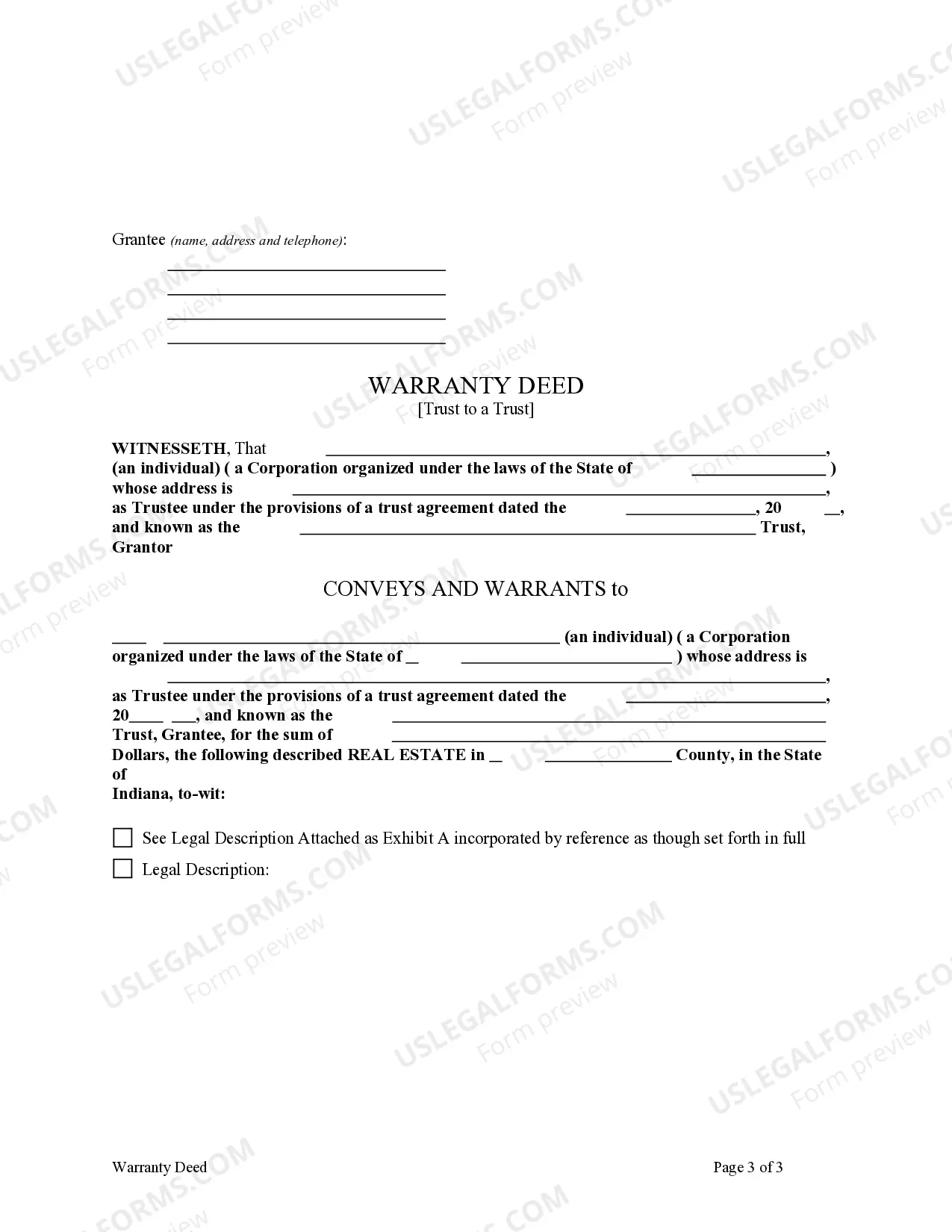

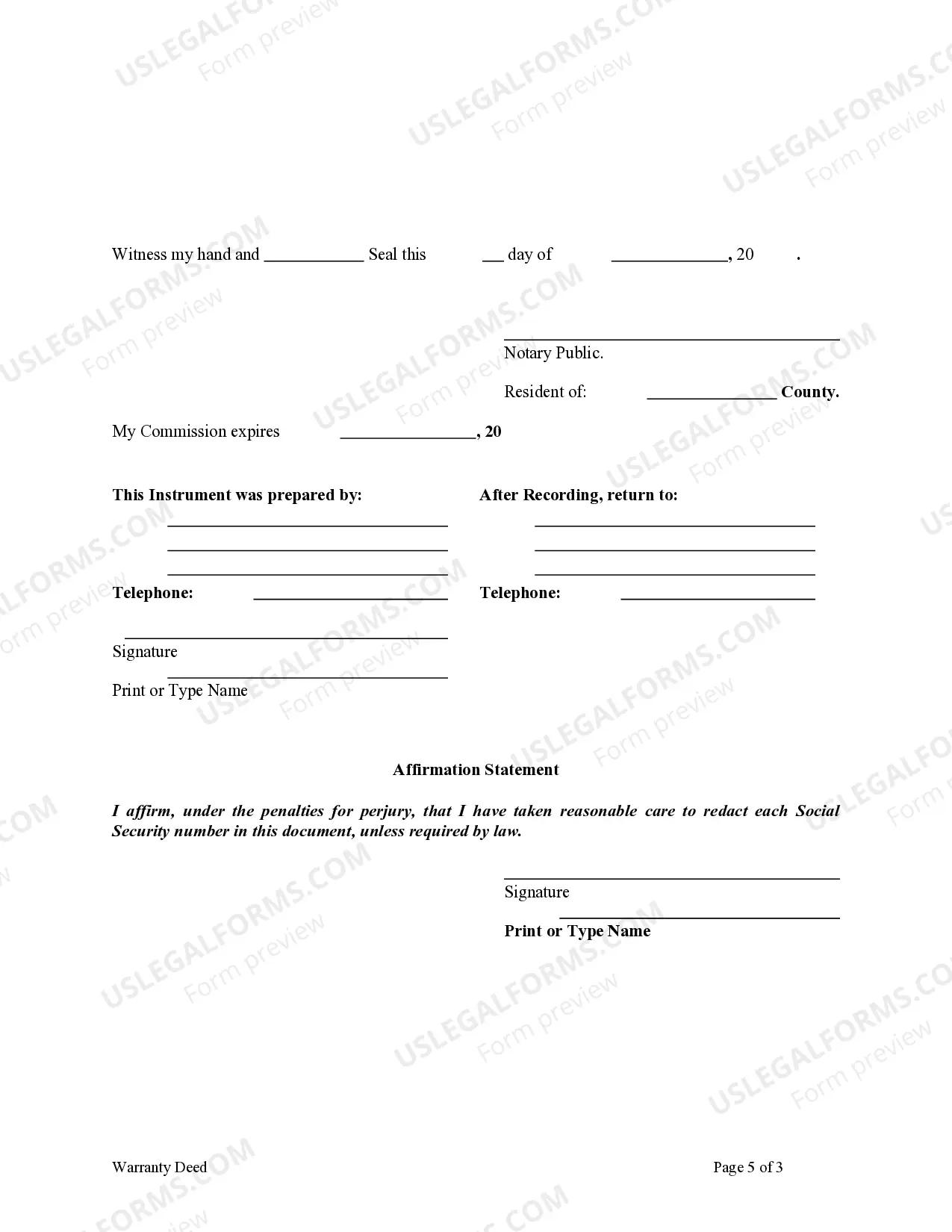

This form is a Warranty Deed where the Grantor is a Trust and the Grantee is also a Trust. Grantor conveys and warrants the described property to Trustee of the Grantee. This deed complies with all state statutory laws.

Indianapolis Indiana Warranty Deed - Trust to a Trust

Description

How to fill out Indiana Warranty Deed - Trust To A Trust?

Take advantage of the US Legal Forms and gain instant access to any form sample you desire.

Our helpful platform, featuring a vast array of document templates, simplifies the process of locating and acquiring nearly any document sample you need.

You can export, complete, and sign the Indianapolis Indiana Warranty Deed - Trust to a Trust in just a few minutes rather than spending hours browsing the internet for the appropriate template.

Leveraging our library is an excellent method to enhance the security of your record submissions.

If you haven’t yet signed up for an account, follow the instructions outlined below.

Visit the page containing the form you need. Ensure it is the form you were searching for: check its title and description, and use the Preview option if available. Otherwise, utilize the Search feature to find the necessary one.

- Our experienced legal professionals routinely examine all documents to ensure that the forms are applicable for a specific state and in line with updated laws and regulations.

- How can you obtain the Indianapolis Indiana Warranty Deed - Trust to a Trust.

- If you already have a subscription, simply Log In to your account.

- The Download option will surface on all the samples you view.

- Additionally, you can locate all your previously saved records in the My documents section.

Form popularity

FAQ

Submit your document Marion County Assessor: $10.00 per parcel per document; AND $20.00 for each Sales Disclosure, if required. Marion County Recorder: $35.00 per document. The Assessor is responsible for transferring property in Marion County. The transfer stamp from their office is required before it can be recorded.

