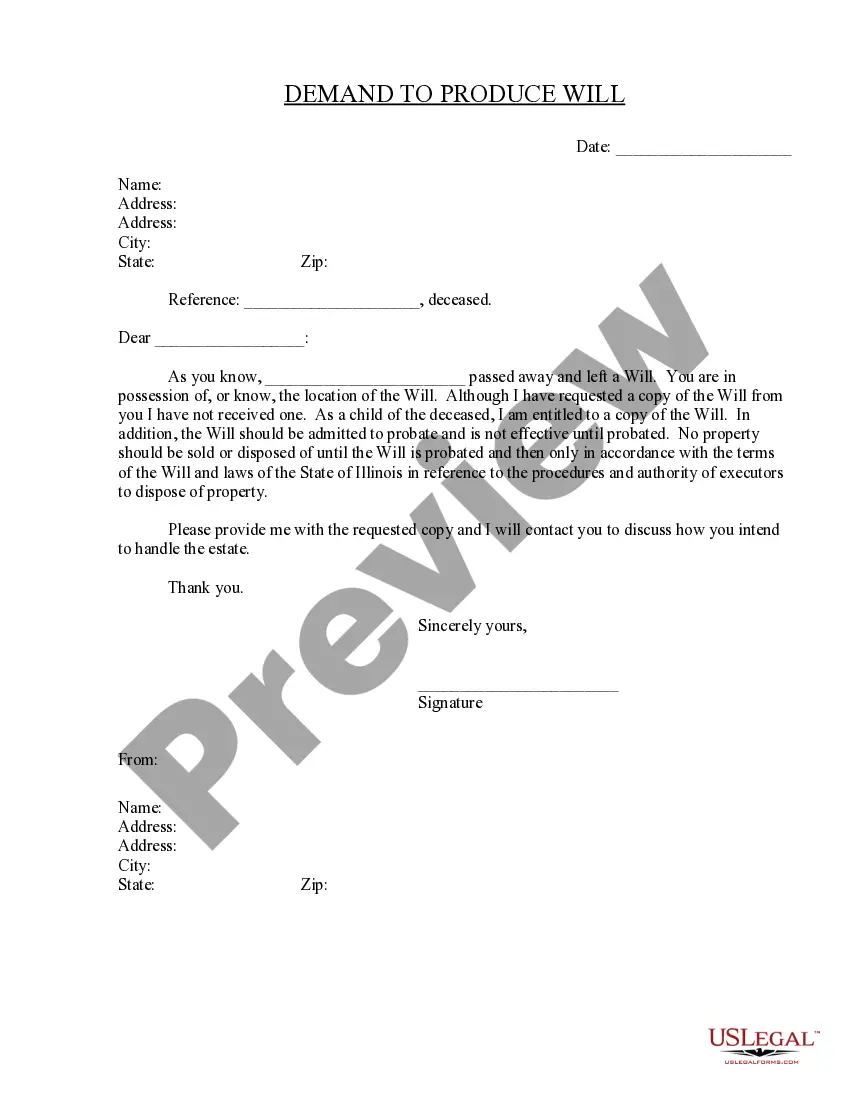

Chicago Illinois Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will

Description

How to fill out Illinois Demand To Produce Copy Of Will From Heir To Executor Or Person In Possession Of Will?

Regardless of social or professional standing, finishing legal paperwork is a regrettable requirement in the current professional landscape.

Frequently, it’s almost unfeasible for an individual without legal training to create such documents from the ground up, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Ensure that the form you’ve selected is suitable for your area as the regulations for one state or county do not apply to another.

Once the payment is confirmed, you can download the Chicago Illinois Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will.

- Our platform provides an extensive repository of over 85,000 immediately usable state-specific documents applicable to nearly any legal situation.

- US Legal Forms also functions as a fantastic tool for associates or legal advisors wishing to conserve time with our DIY forms.

- No matter if you need the Chicago Illinois Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will or any other document that is valid in your state or county, with US Legal Forms, everything is readily available.

- Here’s how you can obtain the Chicago Illinois Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will quickly through our dependable platform.

- If you are already a subscriber, you can go ahead and Log In to your account to acquire the relevant form.

- However, if you are new to our platform, make sure to adhere to these steps before obtaining the Chicago Illinois Demand to Produce Copy of Will from Heir to Executor or Person in Possession of Will.

Form popularity

FAQ

The easiest way to get a copy of the will is to contact the executor of the estate and request one. If you know who the executor is, this might be just a phone call. If you don't know who was named executor, you can call the Florida probate court in the county in which your father resided.

Beneficiaries have every right to see the accounting, including all of an executor's activities before the file is permanently closed. Technically, this is the only time the executor is required to share the accounting with all of the beneficiaries.

Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

Deadline to close the estate: 14 months from the date the will is admitted to probate. If the estate remains open after 14 months, the court will expect the representative to account or report to the court to explain why the estate needs to remain open.

Contact the probate court in the counties where the deceased lived to determine whether the will was registered. Contact a probate attorney for help. These attorneys have access to networks of other probate attorneys in the state, one of whom may have the will you are looking for.

It is common for beneficiaries to ask to see a copy of the Will. It is however your discretion as Executor whether or not to disclose it to the beneficiary.

In other words, an executor's powers arise from the will and not from the grant of probate. Therefore, a sole executor or, where there is more than one executor, all executors jointly, subject to adequate verification of identity, are entitled to the original will from the date of death.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

From the date at which the deceased passed away, there is an accepted period of 12 months for the Executor or Executors to begin the distribution of the Estate. This is known as 'Executor's Year', and allows good time for the locating of beneficiaries etc.

If they fail to cooperate it is possible to apply for an Order that they produce and account of the administration of the Estate. This can be used also if you have doubts about the inclusion or value of assets in the estate and This may then and determine whether further action is required.