Rockford Illinois Closing Statement

Description

How to fill out Illinois Closing Statement?

If you have previously utilized our service, Log In to your account and download the Rockford Illinois Closing Statement onto your device by pressing the Download button. Ensure that your subscription is active. If it’s not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have endless access to every document you have bought: you can find it in your profile under the My documents section whenever you need to use it again. Leverage the US Legal Forms service to effortlessly find and save any template for your personal or business requirements!

- Confirm that you have found the correct document. Review the description and utilize the Preview feature, if available, to verify if it aligns with your requirements. If it does not meet your needs, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Establish an account and make a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Rockford Illinois Closing Statement. Choose the file format for your document and save it on your device.

- Complete your document. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

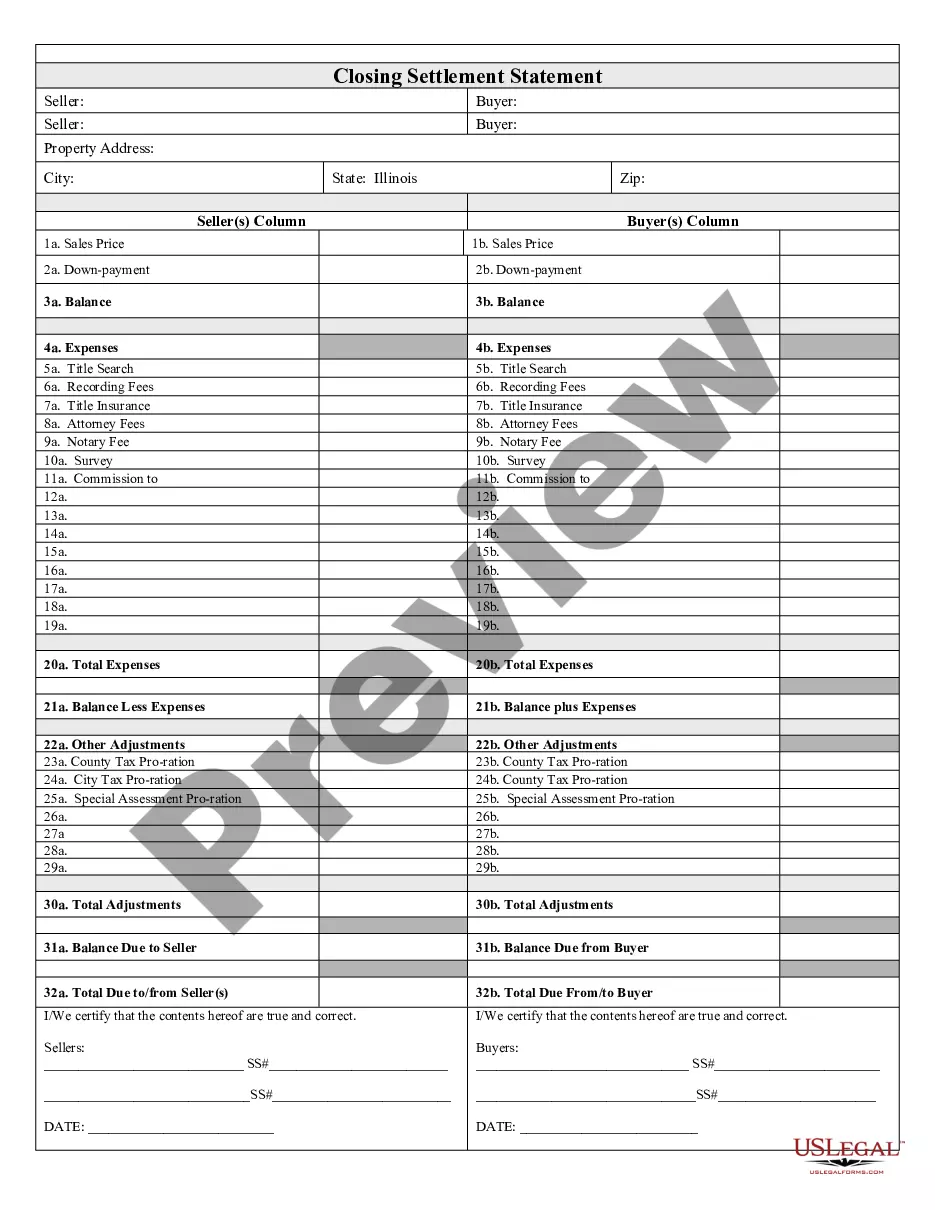

The final closing statement is typically provided by the closing agent or title company overseeing the transaction. They prepare this document to ensure all financial details are clear to both parties involved. In Rockford, Illinois, it is important to verify that this statement is accurate to avoid any potential issues during your closing.

Your closing statement should accurately represent all costs associated with your real estate transaction, including any credits or debits. In Rockford, Illinois, reviewing your closing statement carefully is crucial for ensuring that all figures are correct and that you understand your financial obligations. Consulting with a trusted professional or using uslegalforms can help clarify these details.

To obtain a closing statement in Illinois, you typically need to work with your closing attorney or title company, as they prepare this document. They will provide a detailed Rockford Illinois Closing Statement that outlines all costs associated with the transaction. Make sure to request this document ahead of closing day to clarify any uncertainties. This proactive approach helps you understand your financial responsibilities better.

In Illinois, closing documents are usually prepared by the closing attorney or title company managing the transaction. This professional organizes all the necessary documents, ensuring that they meet legal requirements. As part of this process, you'll receive a comprehensive Rockford Illinois Closing Statement, which outlines your financial obligations in detail. Engaging a reputable professional can simplify this complex step.

The closing process involves several key steps, starting with a title search and ending with the signing of documents. You'll need to review and finalize financing, complete inspections, and negotiate repairs as necessary. Each step is crucial to ensure a smooth transition into your new home. Finally, the Rockford Illinois Closing Statement will itemize costs and confirm all the details of the transaction.

In Illinois, the closing process typically takes between 30 to 45 days after your offer has been accepted. Various factors can influence this timeline, including inspections, lender processing times, and local laws. Considering these elements, it’s crucial to stay organized and monitor your progress. Getting a clear Rockford Illinois Closing Statement at the end solidifies your understanding of the transaction.

A mortgage closing statement lists all of the costs and fees associated with the loan, as well as the total amount and payment schedule. A closing statement or credit agreement is provided with any type of loan, often with the application itself.

The Seller's Closing Statement, or Settlement Statement, is an itemized list of fees and credits that shows your net profits as the seller, and sums up the finances of the entire transaction.

Closing Checklist means the schedule, including all appendices, exhibits or schedules thereto, listing certain documents and information to be delivered in connection with the Agreement, the other Loan Documents and the transactions contemplated thereunder, substantially in the form attached hereto as Annex D.

Closing arguments are the opportunity for each party to remind jurors about key evidence presented and to persuade them to adopt an interpretation favorable to their position.