This form is a Beneficiary or Transfer on Death Quitclaim Deed where the Grantor is an individual and the Grantee is an individual. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. The Deed has provisions for a contingent and a secondary contingent beneficiary. This deed complies with all state statutory laws.

Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual

Description

How to fill out Indiana Beneficiary Transfer On Death Quitclaim Deed From Individual To Individual?

We consistently endeavor to reduce or evade legal complications when addressing intricate legal or financial issues.

To achieve this, we seek legal services that, as a general rule, are exceptionally costly.

However, not every legal matter is of the same intricacy.

A majority of them can be handled independently.

Take advantage of US Legal Forms whenever you require to locate and retrieve the Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual or any other form swiftly and securely.

- US Legal Forms is an online compilation of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform empowers you to manage your affairs without relying on the assistance of a lawyer.

- We offer access to legal form templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, which significantly eases the search process.

Form popularity

FAQ

To transfer a deed after death in Indiana, you typically need the Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual form to be executed before the owner's death. After the owner passes away, you can file this deed with the county recorder. It is crucial to follow the specific guidelines and ensure all necessary documentation is prepared, which is where platforms like US Legal Forms can assist in providing the correct forms and instructions. By using their services, you can simplify the process of transferring property.

You do not necessarily need an attorney to execute a Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual, as the process can be straightforward. However, consulting with an attorney can provide clarity, especially if the property has complexities or potential disputes among beneficiaries. Having professional guidance can help prevent mistakes that might complicate the transfer in the future. It’s always a good idea to ensure you understand your obligations and options.

While the Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual offers many advantages, there are some disadvantages to consider. One major concern is that it does not provide protection from creditors, meaning your heirs could face claims against the property. Additionally, the title might complicate when multiple beneficiaries are involved, potentially leading to disputes. Understanding these factors is essential in making informed decisions.

One disadvantage of a transfer on death deed, like the Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual, is that it may not provide full control over the property post-death. For instance, if the beneficiary is unable to take possession or if multiple beneficiaries are named, disputes may arise. Additionally, changes in personal circumstances can complicate the intended outcome of the deed. Being aware of these potential issues beforehand can help you make more informed estate planning choices.

Engaging an attorney for a transfer on death deed, such as the Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual, is not mandatory but can be very helpful. Consulting with a qualified legal professional ensures that the deed complies with local laws and meets your specific needs. This assistance can clarify any complex issues and enhance the security of your estate planning decisions. Ultimately, it makes navigating the process smoother.

Yes, Indiana does allow the use of a transfer on death deed, specifically a Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual. This deed enables property owners to designate beneficiaries who will inherit property upon their death. It's a valuable tool in estate planning, as it simplifies the transfer of property and avoids the lengthy probate process. Knowing this can greatly enhance your estate planning toolkit.

While hiring a lawyer for a Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual is not legally required, it can be beneficial to consult with one. An attorney can help you navigate the specifics of Indiana law and ensure that your deed is executed properly. This knowledge can help prevent future legal complications and streamline the transfer process. Ultimately, it's about ensuring peace of mind regarding your estate plan.

A quitclaim deed transfers ownership interests in property without warranty, meaning the grantor makes no promises about the title's status. In contrast, a Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual allows a property owner to name a beneficiary who will receive the property upon their death. This deed does not affect the owner's rights during their lifetime and bypasses probate. Thus, understanding these differences can greatly influence estate planning strategies.

