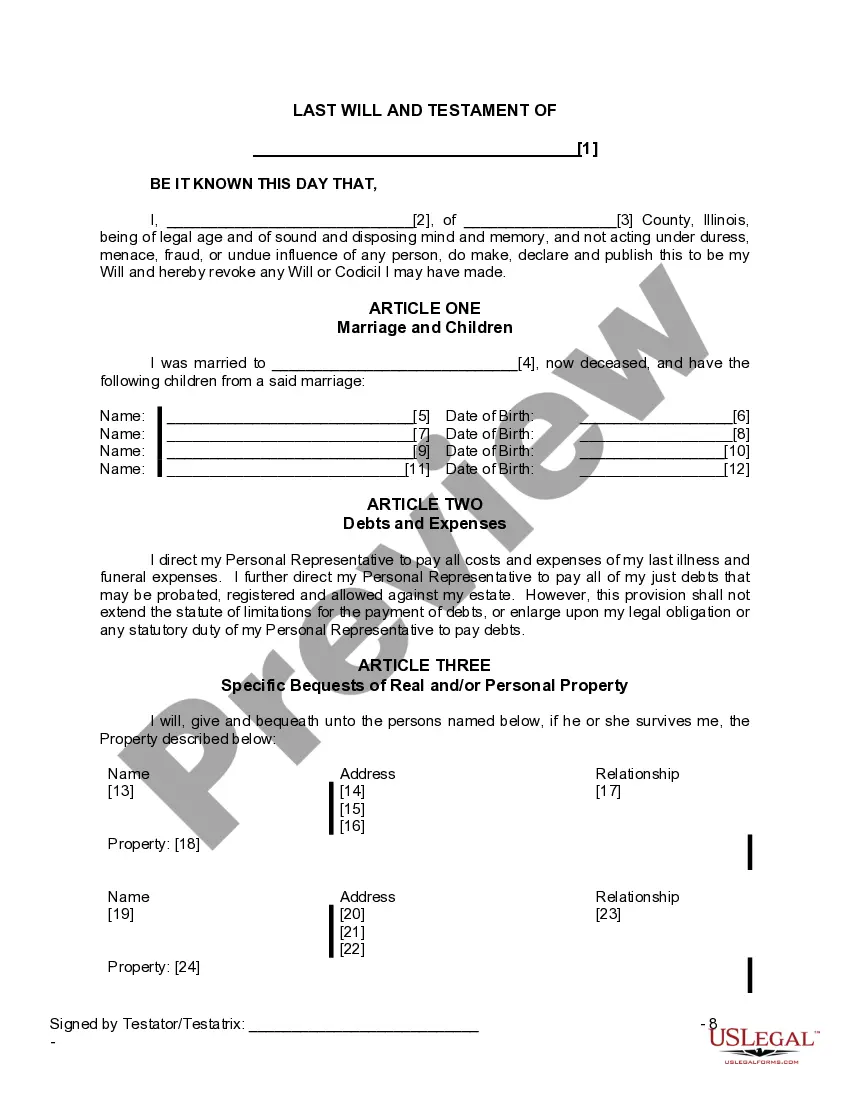

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children

Description

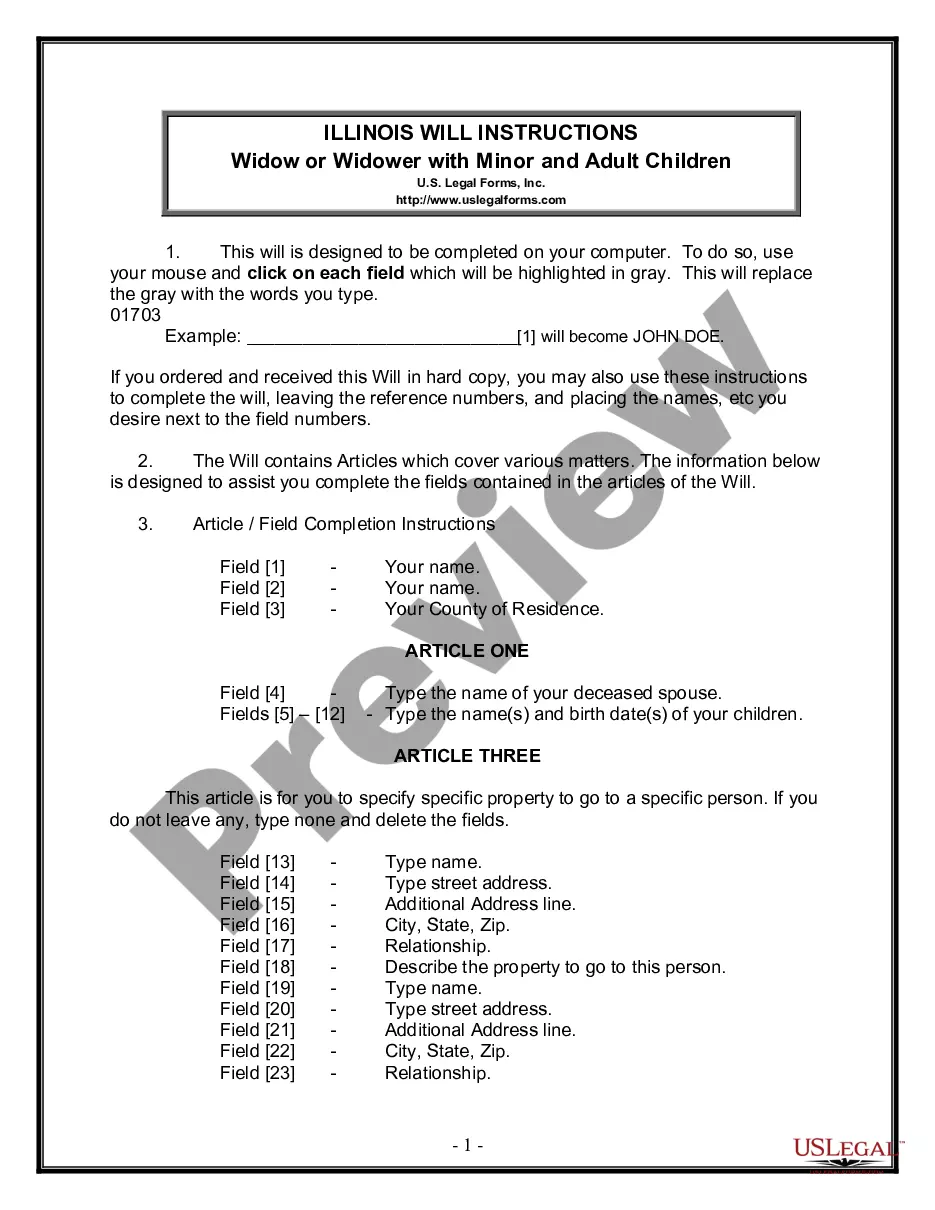

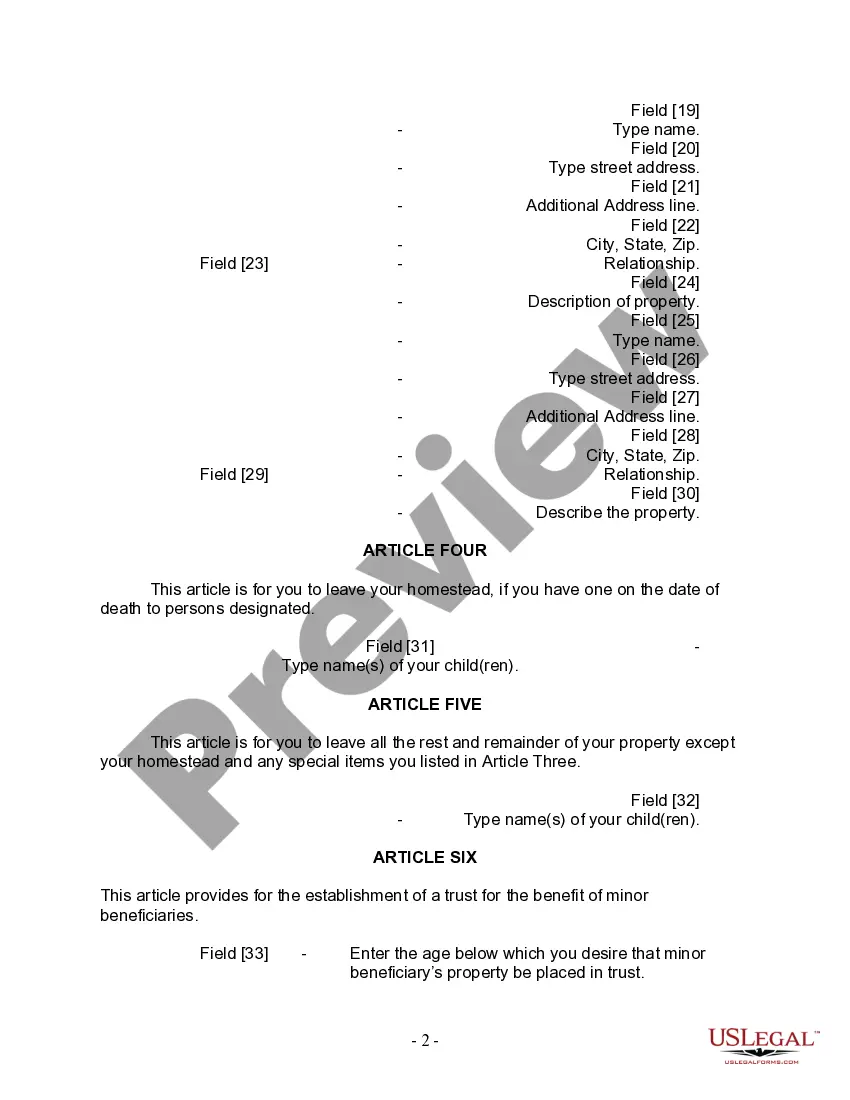

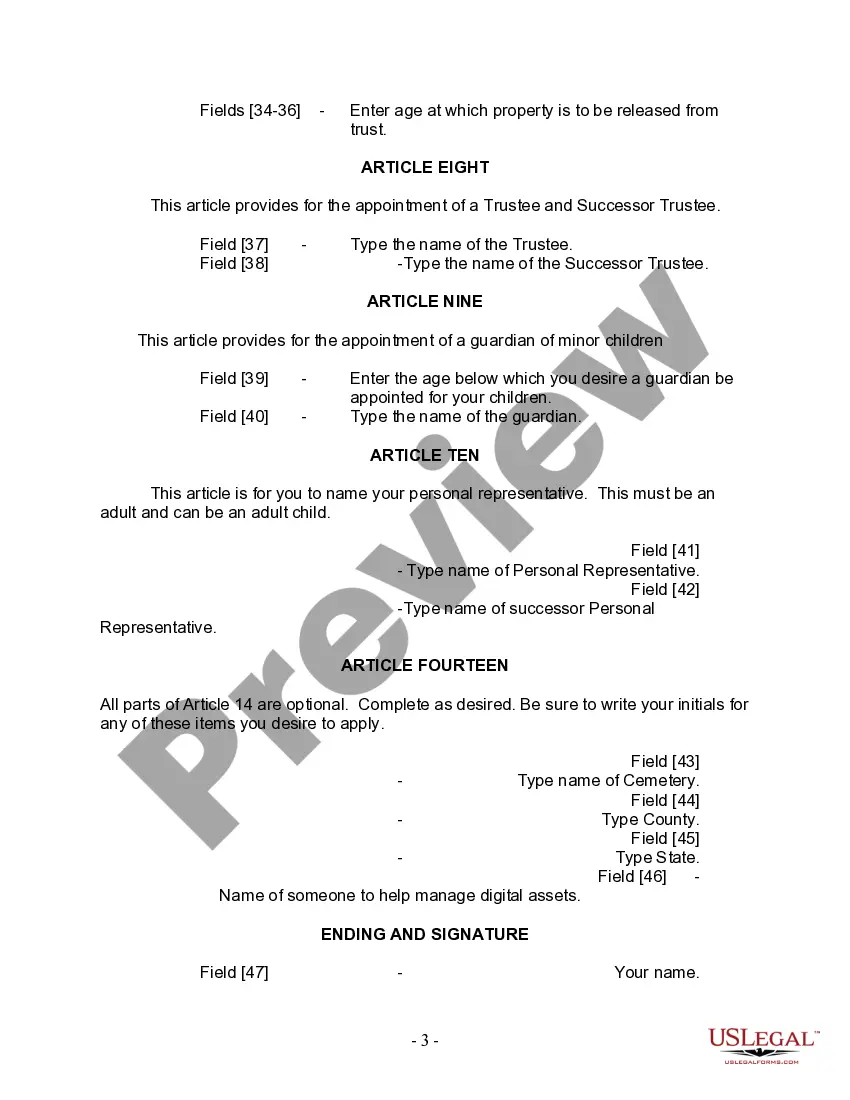

How to fill out Illinois Last Will And Testament For A Widow Or Widower With Adult And Minor Children?

We consistently aim to reduce or avert legal complications when managing intricate legal or financial matters.

To achieve this, we enlist attorney services that are generally quite costly.

Nevertheless, not all legal challenges are equally intricate.

The majority can be addressed by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the Cook Illinois Legal Last Will and Testament Form for a Widow or Widower with Adult and Minor Children, or any other form, quickly and securely.

- US Legal Forms is an online repository of current DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to take control of your affairs without requiring the services of legal representation.

- We offer access to legal form templates that are not always publicly accessible.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

