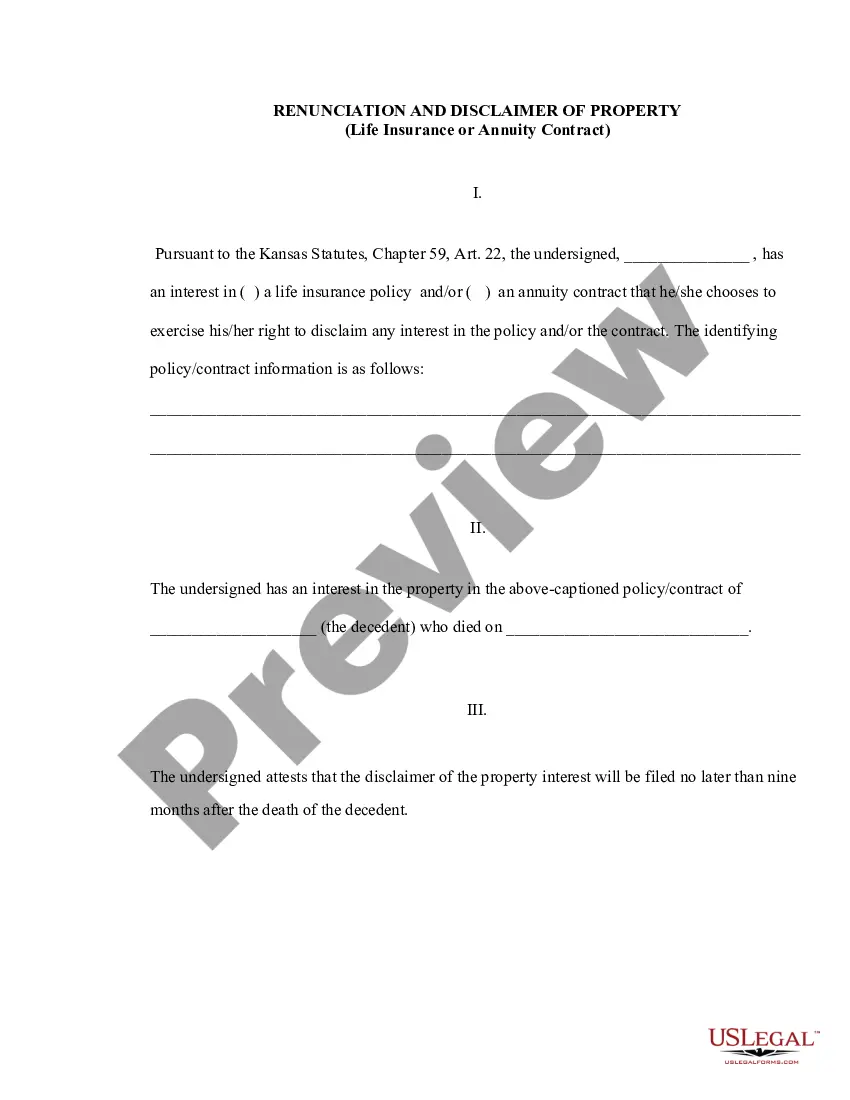

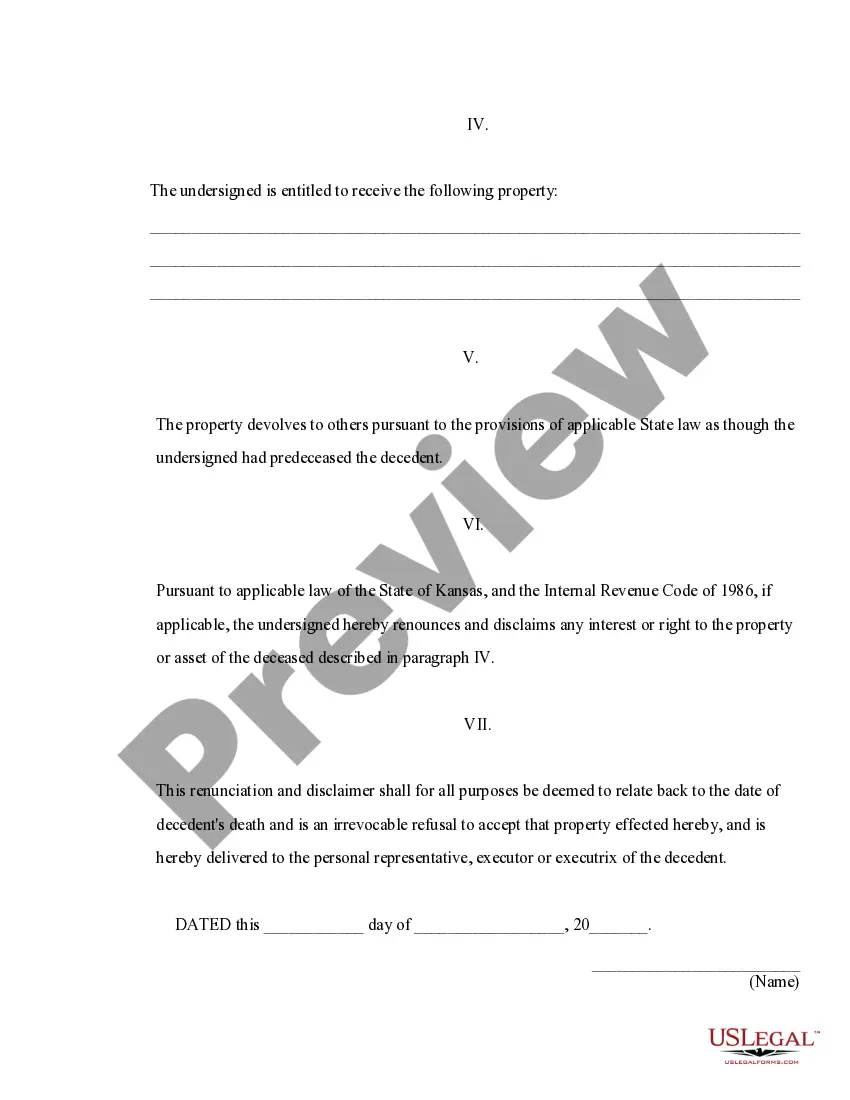

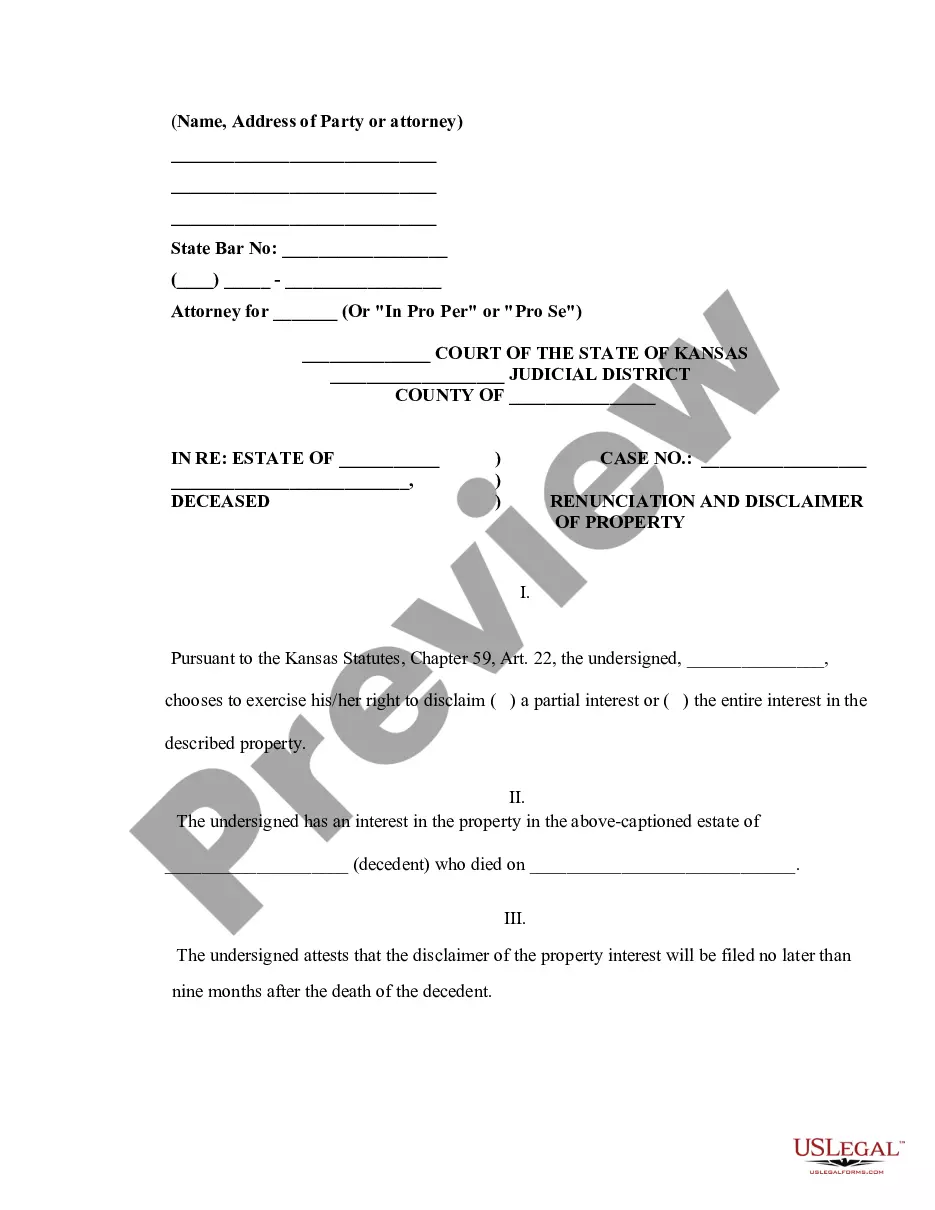

Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

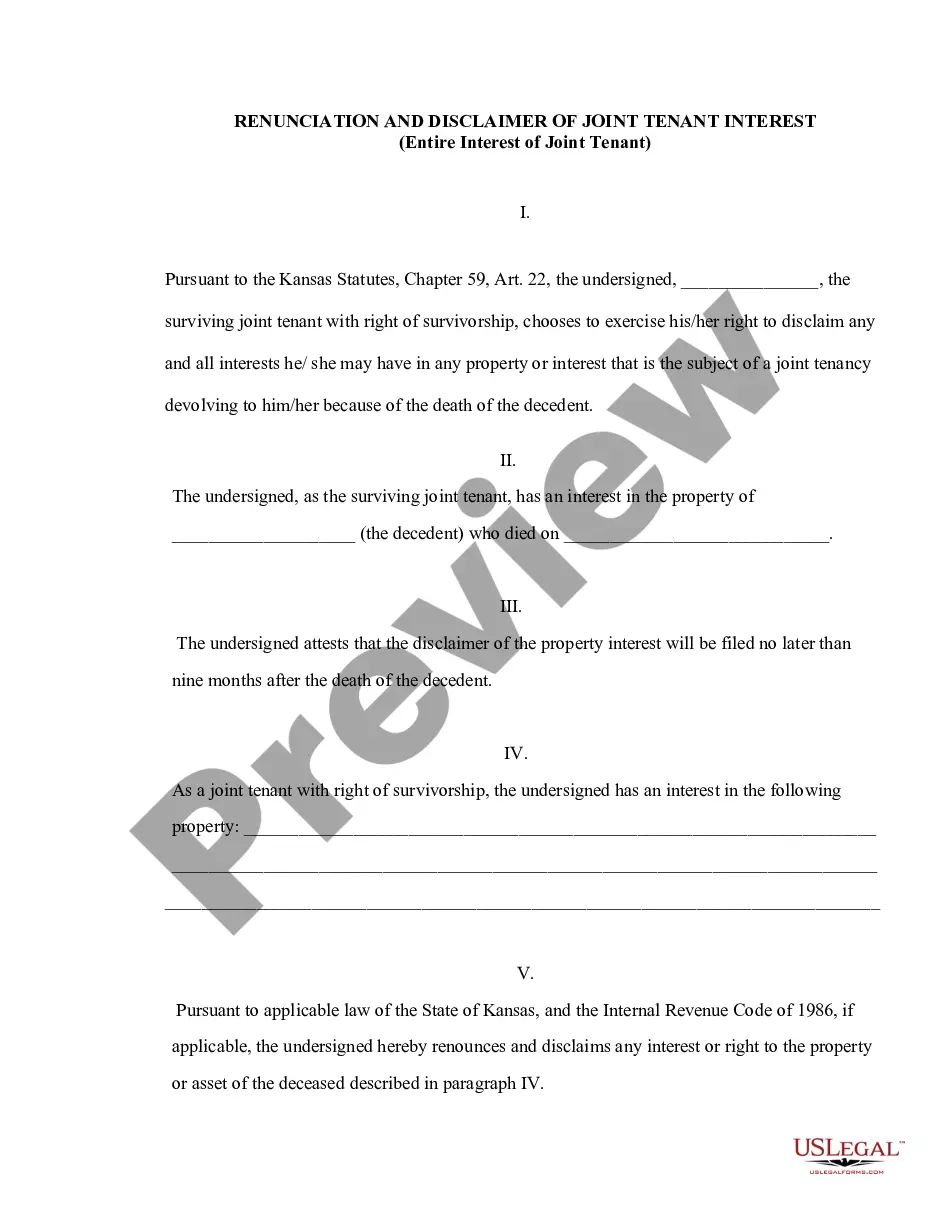

How to fill out Kansas Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

If you have previously used our service, sign in to your account and retrieve the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract on your device by clicking the Download button. Ensure your subscription is active. If not, renew it following your billing plan.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents section whenever you wish to access them again. Utilize the US Legal Forms service to quickly search for and download any template for your personal or business needs!

