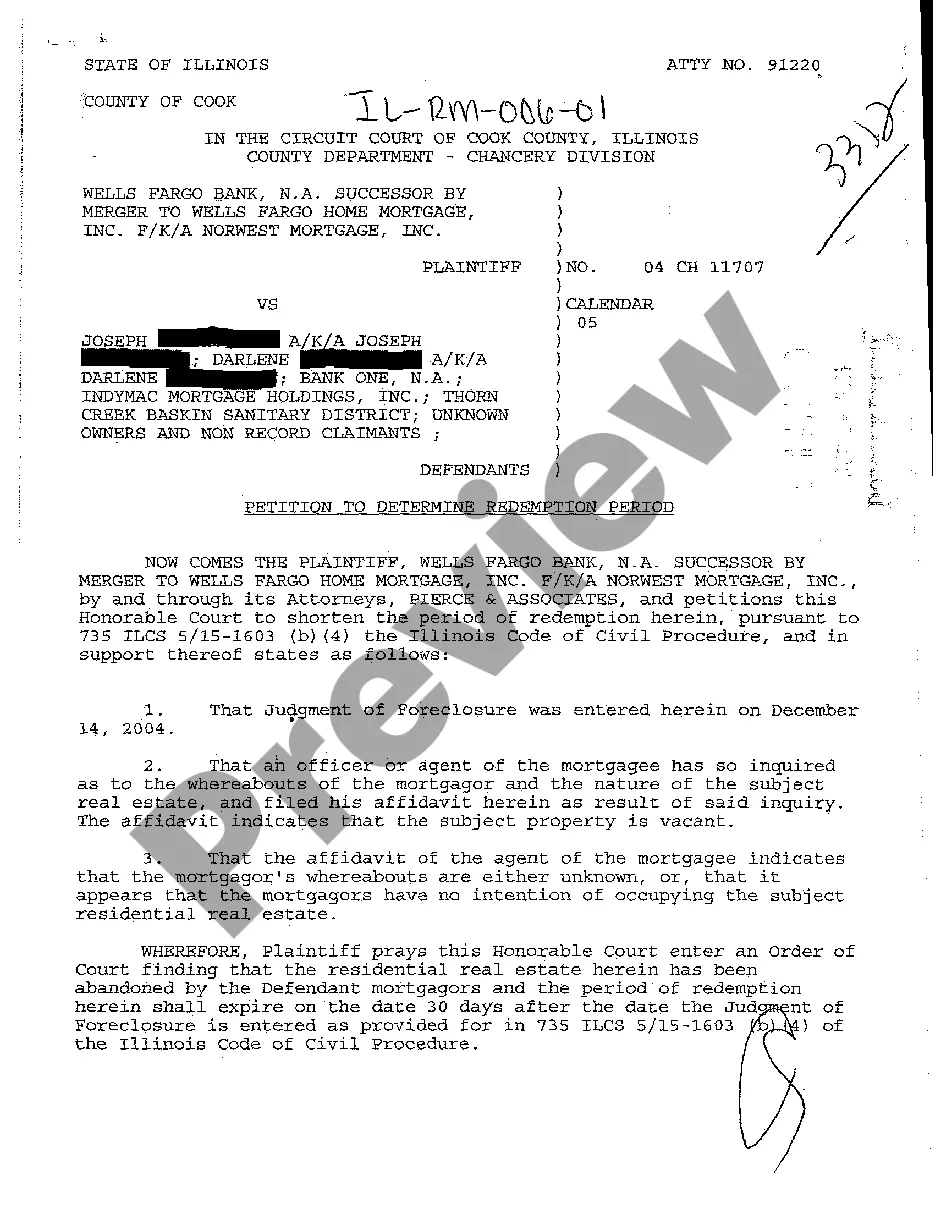

Rockford Illinois Petition To Determine Redemption Period

Description

How to fill out Illinois Petition To Determine Redemption Period?

Are you searching for a reliable and cost-effective provider of legal forms to obtain the Rockford Illinois Petition To Determine Redemption Period? US Legal Forms is your preferred option.