While a surviving spouse in Illinois has strong inheritance rights, they do not inherit everything by default. The division of assets may depend on the existence of a will and the overall family structure. It's beneficial to create a Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children so your exact wishes regarding asset distribution are clearly outlined and followed.

In Illinois, a surviving spouse does not automatically inherit everything, but they are entitled to a significant share of the estate. If no will exists, the surviving spouse may receive a set portion of marital assets. Ensuring your wishes are documented through a Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children is essential for providing clarity regarding inheritance and protecting your rights.

If your husband dies and the house is in his name, ownership typically transfers to the surviving spouse or according to the will's terms. In some cases, rights can be claimed through joint tenancy or a surviving spouse award. Knowing how property ownership works in these situations can help navigate the complexities, so consider using a Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children to clarify future arrangements.

Writing your own will in Illinois involves outlining how you wish to distribute your property and designating guardians for any minor children. Start by gathering essential information, then use clear language to express your wishes. Resources like USLegalForms can provide valuable templates and guidance to create a comprehensive Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children.

Yes, filing a will is typically necessary after a spouse's death in order to initiate the probate process. This legal procedure helps to validate the will and ensure that the deceased's wishes are honored. It's important for widows and widowers to understand this process, especially when dealing with a Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children, as it directly impacts estate management.

After a husband's death, the wife retains significant rights, including the right to inherit their share of marital property. In Illinois, the surviving spouse may also claim a portion of the deceased spouse's estate, known as a statutory share. Understanding these rights helps widows navigate the complexities of estate distribution, making the Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children an essential tool.

To fill out your last will and testament, start by clearly identifying yourself and your intentions. Include specific details about the distribution of your property, considering both adult and minor children. Utilizing a user-friendly platform like USLegalForms can simplify this process, providing templates that ensure your Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children meets all legal requirements.

In Illinois, the surviving spouse award provides financial support to the widow or widower after the death of their spouse. This award can help cover living expenses, ensuring that the surviving spouse can maintain a stable life during a difficult time. It's crucial for widows and widowers to know their rights and the benefits available under the law, particularly when considering a Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children.

Yes, you can write your own will in Illinois, and many people choose to do so to save on legal fees. However, it's crucial to ensure that the will complies with state laws to be considered valid. Using a straightforward template, like a Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children, can provide you with the structure you need while covering all necessary elements. This way, you can be confident that your wishes will be respected after your passing.

In Illinois, a will must be written and signed by the person creating it, known as the testator. The signature should be witnessed by at least two individuals who are present at the same time. It's also essential that the testator is of sound mind and at least 18 years old. Utilizing a Cook Illinois Last Will and Testament for a Widow or Widower with Adult and Minor Children can simplify these requirements and ensure your will meets all legal standards.