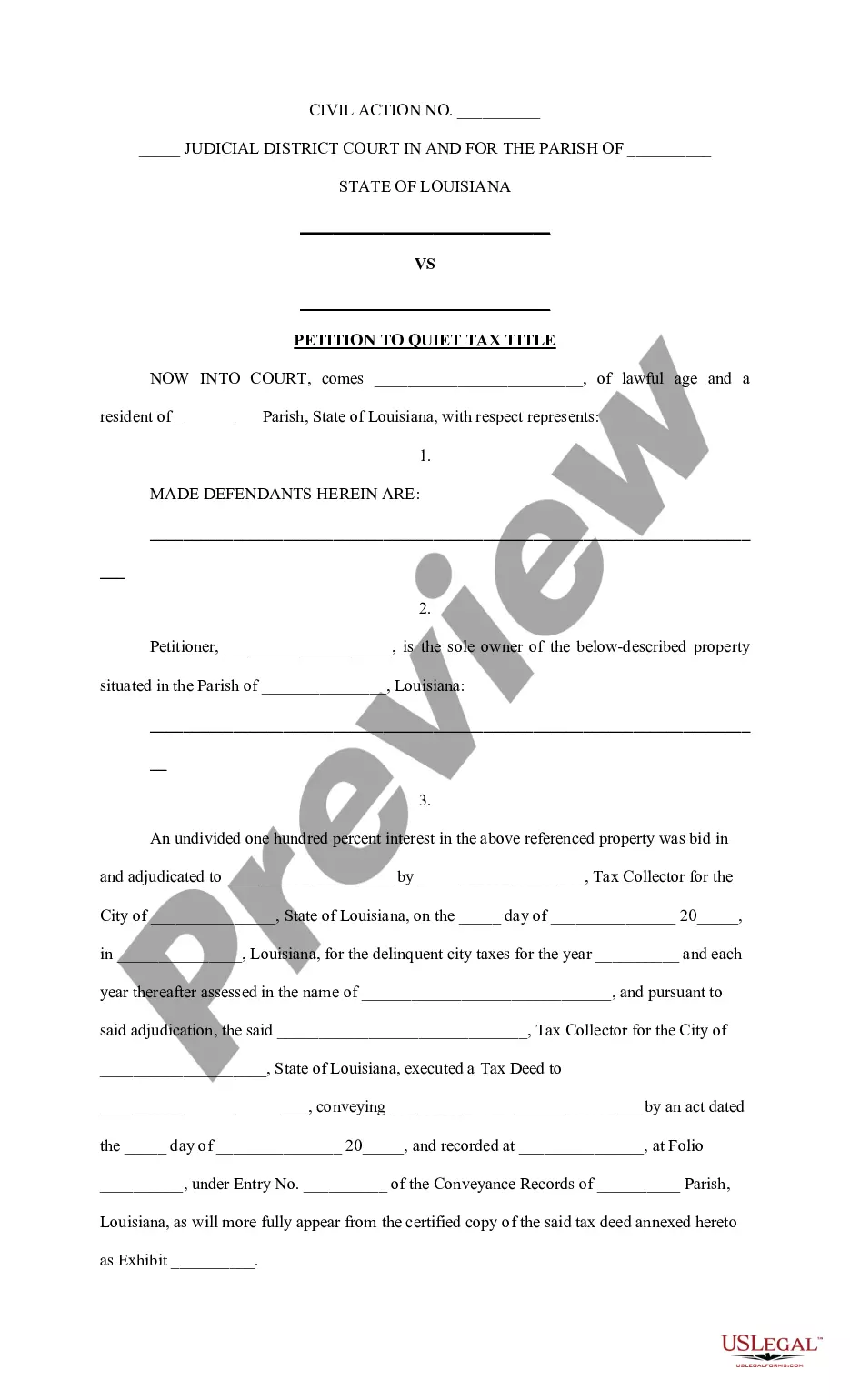

Baton Rouge Louisiana Petition to Quiet Tax Title

Description

How to fill out Louisiana Petition To Quiet Tax Title?