- Ensure you’ve found a suitable document. Read the summary and utilize the Preview feature, if applicable, to verify if it aligns with your needs. If it doesn't fit, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or select the PayPal option to finalize the transaction.

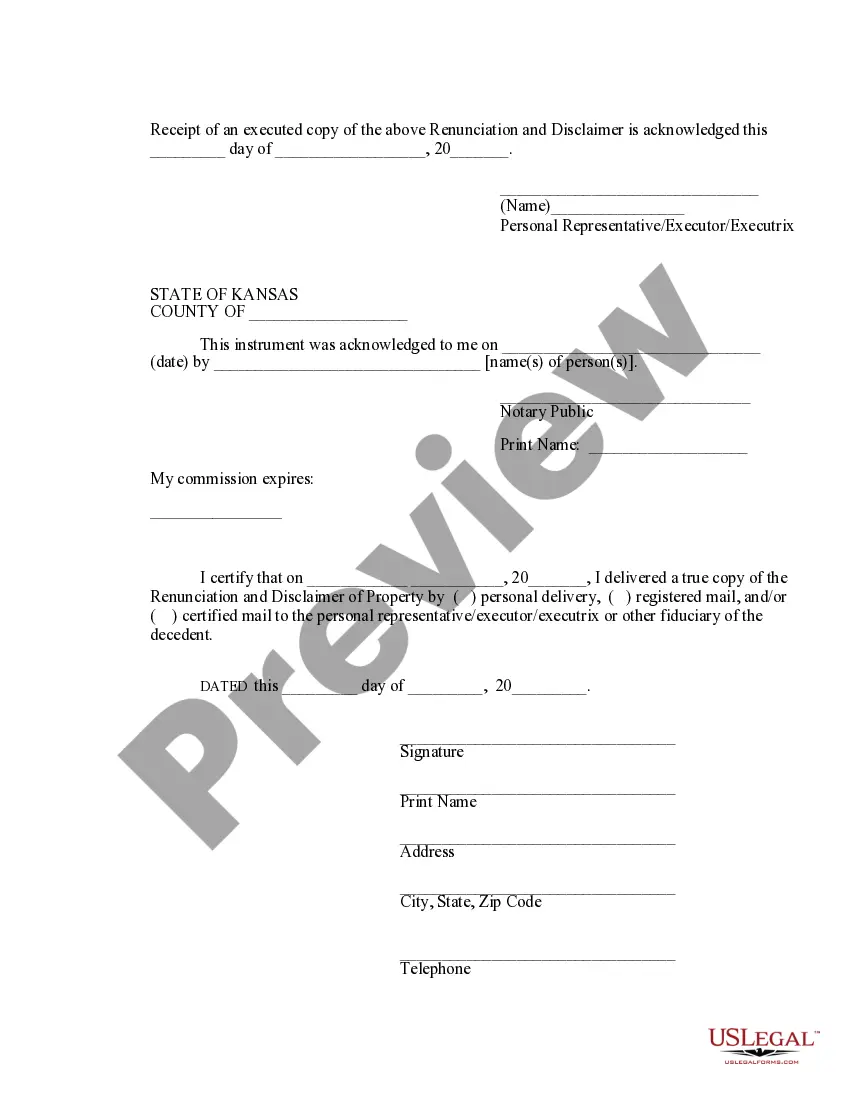

- Obtain your Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize online professional editors to fill it out and sign it electronically.

Form popularity

FAQ

Yes, you can disclaim a life estate, but it must be performed through a qualified disclaimer, as outlined under applicable law. When you disclaim a life estate, you will relinquish your rights and any associated responsibilities, allowing the property to pass to the next beneficiary without complications. It is crucial to ensure that the disclaimer meets statutory requirements in your jurisdiction to be effective. For guidance, refer to the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

A qualified disclaimer permits an individual to refuse property by meeting specific legal criteria, including a written statement of refusal. This disclaimer must be made within a certain timeframe and cannot be contingent upon any conditions. By implementing a qualified disclaimer, you can protect yourself from unwanted tax implications or liabilities attached to the property. Utilizing resources like the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can help you navigate this process smoothly.

To disclaim an inheritance in Florida, you must create a written disclaimer that fulfills Florida law requirements. This document should clearly state your intention to refuse the property, including details about the inheritance. It is essential to file this disclaimer with the appropriate court or executor before accepting any benefits from the life insurance or annuity contract. For a more straightforward process, consider using the Topeka Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract to guide you.