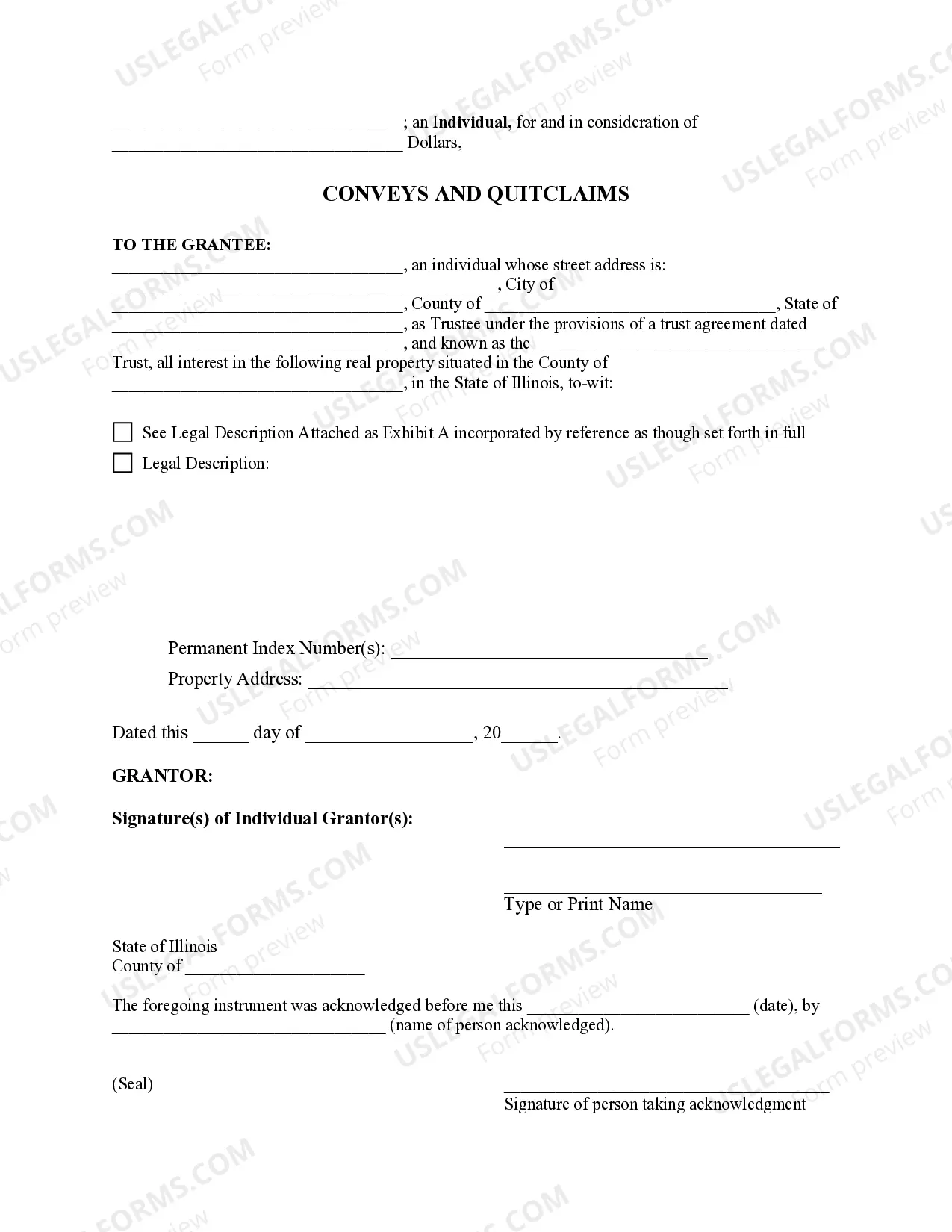

This form is a Quitclaim Deed where the Grantor is an individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Chicago Illinois Quitclaim Deed from an Individual to a Trust

Description

How to fill out Illinois Quitclaim Deed From An Individual To A Trust?

If you are in search of a pertinent form template, it’s challenging to uncover a more convenient service than the US Legal Forms website – arguably the most exhaustive online repositories.

Here you can obtain a vast array of document samples for business and personal use categorized by type and region, or by keywords.

With the excellent search feature, locating the latest Chicago Illinois Quitclaim Deed from an Individual to a Trust is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finish the registration process.

Obtain the template. Choose the file format and save it to your device. Modify as needed. Complete, alter, print, and sign the obtained Chicago Illinois Quitclaim Deed from an Individual to a Trust.

- Furthermore, the relevance of each file is verified by a group of skilled attorneys who regularly review the templates on our platform and refresh them according to the most recent state and county regulations.

