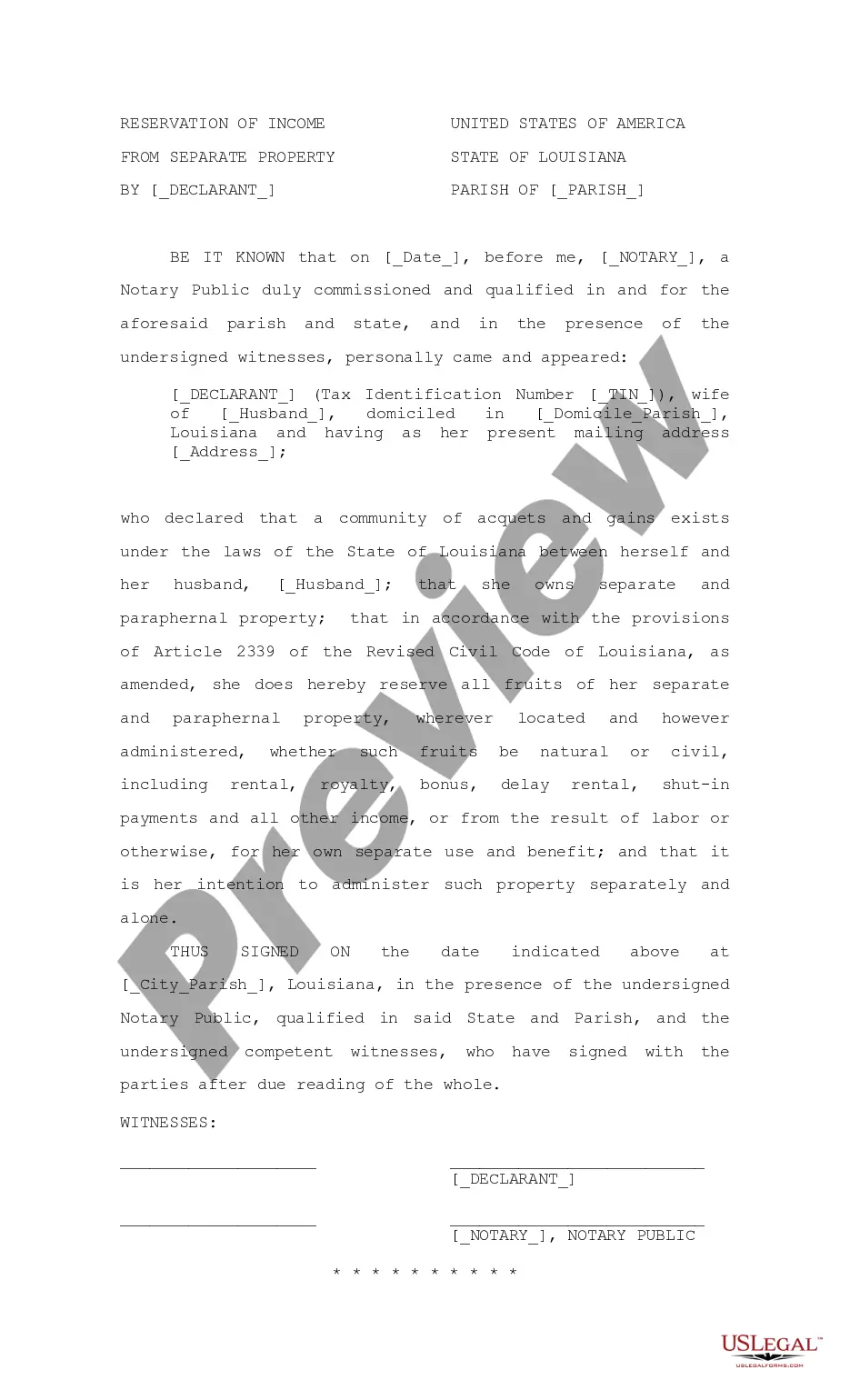

Shreveport Louisiana Reservation of Income from Separate Property

Description

How to fill out Louisiana Reservation Of Income From Separate Property?

Utilize the US Legal Forms and gain immediate access to any form template you need. Our helpful site with a vast array of templates streamlines the process of locating and acquiring almost any document sample you require.

You can download, fill out, and validate the Shreveport Louisiana Reservation of Income from Separate Property in just a few minutes instead of spending hours searching online for the suitable template.

