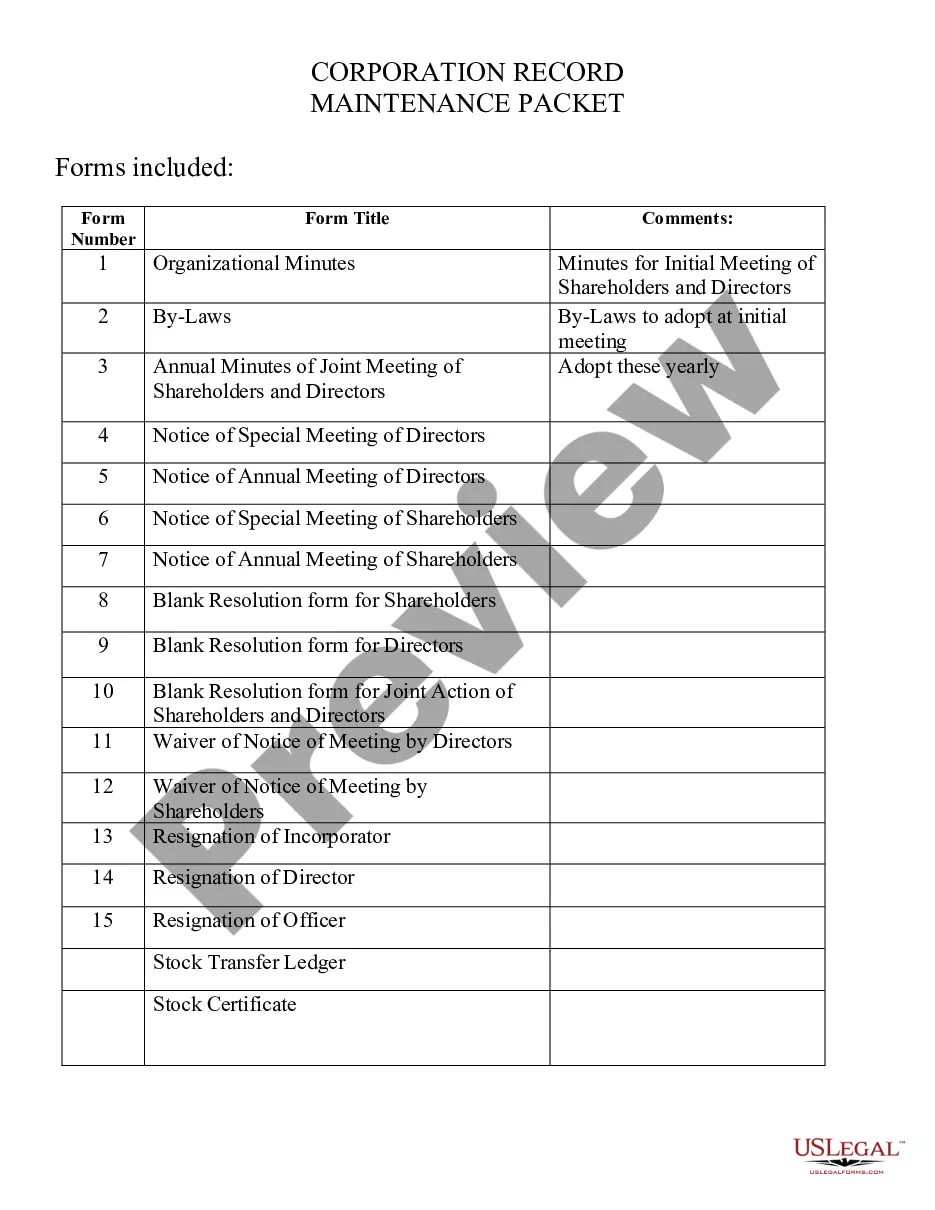

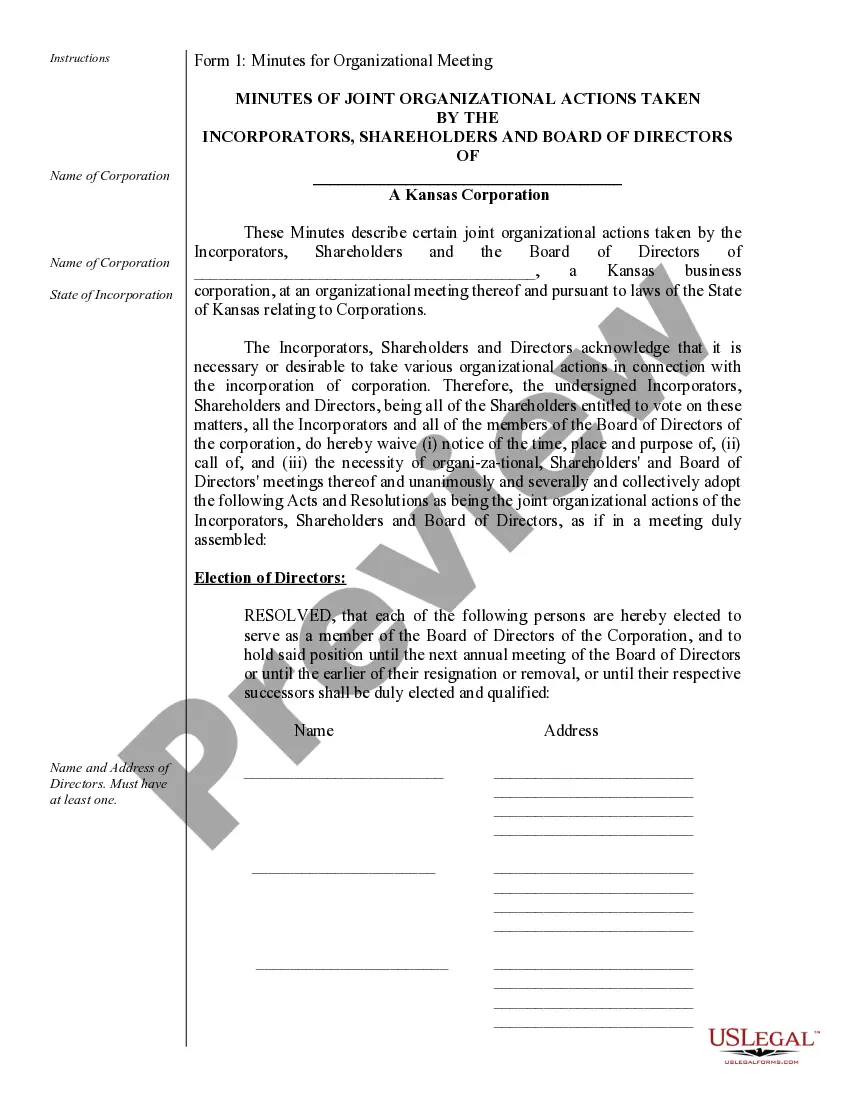

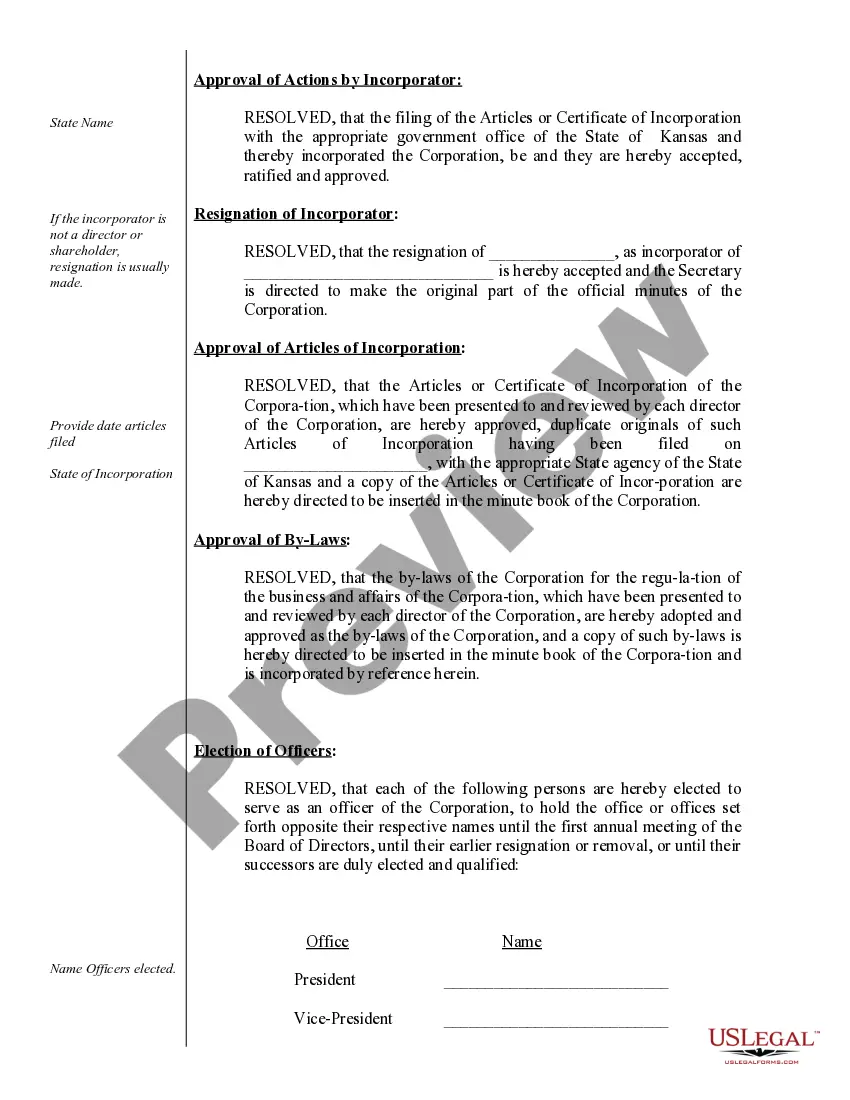

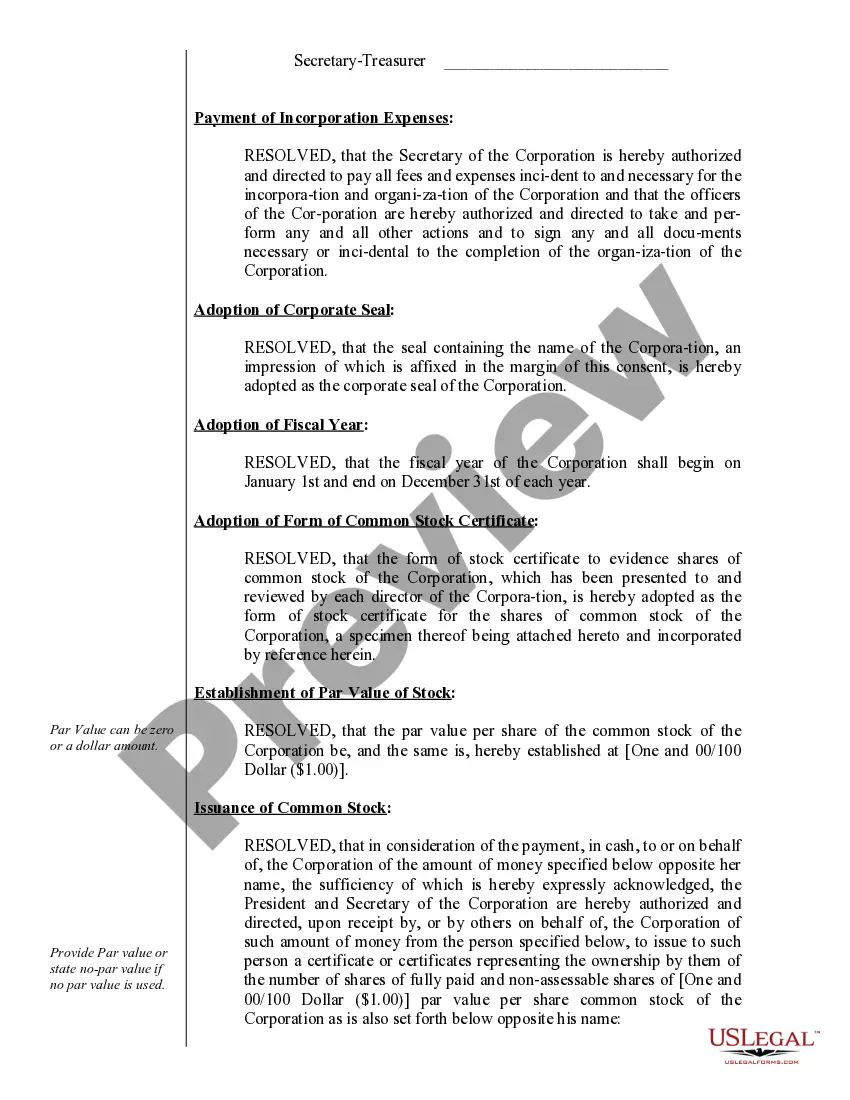