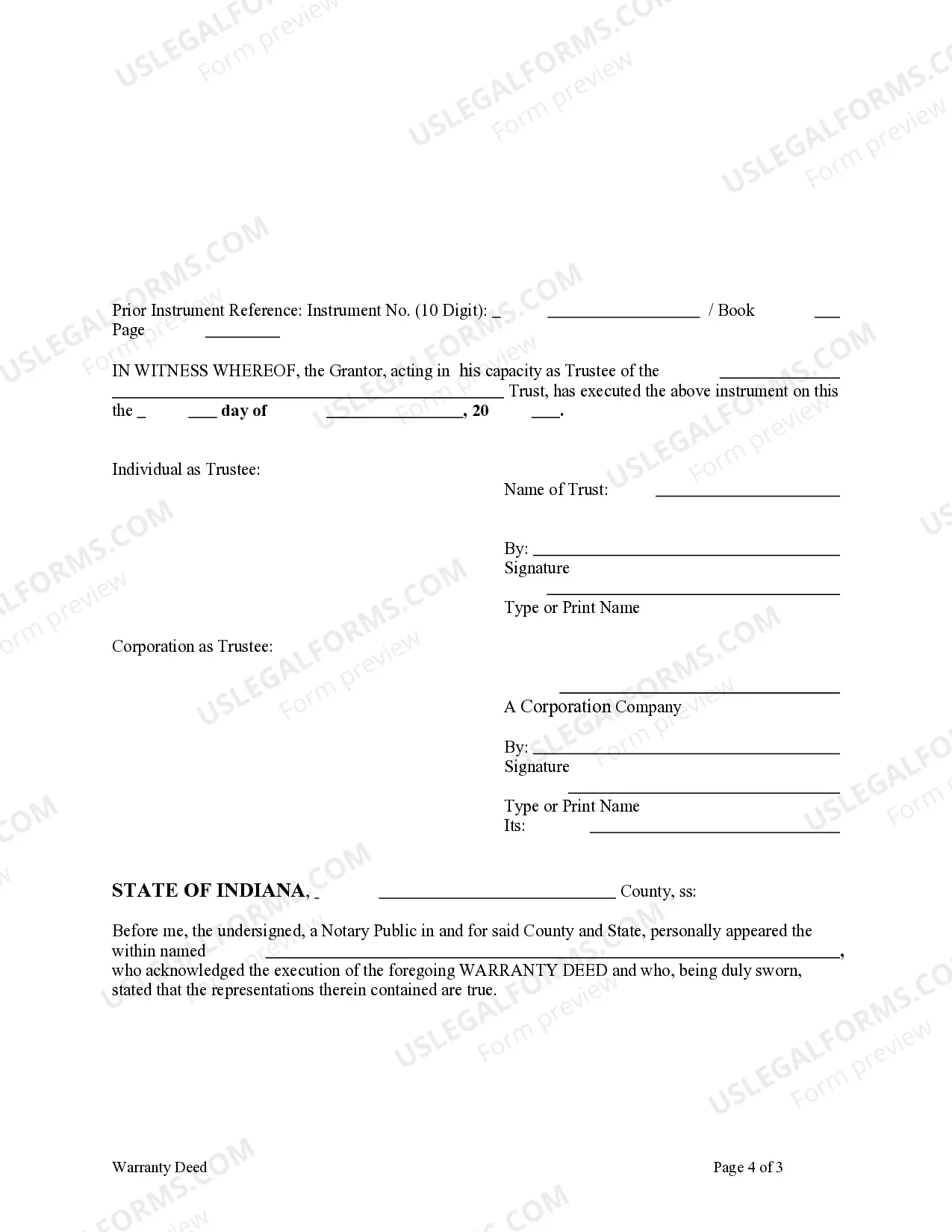

Transferring Indiana real estate usually involves four steps: Locate the prior deed to the property.Create the new deed.Sign the new deed.Record the original deed.

There are various modes of transferring ownership of property: permanently by 1) relinquishment 2) sale 3) gift; and temporarily by way of 4) mortgage 5) lease and, 6) leave and license agreement.

The process for transferring Alabama real estate by deed involves several steps: Find the most recent deed to the property.Create the new deed.Sign and notarize the deed.Record the signed, notarized original deed with the Office of the Judge of Probate.

Step 1. Determine and prepare the needed requirements for a title transfer. Deed of Conveyance.Photocopies of valid IDs of all signatories in the deed.The Notary Public's official receipt for the deed's notarization. Certified True Copy of the Title (3 copies)Certified True Copy of the latest Tax Declaration.

The Indiana TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

The recording charge is set by the county and we charge a administative fee. For counties from Erie, Elk, Franklin and Centre to Bucks, Berks, and Butler, the charge for a deed transfer across Pennsylvania is $700, with the sole exception of Philadelphia, which is $800. How long does it take?

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

A Conveyancing Solicitor will likely charge between £100 and £500 + VAT. It's always worth comparing prices of Conveyancing Solicitors so you get the right service for you for the best deal.