Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Kansas Dissolution Package To Dissolve Limited Liability Company LLC?

If you have previously used our service, Log In to your account and acquire the Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have permanent access to every document you have acquired: you can locate it in your profile within the My documents menu whenever you wish to reuse it. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional requirements!

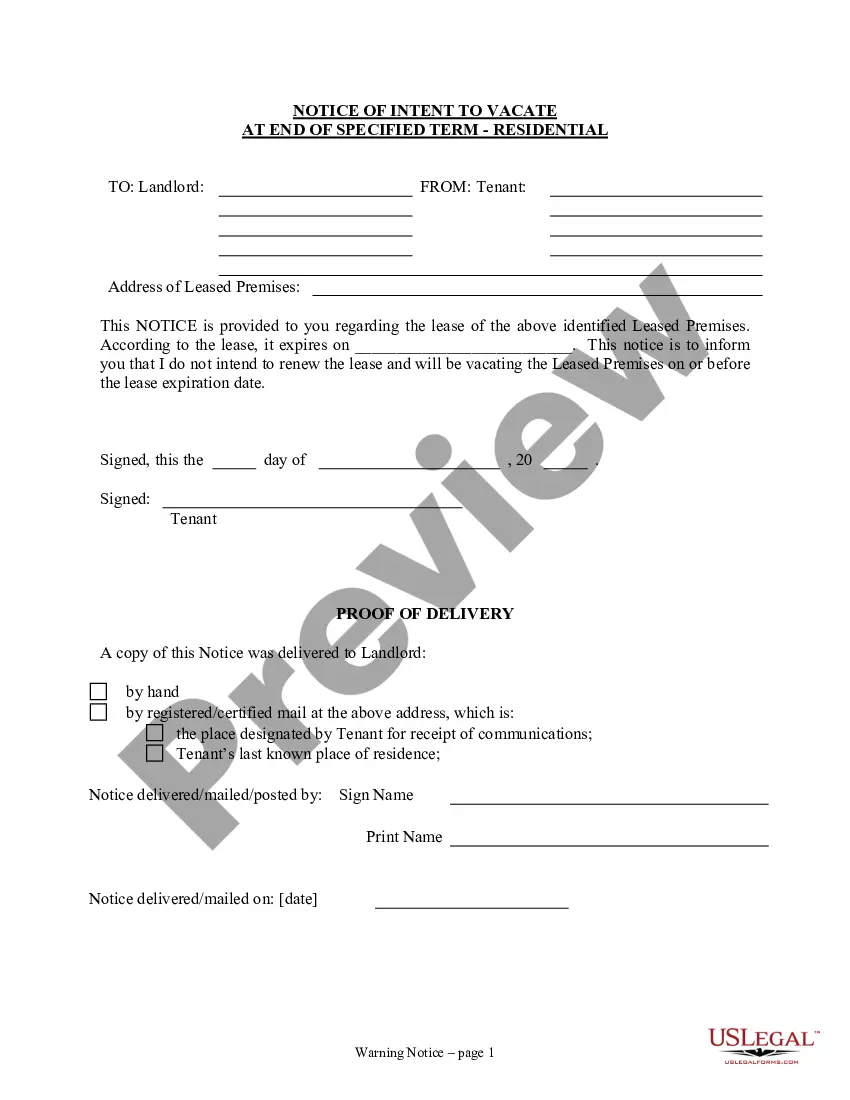

- Confirm you have found an appropriate document. Review the description and use the Preview feature, if available, to determine if it satisfies your requirements. If it’s not suitable, use the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

In Connecticut, you do not need to renew your Limited Liability Company (LLC) registration annually. However, your LLC must file an annual report to maintain good standing. This requirement is crucial for avoiding penalties and ensuring compliance with state regulations. If you are considering the Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC, you might want to understand state-specific requirements, which uslegalforms can help clarify.

Deciding whether to dissolve your LLC or leave it inactive is important. An Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC provides a clear path for those looking to fully close their business, eliminating unnecessary fees and liabilities. Remaining inactive may seem less burdensome, but it can still incur costs and administrative responsibilities. By choosing to dissolve, you ensure that your business is legally closed, providing peace of mind and a clean break.

If you're looking to close down an LLC in Kansas, you need to submit a Certificate of Dissolution to the Kansas Secretary of State. Before filing, ensure all debts and liabilities have been settled. It’s also a good idea to inform all members and creditors about the impending closure. The Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC can provide valuable resources to help you navigate this process seamlessly.

To officially close an LLC, you must follow the specific procedures established by your state. This typically involves filing necessary paperwork, settling debts, and notifying members and creditors of the closure. After completing these steps, ensure you obtain confirmation from your state that your LLC has been dissolved. For assistance, consider the Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC, which offers a comprehensive approach to this process.

To dissolve your LLC in Kansas, you must file a Certificate of Dissolution with the Kansas Secretary of State. Ensure that any previous obligations have been resolved and property distributed appropriately. After filing, the state will process your request, and your LLC will officially cease to exist. Utilize the Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC for an easy and efficient solution in this endeavor.

To dissolve a Delaware LLC, you need to file a Certificate of Cancellation with the Delaware Division of Corporations. This document should include your LLC's name and the date of dissolution. Additionally, ensure that any outstanding debts are settled and compliance with state regulations is maintained. For a smooth process, consider the Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC, which guides you step-by-step.

In Kansas, you do not have to renew your LLC every year, but you must file an Annual Report. This ensures your business remains in good standing. The Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC provides clarity on ongoing requirements, helping you maintain compliance easily.

In Kansas, LLCs are typically subject to pass-through taxation. This means that the income is reported on the individual owners' personal tax returns rather than being taxed at the business level. With the Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC, you can get insights into the tax implications during the dissolution process.

Closing out an LLC in Missouri involves a few key steps, including settling debts and filing the Articles of Termination. You should notify the IRS and other relevant parties about your LLC’s closure. The Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC offers guidance on these steps, making the process smoother.

To close your LLC in Missouri, you need to file Articles of Termination with the Secretary of State. This form signals the end of your business entity legally. If you use the Overland Park Kansas Dissolution Package to Dissolve Limited Liability Company LLC, it simplifies the process, ensuring all necessary steps are completed correctly.