- If you are already familiar with our system and possess an account, all you need to acquire the Chicago Illinois Quitclaim Deed from an Individual to a Trust is to Log In to your profile and click the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the instructions provided below.

- Ensure you have selected the form you need. Read its description and utilize the Preview option to examine its contents. If it does not satisfy your requirements, use the Search function at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. Subsequently, choose the desired subscription plan and provide your information to register for an account.

Form popularity

FAQ

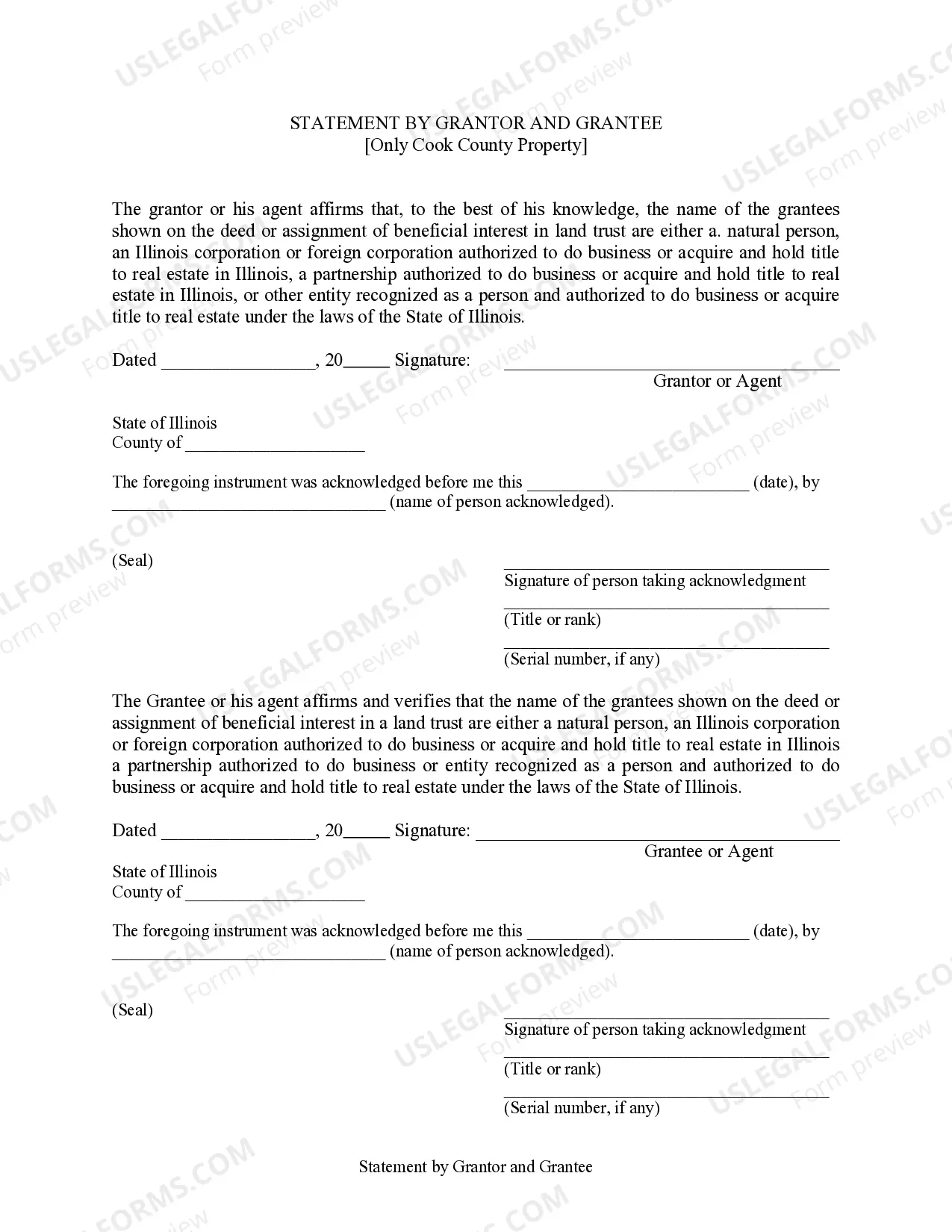

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

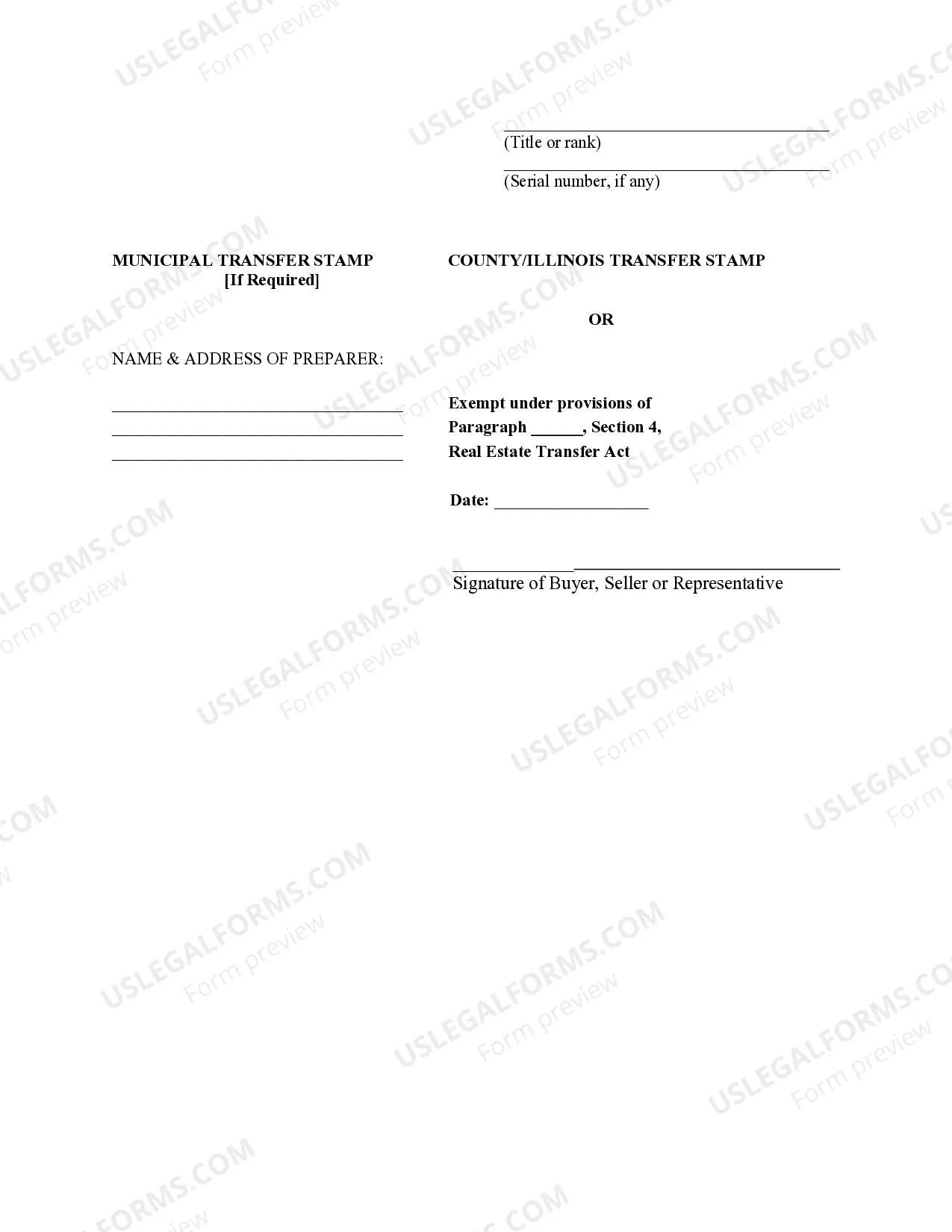

Overview of Illinois Real Estate Transfer Tax State real estate transfer tax are imposed at a rate of $0.50 per $500 of value stated in the Transfer Tax Return. County real estate transfer tax are imposed at a rate of $0.25 per $500 of value stated in the Transfer Tax Return.

If you want to transfer real estate in Illinois to a relative or a friend, you might consider doing this yourself by using a quitclaim deed. A quitclaim deed in Illinois is often used to transfer property between close family members or trusted friends.

A quitclaim deed requires trust on the part of the person receiving the deed, because the person transferring it, also known as the grantor, isn't guaranteeing they actually own the property. With a quitclaim deed, when you're getting the property, you're only getting what the grantor actually owns.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.

It usually takes four to six weeks to complete the legal processes involved in the transfer of title.

Recording the Quitclaim Deed with the County All counties in Illinois now have flat / fixed pricing to record the deed. Amounts vary from $54 to $98 depending on the county.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The most basic service that most people chose is for me to prepare the Illinois quitclaim deed and grantor/grantee statement for $150. With this option, it will be your responsibility to get the local transfer stamp (if required) and get the deed recorded with the County Recorder.

In Illinois, the real estate transfer process usually involves four steps: Locate the most recent deed to the property.Create the new deed.Sign and notarize the new deed.Record the deed in the Illinois land records.