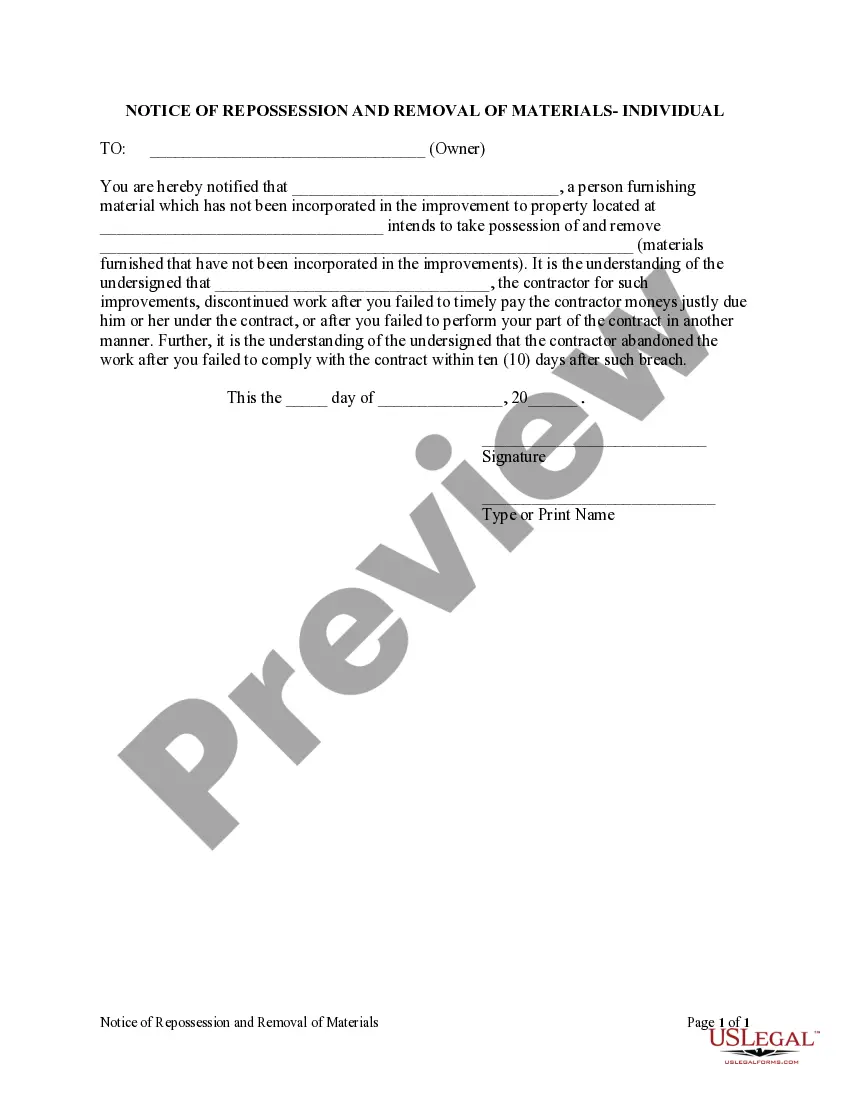

Chicago Illinois Notice of Repossession and Removal of Materials - Corporation or LLC

