Naperville Illinois Satisfaction, Release or Cancellation of Mortgage by Individual

Description

How to fill out Illinois Satisfaction, Release Or Cancellation Of Mortgage By Individual?

We consistently aim to reduce or evade legal repercussions when handling intricate legal or financial issues.

To achieve this, we enroll in legal services that are typically quite costly.

However, not every legal concern is excessively complicated; most can be resolved independently.

US Legal Forms is an online repository of current DIY legal paperwork covering everything from wills and power of attorney to articles of incorporation and dissolution petitions.

To do this, simply Log In to your account and click the Get button adjacent to it. If you happen to misplace the form, you can always retrieve it again from within the My documents section. The procedure is equally uncomplicated if you’re new to the platform! You can establish your account in a matter of minutes. Ensure you verify that the Naperville Illinois Satisfaction, Release or Cancellation of Mortgage by Individual complies with the laws and regulations of your locality. Additionally, it’s important to review the form’s outline (if available), and if you detect any inconsistencies with what you were initially seeking, look for an alternative template. Once you confirm that the Naperville Illinois Satisfaction, Release or Cancellation of Mortgage by Individual is appropriate for your needs, you can choose a subscription plan and complete your payment. Then you can download the form in any preferred format. With over 24 years in the market, we’ve assisted millions by providing customizable and current legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your affairs without the need for an attorney.

- We provide access to legal form templates that aren’t universally available.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Leverage US Legal Forms whenever you require to locate and download the Naperville Illinois Satisfaction, Release or Cancellation of Mortgage by Individual or any other form with ease and security.

