Cook Illinois Assignment of Lien - Corporation or LLC

Description

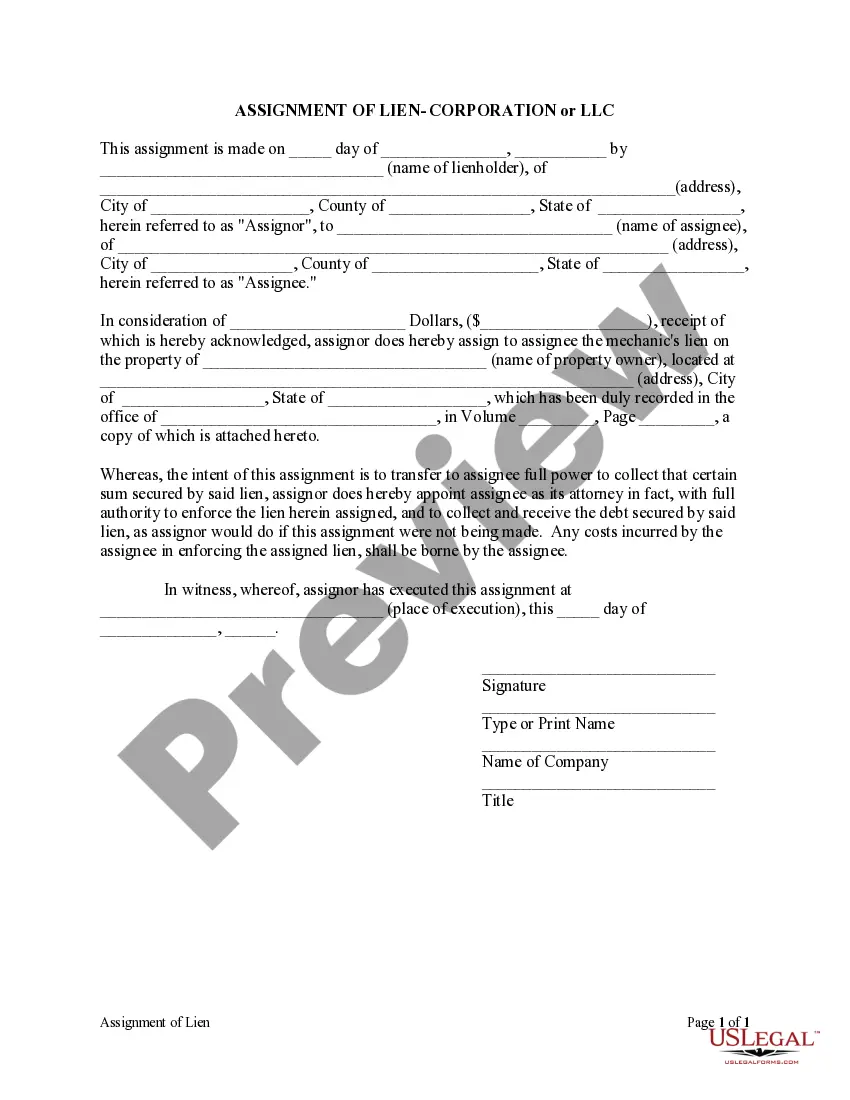

How to fill out Illinois Assignment Of Lien - Corporation Or LLC?

Regardless of one's societal or career position, filling out legal forms is a regrettable requirement in the modern professional landscape.

Frequently, it’s nearly impossible for individuals lacking legal training to draft such documents independently, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms proves to be useful.

Confirm that the template you have selected is tailored to your location, as the regulations of one state may not be applicable in another.

Preview the document and review a short summary (if provided) regarding the situations for which it can be utilized.

- Our service includes an extensive collection of over 85,000 ready-to-use, state-specific documents applicable to virtually any legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors aiming to enhance their time efficiency by utilizing our DIY paperwork.

- Whether you require the Cook Illinois Assignment of Lien - Corporation or LLC, or any other document valid in your jurisdiction, US Legal Forms makes everything accessible.

- Here’s how to acquire the Cook Illinois Assignment of Lien - Corporation or LLC in minutes using our reliable service.

- If you are already a member, you can simply Log In to your account to access the relevant form.

- However, if you are new to our platform, please follow these steps prior to downloading the Cook Illinois Assignment of Lien - Corporation or LLC.

Form popularity

FAQ

In Illinois, 'NGS' refers to 'Non-Governmental Service.' It is primarily used in the context of identifying certain types of business services or designations. Understanding terms like NGS can assist in navigating various legal processes, including those related to a Cook Illinois Assignment of Lien - Corporation or LLC. For more detailed explanations, consider exploring resources on the uslegalforms platform.

Starting an LLC in Illinois requires a few key steps. You need to choose a unique name for your LLC, appoint a registered agent, and file the Articles of Organization with the Illinois Secretary of State. Additionally, you should create an operating agreement to outline the management structure. Following these steps will facilitate a smooth Cook Illinois Assignment of Lien - Corporation or LLC process.

To domesticate your LLC, begin by researching the laws in both the original state and Illinois. You will need to file the appropriate paperwork with the Illinois Secretary of State, as well as notify your current state of your intention to domestic. For a smooth transition, consider using US Legal Forms for guidance on the Cook Illinois Assignment of Lien - Corporation or LLC process.

Several states allow LLC domestication, including Delaware, Florida, and Texas, among others. Each state has its own rules and requirements for the domestication process. If you are considering a Cook Illinois Assignment of Lien - Corporation or LLC, familiarize yourself with the specific laws governing the states you are interested in.

Yes, Illinois allows the domestication of LLCs from other states. This means that if you formed an LLC elsewhere, you can transfer its registration to Illinois. This process is particularly useful if you want to take advantage of the benefits associated with a Cook Illinois Assignment of Lien - Corporation or LLC.

A domestic LLC in Illinois refers to a limited liability company that is formed under Illinois law. This type of LLC typically has the same rights and responsibilities as any other business entity in the state. When considering a Cook Illinois Assignment of Lien - Corporation or LLC, ensure that you are compliant with state regulations as a domestic entity.

Yes, Illinois allows domestication of LLCs. This means that an LLC formed in another state can become an Illinois LLC without dissolving the original entity. If you are considering a Cook Illinois Assignment of Lien - Corporation or LLC, understanding the domestication process can be beneficial for your business.

No, Illinois does not require an operating agreement for an LLC, but creating one is highly recommended. An operating agreement outlines the management structure and operating procedures of the LLC, helping to prevent misunderstandings among members. Additionally, having a clear agreement can strengthen the legal protection of your Cook Illinois Assignment of Lien - Corporation or LLC.

To transfer property title from an individual to an LLC, you will need to draft a deed that includes the property details and names both the grantor and grantee. This deed must be signed, dated, and may require notarization. Completing this process properly is vital for your Cook Illinois Assignment of Lien - Corporation or LLC to protect your asset's title. Seeking guidance from a legal professional can help ensure everything is executed correctly.

Transacting business in Illinois generally includes any activities that seek to generate revenue within the state. This can involve selling products, providing services, or soliciting sales. For entities engaging in the Cook Illinois Assignment of Lien - Corporation or LLC, understanding these activities is essential for compliance with state laws. Proper registration ensures protection and legal rights in such transactions.