Are you seeking a trustworthy and affordable legal forms provider to purchase the Baton Rouge Louisiana Petition to Quiet Tax Title? US Legal Forms is your ultimate resource.

Whether you need a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we have you covered. Our platform offers over 85,000 current legal document templates for personal and business use. Every template we provide is not generic and tailored according to the specifications of particular state and county.

To obtain the document, you must sign in to your account, locate the necessary form, and click the Download button next to it. Please keep in mind that you can download your previously acquired document templates at any time from the My documents section.

Is this your first time visiting our platform? No problem. You can set up an account in just a few minutes, but before that, ensure to do the following.

Now you can register for your account. Next, choose the subscription plan and proceed to payment. After the payment is completed, download the Baton Rouge Louisiana Petition to Quiet Tax Title in any available format. You can return to the website at any time and re-download the document at no additional charge.

Obtaining current legal forms has never been simpler. Experience US Legal Forms today and say goodbye to spending hours researching legal documents online for good.

- Verify whether the Baton Rouge Louisiana Petition to Quiet Tax Title meets the regulations of your state and locality.

- Review the form's description (if available) to understand who and what the document is designed for.

- Restart your search if the form does not fit your specific situation.

Form popularity

FAQ

In Louisiana, property taxes are assessed annually based on the property's value. The local tax assessor calculates the assessed value, usually at 10% of the property's market value for residential properties. Property owners are responsible for paying these taxes, which help fund local services like schools and infrastructure. If you face issues related to tax title disputes, consider using a Baton Rouge Louisiana Petition to Quiet Tax Title to resolve any uncertainties regarding your property ownership.

The 14-67 law in Louisiana refers to the legislation governing the criminal implications of theft of property, including tax titles. Understanding this law is essential for anyone considering a Baton Rouge Louisiana Petition to Quiet Tax Title, as it helps clarify the legal framework around property disputes. This law can impact the process of resolving ownership issues, highlighting the importance of legal advice. Knowledge of the 14-67 law can ensure that property owners navigate potential challenges effectively.

