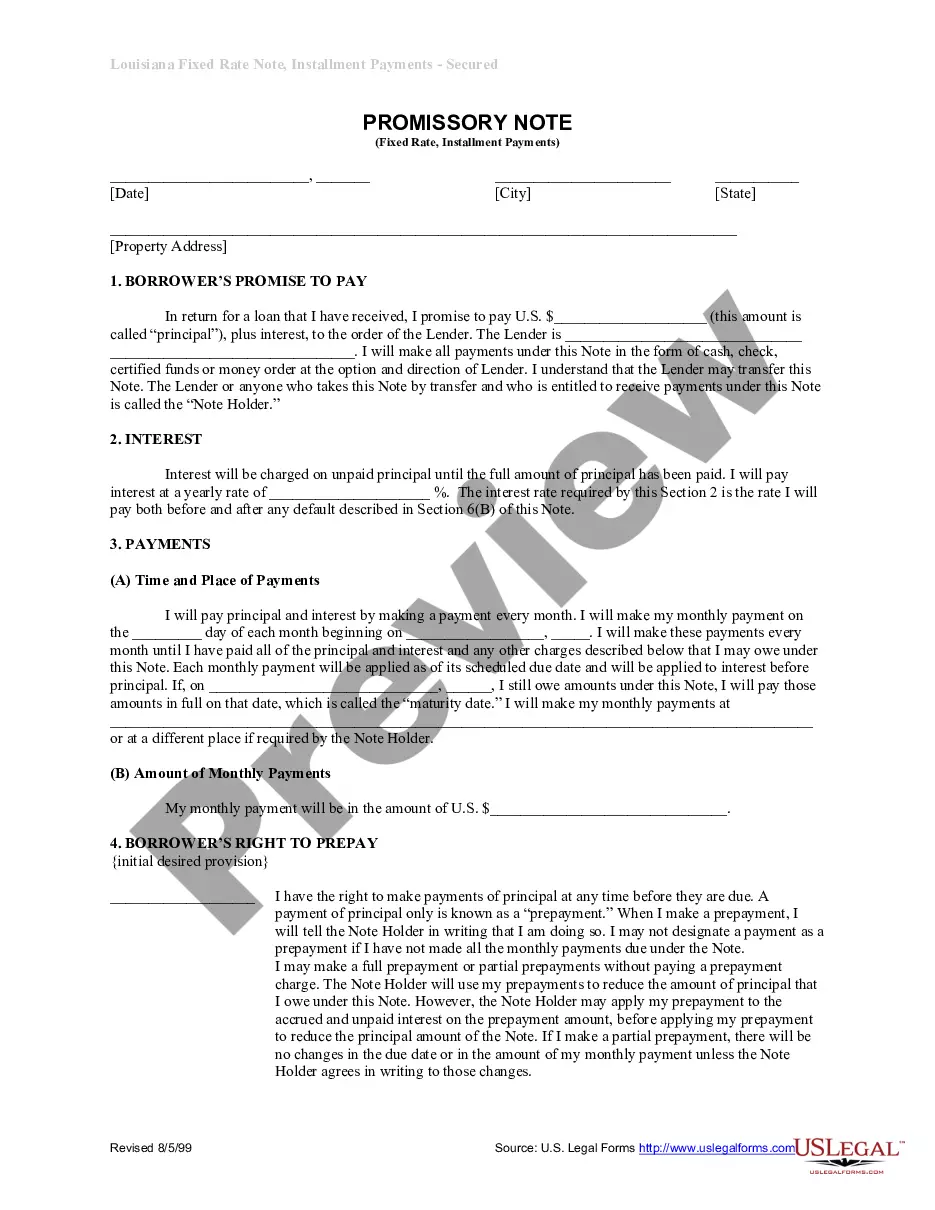

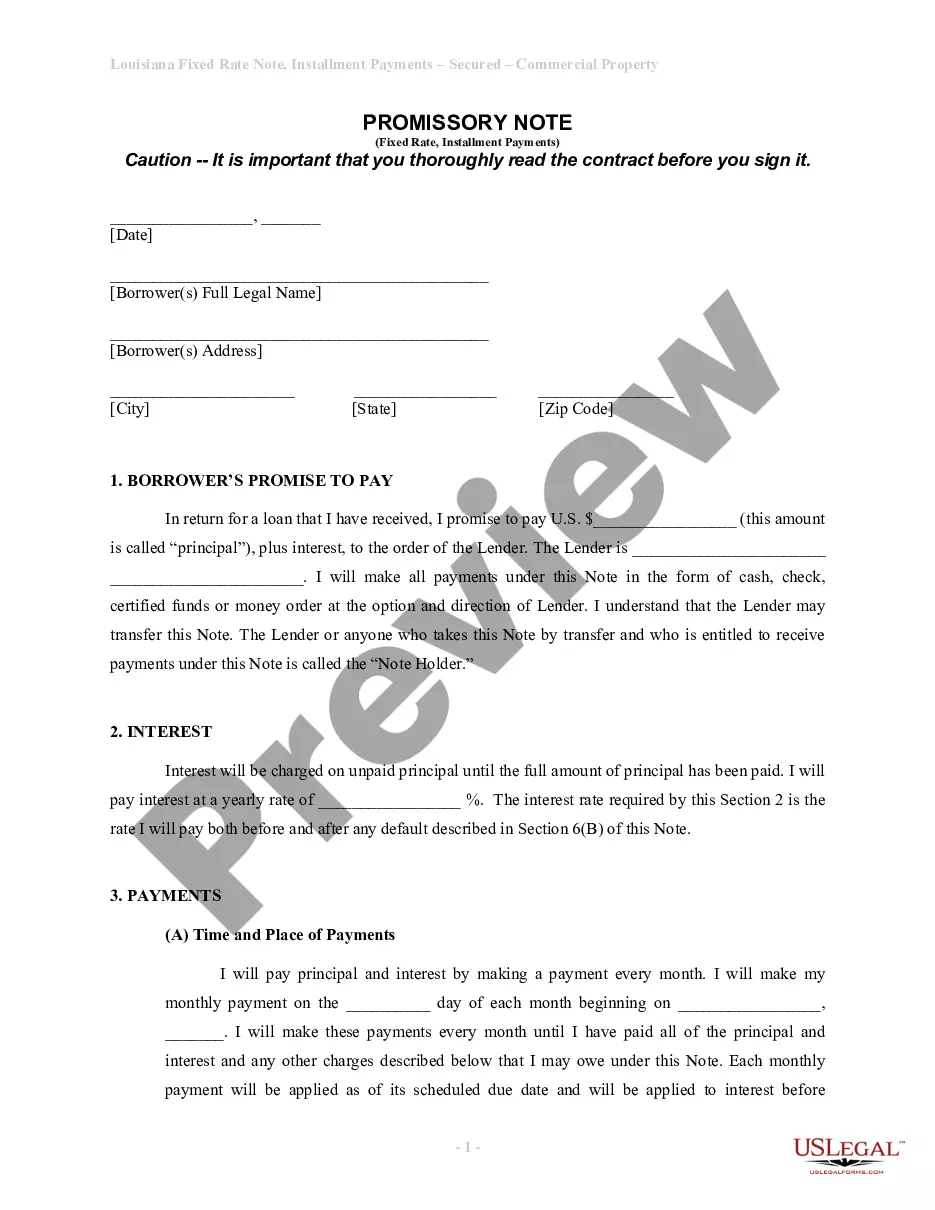

Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Louisiana Installments Fixed Rate Promissory Note Secured By Personal Property?

Utilize the US Legal Forms to gain immediate access to any form template you may require.

Our helpful website featuring a large collection of documents enables you to locate and obtain nearly any document sample you need.

You can export, fill out, and sign the Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property in a few minutes instead of spending hours searching online for the appropriate template.

Using our directory is an excellent approach to enhance the security of your form submission.

Open the page with the template you need. Ensure that it is the template you were looking for: verify its title and description, and use the Preview option when it is accessible. Otherwise, utilize the Search bar to find the required one.

Initiate the downloading process. Click Buy Now and select the pricing plan that suits you. After that, create an account and complete your order using a credit card or PayPal.

- Our expert attorneys routinely review all documents to ensure that the templates are suitable for a specific region and comply with current laws and regulations.

- How can you acquire the Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property.

- If you have a subscription, simply Log In to your account. The Download option will be available on all the samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the instructions below.

Form popularity

FAQ

A promissory note is secured through collateral, which can include personal property. For example, with a Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property, you pledge specific assets as a guarantee for repayment. If the borrower defaults, the lender can claim the collateral to recover their losses. This type of security enhances trust between parties and provides a clear pathway for enforcement.

Yes, a promissory note can be secured by personal property, which provides the lender with more security. In the case of a Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property, collateral might include real estate, vehicles, or other valuable assets. This arrangement offers protection in case the borrower defaults on payments. For guidance on drafting such a note, explore the resources available on the US Legal Forms platform.