Form popularity

FAQ

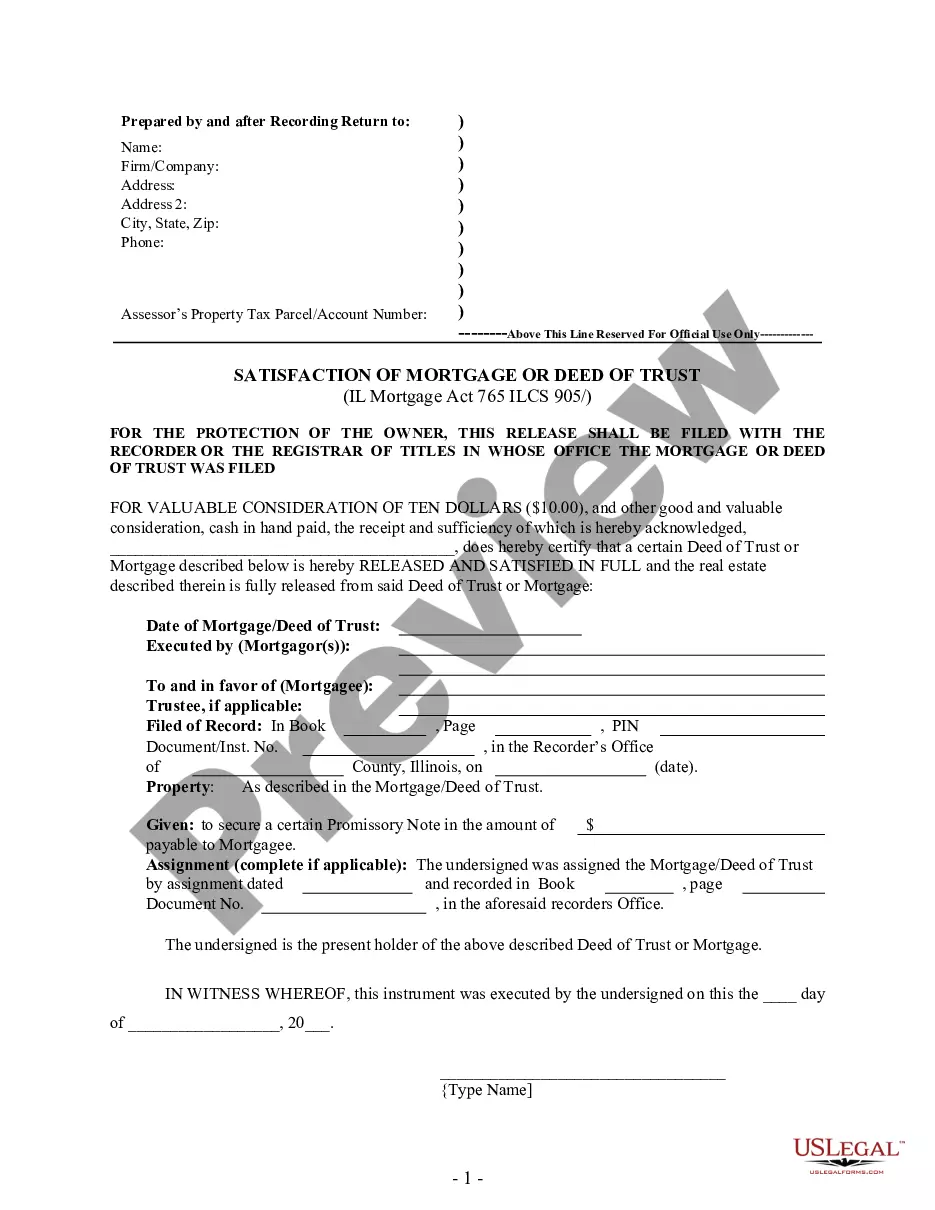

While both terms relate to the conclusion of a mortgage, a release typically refers to the legal process of removing a lien from public records, whereas satisfaction confirms the mortgage has been fulfilled. Understanding these differences is vital for homeowners in Naperville, Illinois, dealing with a Satisfaction, Release or Cancellation of Mortgage by Individual. Legal platforms like uslegalforms can guide you through the nuances of these terms, ensuring that all documents are prepared correctly and in compliance with state requirements.

