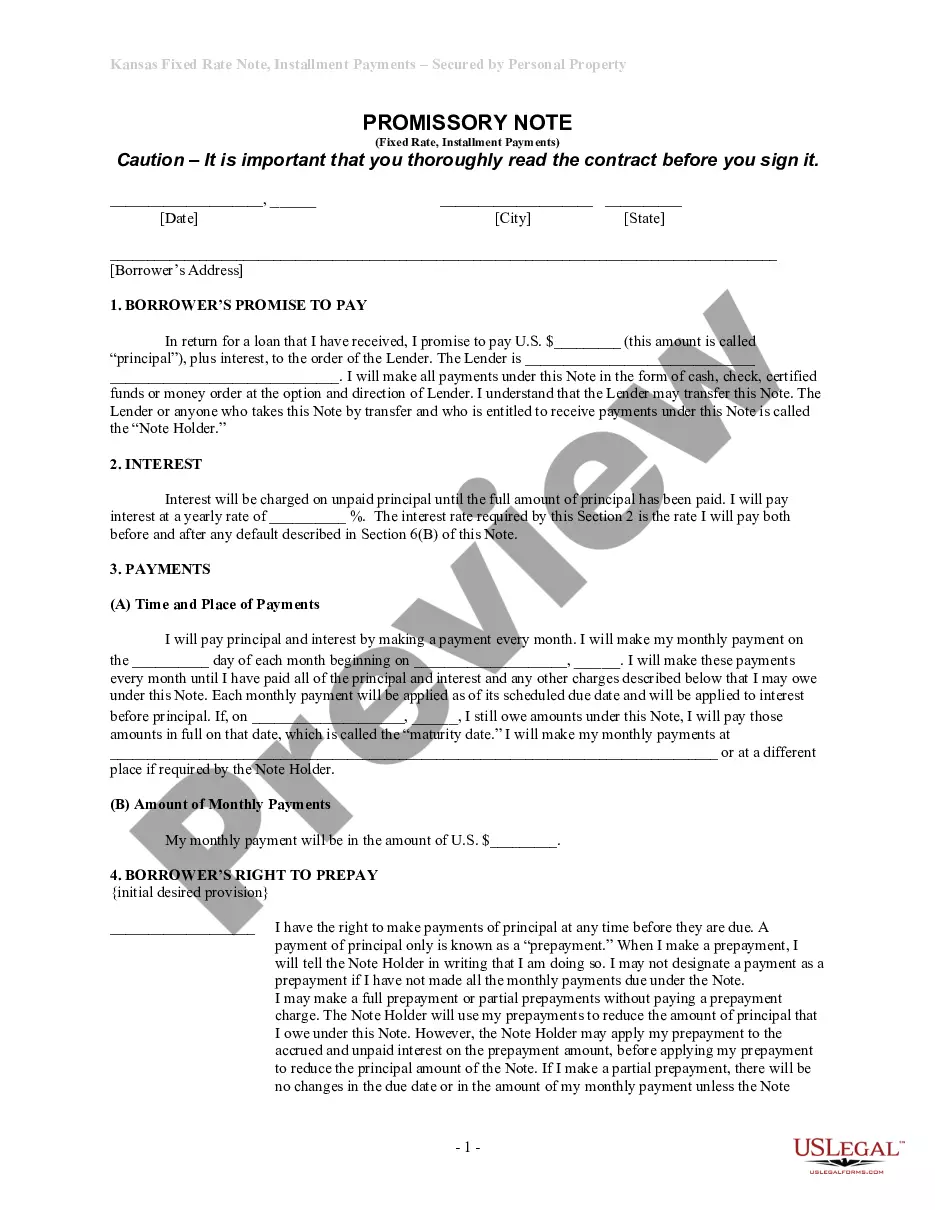

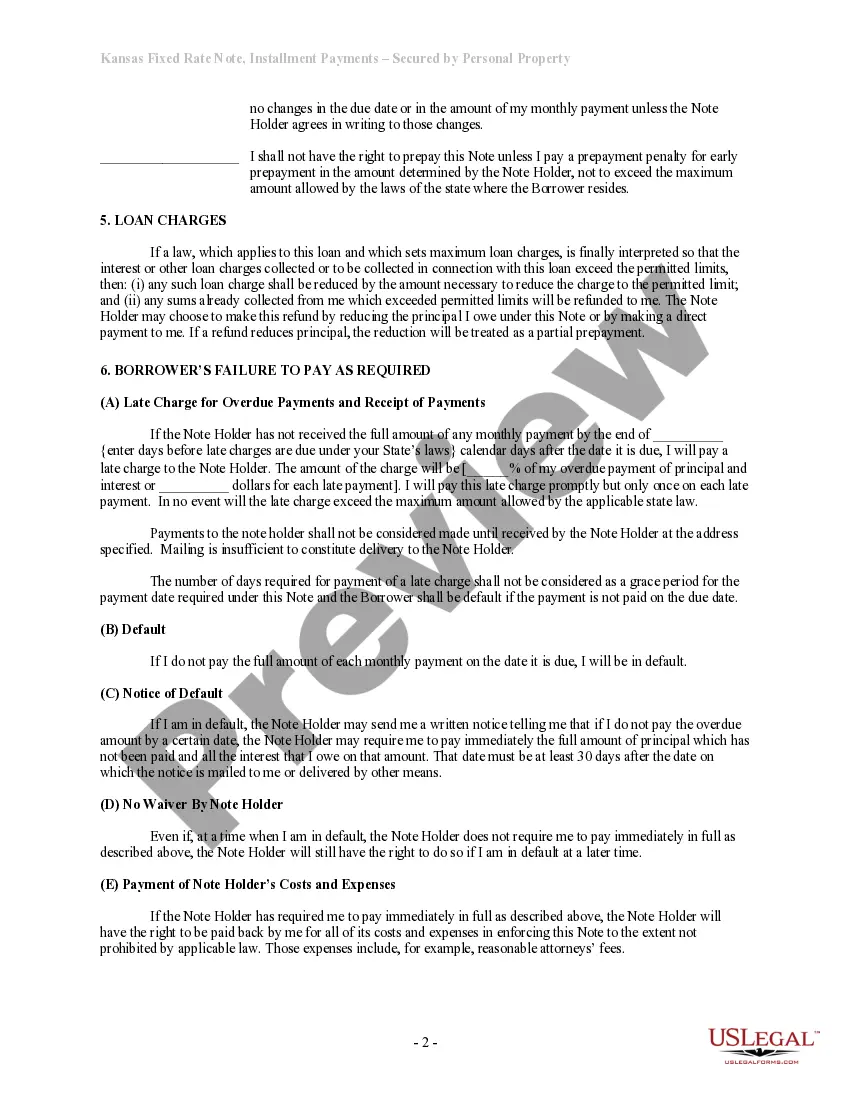

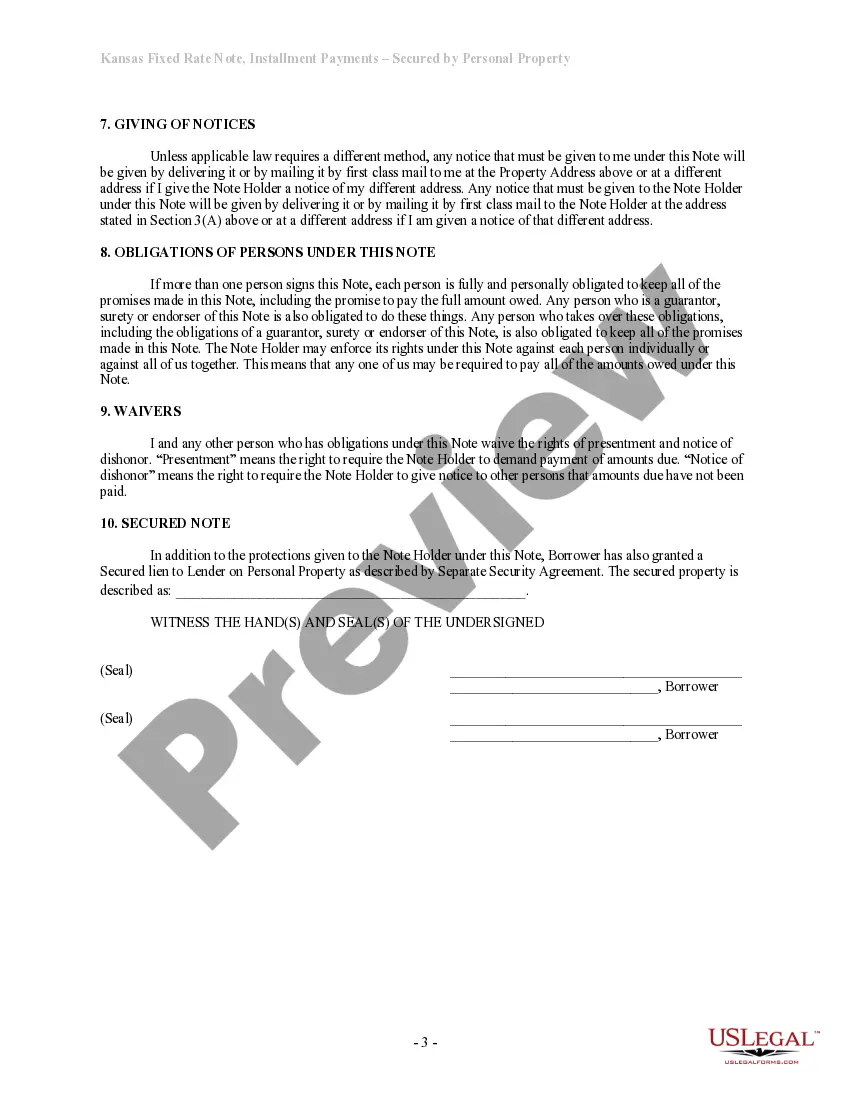

Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is a legal financial agreement commonly used in Olathe, Kansas. It serves as a binding contract between a borrower and a lender, outlining the terms and conditions of a loan. This type of promissory note is specific to Olathe, Kansas, ensuring compliance with local laws and regulations. The Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property specifies that the borrower will repay the loan amount in regular installments over a predetermined period. The interest rate on the loan remains fixed throughout the repayment period, providing stability for both parties involved. The promissory note is secured by personal property, which serves as collateral to protect the lender's investment. In the event of a default, the lender has the right to seize the borrower's personal property to recover the outstanding loan balance. There can be different types of Olathe Kansas Installments Fixed Rate Promissory Notes Secured by Personal Property, such as: 