Utilizing our catalog is a fantastic method to enhance the security of your document submission. Our expert legal advisors consistently review all documents to verify that the templates are pertinent to a specific area and adhere to current laws and regulations.

How do you acquire the Shreveport Louisiana Reservation of Income from Separate Property? If you have a subscription, simply sign in to your account. The Download feature will be available on all the samples you view. Additionally, you can access all previously saved documents in the My documents section.

US Legal Forms is among the largest and most reliable document libraries online. We are always eager to assist you with any legal matter, even if it merely involves downloading the Shreveport Louisiana Reservation of Income from Separate Property.

Feel free to fully utilize our form catalog and make your document experience as easy as possible!

- Open the page with the form you need. Confirm that it is the form you were searching for: review its title and description, and utilize the Preview option if available. Otherwise, apply the Search field to find the required document.

- Begin the downloading process. Choose Buy Now and select the pricing plan that best suits your needs. Then, create an account and complete your purchase using a credit card or PayPal.

- Download the document. Select the format to obtain the Shreveport Louisiana Reservation of Income from Separate Property and modify and complete, or sign it as necessary.

Form popularity

FAQ

In Louisiana, inherited property is typically considered separate property, distinguishing it from community property. This means that when someone inherits assets, they retain full control over them. The concept of the Shreveport Louisiana Reservation of Income from Separate Property plays a vital role in estate planning, ensuring that one's intentions are clear regarding inherited assets. For assistance, check out uslegalforms for tailored solutions.

If a person dies without a will in Louisiana, the state's intestacy laws govern property distribution. Generally, the estate will pass to the spouse and children first, followed by parents and siblings. The Shreveport Louisiana Reservation of Income from Separate Property is crucial here, as it defines how separate assets are treated. To navigate these complexities effectively, uslegalforms offers valuable resources.

Heirs at law in Louisiana primarily consist of a decedent's surviving spouse, children, parents, and siblings. If no direct heirs exist, more distant relatives may claim inheritance. Understanding the Shreveport Louisiana Reservation of Income from Separate Property can help identify how these relationships affect property ownership and distribution. For detailed guidance, consider consulting uslegalforms.

In Louisiana, the first in line for inheritance generally includes the deceased's spouse and children. If there are no children, parents or siblings may inherit next. It's important to consider the Shreveport Louisiana Reservation of Income from Separate Property when dealing with your estate plan. This allows for clarity about how separate property may be recognized and passed on.

In Louisiana, you generally are not responsible for your spouse's debts incurred prior to marriage. However, debts acquired during the marriage can be subject to joint responsibility, depending on how they were acquired. Understanding the implications of the Shreveport Louisiana Reservation of Income from Separate Property can provide further insight into your financial rights. Ensuring clarity on these matters can reduce stress and help with financial decisions.

In Louisiana, separate property includes assets owned before the marriage, inheritances, and gifts given specifically to one spouse. It also covers profits from these assets if they remain distinct from marital funds. Knowing how the Shreveport Louisiana Reservation of Income from Separate Property categorizes these assets provides significant advantages in asset protection. Clear classification of separate property can help in disputes and financial planning.

The separate property law in Louisiana outlines that certain assets remain owned by one spouse, not subject to division in case of divorce. This includes property acquired before marriage or given as a gift or inheritance. The Shreveport Louisiana Reservation of Income from Separate Property allows income generated from these separate assets to stay with the original owner. This law helps individuals safeguard their financial interests.

Separate property in Louisiana is typically acquired through inheritance, gifts, or property bought with separate funds. If one spouse receives an inheritance, it remains their exclusive property under Louisiana law. Additionally, understanding how the Shreveport Louisiana Reservation of Income from Separate Property applies helps in managing any gains from separate assets effectively. This knowledge ensures clarity in asset ownership.

A Judgment of separation of property in Louisiana is a legal ruling that divides the assets and debts of a marital couple. This judgment clarifies which property belongs to each spouse. It emphasizes the principles of the Shreveport Louisiana Reservation of Income from Separate Property, allowing the individual to retain income from their own separate assets. Understanding this judgment can help protect your financial future.

In Louisiana, income generated from separate property typically remains separate. However, if both spouses contribute to generating income from it, some income may be classified as community property. Understanding the Shreveport Louisiana Reservation of Income from Separate Property aids in financial planning for individuals. It provides guidance on how income from separate assets is treated under Louisiana law.