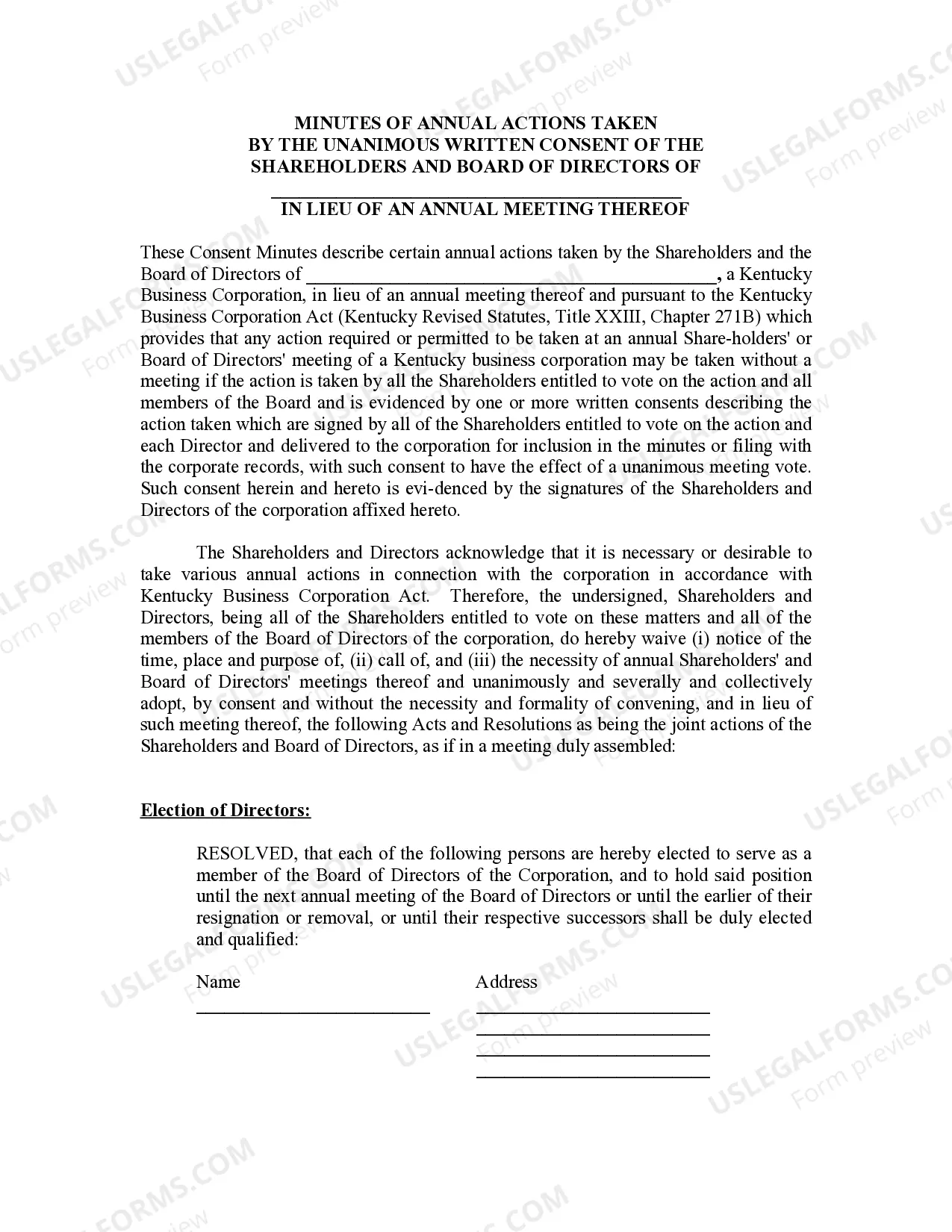

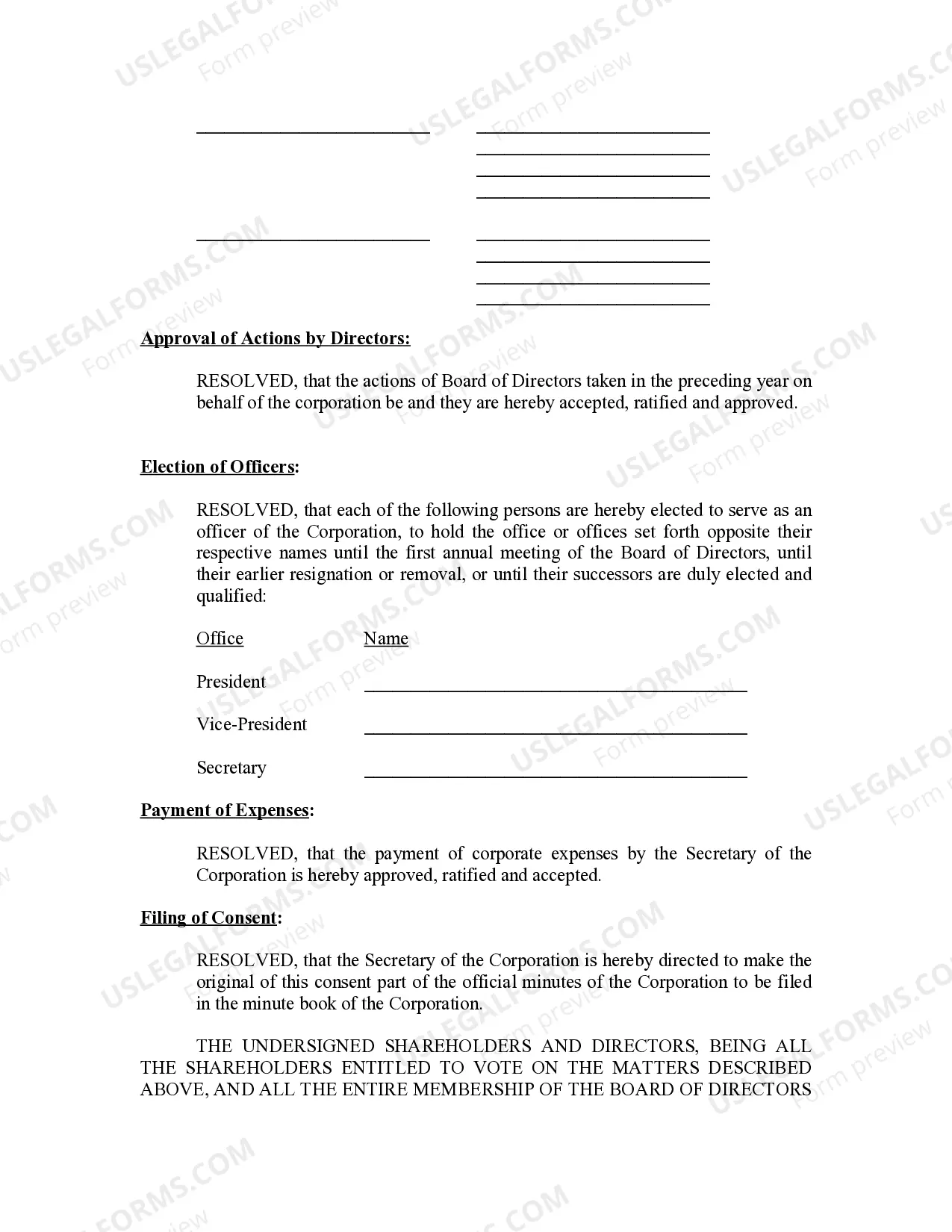

The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Louisville Kentucky Annual Minutes

Description

How to fill out Kentucky Annual Minutes?

Utilize the US Legal Forms and gain immediate access to any template you require. Our user-friendly website with a vast array of documents enables you to locate and acquire nearly any document sample you need.

You can download, complete, and sign the Louisville Annual Minutes - Kentucky in just a few minutes instead of spending hours online searching for the correct template.

Using our collection is an excellent way to enhance the security of your form submissions. Our experienced attorneys regularly review all documents to ensure that the forms are suitable for a specific state and comply with current laws and regulations.

How can you acquire the Louisville Annual Minutes - Kentucky? If you possess a profile, simply Log In to your account. The Download option will be available on all documents you explore. Additionally, you can access all the previously saved files in the My documents section.

US Legal Forms is among the most comprehensive and reputable template libraries available online. We are always prepared to assist you with virtually any legal process, even if it merely involves downloading the Louisville Annual Minutes - Kentucky.

Feel free to take advantage of our platform and optimize your document experience!

- Locate the form you need. Confirm that it is the form you were seeking: check its title and description, and use the Preview option if available. If not, utilize the Search box to find the desired one.

- Initiate the downloading procedure. Click Buy Now and choose the pricing plan that suits you. Then, create an account and pay for your order using a credit card or PayPal.

- Download the document. Choose the format to export the Louisville Annual Minutes - Kentucky and modify, complete, or sign it as per your needs.

Form popularity

FAQ