1. Auto Loan Promissory Note: This type of promissory note is used for financing the purchase of a vehicle. The borrower pledges the vehicle as collateral, and the lender can repossess it if the borrower fails to make timely payments. 2. Home Equity Promissory Note: This promissory note is used when a borrower seeks a loan using the equity in their home as collateral. It secures the loan against the property and allows the lender to foreclose and sell the property if the borrower defaults. 3. Business Equipment Promissory Note: This type of promissory note is utilized when a borrower needs financing for business equipment. The equipment purchased serves as collateral, giving the lender the right to seize and sell it in case of default. 4. Personal Asset Promissory Note: This promissory note is used when a borrower wants to secure a loan with personal assets like jewelry, electronics, or valuable collectibles. If the borrower defaults, the lender can claim and sell the pledged assets. It is crucial for both parties to carefully review and understand the terms and conditions outlined in the Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property before finalizing the agreement. Seeking legal advice is recommended to ensure compliance with local laws and to protect the interests of all involved parties.

Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Olathe Kansas Installments Fixed Rate Promissory Note Secured By Personal Property?

We consistently aim to reduce or evade legal repercussions when managing subtle legal or financial issues.

To achieve this, we request legal representation that, in general, comes at a high cost.

Nevertheless, not every legal issue is equally intricate. The majority can be handled independently.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Simply Log In to your account and click the Get button next to it.

- Our collection empowers you to manage your affairs without needing a lawyer's services.

- We offer access to legal document templates that may not always be available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Benefit from US Legal Forms whenever you need to locate and download the Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property or any other document promptly and securely.