Description

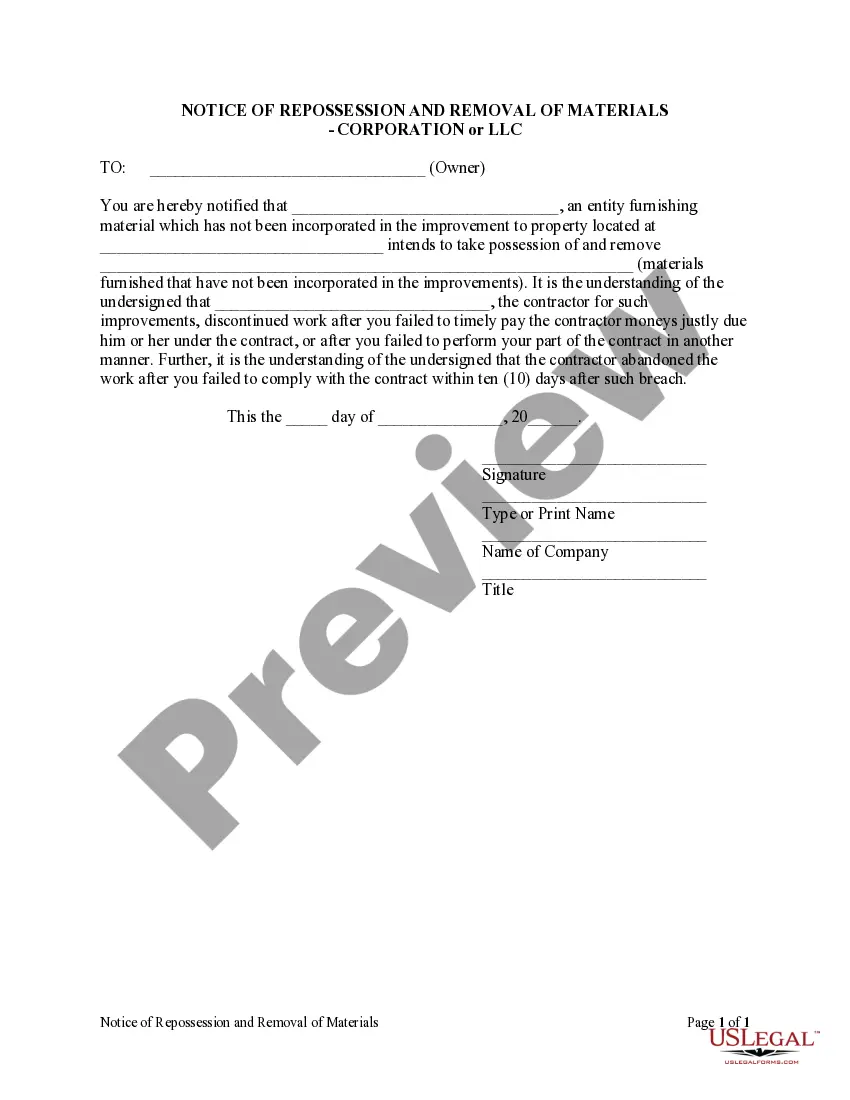

How to fill out Illinois Notice Of Repossession And Removal Of Materials - Corporation Or LLC?

If you are looking for a legitimate form, it’s incredibly challenging to select a superior service than the US Legal Forms website – arguably the most extensive libraries on the internet.

Here you can obtain a vast array of document samples for both business and personal use, organized by categories and regions, or keywords.

With our premium search function, locating the latest Chicago Illinois Notice of Repossession and Removal of Materials - Corporation or LLC is as simple as 1-2-3.

Obtain the document. Decide on the format and save it to your device.

Edit as needed. Fill out, adjust, print, and sign the acquired Chicago Illinois Notice of Repossession and Removal of Materials - Corporation or LLC.

- If you are already familiar with our platform and possess an account, all you have to do to get the Chicago Illinois Notice of Repossession and Removal of Materials - Corporation or LLC is to Log In to your account and hit the Download button.

- If you are using US Legal Forms for the first time, simply follow the steps listed below.

- Ensure you have accessed the sample you wish to use. Review its details and utilize the Preview feature to examine its contents. If it doesn’t meet your requirements, use the Search box at the top of the page to find the appropriate document.

- Verify your choice. Choose the Buy now option. Then, select the preferred pricing plan and provide your details to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

How to Write a Vehicle Repossession Letter The outstanding balance on the loan at the time of the repossession, including any relevant fees or other charges.The deadline for the buyer to redeem the loan.The method by which the buyer can make the necessary payment to redeem the loan.Any other relevant state laws.

If you've paid at least 30% of your loan when the car is seized, you have 21 days from the date of repossession to pay back the missed payments. If you haven't paid 30% of your loan or you don't make the past payments in the 21 day period, you'll have 21 days to pay off the loan in full to get your car.

After repossessing your car, the creditor must send you a Notice of Redemption and an Affidavit of Defense. The Notice of Redemption tells you whether the creditor will keep or sell your car. It also tells you that you have a right to buy back your car.

Under the Illinois vehicle code, lenders can repossess your car if you miss even one car payment. In some cases, your car loan agreement will give you more time. Review your loan documents to see how many payments you can miss before you risk repossession or if you have a grace period to make your payment.

How to Get an Illinois Repossession License Meet the basic requirements. Illinois recovery agents must be at least 18 years old and must complete a Certified Asset Recovery Specialist certification program.Prepare an application.Submit the application with the appropriate fee.

In Illinois, creditors are allowed to conduct a repossession without sending a pre-repossession notice to the consumer. However, the creditor must make sure that they have a valid security interest in the vehicle being repossessed and that the consumer is in default.

No. In Illinois, creditors are allowed to conduct a repossession without sending a pre-repossession notice to the consumer. However, the creditor must make sure that they have a valid security interest in the vehicle being repossessed and that the consumer is in default.

Some clever folks think that they can hide the vehicle on another street or prevent the repo man from accessing the vehicle. This, however, is illegal. Despite that fact, the repo man may not destroy your property to access the vehicle, nor can they break into your home.

Can a repo man move another car to get yours? No, a repossession agent may not do that. But, if the repossession company can't access your car because it is hidden, blocked, or locked up, your lender goes to court to get a replevin. Replevin is a court order compelling the collection of the vehicle.