A promissory note in Louisiana does not typically need to be notarized to be legally binding. However, having your Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property notarized can provide an additional layer of security and help validate the document. Notarization might also be required by lenders or for certain types of agreements. To make the process easier, you can find templates on the US Legal Forms platform.

In Louisiana, the statute of limitations for enforcing a promissory note is generally 10 years. This means you have a decade to take legal action if the borrower defaults on the payment. It's crucial to keep this timeline in mind, especially for a Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property. To ensure you are protected, consider consulting a legal professional or using a reliable platform like US Legal Forms.

Notes payable can be either secured or unsecured, depending on whether they are backed by collateral. A Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property is an example of a secured note, offering extra security to the lender through the backing of the personal property. In contrast, unsecured notes do not have collateral and carry a higher risk for lenders. With the help of platforms like uslegalforms, you can identify the best fit for your borrowing needs.

Typically, the borrower guarantees a promissory note by agreeing to repay the specified amount plus any interest. In a Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property, a co-signer may also guarantee repayment, thus adding an extra layer of security for the lender. This means that if the primary borrower fails to make payments, the co-signer will be responsible. For clarity and assurance in your agreements, consider using uslegalforms to draft your contracts.

Promissory notes can be secured by various types of collateral, including vehicles, real estate, and equipment. In the context of a Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property, any personal property that holds value can serve as collateral. This arrangement helps assure the lender that they can recover their investment if needed. Utilizing services like uslegalforms helps ensure that these agreements are structured correctly.

An on demand promissory note is a financial instrument where the borrower agrees to repay the lender upon request. In the context of a Shreveport Louisiana Installments Fixed Rate Promissory Note Secured by Personal Property, this type of note allows for flexibility in repayment, as the lender can demand payment at any time. Such notes are often used in personal loans and informal agreements.