Form popularity

FAQ

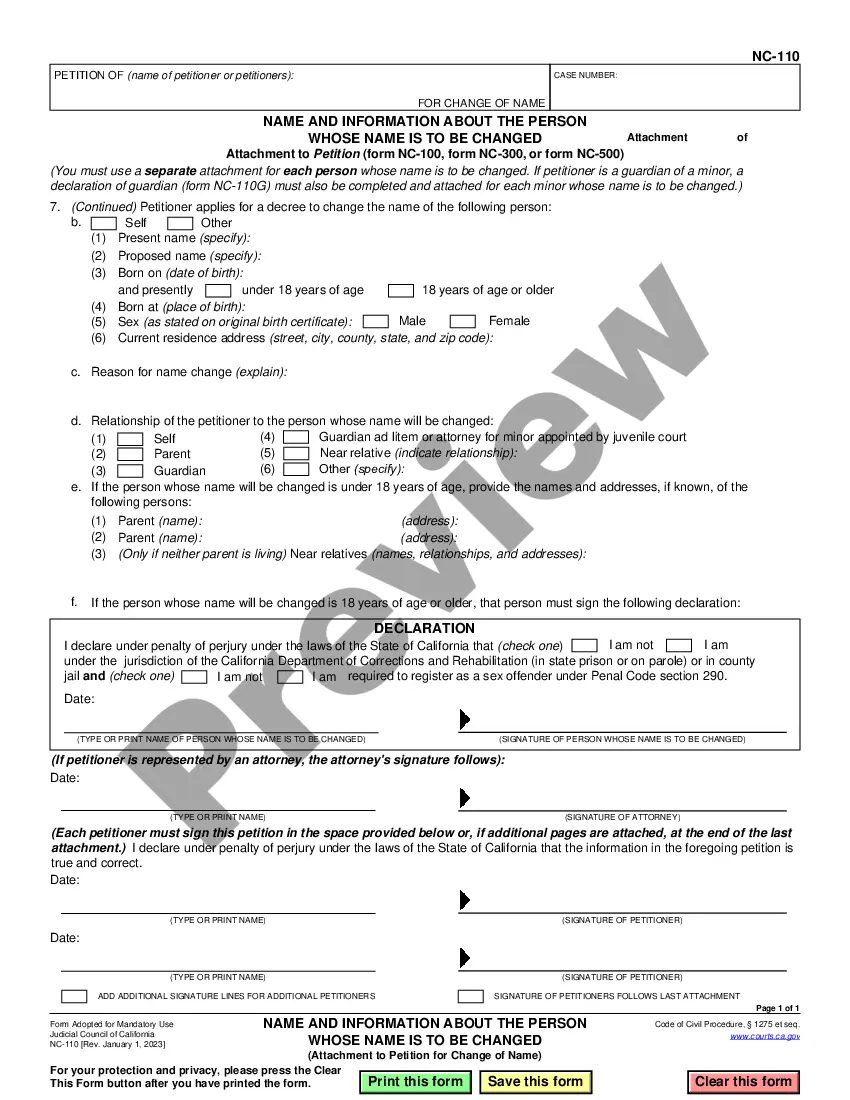

You typically do not file a promissory note with the court, but you should retain it for personal records. In the case of an Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property, it is advisable to have it documented with your local county recorder if it is secured by real property. This adds a layer of protection by making your interest in the property public. The uslegalforms platform can help guide you through the filing process.

Yes, promissory notes are legally binding documents that hold up in court, provided they meet certain requirements. An Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property can be enforced, as it clearly states the terms, conditions, and obligations of both parties. Courts generally view such documents as valid due to their formal nature. Thus, having a well-drafted note increases your chances of a favorable outcome in disputes.

You can record a promissory note at your local county recorder's office in Olathe, Kansas. This is particularly important for an Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property, as it establishes a public record of the obligation. By recording the note, you can protect your interests in the event of disputes or claims. Consider using the uslegalforms platform to simplify this process.

An installment note is a legal document that details the agreement between a lender and a borrower for repayment in multiple payments over time. These notes specify the amount borrowed, the interest rate, and the repayment schedule. The Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is designed to simplify the borrowing process, making it accessible for individuals seeking structured financial solutions.

The primary difference lies in the repayment structure. An installment note requires payments over a set period, while a standard promissory note may require full repayment at a single point in time. The Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is essentially an installment note, offering clarity and predictability in repayment.

Promissory notes come in various forms, including secured and unsecured notes. A secured note is backed by collateral, while an unsecured note is based solely on the borrower's creditworthiness. The Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property is an example of a secured promissory note. It's essential to choose a type that best suits your needs.

To write a secured promissory note, first include all the necessary details of the agreement, similar to any promissory note. Next, explicitly state the collateral involved, such as personal property, to ensure it is clear what security the lender has. Resources available on the US Legal Forms platform can help create an Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property effectively, making the process straightforward for you.

To write a simple promissory note, start with the title, clearly stating it is a promissory note. Include the names and addresses of both the borrower and the lender, the amount borrowed, the interest rate, and the repayment schedule. Be sure to specify if the Olathe Kansas Installments Fixed Rate Promissory Note Secured by Personal Property includes any terms for late payments or default, ensuring clarity for both parties.