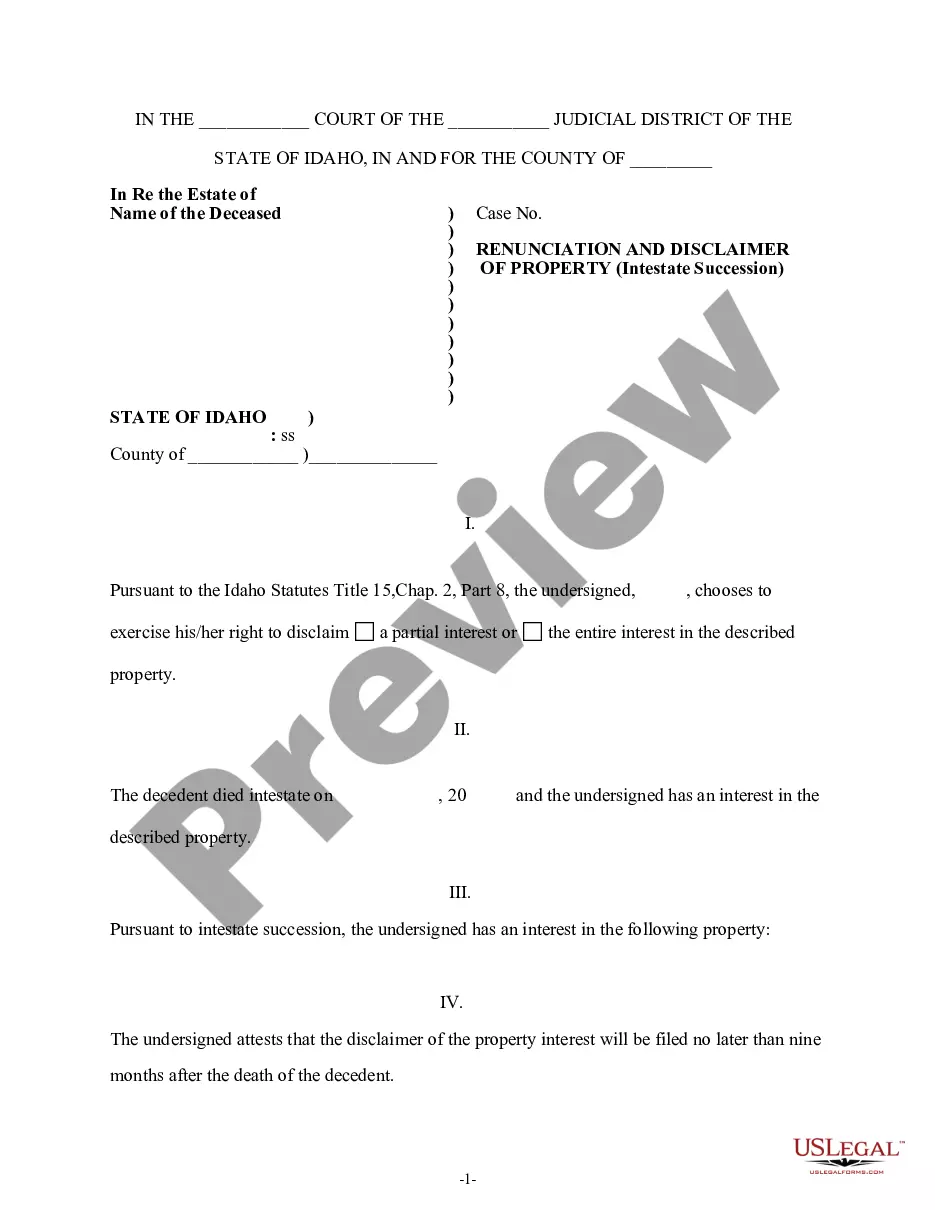

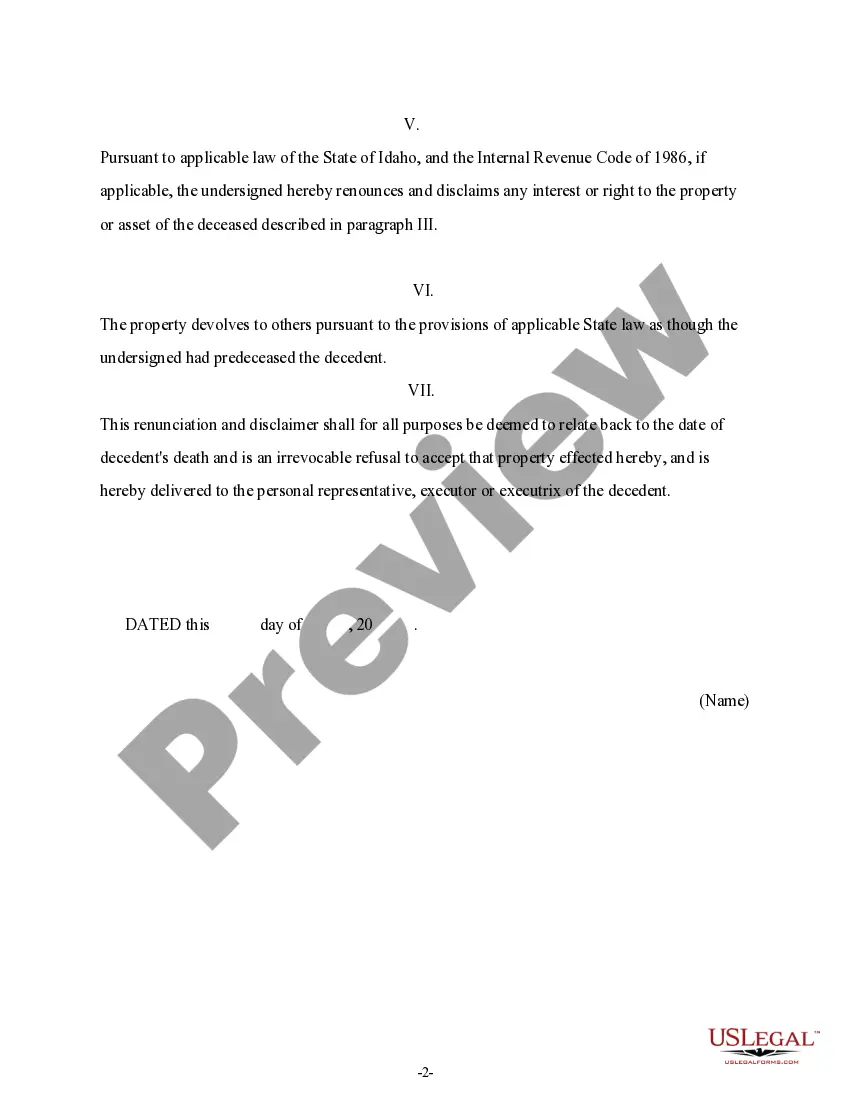

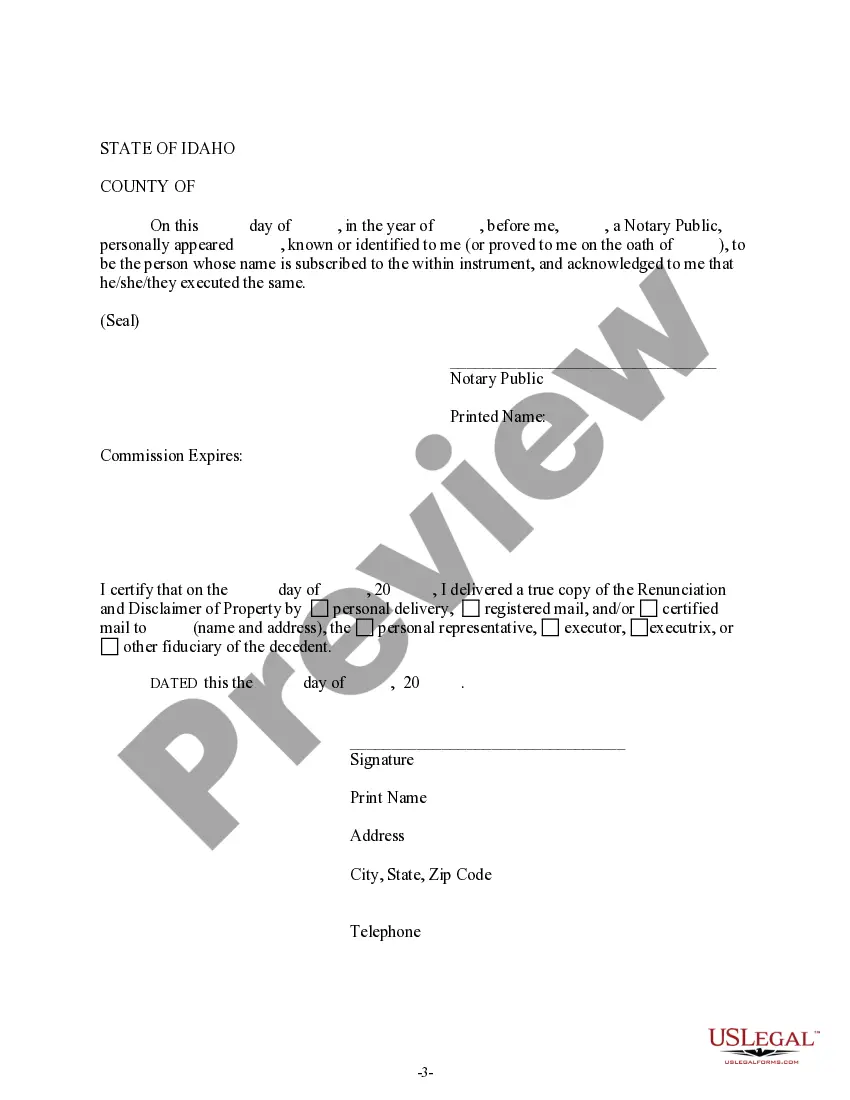

This form is a Renunciation and a Disclaimer of Property acquired by Intestate Succession. The decedent died intestate and the beneficiary gained an interest in the described property. However, pursuant to Idaho Statutes Title 15, Chap. 2, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest he/she has in the property. The disclaimer will relate back to the date of death of the decedent and will serve as an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Meridian Idaho Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Idaho Renunciation And Disclaimer Of Property Received By Intestate Succession?