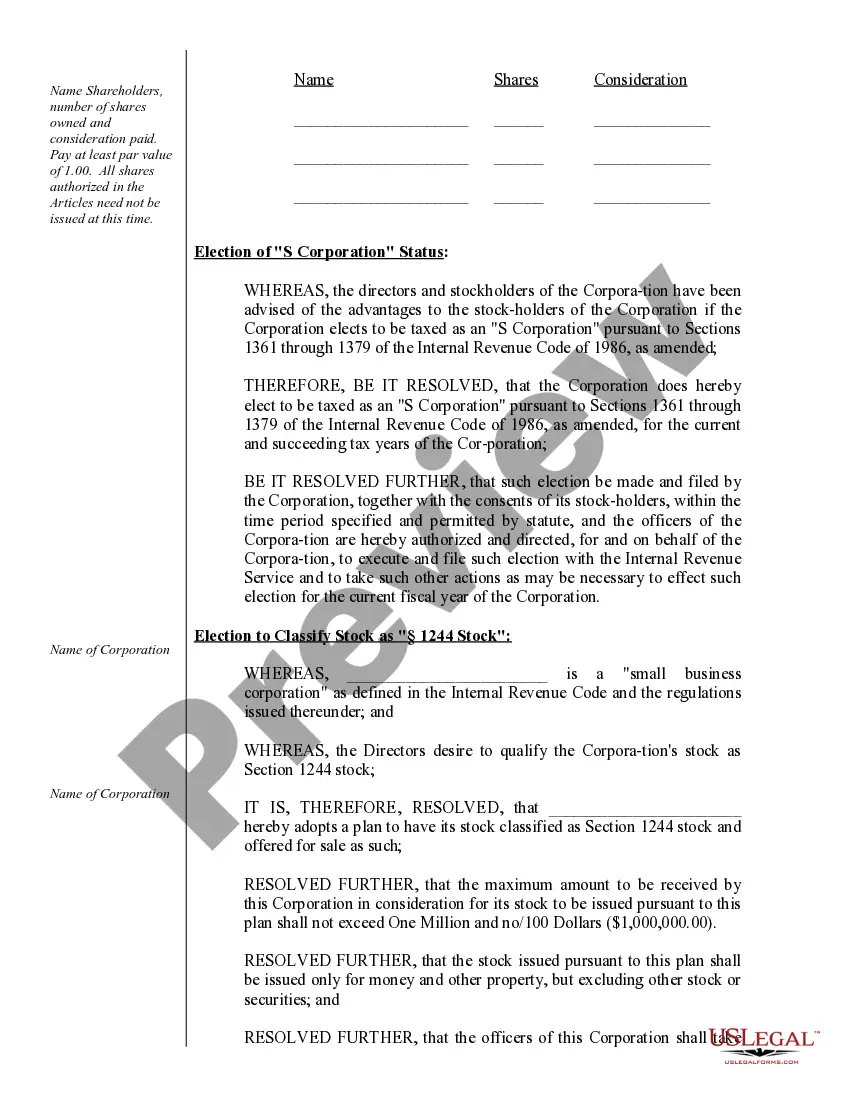

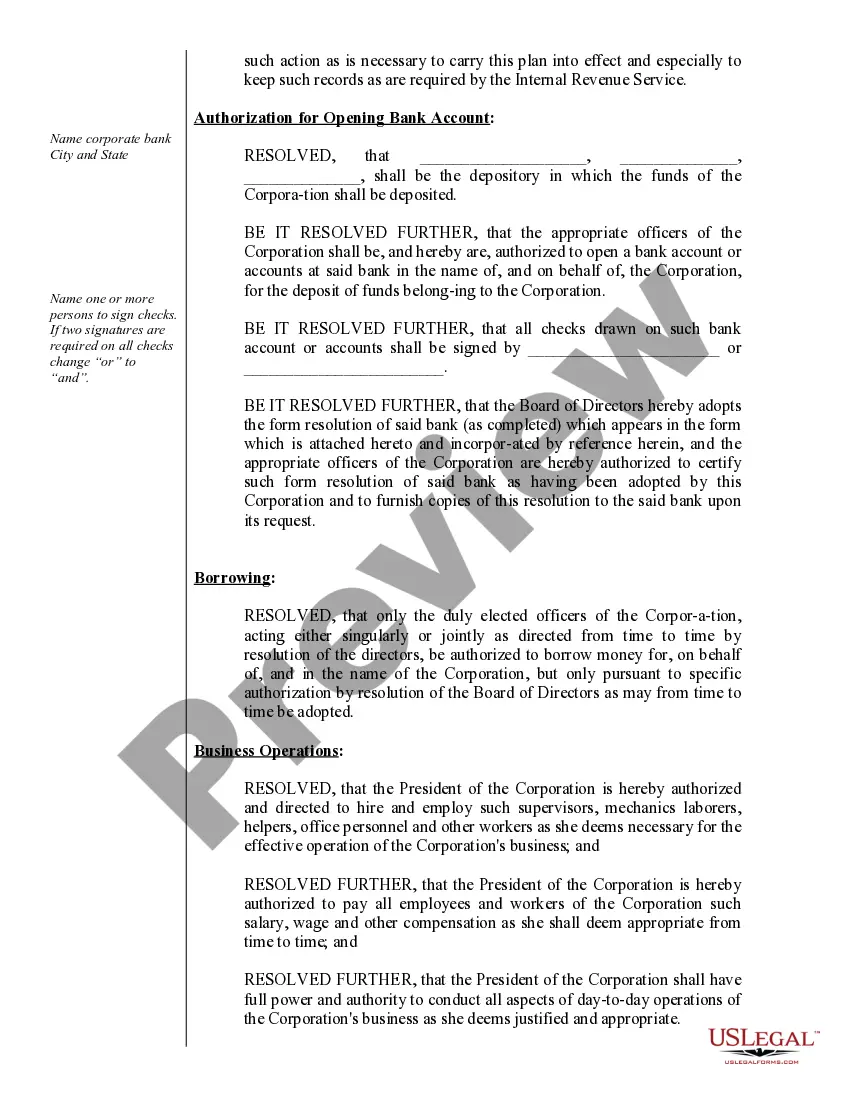

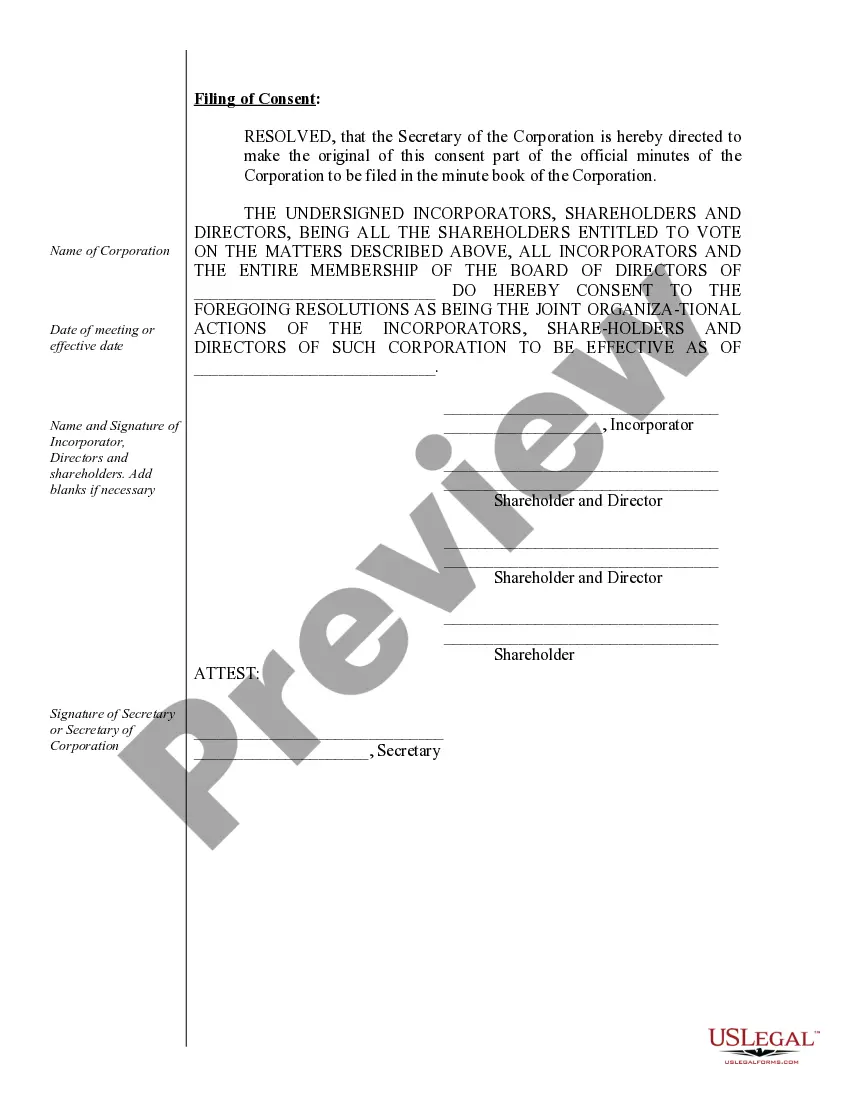

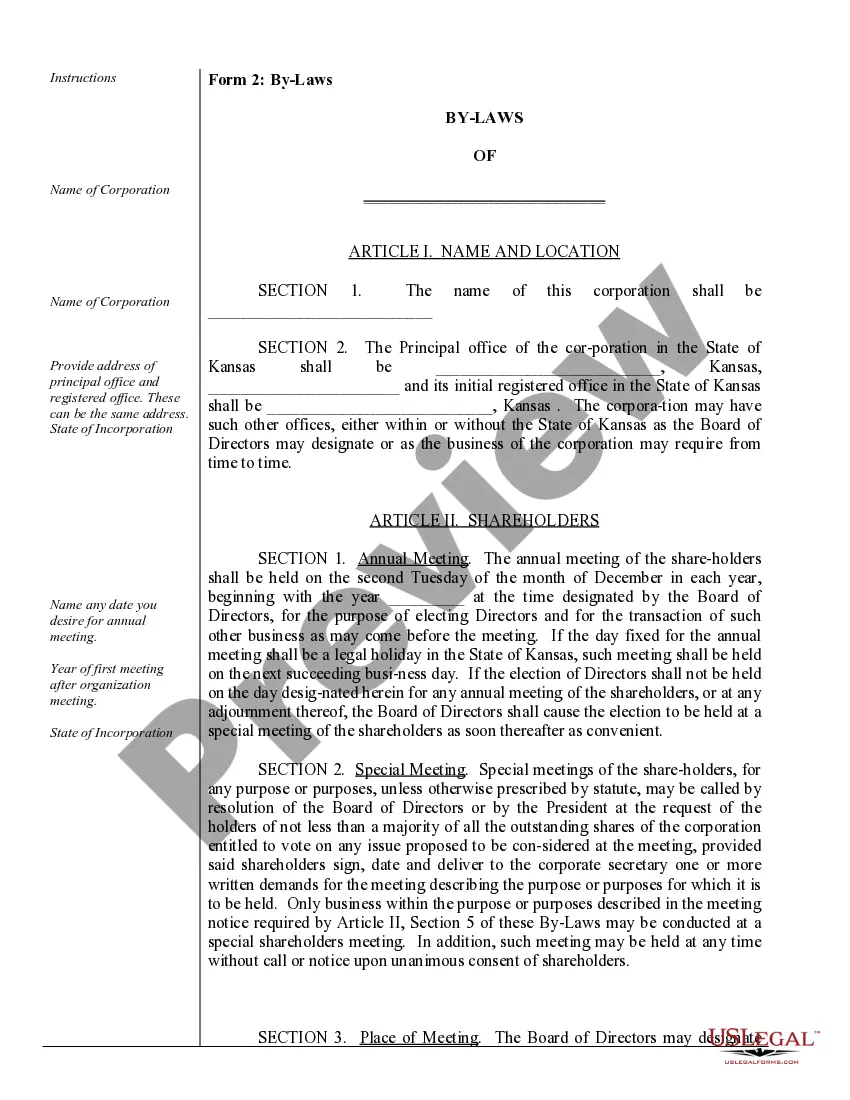

