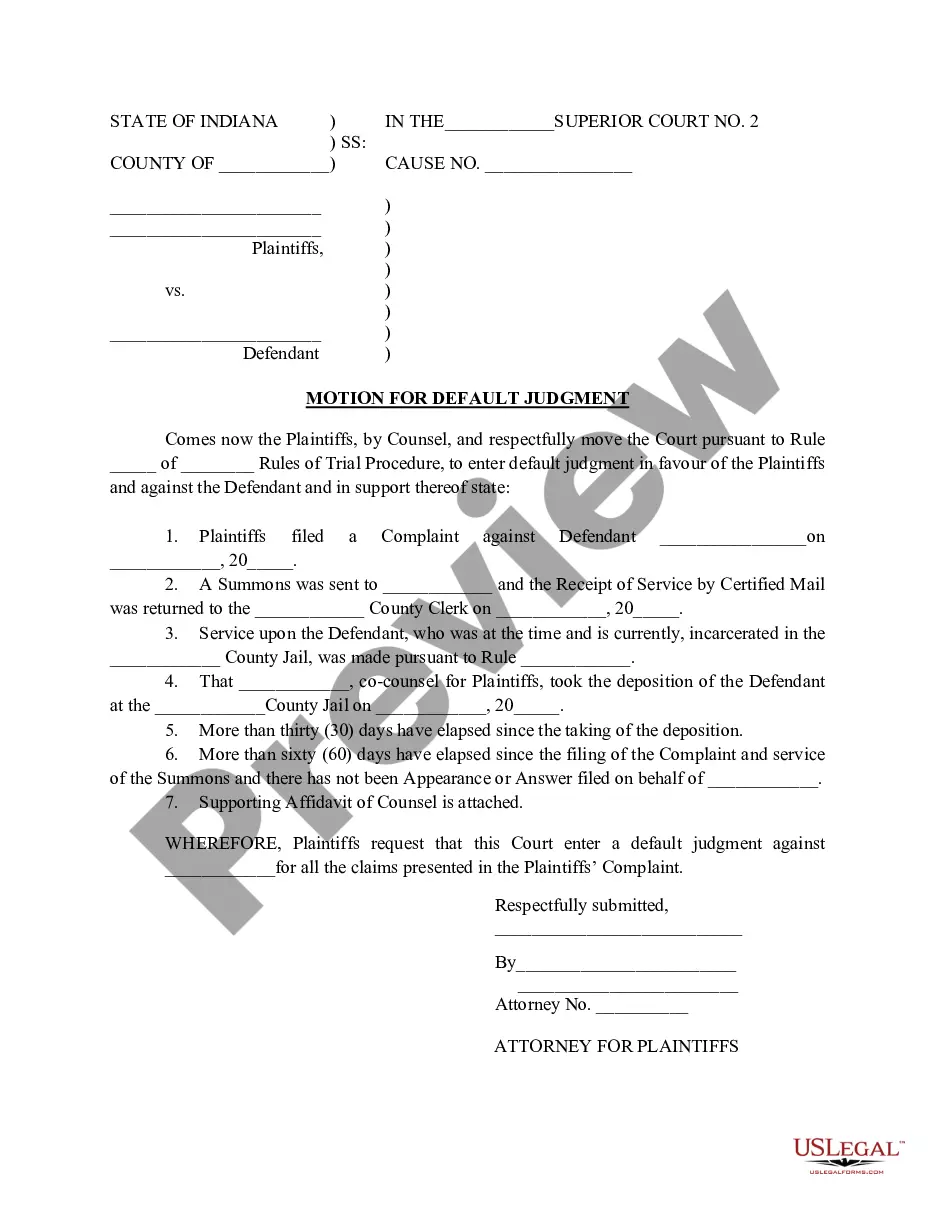

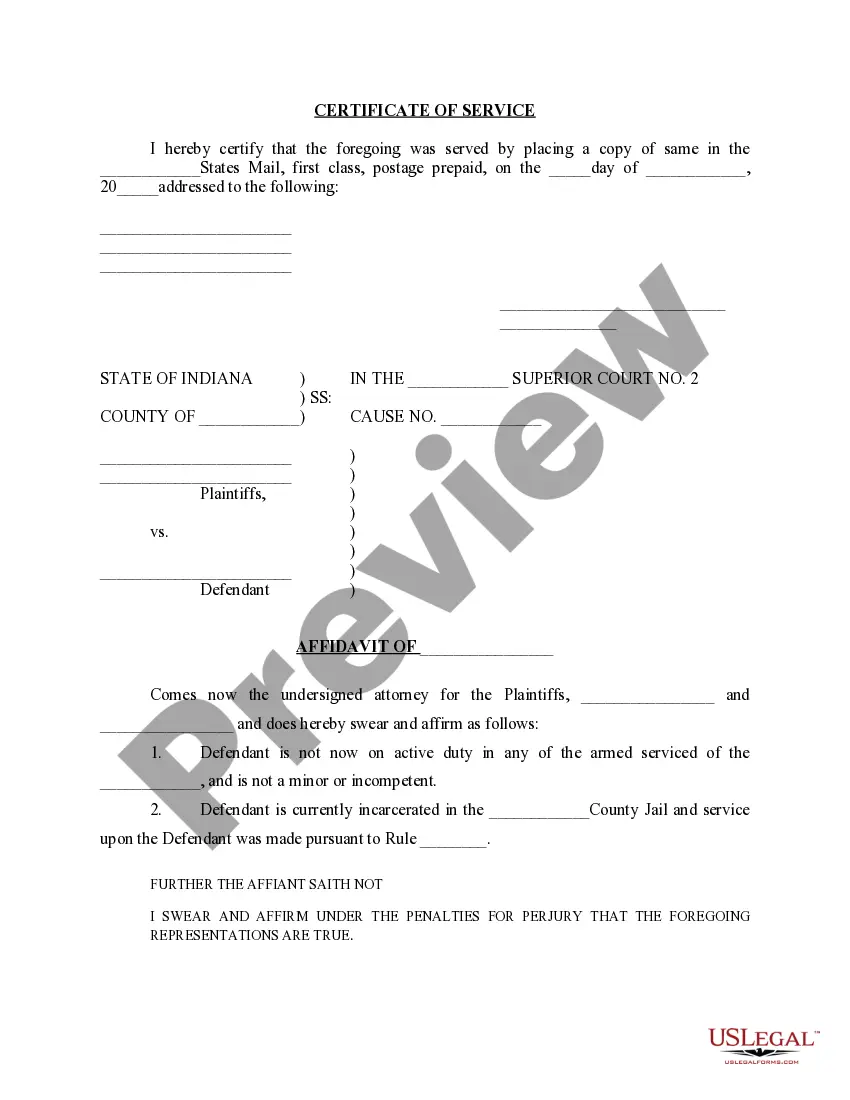

Indianapolis Indiana Motion for Default Judgment

Description

How to fill out Indiana Motion For Default Judgment?

If you have previously utilized our service, sign in to your account and download the Indianapolis Indiana Motion for Default Judgment onto your device by clicking the Download button. Ensure your subscription is active. If it is not, renew it based on your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or business requirements!

- Confirm you’ve found the correct document. Review the description and use the Preview option, if available, to verify if it satisfies your requirements. If it does not, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Set up an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Indianapolis Indiana Motion for Default Judgment. Choose the file format for your document and save it to your device.

- Fill out your template. Print it or use professional online editors to complete and sign it electronically.

Form popularity

FAQ

Under T.R. 53.2, if a judge takes a cause tried to the court under advisement and fails to determine any issue of law or fact within ninety (90) days of the submission of all pending matters, the case may be withdrawn from the judge. Ind.

It is a court judgment awarding a plaintiff the relief sought in the complaint because the defendant has failed to appear in court or otherwise respond to the complaint.