Who receives a Form W-2? You should only receive a W-2 if you are an employee. TurboTax Tip: If you are an independent contractor or work for yourself, the work you do may be similar to what an employee does, but you should receive an earnings statement on a Form 1099-NEC rather than a W-2.

12 Payroll Forms Employers Need 1 W-4 Form: Withholding Allowance Certificate. 2 W-2 Form: Wage and Tax Statement. 3 W-3 Form: Transmittal of Wage & Tax Statements. 4 Form 940: Federal Unemployment Tax Reporting. 5 Form 941: Quarterly Federal Tax Return. 6 Form 944: Employer's Annual Federal Tax Return.

For employees who both work and live in Louisville Metro, the occupational fee / tax is 2.2% (. 0220).

Occupational (Withholding) Tax Returns An Occupational License Fee is imposed on the wages of those employees working in Shelby County at the rate of 1% of all salaries, wages, commissions and other compensation including deferred compensation, earned for work and or services performed in the county.

For employees who work in Louisville Metro, but live outside of Louisville Metro, the occupational fee/tax rate is 1.45% (. 0145). For employees who both work and live in Louisville Metro, the occupational fee/tax rate is 2.2% (. 0220).

Use Form W-11 to confirm that an employee is a qualified employee under the HIRE Act.

Jeffersontown's Occupational Tax is a 1% wage withholding tax on an employee's gross wage. The tax must be withheld and remitted by the employer to the Jeffersontown Revenue Department on a quarterly basis each April 30th, July 31st, October 31st and January 31st.

Each year, employers must send Copy A of Forms W-2 (Wage and Tax Statement) to Social Security to report the wages and taxes of your employees for the previous calendar year. In addition, a Form W-2 must be given to each employee.

1. The form 1, Return of Income Tax ithheld on ages, was the original form used to report Federal income tax withholding.

The minimum combined 2022 sales tax rate for Louisville, Kentucky is 9.5%. This is the total of state, county and city sales tax rates. The Kentucky sales tax rate is currently 4%. The County sales tax rate is 1.5%.