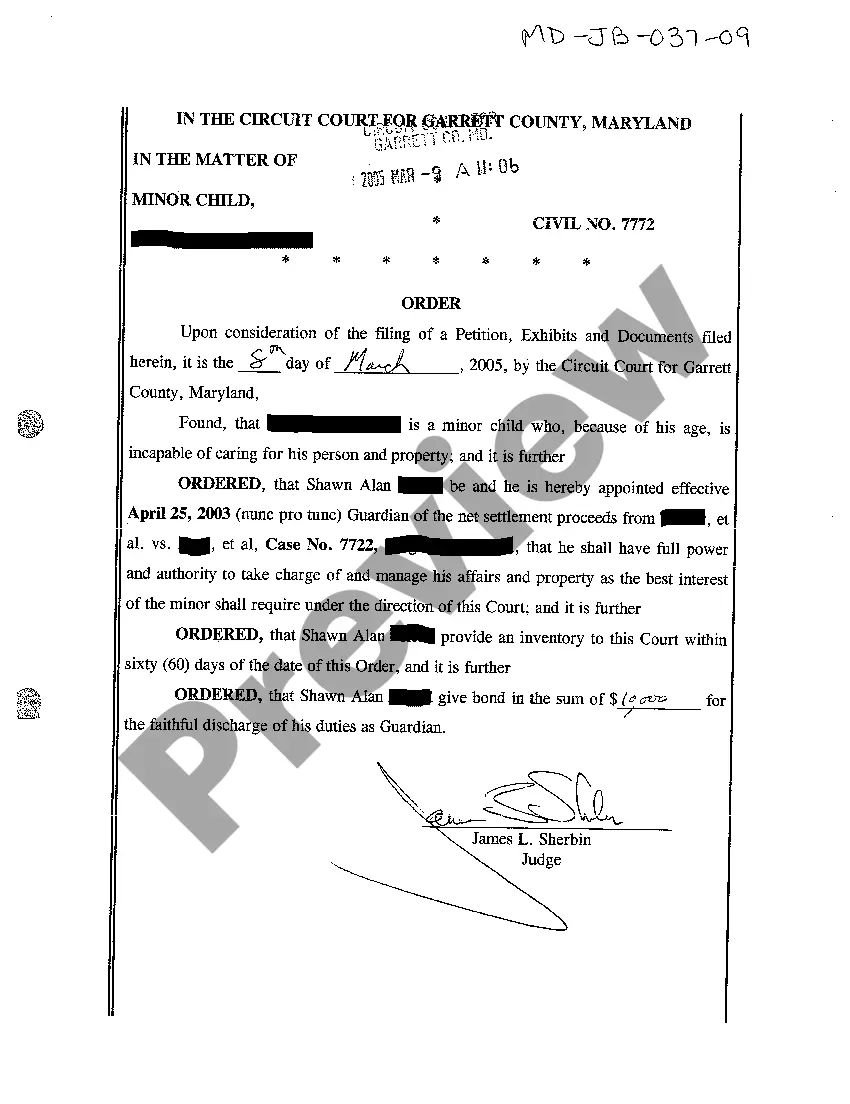

This package includes the following forms: Organizational Minutes, Minutes for Initial Meeting of Shareholders and Directors, By-Laws, Annual Minutes of Joint Meeting of Shareholders and Directors, Notice of Special Meeting of Directors, Notice of Annual Meeting of Directors, Notice of Special Meeting of Shareholders, Notice of Annual Meeting of Shareholders, Blank Resolution form for Shareholders, Blank Resolution form for Directors, Blank Resolution form for Joint Action of Shareholders and Directors, Waiver of Notice of Meeting by Directors, Waiver of Notice of Meeting by Shareholders, Resignation of Incorporator, Resignation of Director, Resignation of Officer, Stock Transfer Ledger and Simple Stock Certificate.

