial gifts on behalf of minors in a safe and structured manner. This act ultimately aims to provide financial security and growth opportunities for the minor.

Transferring an UTMA account to another child is generally not allowed under the Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act. The assets are designated for the specific beneficiary, and they cannot be reassigned to a different minor. However, you may explore alternative financial strategies if you want to provide for another child. For guidance, consider consulting financial advisors or legal experts.

Transferring ownership of a custodial account involves notifying the financial institution holding the account. You will likely need to provide the child’s identification and complete necessary paperwork. By adhering to the Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act, you can facilitate a clear ownership transfer. Ensuring compliance with legal requirements can help avoid delays and complications.

To transfer a UTMA account to the child, you will need to inform the financial institution managing the account. This process typically requires filling out a form or providing documentation that proves the child has reached the required age. By following the guidelines under the Middlesex Transfer Under The Massachusetts Uniform Transfers to Minors Act, you ensure a smooth transfer of control. It’s often advisable to consult with legal professionals to make sure all requirements are met.