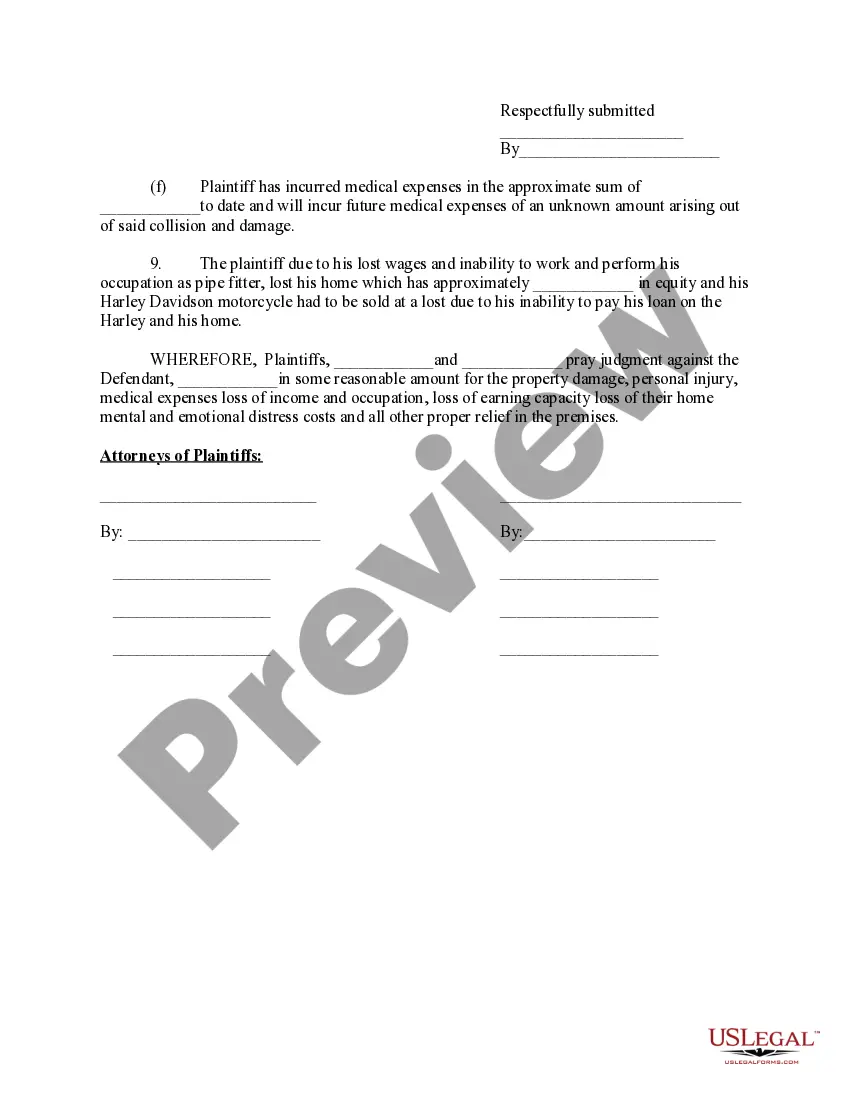

If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

A judgment remains on your credit record for 5 years or until it is paid in full or a rescission is granted by the courts. Although not always the case, in general a consumer is listed as defaulting before a credit provider applies for a judgment.

A default judgment (also known as judgment by default) is a ruling granted by a judge or court in favor of a plaintiff in the event that the defendant in a legal case fails to respond to a court summons or does not appear in court.

In the US, a default judgment is entered against the defaulting party without consideration of the merits of the case. A default judgment is binding and may be entered against a party who fails to: Respond to a complaint. Appear at a scheduled hearing or trial.

Generally, a default allows you to obtain an earlier final hearing to finish your case. Once the default is signed by the clerk, you can request a trial or final hearing in your case.

This would mean that the Defendant has entered appearance and is going to defend himself. However, if the Defendant has not entered an appearance within the time limit which is within 14 days after the service of writ. This is when the Plaintiff is entitled to obtain a Judgement in Default of Appearance.

When a loan defaults, it is sent to a debt collection agency whose job is to contact the borrower and receive the unpaid funds. Defaulting will drastically reduce your credit score, impact your ability to receive future credit, and can lead to the seizure of personal property.