If you’ve previously used our service, sign in to your account and download the Meridian Idaho Renunciation and Disclaimer of Property gained through Intestate Succession onto your device by selecting the Download button. Ensure your subscription is active. Otherwise, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to acquire your file.

You have ongoing access to all documents you have purchased: they can be found in your profile under the My documents menu whenever you need to retrieve them. Utilize the US Legal Forms service to easily find and download any template for your personal or professional needs!

- Ensure you’ve located the correct document. Review the description and utilize the Preview option, if available, to verify its compatibility with your needs. If it doesn’t fit, use the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and make a payment. Enter your credit card information or use the PayPal option to finalize the transaction.

- Acquire your Meridian Idaho Renunciation and Disclaimer of Property obtained via Intestate Succession. Choose the file format for your document and save it to your device.

- Complete your form. Print it out or utilize online editing services to fill it in and sign it electronically.

Form popularity

FAQ

Succession of the intestate refers to the process by which property is inherited by legal heirs when an individual dies without a valid will. The law specifies a hierarchy, typically granting priority to spouses and children. If you find yourself navigating this complex area in Idaho, consider looking into a Meridian Idaho Renunciation and Disclaimer of Property received by Intestate Succession to assist in managing inherited assets effectively.

In Idaho, intestate succession laws dictate how property is distributed when someone dies without a will. Generally, the assets are first divided among the deceased's immediate family, such as their spouse and children. Understanding these laws is essential in cases of Meridian Idaho Renunciation and Disclaimer of Property received by Intestate Succession, as they help clarify distribution when no explicit wishes exist.

In Idaho, you can inherit property without paying state inheritance taxes. The federal estate tax applies only to larger estates exceeding $12 million. Therefore, if the value of your inheritance follows Idaho's rules, you should not have to worry about taxes. This information is crucial when considering a Meridian Idaho Renunciation and Disclaimer of Property received by Intestate Succession.

An example of a disclaimer of inheritance rights is when a spouse decides not to inherit property from their partner's estate due to personal reasons. By formally disclaiming their rights, the property would then pass to the next beneficiary outlined in the distribution plan. This step can be particularly useful in Meridian, Idaho, as it helps simplify the inheritance process and avoids potential disputes among heirs.

A simple disclaimer can be drafted by stating your intent not to accept the property or inheritance clearly. Provide essential details, such as your name, the decedent's name, and a description of the property being disclaimed. Signing and dating the document is crucial, and various resources, including uslegalforms, can guide you in creating a compliant disclaimer tailored to Meridian Idaho Renunciation and Disclaimer of Property received by Intestate Succession.

An inherited disclaimer letter should clearly express your intent to renounce your inheritance. Start with your contact details and the date, then address the letter to the estate executor. Specify the property, your relation to the deceased, and your reason for disclaiming. This letter should be submitted to the court to support your formal disclaimer process.

To write a disclaimer of inheritance, begin by stating your intention to disclaim the property clearly. Include your full name, the decedent’s name, and a description of the property you wish to disclaim. Ensure the document is signed, dated, and submitted to the appropriate probate court in Meridian, Idaho, to complete the Meridian Idaho Renunciation and Disclaimer of Property received by Intestate Succession.

In Meridian, Idaho, a beneficiary has nine months from the date of inheritance to file a disclaimer of property received through intestate succession. It is crucial to act promptly, as missing this window could complicate your estate planning. Once you file the disclaimer, the inherited property will pass to the next rightful heir according to state law.

A disclaimer of estate is a legal document where a beneficiary refuses to accept property or assets from an estate. For instance, if a person inherits a house in Meridian, Idaho, through intestate succession but wants to avoid tax implications, they can file a disclaimer. This action prevents the property from being included in their estate, allowing it to pass to the next eligible heir as dictated by Idaho law.

In Idaho, a spouse does not automatically inherit everything if the decedent also has children. The distribution of property will take into account the spouse and the children's shares. If you're navigating the Meridian Idaho Renunciation and Disclaimer of Property received by Intestate Succession, it's important to understand these nuances. For further assistance, consider using US Legal Forms to help clarify your rights and responsibilities in these situations.