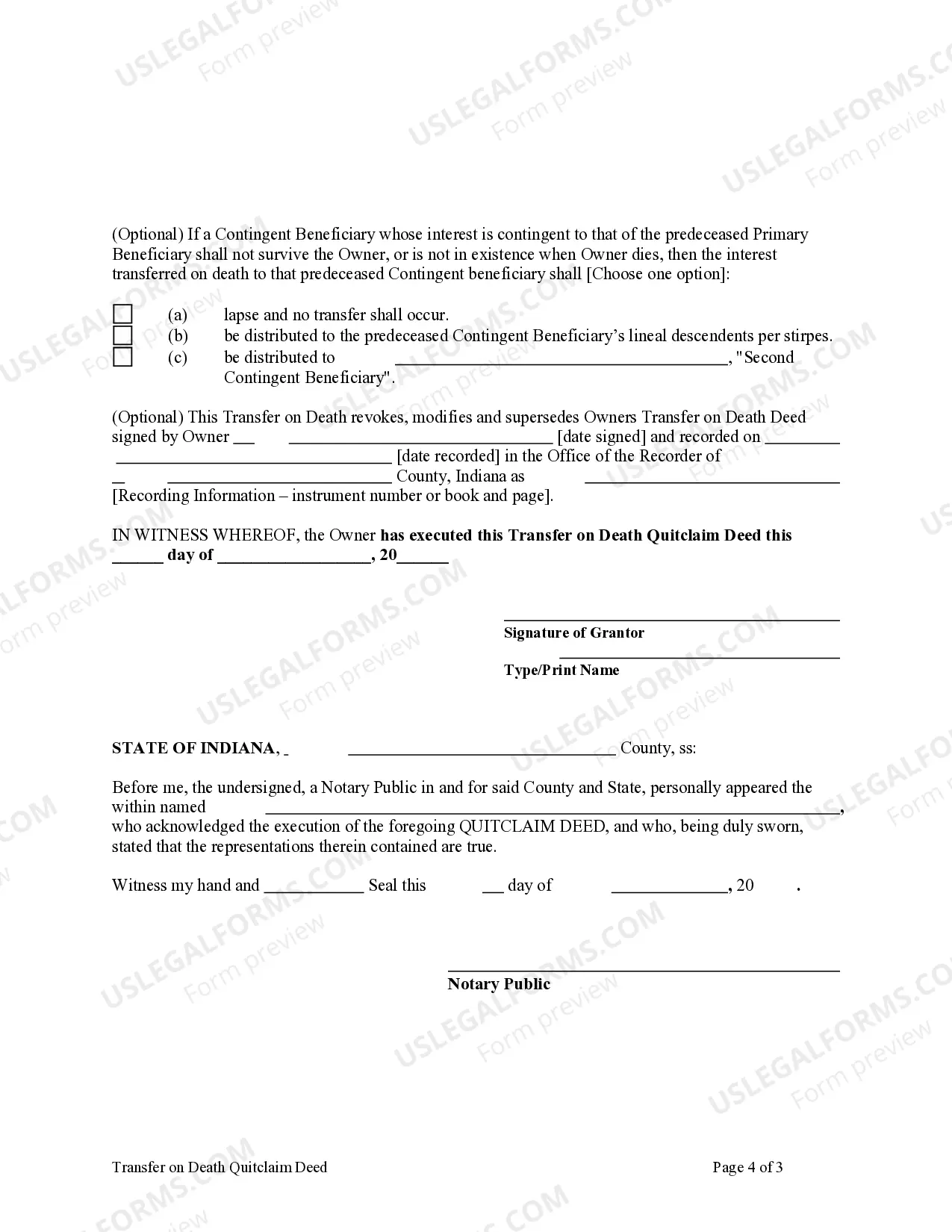

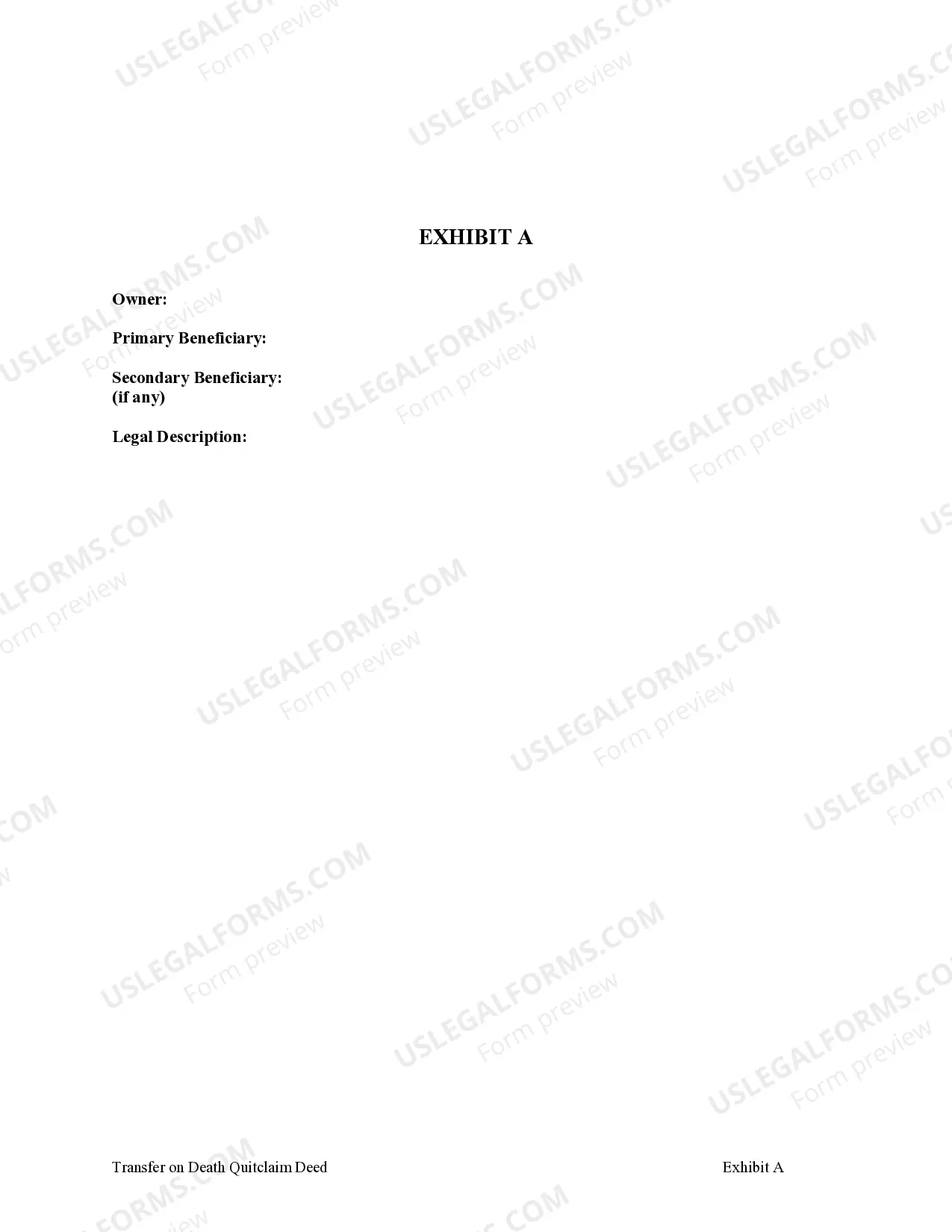

To execute a Transfer on Death deed in Indiana, you need to follow specific legal steps. First, you must complete the Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual form correctly. Ensure you provide the necessary details, including the names of both the grantor and the beneficiary. Once completed, you should sign the deed in front of a notary public and then record it with the county recorder's office to make it effective. For ease, you can find trusted resources on platforms like uslegalforms to assist you through this process.

Yes, a Transfer on Death deed avoids probate in Indiana. By utilizing the Fort Wayne Indiana Beneficiary Transfer on Death Quitclaim Deed from Individual to Individual, your property can transfer directly to your designated beneficiary without the complexities of the probate process. This can simplify the transfer for your heirs, allowing them to receive their inheritance more quickly and efficiently. Therefore, this option is often a practical choice for estate planning.