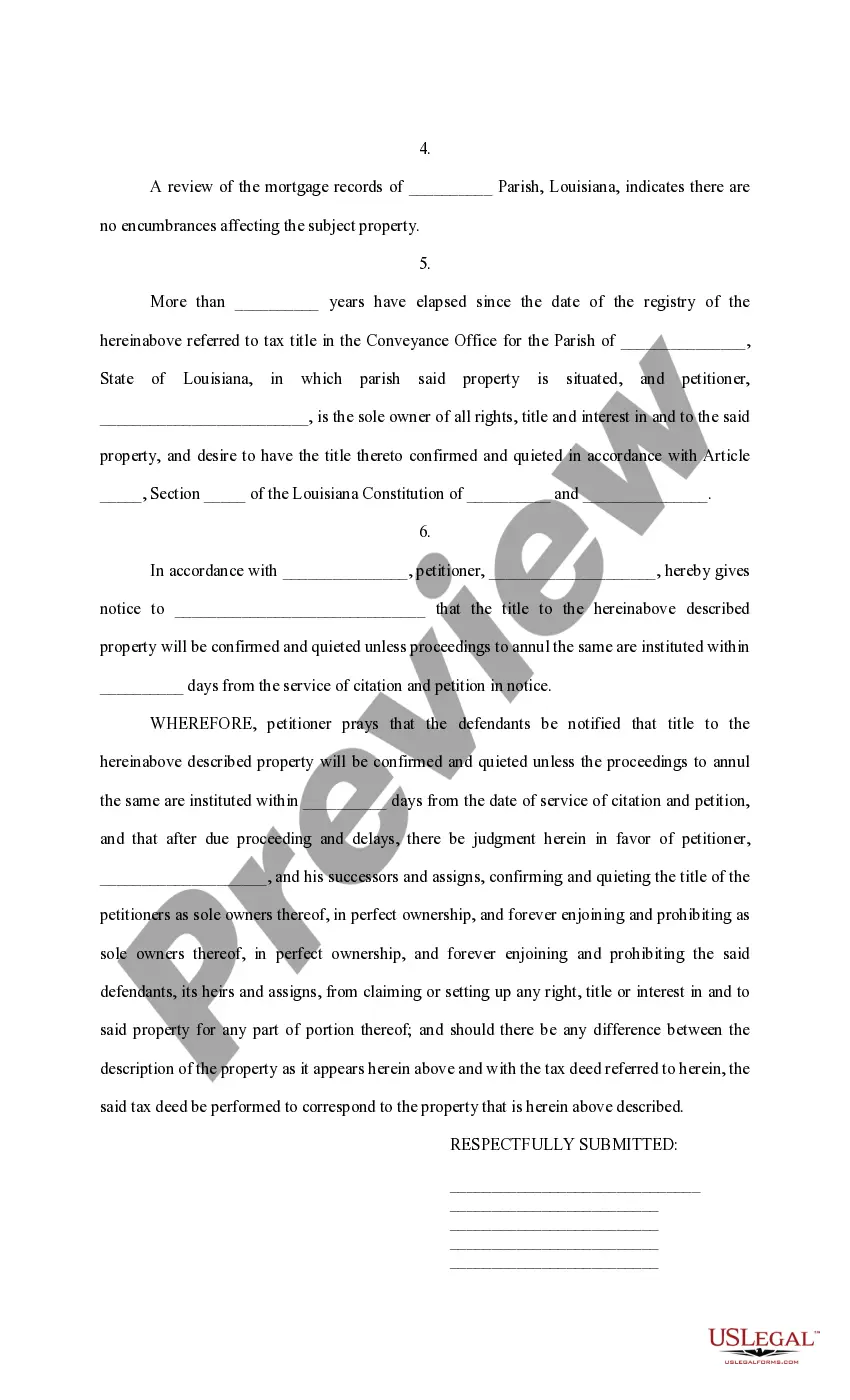

A quiet title in Louisiana is a legal action used to establish ownership of property and remove any claims against it. This process is especially valuable for those looking to clear any uncertainties regarding property titles, such as through a Baton Rouge Louisiana Petition to Quiet Tax Title. By filing this petition, property owners can address potential disputes or liens that could affect their rights to the property. Ultimately, a successful quiet title action provides peace of mind about your property rights.

Property taxes in Louisiana are based on the assessed value of your property and vary by parish. Local tax assessors determine property values, which then influence the amount you owe each year. Understanding your obligations is essential, especially if you plan on pursuing a Baton Rouge Louisiana Petition to Quiet Tax Title, as resolving any tax issues can enhance your property ownership clarity. Staying informed about tax regulations can help you manage your property investment wisely.

In Louisiana, property inheritance follows the state's civil law system, which is distinct from common law. Typically, a spouse and children are the primary inheritors, but descendants and other relatives may also be entitled depending on the situation. If disputes arise regarding property ownership, a Baton Rouge Louisiana Petition to Quiet Tax Title can help clarify the rightful heirs. Consulting with legal professionals can simplify the inheritance process.

In Louisiana, seniors may qualify for a property tax exemption starting at age 65. To benefit from this exemption, seniors must apply through their local tax assessor's office. Understanding these regulations can be critical, especially when considering a Baton Rouge Louisiana Petition to Quiet Tax Title, as clear title can impact eligibility for tax exemptions. Always check with local authorities for the most current information.

To quiet title in Louisiana, you typically need to file a lawsuit in the appropriate court. This process involves demonstrating your claim to the property and addressing any challenges to your ownership. Utilizing a Baton Rouge Louisiana Petition to Quiet Tax Title simplifies this procedure, as it effectively addresses issues related to unclear titles or outstanding claims. Working with professionals can provide guidance throughout this process.