Topeka Kansas Corporate Records Maintenance Package for Existing Corporations

Description

How to fill out Kansas Corporate Records Maintenance Package For Existing Corporations?

Locating authentic templates tailored to your regional regulations can be challenging unless you access the US Legal Forms library.

This is an online repository of over 85,000 legal documents catering to both personal and professional requirements across various real-world scenarios.

All forms are aptly categorized by field of use and jurisdictional areas, making it incredibly straightforward to find the Topeka Kansas Corporate Records Maintenance Package for Existing Corporations.

Complete your transaction by providing your credit card information or utilizing your PayPal account to settle the payment.

- Check the Preview mode and description of the form.

- Ensure you’ve selected the correct one that aligns with your needs and fully complies with your local jurisdictional requirements.

- Search for another template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one.

- Click the Buy Now button and choose your preferred subscription plan.

Form popularity

FAQ

All registered corporations, including LLCs in Kansas, must file an annual report each year to keep their status active. This requirement ensures that the state has updated information on your business. By using the Topeka Kansas Corporate Records Maintenance Package for Existing Corporations, you can simplify this process, receive alerts, and ensure your reports are filed correctly and on time.

Yes, in Kansas, your LLC is required to file an annual report to maintain its active status. Failure to submit this report can result in penalties or even dissolution of your LLC. You can stay on top of your reporting obligations by enrolling in our Topeka Kansas Corporate Records Maintenance Package for Existing Corporations, which provides you with reminders and assistance in managing your filings effectively.

To obtain a certificate of Good Standing in Kansas, you need to request one through the Kansas Secretary of State's office. This certificate verifies that your corporation is compliant and has submitted all required documents. You can easily streamline this process by utilizing the Topeka Kansas Corporate Records Maintenance Package for Existing Corporations. This package simplifies your compliance requirements and ensures timely renewals, making it a valuable tool for your business.

Indeed, renewing your LLC each year in Kansas is mandatory. This helps maintain your business's legal status and ensures compliance with state regulations. Utilizing the Topeka Kansas Corporate Records Maintenance Package for Existing Corporations can make this annual renewal process seamless, helping you stay organized and focused on your business growth.

To obtain a copy of your articles of organization in Kansas, you can request it from the Kansas Secretary of State's office. Additionally, using the Topeka Kansas Corporate Records Maintenance Package for Existing Corporations can help you access important documents like these quickly and efficiently, making it easier to manage your corporate records.

The Kansas information report is distinct from the annual report. While both documents involve filing requirements, the information report focuses more on specific data about your corporation’s status. To streamline the filing process, the Topeka Kansas Corporate Records Maintenance Package for Existing Corporations offers guidance on both reports, ensuring you meet all state requirements.

Yes, Kansas requires all corporations to file an annual report each year. This report provides updates about your business activities and is essential for maintaining your corporation's active status. With the Topeka Kansas Corporate Records Maintenance Package for Existing Corporations, you can easily prepare and submit your annual report without hassle.

Yes, in Kansas, you must renew your LLC every year. This renewal process ensures that your business remains in good standing with the state. The Topeka Kansas Corporate Records Maintenance Package for Existing Corporations simplifies this process by providing the necessary reminders and support to keep your LLC on track.

A statement of information and an annual report serve similar purposes, but they are not exactly the same. While both documents provide updated company details to the state, the specific requirements can differ. Our Topeka Kansas Corporate Records Maintenance Package for Existing Corporations helps clarify these distinctions to ensure that you comply with all necessary filings. Relying on our platform simplifies managing these obligations effectively.

Yes, Kansas requires all corporations, including those in Topeka, to file an annual report. This report ensures that your business information remains current and compliant with state regulations. With our Topeka Kansas Corporate Records Maintenance Package for Existing Corporations, we make it easy for you to stay on top of these requirements. You can focus on running your business while we handle the paperwork.