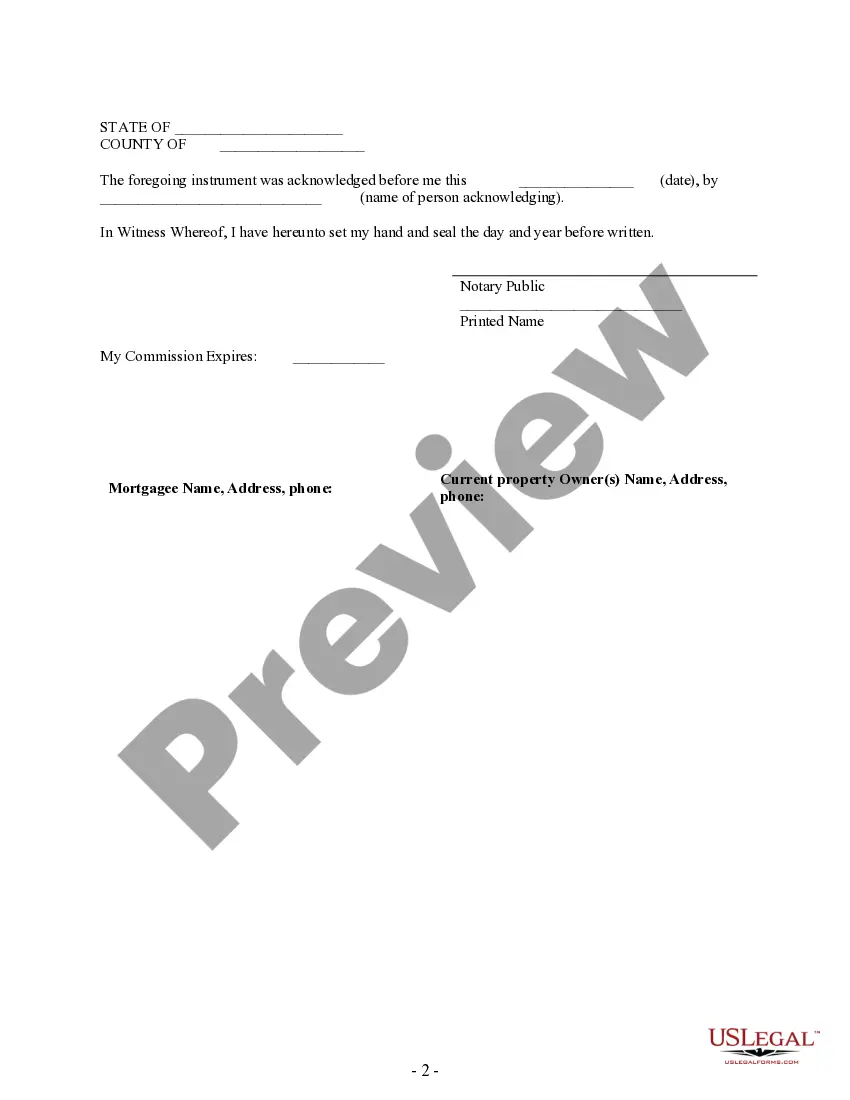

In Naperville, Illinois, a satisfaction of mortgage typically does require notarization. This process ensures that the document is legally valid and properly executed. By obtaining notarization, you provide additional credibility to your satisfaction document, making it easier to record in public records. This practice can help streamline the release of your mortgage and protect your interests.

The satisfaction of a mortgage is typically filed by the lender with the local county recorder's office. Once the lender has signed the document, they are responsible for ensuring it is officially recorded. This filing effectively updates public records to show that the mortgage has been satisfied, completing the Naperville Illinois Satisfaction, Release or Cancellation of Mortgage by Individual process for homeowners.

To obtain satisfaction of a mortgage in Naperville, Illinois, you should first make the final payment on your mortgage. Once this payment processes, the lender will prepare the satisfaction document. You can then request a copy from your lender or obtain one through a service like uslegalforms, which streamlines the Naperville Illinois Satisfaction, Release or Cancellation of Mortgage by Individual process.

Filing a mortgage release in Naperville, Illinois, involves several steps. You need to prepare the satisfaction of mortgage document, ensuring it has the appropriate signatures, and then file it with the county recorder's office. This officially removes the lien from your property. Using ulegalforms can help guide you through creating the necessary documents for this process.

Releasing an assignment of a mortgage in Naperville, Illinois, requires specific steps to ensure legal compliance. You start by obtaining the proper form from the county recorder or your lender, where necessary. Fill out all required details, carefully ensuring that your information is complete. After that, submit it to the county recorder's office. This process officially releases any claims tied to the mortgage.

In Naperville, Illinois, you should expect to receive your mortgage satisfaction letter shortly after your final payment is processed. Most lenders send this letter within 30 days, acknowledging that you have met all payment obligations. If you find that the letter is delayed, it’s wise to follow up with your lender promptly. A timely satisfaction letter is crucial for maintaining accurate property records.

Filling out a satisfaction of mortgage in Naperville, Illinois, involves a few straightforward steps. Begin by obtaining the correct form, often available through your lender or local government website. You will typically need to include basic information such as your property address, mortgage account number, and lender details. Clear and accurate information will help ensure the document is processed without any delays.

If no satisfaction of a mortgage is recorded in Naperville, Illinois, the mortgage may still appear active, which can lead to various complications. Lenders might retain a claim on the property until the satisfaction is properly filed. This situation could create challenges if you wish to sell or refinance the property. It’s crucial to ensure the satisfaction is recorded to avoid any future legal or financial issues.

The time it takes to receive a satisfaction of a mortgage in Naperville, Illinois, can vary. Generally, after you make the final payment, the lender should send you the satisfaction document within a few weeks. Once you file this document with the county, it may take additional time for the office to officially record it. Overall, the entire process could take anywhere from a few weeks to a couple of months.