Whether you need a straightforward agreement to establish rules for living with your partner or a set of forms to facilitate your separation or divorce through the court, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and business needs. All templates we provide are not generic and are tailored according to the requirements of distinct states and regions.

To download the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents tab.

Is this your first visit to our website? No problem. You can easily create an account, but before doing so, make sure to take the following steps.

Now you can create your account. Then, choose the subscription plan and proceed with the payment. Once the payment is processed, download the Rockford Illinois Petition To Determine Redemption Period in any available file format. You may revisit the website anytime to redownload the document at no additional cost.

Finding current legal forms has never been simpler. Give US Legal Forms a try today, and stop wasting your valuable time attempting to navigate legal paperwork online once and for all.

- Verify if the Rockford Illinois Petition To Determine Redemption Period meets the regulations of your state and locality.

- Review the form’s description (if available) to understand who and what the document is designed for.

- Begin the search anew if the form does not suit your legal circumstances.

Form popularity

FAQ

Yes, Illinois allows a redemption period during foreclosure, which is generally six months for residential properties. Homeowners can file a Rockford Illinois Petition To Determine Redemption Period within this timeframe to clarify their options for regaining their property. Knowing this information empowers homeowners to navigate the process effectively and seek assistance when needed.

The redemption period for a tax lien in Arizona typically lasts for three years, giving property owners a set timeframe to reclaim their property. During this period, the owner can file a Rockford Illinois Petition To Determine Redemption Period to solidify their intentions to redeem. Understanding this timeline helps homeowners make informed decisions and act swiftly if they wish to recover their property.

In many cases, you may be eligible for a property tax refund upon selling your house, depending on local laws and the specific circumstances of your sale. If taxes were overpaid, you can file for a rebate, which may require submitting a Rockford Illinois Petition To Determine Redemption Period if there are outstanding tax issues. Overall, it’s crucial to keep records and understand the potential for refunds to maximize your financial outcome.

When recording the sale of a property on your tax return, you must report the sale's details on Schedule D of Form 1040. Ensure you include any gain or loss from the sale and consider the implications of the Rockford Illinois Petition To Determine Redemption Period, which may affect your financial responsibilities. Take note of any capital gains tax that may apply as well. Consulting a tax professional can provide clarity and ensure compliance.

In Illinois, the special right to redeem allows property owners to reclaim their property after a tax sale by settling their outstanding taxes and fees. This right is crucial as it provides an opportunity for homeowners to reverse the tax sale. Utilizing the Rockford Illinois Petition To Determine Redemption Period can assist you in understanding and exercising this right effectively.

Some states, like Texas and Nevada, have no official redemption period for property taxes. Once the property is sold at tax auction, it typically cannot be redeemed. If you're exploring the implications of a tax sale or the redemption process, focusing on the Rockford Illinois Petition To Determine Redemption Period can help clarify your options in states with different rules.

In Illinois, there is no specific age at which residents stop paying property taxes. However, there are exemptions available for seniors, which can significantly reduce tax obligations. By utilizing the Rockford Illinois Petition To Determine Redemption Period, seniors can better understand their eligibility for these exemptions and any related benefits.

In Illinois, you can claim property taxes for up to two years prior to the current year. This means if you missed a payment, you can address it retroactively within that timeframe. To navigate this process effectively, consider the Rockford Illinois Petition To Determine Redemption Period, which can clarify your rights and options regarding unpaid taxes.

The right of redemption refers to the opportunity for previous property owners to reclaim their homes after a foreclosure or tax sale. This right affects buyers, as it means they must be aware of potential claims from former owners. In Rockford, Illinois, understanding the implications of a Petition To Determine Redemption Period can be crucial when investing in real estate.

The right of redemption in Illinois allows property owners to recover their properties after a tax sale by paying off the owed taxes and any penalties. This right typically lasts for a specified period, giving owners a fair opportunity to reclaim their assets. Utilizing a Rockford Illinois Petition To Determine Redemption Period can streamline the process and clarify your timeframe for redemption.