In Louisiana, paying property taxes does not automatically grant ownership of the property. Ownership is established through legal titles and deeds. However, consistent payment of property taxes can strengthen your claim to the property, especially when combined with a Baton Rouge Louisiana Petition to Quiet Tax Title. This legal process helps clarify ownership and resolve disputes over property titles.

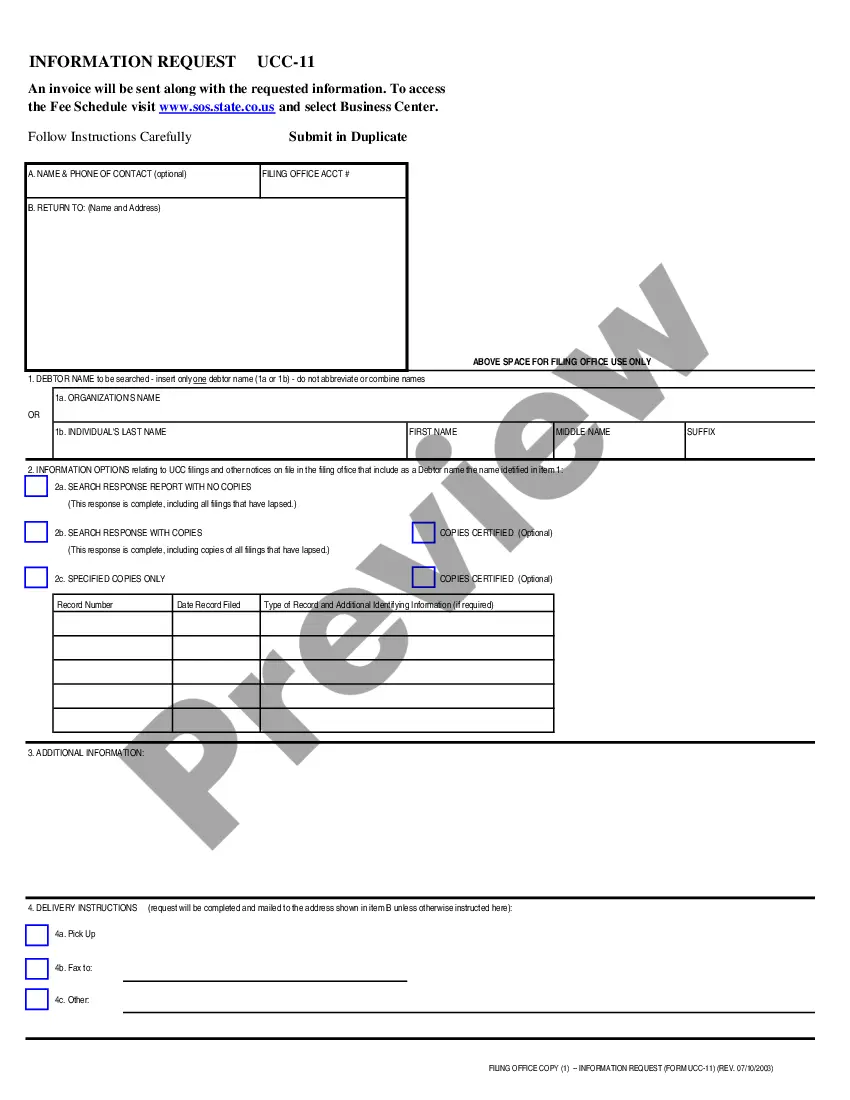

To file a formal petition with the Louisiana Board of Tax Appeals regarding a Baton Rouge Louisiana Petition to Quiet Tax Title, you must begin by completing the appropriate petition form. Next, you should submit your petition along with any required documentation to the Board, ensuring you adhere to all deadlines. It is crucial to provide clear details about your case and cite any relevant tax law. If you need assistance, consider using platforms like US Legal Forms, which offer templates and guidance for filing.